Weekly Technicals Pro - Volume 69

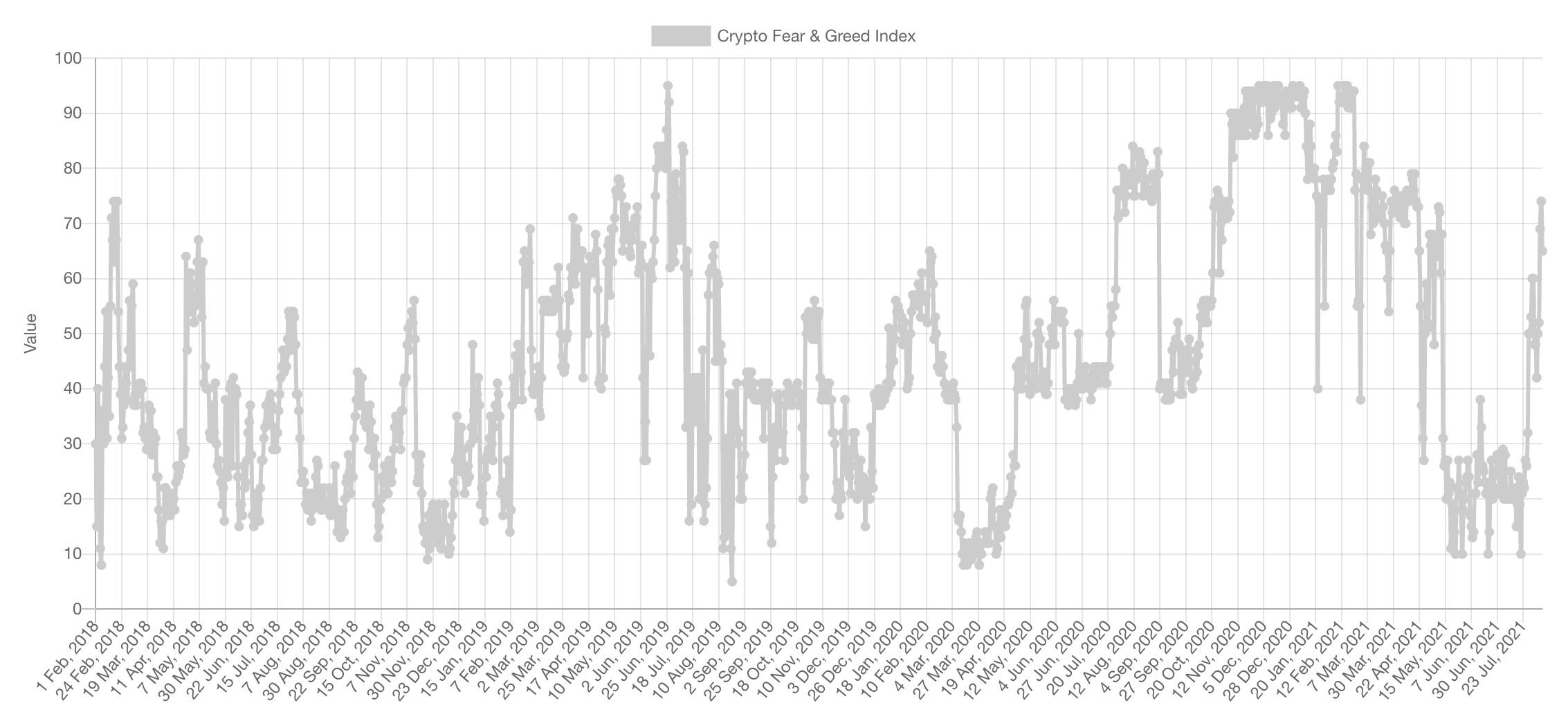

The sentiment has reached low levels of greed according to Fear & Greed index. This is understandable given the market's recent upside movement but we would say that we've not reached levels of euphoria just yet (other than in the NFT space) given the fact that a lot of people remain uncertain about whether this move is legit or not.

