Weekly Technicals Pro - Volume 70

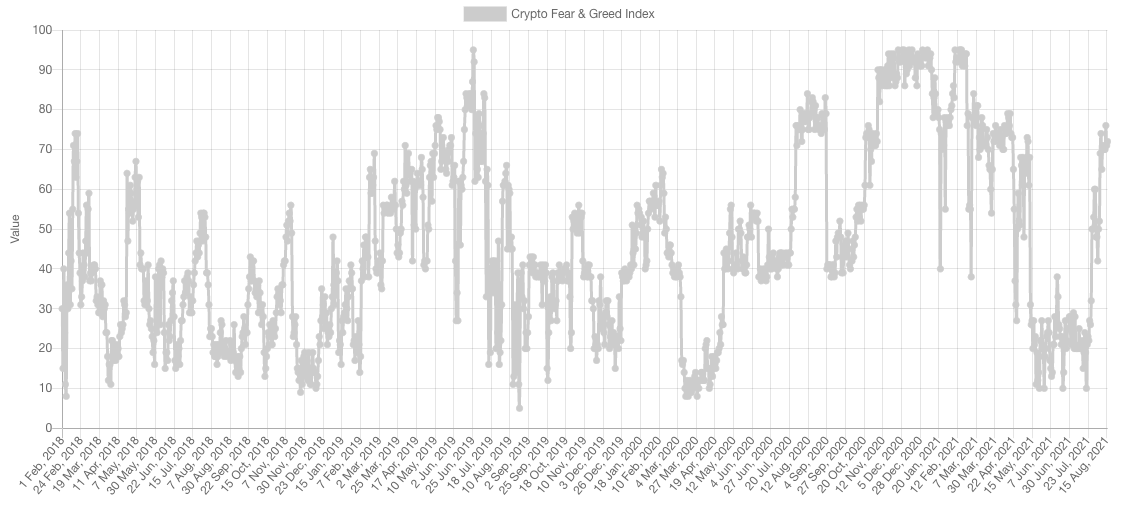

As stated in previous versions of Weekly Technicals Pro, sentiment dropping to extreme levels of fear and for prolonged periods of time represents a great opportunity as we've historically seen. Prices have now recovered quite a bit of ground - with some entering uncharted territory - but greed has not reached extreme levels yet which is both seen on the ground and on this metric.

Market Sentiment

Market Indexes

Total Market Cap

Everything we stated is coming into fulfillment; this is not to brag but rather to explain how looking at the facts and maintaining a rational mind helps turn a profit.

The Total MCap broke out from the [$1.35T-$1.75T] range and is heading towards $2.5T.

Altcoins Market Cap

Another target fulfillment here as $645B led to $1.115T. Now we must await and see price's reaction to that level and whether it is able to turn it from resistance into support.

BTC

The latest breakout is from $45,000 on the weekly timeframe and that has now turned it into support. The market is starting to overextend on this move but given the fact that euphoria has not hit the market tells us that there's probably further room for growth.

ETH

$2,500 was turned from resistance into support and $3,200 was as well on the daily timeframe which sets the next level as the previous ATH at $4,200 - of course this setup gets invalidated should price close a daily candle under $3,200.

DOT

DOT is the slow and steady train that has been rising towards $27 after the $19.40 reclaim as expected.

SNX

SNX is subtly flipping market structure from bearish to bullish on the weekly timeframe for the first time as price is setting higher highs and higher lows (on a candle closure basis). The next key level for SNX is $14.10.

RUNE

Alongside the remainder of the market, RUNE is seeing strength and is likely to approach the $10 mark even further - which it's practically at at this point.

As explained in the past, RUNE's price action is in a bearish market structure on the weekly timeframe and what would invalidate it is a weekly reclaim of $11.50 (thick white line). Given the magnitude of the May drop, expecting a V-shaped recovery is unreasonable and hence the market is now presenting an opportunity for anyone who wouldn't want to undergo further ranging and downside by selling and only re-entering once $11.50 is reclaimed. Now of course, there's no free lunch and everything comes at a cost and the cost here (the premium) is having to rebuy at a higher price. However, this is a method to reduce risk/exposure.

SOL

SOL has powered through like nothing else this last week and has officially turned $50 from resistance into support. Price is in uncharted territory and upside targets are round psychological numbers (i.e. $100).

SRM

FTT

FTT turned the $51 target into support and is looking to enter price discovery just like SOL did.

MINA

Once again, another plan in fulfillment as $2.80 held as support on MINA which puts the target at $4.88 for it.

XRP

Great run by XRP which helped it turn $1.25 from resistance into support which now sets the stage for a run towards $2 where we'll take further profits on our investment.