Going to be a big week

— Barry Silbert (@BarrySilbert) November 7, 2021

Welcome to Weekly Technicals Pro where we analyse various crypto assets on the weekly timeframe to depict the most probable outcomes over the mid-term.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility and only you are accountable for the results.

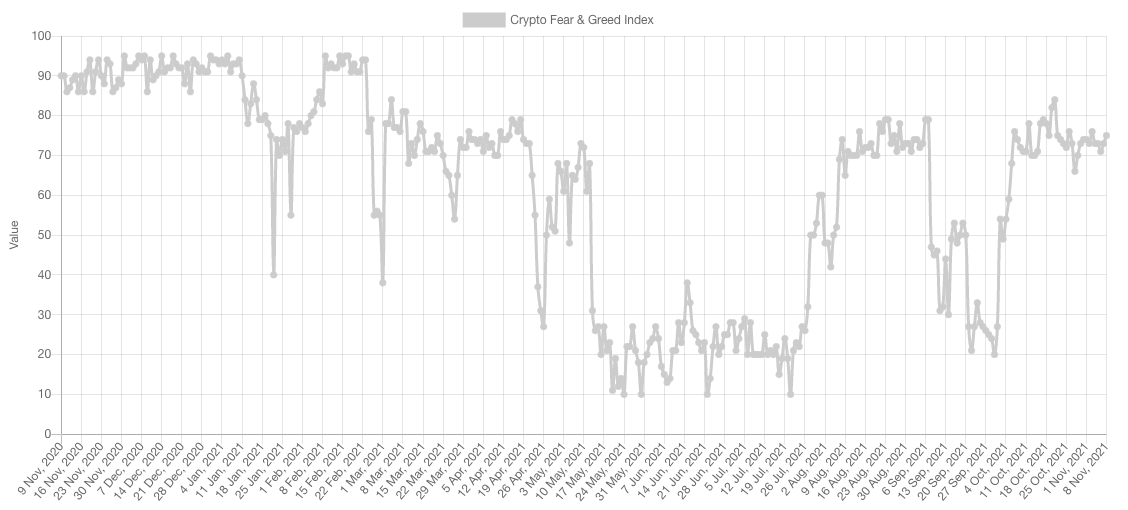

Market Sentiment

Sentiment has been stagnant for roughly 5 weeks now and that is because price has been rangebound during that period of time. We keep an eyes on the Fear & Greed index mainly because it acts as a caution gauge when momentum runs too hot. Nonetheless, this metric is only useful when it reaches either side of the extremities where it currently is not.