Market Sentiment

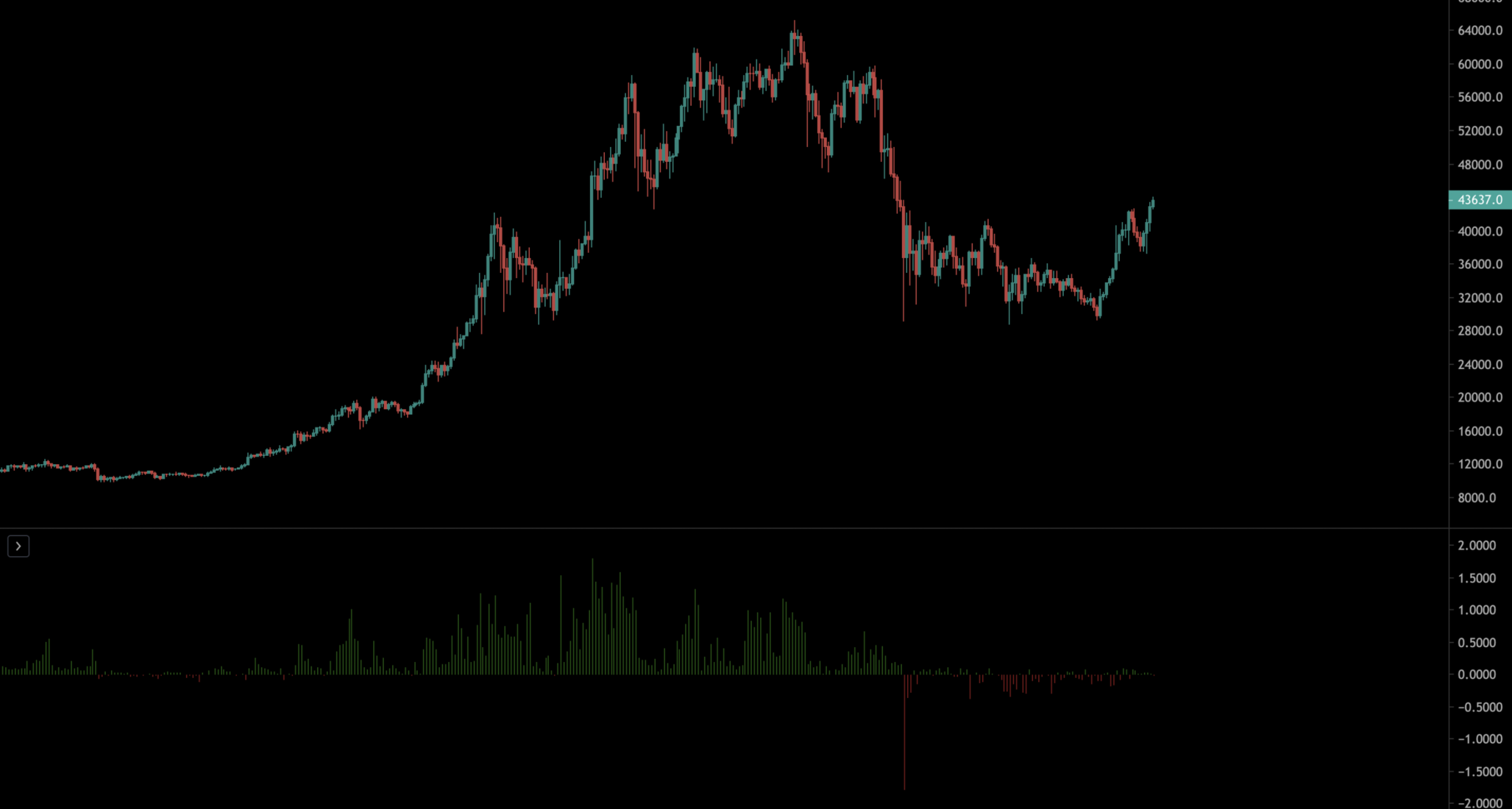

There is another metric that confirms it as well: the Funding Rate.

Funding remains very low despite the recent move from $30,000 -> $45,000 (+50%) in three weeks. This means that market participants have not become overweight in longs just yet and willing to pay exorbitant fees just to be long Bitcoin.

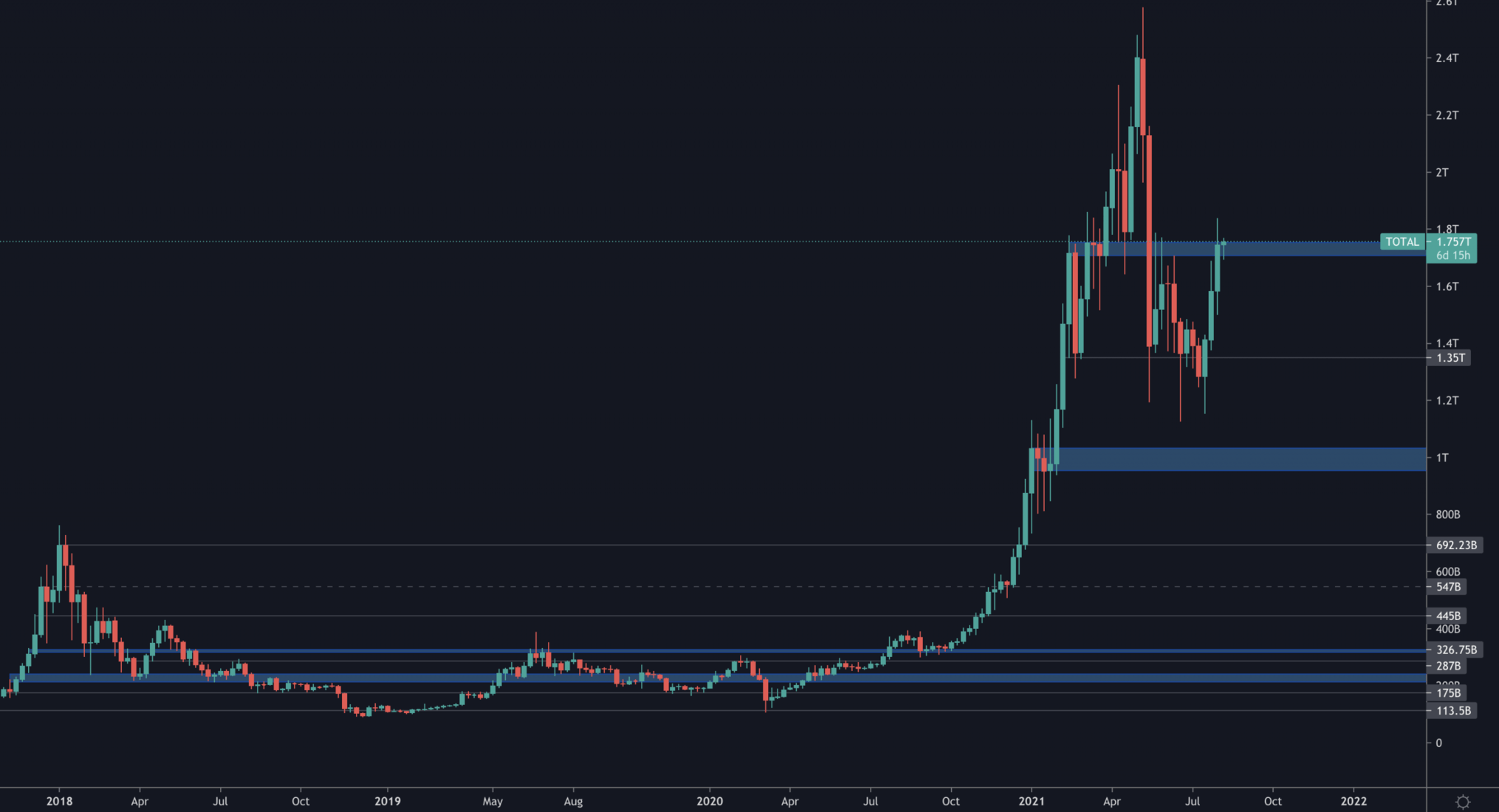

Market Indexes

Total Market Capitalisation

The Total MCap has crossed above the [$1.70-$1.75T] liquidity area. This breakout has increased the odds of a full market recovery towards $2.5T quite significantly.

