Weekly Technicals Pro - Volume 71

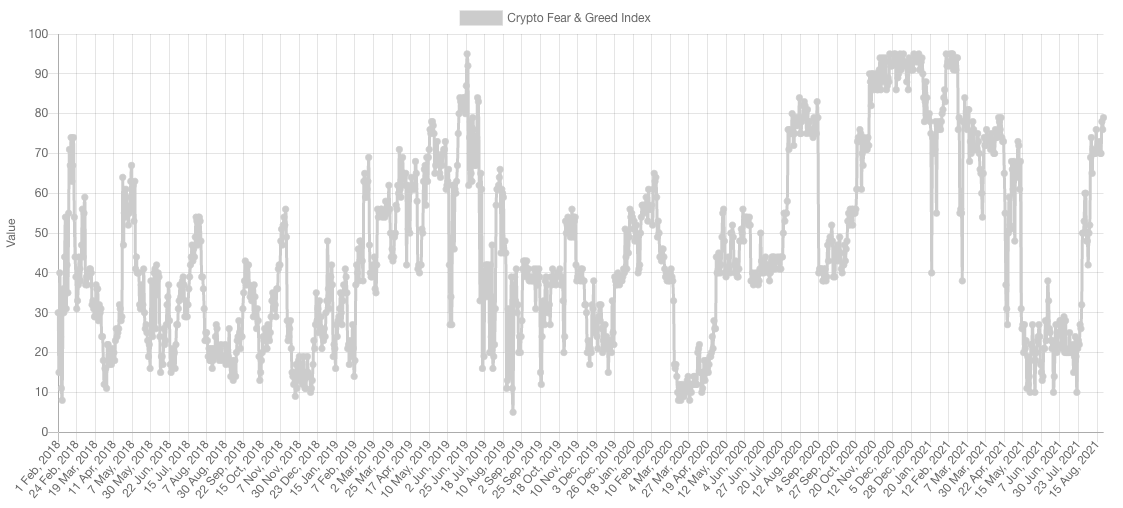

The cryptocurrency market has reached a sentiment of Extreme Greed, not at the extremities yet however. This metric cannot be used to time the market, however it does force us to exercise some caution and remain careful.

Market Sentiment

Market Indexes

Total Market Cap

The crypto market is on its 6th green weekly candle so far. Bullish engulfing candles are rarely deceptive as we can see here in hindsight.

The Total MCap is still heading towards $2.5T from which we expect to see some rejection; even if temporary only.

Altcoins Market Cap

The Alt MCap rallied from $645B towards $1.115T exactly as expected and has now turned the latter from resistance into support. Similar to the Total MCap, this index is also gearing towards a test of its May 2021 highs.

Bitcoin

Bitcoin turned $45,000 from resistance into support and tackled $50,000 already - all of which on low funding. From here, Bitcoin is gearing towards mid-$50,000s.

Ether

Bullish hammer weekly candlestick which showed demand stemming from $3,000 which was unexpected after a slight change in market structure. Nonetheless, ETH has set a new intermediate high which makes the bullish trend alive and well and the same target of $4,200 on the horizon - of course this assumes the $3,200 level of support holds on the daily timeframe.

DOT

DOT has set a new intermediate high and has crossed the $27 key level which now sets the stage for a run towards $40 - especially possible if parachains are announced soon.

SNX

SNX is starting to change the market structure from bearish to bullish on the weekly timeframe with the last straw being a reclaim of $14.

RUNE

Undeniable strength for RUNE, however it was no able to tackle the $11.50 weekly key level which is the line in the sand which would turn the market structure from bearish to bullish on the weekly timeframe.

SOL

SOL is in price discovery so no real key levels here, our target remains $100 on it.

SRM

Following SOL's footsteps but struggling with $8.50 - if this level gets out of the way for buyers, the rally towards price discovery would become much easier.

FTT

Great demand found at $42.50 and a bullish hammer candlestick has been set on the weekly timeframe. No convincing closure above $51 but it is showing strength through the hammer closure.

MINA

Consolidating at support. As long as $2.80 holds, them $4.88 is next.