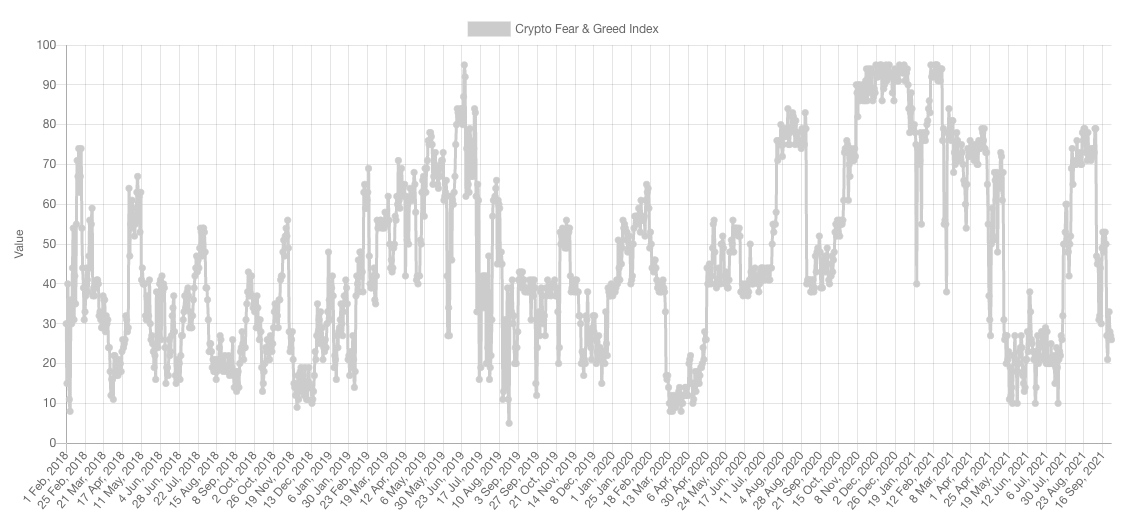

Fear & Greed Index

Sentiment is back into Fear amidst the ongoing FUD stemming from China; the latest one banning cryptocurrency exchanges from operating in the country. This particular event has kickstarted a rally amongst DeFi tokens.

Generally speaking, the extremities of sentiment are stronger signals (i.e. Extreme Fear & Extreme Greed) than plain Fear which is less actionable.

Market Indexes

Total Market Cap

The Total MCap closed a weekly candle below $2T. In general, we've drawn our expectations in regards to upcoming price action.

The line in the sand for further upside and price discovery is $1.7T - this is the level we want to see hold.

Altcoins' Market Cap

This index is looking better than the previous one as $1.115T has held as support which is bullish on this timeframe and maintains a target of $1.5T.

Bitcoin

Bitcoin broke $45,000 and fell right through to the liquidity area at [$39,500-$40,650] where it found demand. For now, price action on BTC needs a breakout from either the liquidity area (bearish) or $45,000 (bullish). The bearish case sends it to $30,000, whereas the bullish one sends it to $57,000. In regards to where we are personally leaning (not financial advice) is a breakout of $45,000.

Ether

ETH fell alongside the remainder of the market and met buyers in the weekly liquidity area of ~$2,600. From here, this is the level we want to see hold on this timeframe for further upside and potentially and a cup & handle formation. On the daily timeframe, the resistance in place is $3,200 and that's what we'd like to see be reclaimed for another test of $4,200.

DOT

Perfectly held support at $27 and hence it maintains the same target at $40. Parachain auctions are also on the horizon and if you haven't yet read the report about them then you definitely should (read here).

SNX

SNX is failing to hold $12.40 but more importantly to break through $14.10 on the weekly timeframe as that is what would change the market structure from bearish to bullish for this asset. This means, $7.50 is possible for SNX - unless a reclaim happens.

RUNE

RUNE's main line in the sand is $11.50 on the weekly timeframe as we've discussed multiple times. Now, given the closure under $7.50, it does seem like $5.75 is a probable upcoming test.

SOL

SOL is ranging between the [$124-$130] liquidity area and the $150 psychological level, a break either way is imminent.

SRM

SRM's failure to hold $10.50 and $8.50 is a sign of weakness and it does communicate that a test of $6.20 is likely.

FTT

Still ranging between $50 and $60. A break of the latter will send it back into price discovery.

MINA

MINA seems prone to a test of ~$3 with its current market structure and failure to hold $4.88 as support.

DYDX

Massive advancement by DYDX that has now turned $18 into a support level. DYDX is in price discovery mode and targets are round psychological numbers.