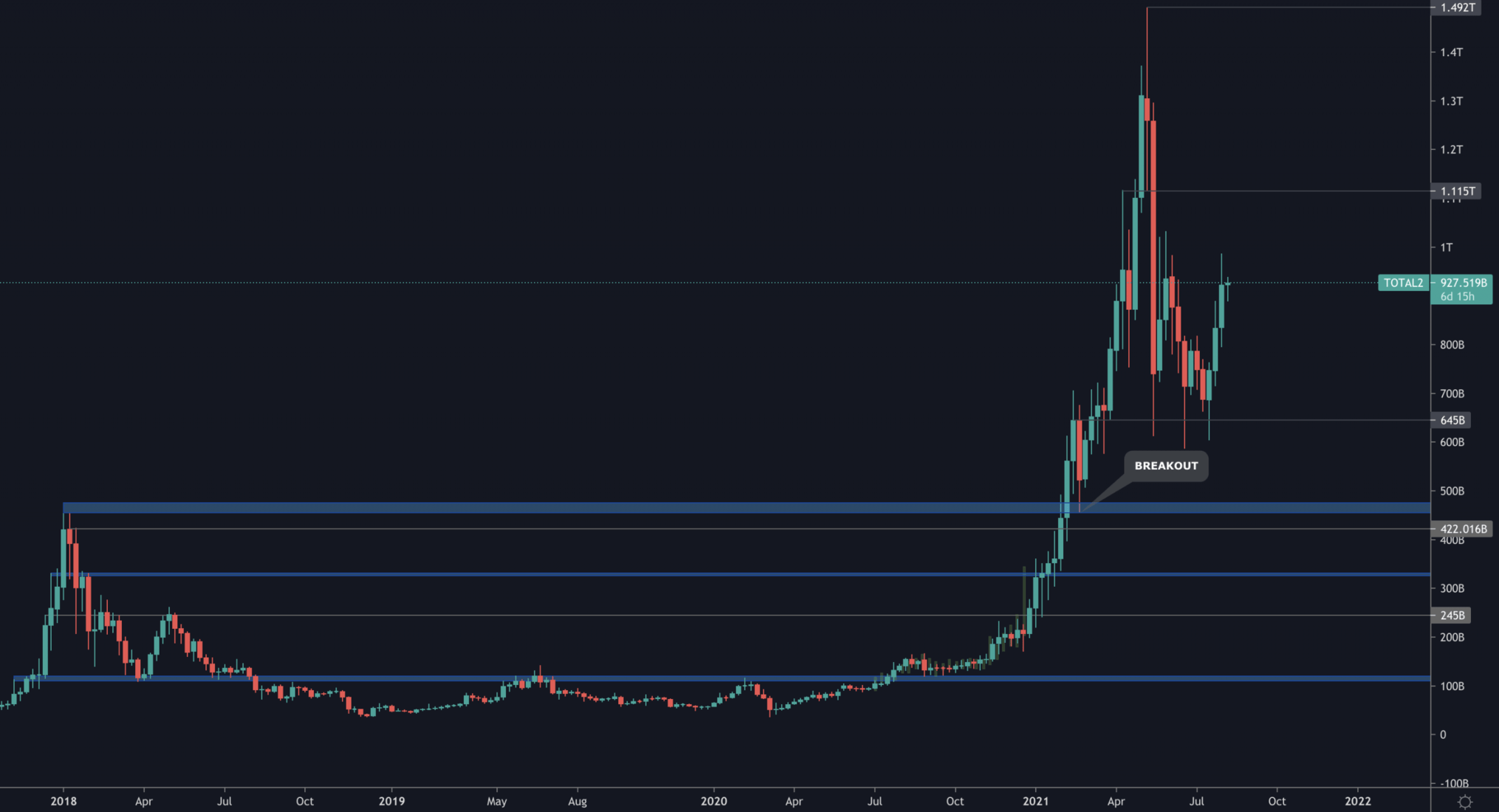

Altcoins Market Capitalisation

The Alts MCap is on its way from $645B towards $1.115B as stated in previous versions of Weekly Technicals Pro.

