Weekly Technicals Pro - Volume 77

Do you remember the quote from July 26th in 'Weekly Technicals Pro - Volume 67': "If you liked the weekly engulfing candles on the daily timeframe, you're going to love them on the weekly."? Well, here we go again!

WE'RE ABSOLUTELY LOVIN' IT - AGAIN!

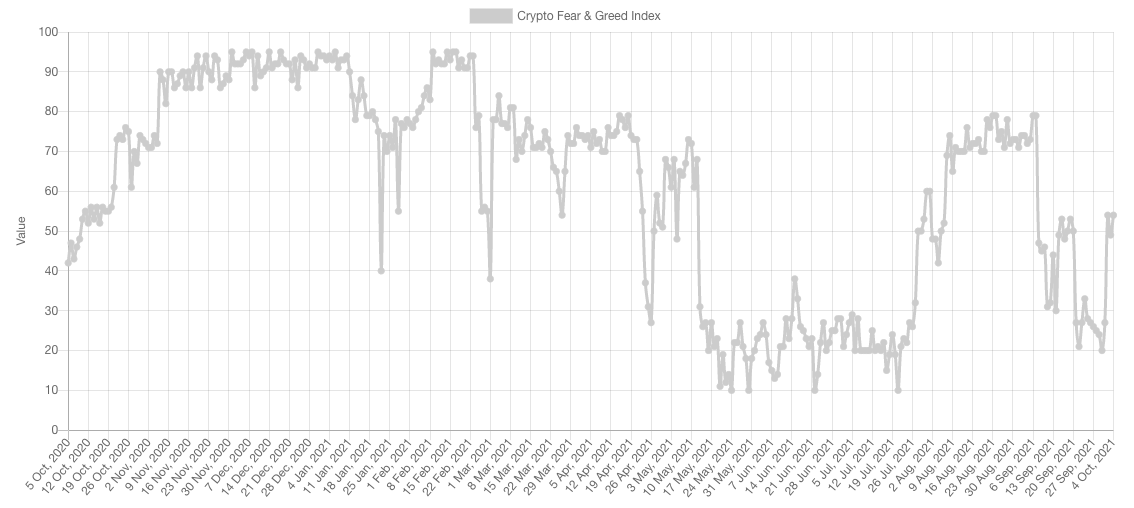

Market Sentiment

Sentiment has improved in the last week after Bitcoin's +$4,000 candle on the 1st of October. While it has improved, it is still in the Neutral region which means sentiment is less likely to affect price action in the near term and it will boil down to the fundamentals and technicals. All analysed below!

