Weekly Technicals Pro - Volume 79

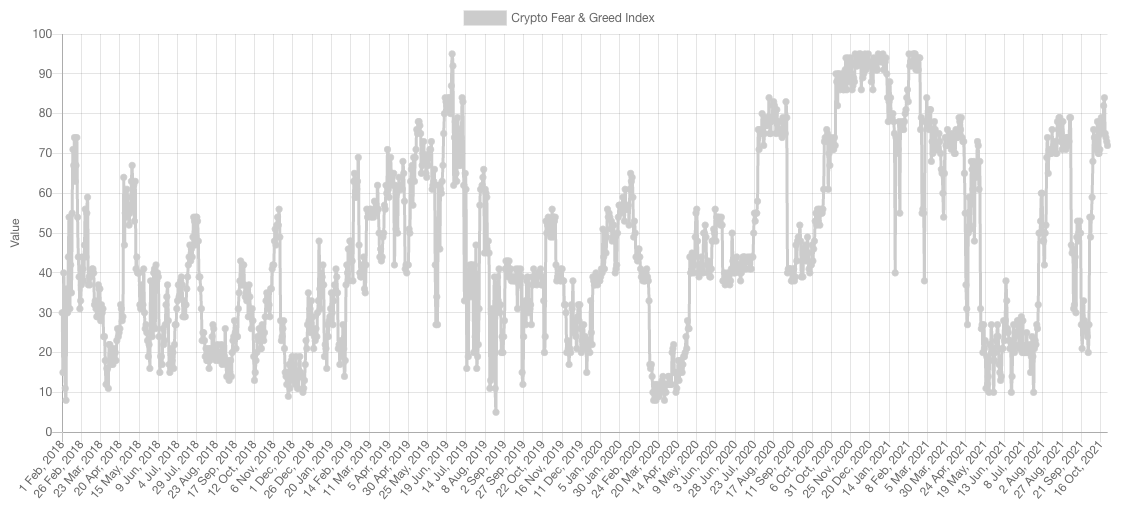

As BTC and the Total MCap entered price discovery, it is expected that market sentiment enters high levels of greed. While it is currently on the lower end of Extreme Greed, it has not reached the extremities where caution becomes of the utmost importance.

Imagine shorting the greatest bull run of all-time.Welcome to Weekly Technicals Pro where we analyse the crypto market from a zoomed-out perspective: the 1w timeframe.

Market Sentiment

Market Indexes

Total Market Cap

Cryptonary's squiggly line is leading the market.

The Total MCap is in price discovery and $2.5T is the latest resistance turned into support so any throwbacks there are no issue as long as there are no breaks below.

Target: $5 Trillion.

Altcoins' Market Cap

What an incredible chart!

When the dip happened in May, we were continuously stating that we'd never be caught fading the multi-generational breakout on Alts and look at where we are now. This index is lagging behind the previous one because BTC is leading the race, nonetheless, it is close to a breakout and all we need is a closure above $1.5T.

Bitcoin

Bitcoin closed above $60,000 and respected the latest breakout. This is the only pre-requisite needed for BTC to remain in price discovery.

Ether

ETH just registered the highest weekly candle closure ever and that's the first step taken for price discovery. The next one is a daily candle closure above $4,200.

Target: $10,000.

DOT

DOT is holding up well at $40 as support and next up is still $50 after which we'll see price discovery. Given the fundamental catalyst for DOT this quarter, we expect it to be an outperformer.

SNX

No changes to our bias on SNX and our interest would be peaked again at either:

- Test of $7.50

- Reclaim of $14.10 on the weekly

RUNE

Incredible performance by RUNE as THORChain is coming back online!

RUNE has closed a candle above $11.50 on the weekly timeframe which sets it back in bull territory and the next target is the previous ATH at $21.

SOL

New weekly high which sets the stage for a run towards $300.

SRM

How boring can an asset be? Well the maximum seems to be SRM lol (just kidding).

SOL is performing well but its ecosystem is lagging behind and until then SRM seems poised for a $6.40 test.

MINA

MINA has a bullish market structure on the weekly but its point of weakness so far is $4.90. If it is able to reclaim the latter then we'd expect it to enter price discovery.

FTT

FTT has broken out of the [$50-$60] range and that sets its next target as $80 - beyond which comes price discovery.

DYDX

L1s are stealing attention from other DeFi tokens - one of which is DYDX. Nonetheless, DYDX is at $18 right now which is support. Our speculation here is further ranging followed by a rally that reclaims $21.50 and helps it run into $36.50 by end of year.