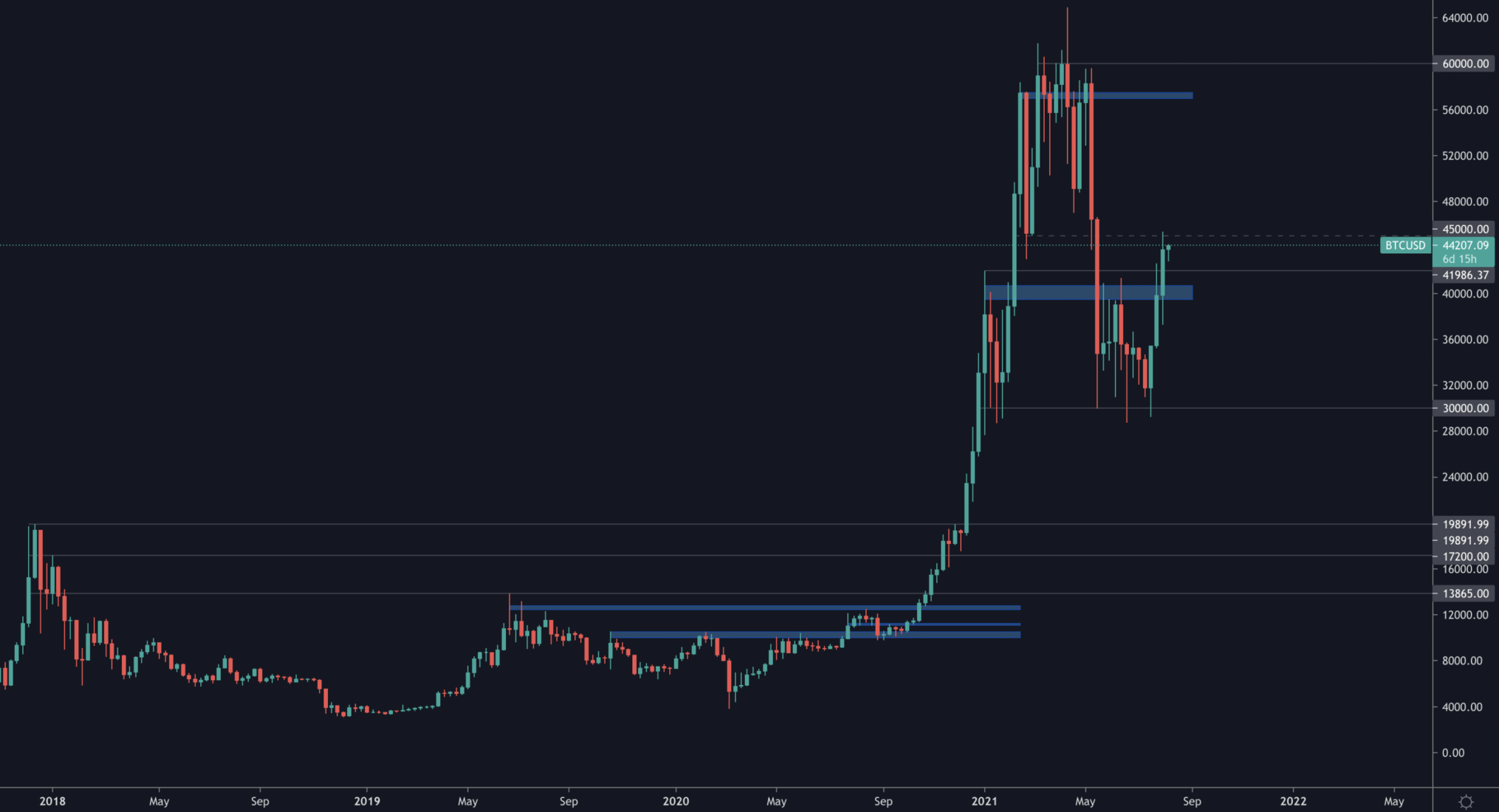

BTC

Breakout on the weekly timeframe from the [$30,000-$40,000] range which has now turned the upper end into support even on this high timeframe. There is resistance at $45,000 and should that be crossed, BTC will likely see a recovery towards mid-$50,000.

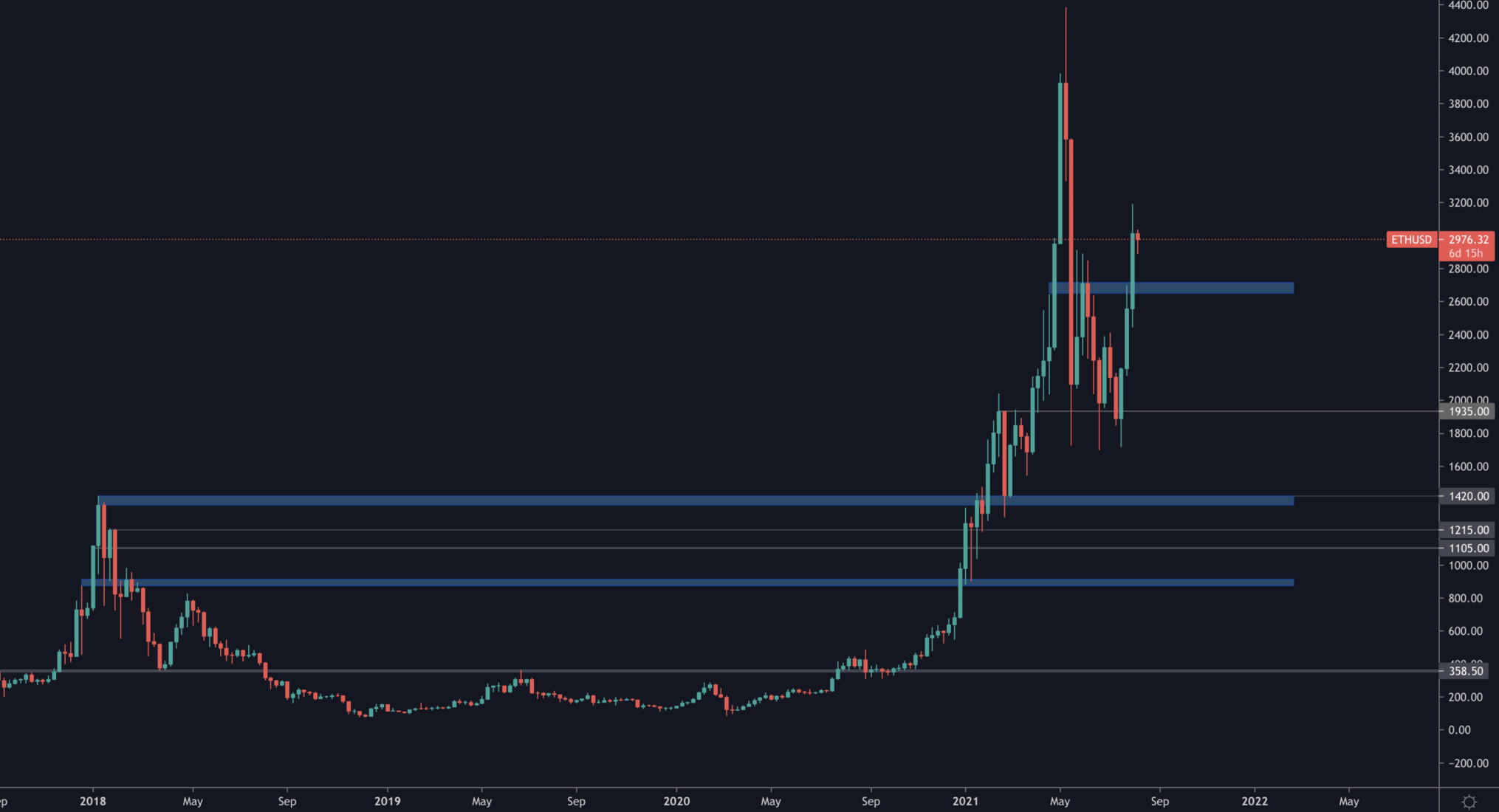

ETH

Intermediate higher high on the weekly timeframe for Ether and price has $2,700 as weekly support underneath.