Market Indexes

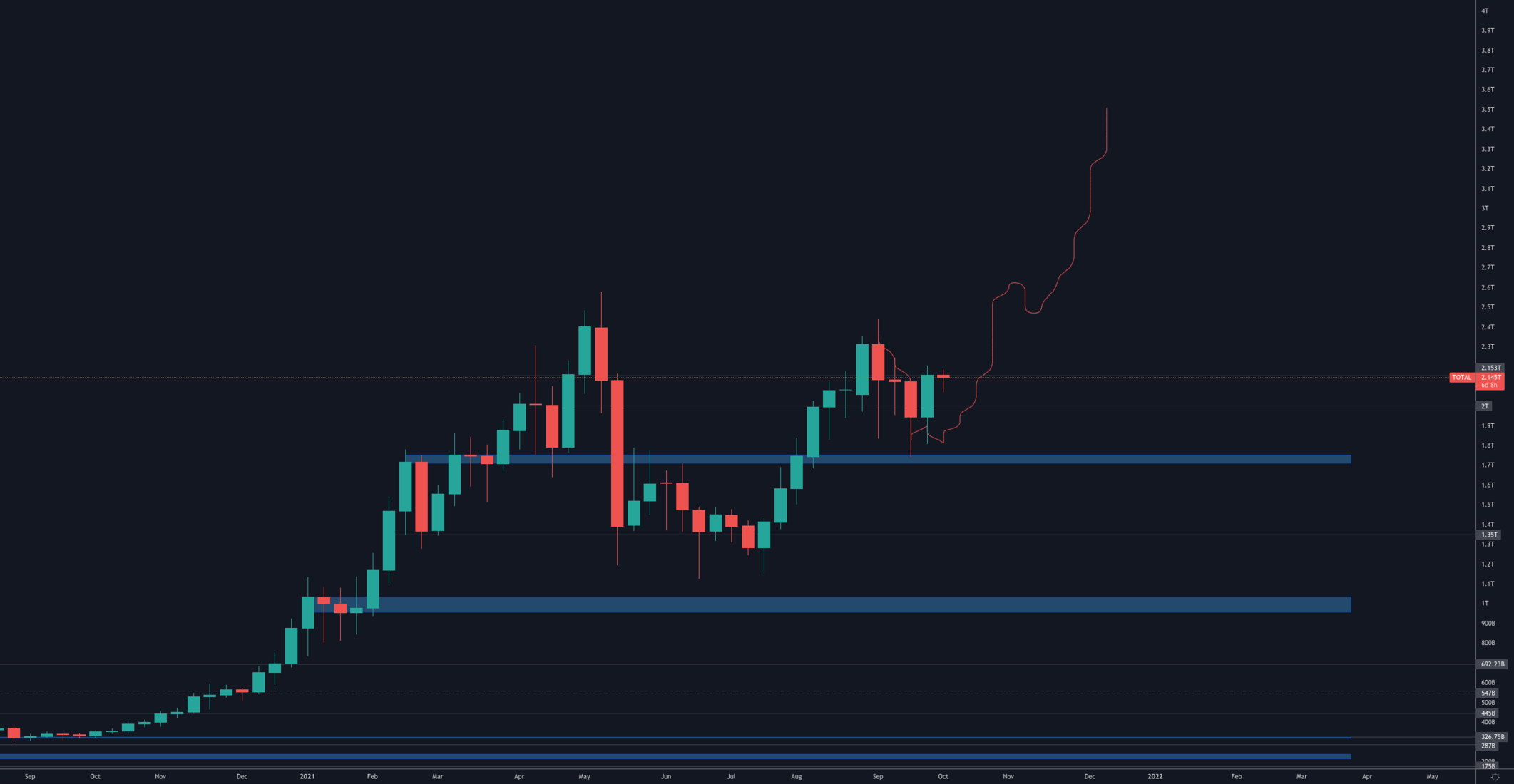

Total Market Cap

The weekly timeframe has registered a bullish engulfing candlestick. The last one we saw was in late July and Bitcoin rallied +70% in the span of 6 weeks. We have also seen the reclaim of $2T which means the only obstacle is now $2.5T beyond which is pure price discovery for the crypto space.

Altcoins' Market Cap

Similar development on the Alts MCap but it did hold better than the previous as it didn't break support and in fact held the $1.115T key level. Next up is the $1.5T mark beyond which is pure price discovery as well. The invalidation of such an "Up Only" scenario is a break of support on this timeframe.

Bitcoin

Bitcoin has a bullish engulfing candle on the daily timeframe reclaiming $45,000 which officially makes it support and maintains the next target at $57,000. Now it has become a matter of patience.

Ether

ETH perfectly found support at the weekly liquidity area ~$2,700 and is now on track for $4,200 once again.

DOT

DOT successfully holding the S/R flip at $27 and aiming for $40. We are still awaiting the fundamental catalyst: parachain auctions. Once $40 is crossed, the only line standing between DOT and price discovery would be $50 which is both a previous high and a psychological resistance.

SNX

SNX is showing weakness and until it reclaims $14.10 on the weekly timeframe it'll remain in bearish territory with a possibility of $7.50.

RUNE

RUNE showed more strength than SNX but is facing resistance at $8.85 still. Nonetheless, anything under $11.50 is considered bear territory on the weekly timeframe.

SOL

SOL reclaimed $150 and is now testing the previous weekly high at $175. A weekly closure above the latter drastically increases the odds of further price discovery.

SRM

$8.50 reclaimed and now a matter of SRM getting back into price discovery because price is struggling at any test of ~$13 so far.

MINA

For this falling wedge formation to remain value, $2.75 is a price that shouldn't be reached. As long as that condition is true then $5.70 remains a target for this pattern.

FTT

FTT remains in the same [$50-$60] range on the daily timeframe. One positive sign for price is the bullish hammer candlestick on the weekly that we just saw close.

DYDX

Bullish market structure intact. DYDX remains in price discovery. Bullish short-term still, until we see a change in market structure.