Weekly Technicals Pro - Volume 74

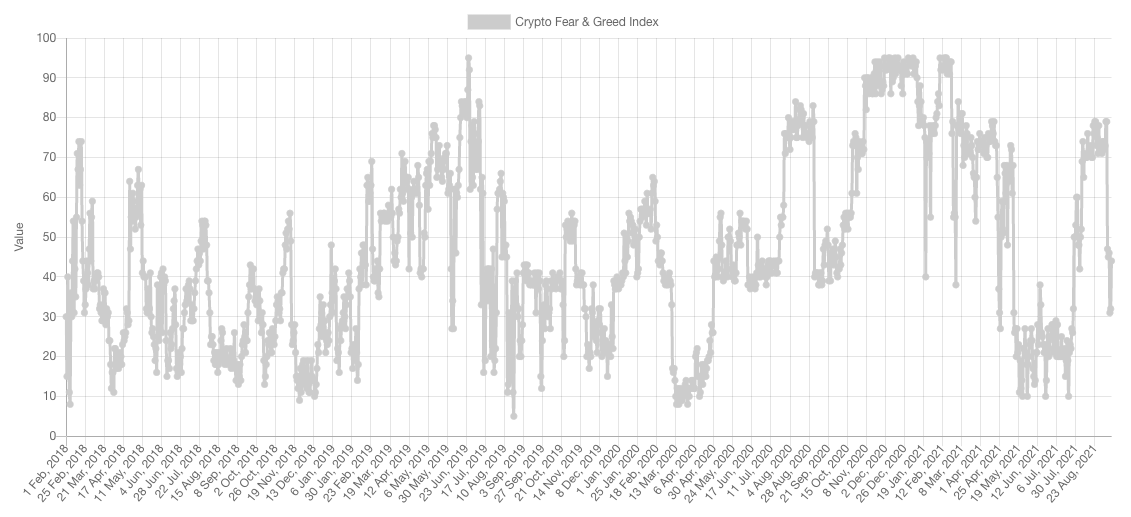

The market sentiment has dipped back into Fear after the fall in prices seen on the 7th of September. These mid-levels are not actionable with a high probability of success, not to the same degree as extremities are. Nonetheless, when we pair fear with supports, it usually ends up being a good sign.

Market Sentiment

Market Indexes

Total Market Cap

We're witnessing a psychological support at $2T hold prices up on the weekly timeframe. The stronger support, which is underneath it, sits at $1.7T.

The two potential routes are:

- Hold $2T as support and break into new all-time highs

- Break $2T and head towards $1.7T for support before rallying again

Altcoins Market Cap

The Alts MCap closed back under the previous weekly candle closure high at $1.3tT but found demand at $1.115T. As of now, this is the new support we are monitoring, a break of it can lead to a lot more downside - but as long as its holding, assuming a break would be premature.

Bitcoin

Weekly candle closure above $45,000 but we must also not that a bearish engulfing candle was registered, which means the recovery may take several weeks. In regards to support, as long as it is holding then $57,000 remains the target.

Ether

Continuous creation of higher highs and higher lows, a market structure that was surprisingly unbroken. Additionally, $3,200 is holding as support on the daily timeframe.

DOT

Rallying now with parachain auctions coming soon. Price is reflecting the positive developments that are incoming to the chain, can be clearly seen by the weekly candle just closed. Target remains $40 on a level-by-level basis.

SNX

SNX did not hold $12.40 on the weekly timeframe which communicates a heightened likelihood of a $7.50 test. However, the daily timeframe will determine when and how likely that becomes in the coming days once it breaks out from the [$10.50-$11.10] range.

RUNE

RUNE still has the same line in the sand separating bullish from bearish territory and that is $11.50. In addition we also have the double top formation which is still active (shared in Discord Pro) and targets $5.75.

SOL

We had to stay on the daily timeframe as the weekly one didn't share enough insights. We can see that SOL found support perfectly at $150, the resistance remains $200 for now.

SRM

SRM has set a new weekly high and a new ATH. Now, SRM has $10.50 as a support level.

FTT

FTT in price discovery and a test of $60 is possible and wouldn't invalidate it.

MINA

MINA's holding surprisingly well, as long as $4.88 holds as support on the daily, $10 is possible. If the key level breaks however, then it'd be back to [$2.80-$3.10].