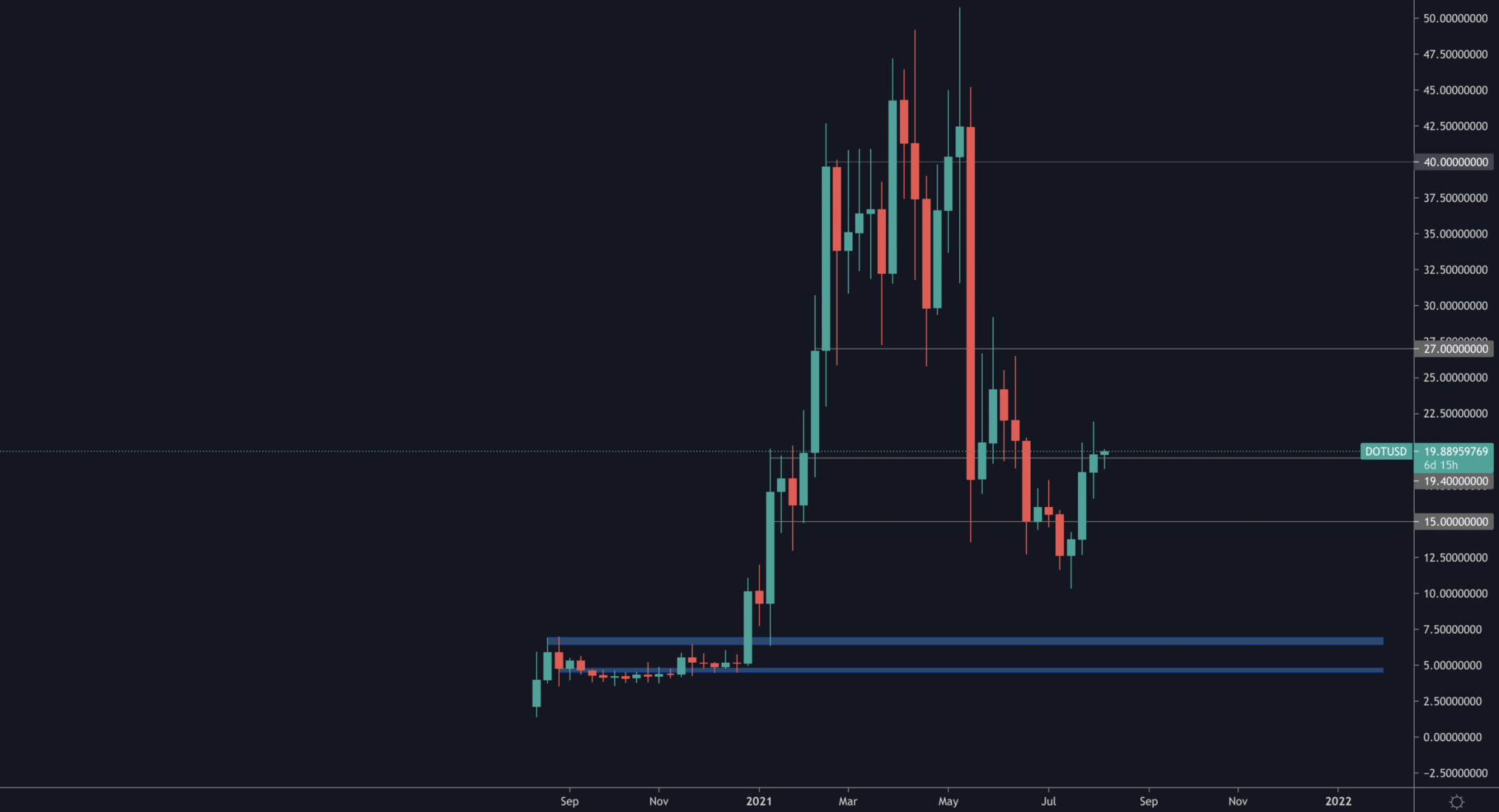

DOT

Daily reclaim of $19.40 has now translated into the weekly timeframe which reinforces the likelihood of the move up towards $27 over the next few weeks.