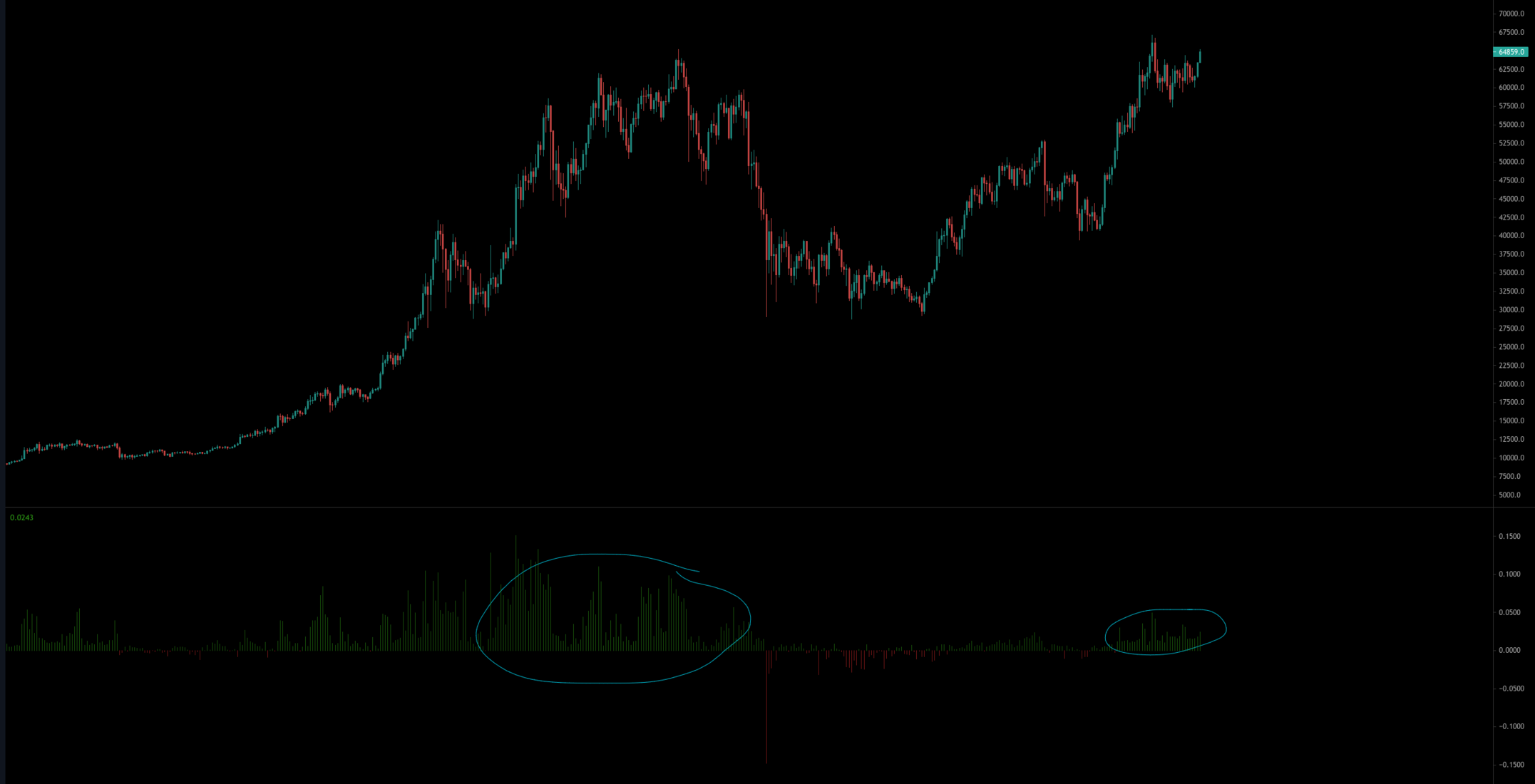

The metric that does assist right now in mapping out where the market is most likely to go is the funding rate.

Funding Rate

TLDR: When the funding rate is too high, the market is in an unsustainable rally. The same can be said when funding goes negative.

Right now, we're seeing very average levels of funding, lower than even what we saw during the first breakout of the year from $20,000. This communicates to us that the market won't be limited by leverage in the system at this point as traders aren't blindly "ape longing".

Market Indexes

Total Market Cap

The squiggly line is lighting the path forward. Up next is $5T.

The R:R is slowly diminishing for new entries as price move away from the $2.5T level of support.

Altcoins Market Cap

We've seen the breakout from $1.5T on the daily timeframe and now on the weekly as well. This has activated the cup & handle bullish formation that holds a technical target of $2.4T.

Bitcoin

Bitcoin is properly maintaining support above $60,000 and has just registered its highest ever weekly closure. Given the maintenance of the latter as support, we remain highly bullish on BTC for the upcoming weeks with targets of $74,000 followed by $100,000.

Ether

ETH is in pure price discovery mode. This is the moment we've waited multiple months for and it has no arrived. In terms of support, we have $4,200 but the further price moves away from it the lower the R:R becomes on ETH in the short and mid-terms. In regard to a target, we are still aiming for $10,000.

DOT

The launch of parachain auctions has pushed DOT into uncharted territory. $50 has been turned into support and the next level we're looking for is $100.

SNX

No changes as we remain awaiting:

- $7.50 test

- $14.10 reclaim

RUNE

Since RUNE entered back into the bullish territory, we once again both short and mid-term bullish on it. $16.50 has caused some resistance as well as the THOR IDO but that has been resolved rather well by THORChain. In regard to a target, we are still looking for $21 in the near term.

SOL

Price ranged between [$135-$175], broke out from that range, retested it and rallied into the stratosphere. Now we maintain the $300 target for the upcoming few weeks which we honestly expect to be crushed - but that's just intuition not technicals.

SRM

The application layer will receive its fair share of hype once the base layers cool down, SRM belongs in there. In regard to price action, SRM is ranging between $6.40 and $8.50.

MINA

Over the past couple months, MINA has moved in a pure sideways fashion and nothing interesting will arise until $5 is reclaimed.

FTT

FTT has managed to close back up again above $61 which represents the highest candle closures in May. This reinforces our bias that has EOY targets consisting of $85 and $100.

DYDX

DYDX may be in the process of setting a local bottom, if that is the case then a reclaim of $18 would act as confirmation.