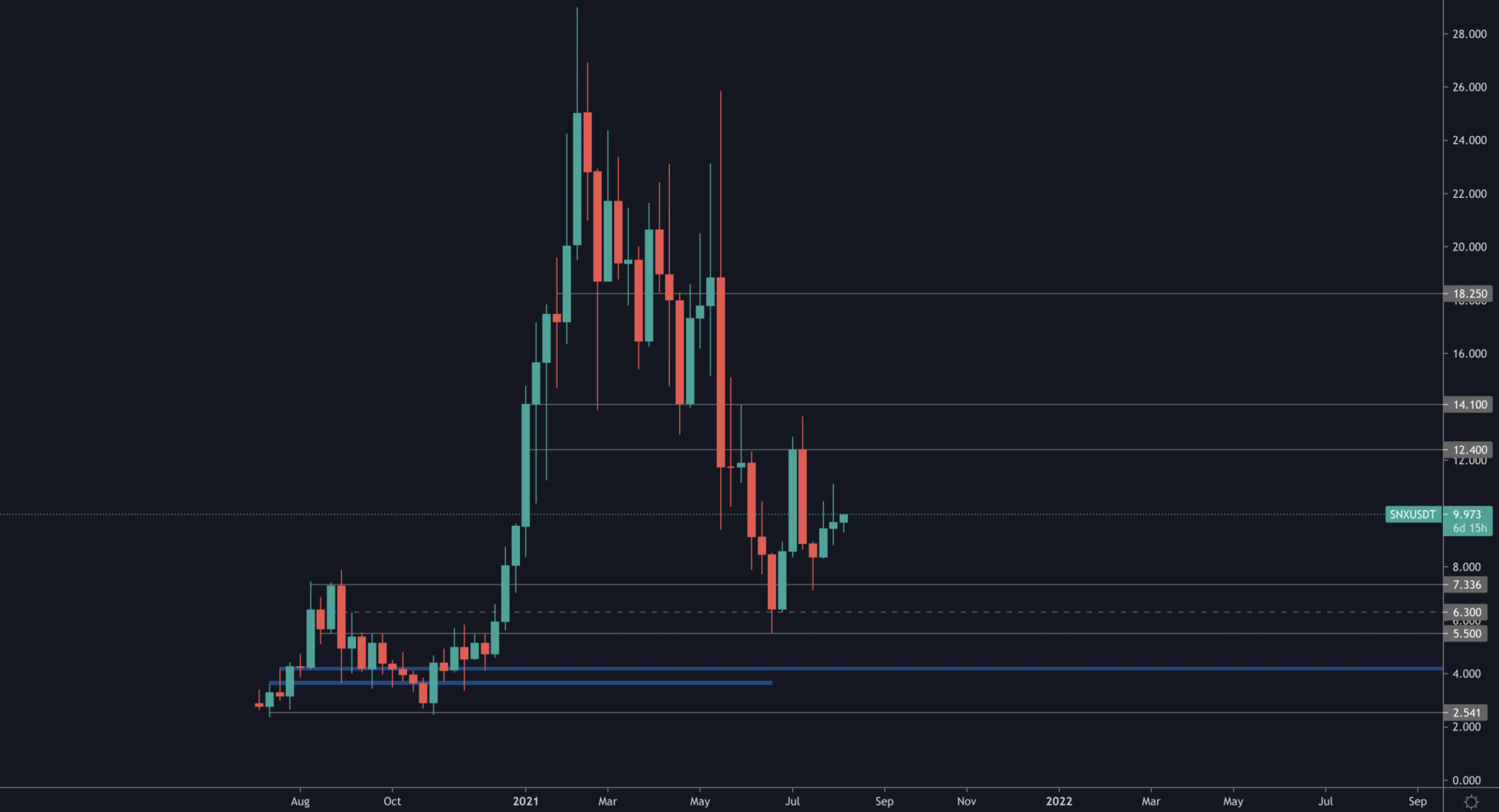

SNX

SNX has set an intermediate higher low, should it be able to set a higher high above $14.10 on the weekly timeframe then the bearish market structure would be turned into a bullish one.

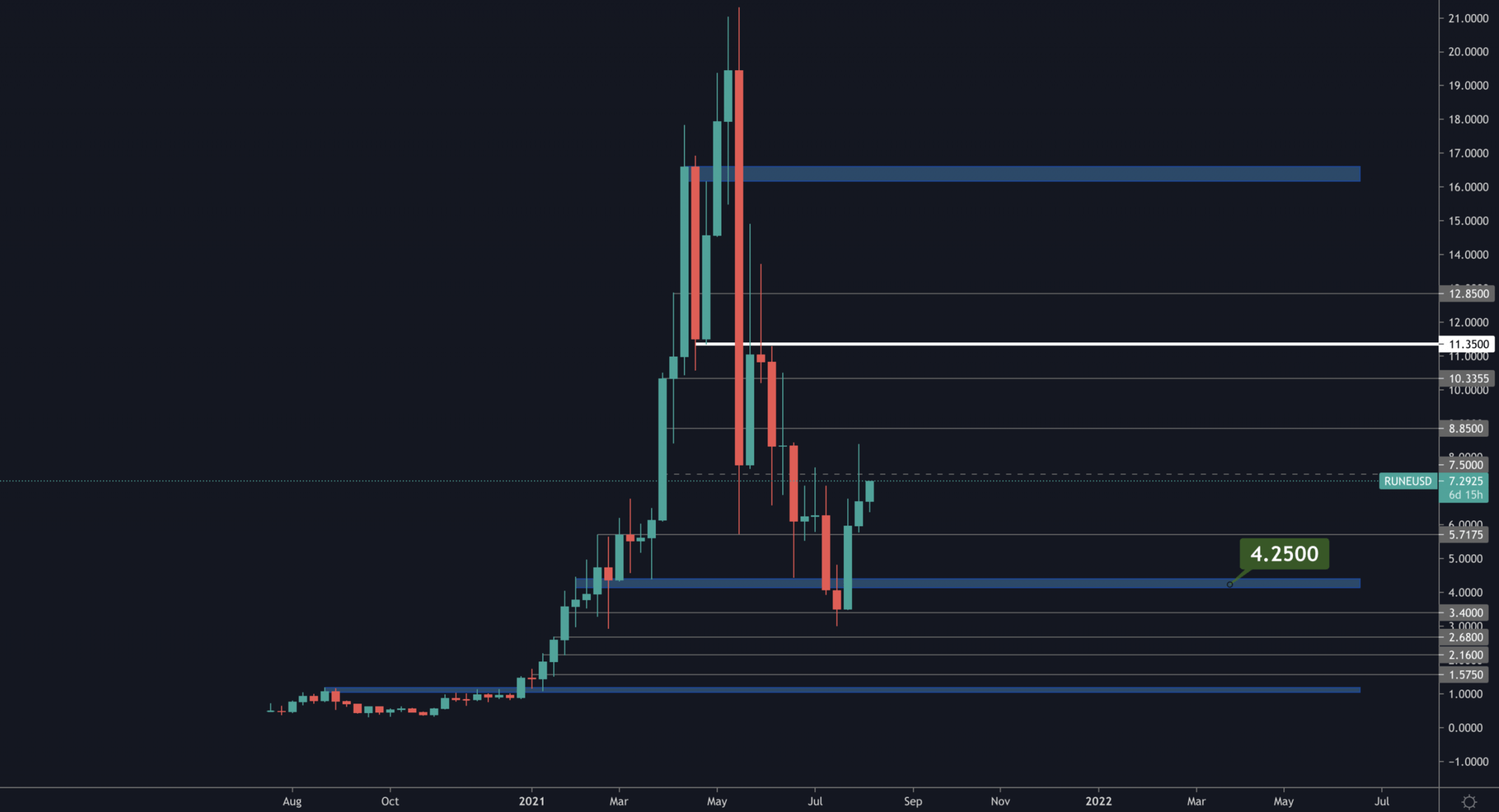

RUNE

RUNE has shown strength over the past couple of weeks despite attention being on majors. Price is likely to head towards $8.85 but we must remain careful as recoveries don't happen in a V shape after such sharp corrections and will take multiple months to be fixed. The line in the sand is $11.50 (white line) above which RUNE would turned back into bullish market structure.

SOL

SOL now has $36 as a level of support on the weekly timeframe and $40 is the resistance standing in the way between it and $50 - above which is fresh new grounds for SOL.

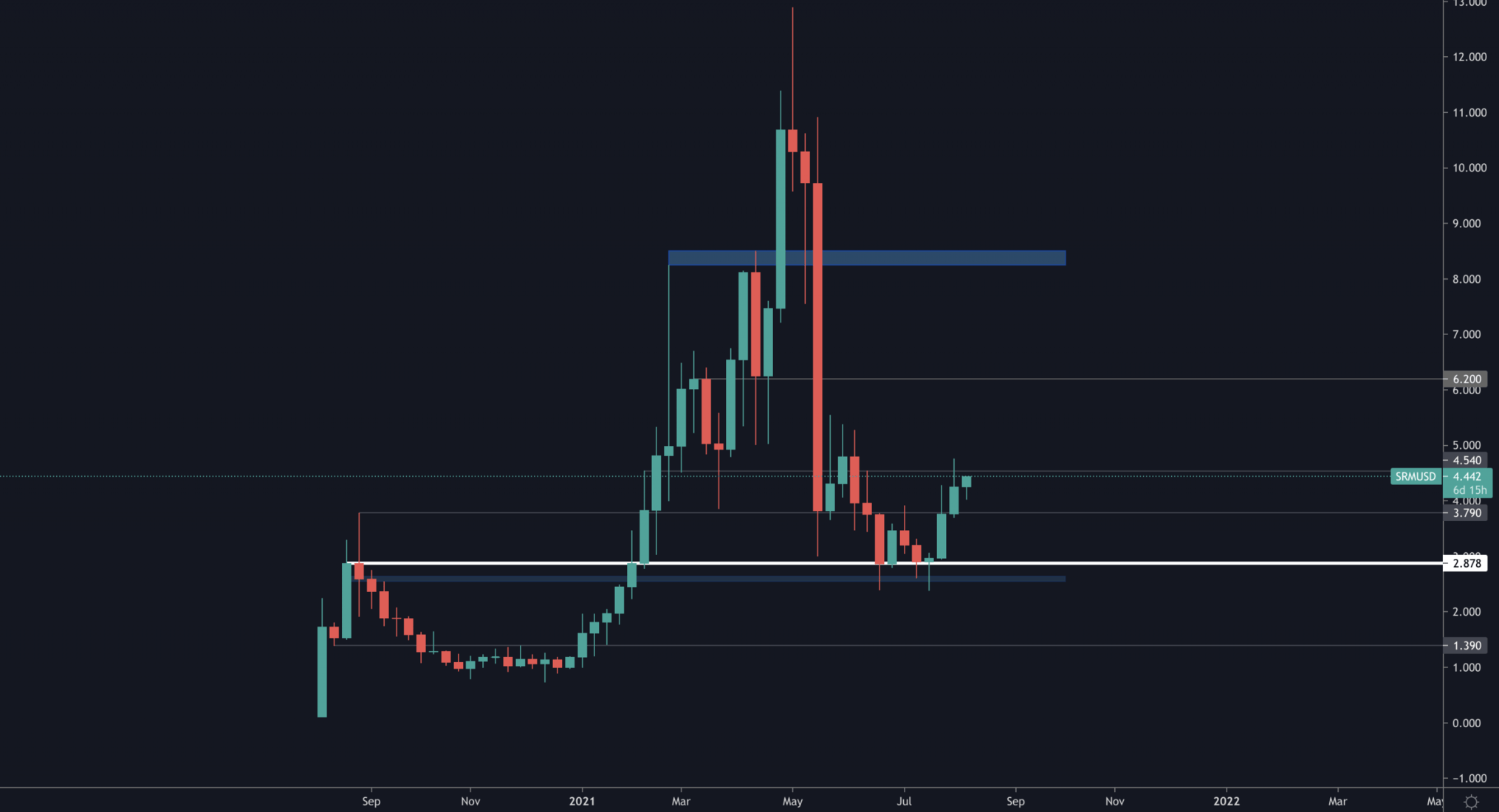

SRM

SRM respectfully turned $3.79 on the daily timeframe from resistance to support after a long few weeks. Now price has $4.50 as support and $6.40 as the level after it after a breakout should Bitcoin allow it.

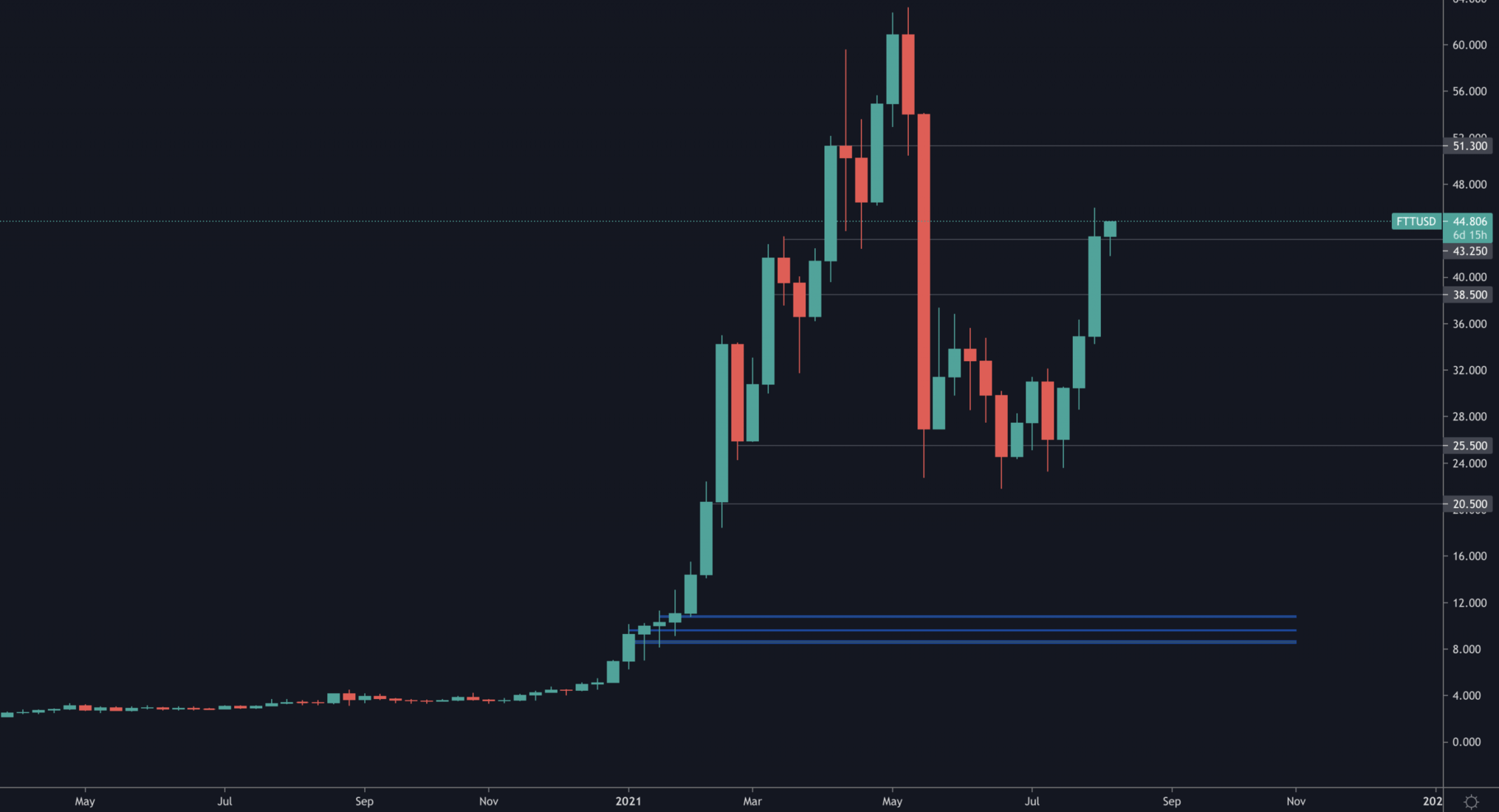

FTT

FTT is seeing one of the quickest recoveries in the market and it may be due to all the trouble Binance is facing. From here, FTT has $43 as a level of support and $51 as the next key level.

MINA

As MINA turned $1.03 from resistance into support we immediately stated the change in market structure and it has panned out perfectly. Now MINA does have support at $2.19 but $3 is a tough level of resistance for it and price does seem overextended on this short-term move.

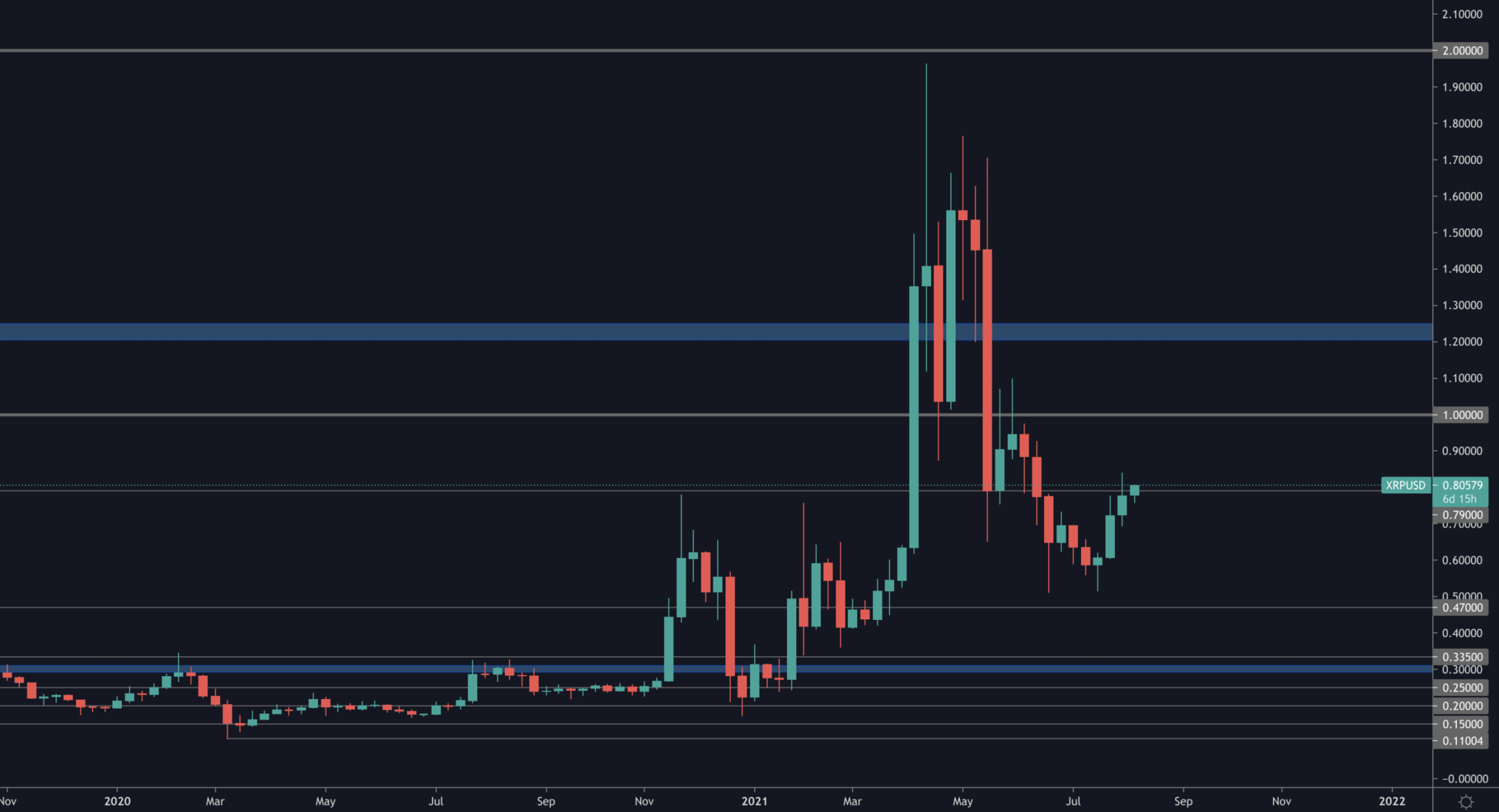

XRP

No reclaim of $0.79 yet which is necessary for any further upside.