Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility and only you are accountable for the results.

Market Sentiment

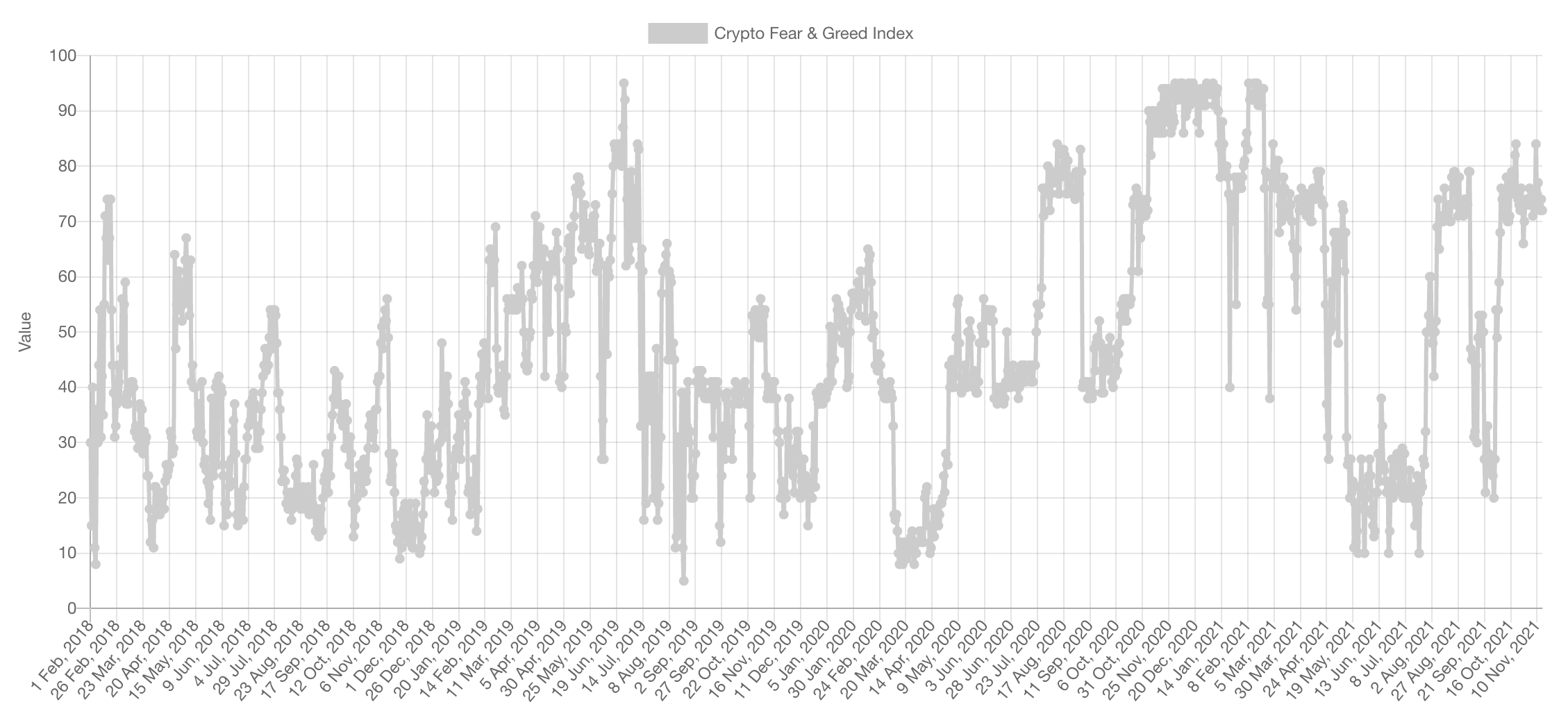

Sentiment is not near the extremities where caution can become warranted on the Fear & Greed index. The more accurate depiction of sentiment is going to be the funding rate on perpetual futures across exchanges.

Let's simplify what this chart communicates: the higher the green bars at the bottom, the more euphoric the market is. As you can see the market is in a much healthier state here in the mid-$60,000s than it was in the first half of this year. This tells us that sentiment isn't standing in the way of growth over the next few weeks.

Market Indexes

Total Market Cap

The Total MCap index is following through on the path set out by our squiggly line. As you can see, price is continuously setting new highs and has recently turned $2.5T from resistance into support which opened up the doors to price discovery. Targets are round psychological numbers, however, we are only interested in $5T.

Altcoins' Market Cap

Shorting breakouts into new highs is weird - not the good kind of weird...

Alts MCap absolutely ripping here and signalling that there's much more incoming with the latest breakout and activation of the bullish cup and handle formation that targets $2.35T.

Bitcoin

Despite it being an indecisive and semi-volatile week, Bitcoin still managed to close the highest weekly candle closure to date with a very clear breakout from $60,000. When we take into consideration the fact that the market structure has been only made up of higher highs and higher lows over the past few weeks, the image becomes clear. The most probable route from here is: up. The only requirement is that $60,000 holds on the daily.

Ether

The R:R on ETH entries keeps diminishing as price goes up. Generally speaking, for ETH, the situation is as simple as:

Trading above $4,200 -> $10,000 is the next target.

DOT

DOT's weekly timeframe remains intact as no breaks have happened so the bullish bias remains alive and well. The daily is the problematic timeframe and it is where DOT must reclaim $50 soon.

SNX

No changes to previous weeks.

RUNE

The only requirement for us is that RUNE keeps trading above $11.50 on the weekly timeframe as that is what denominates the bullish territory. As long as it remains in this zone then we keep targeting $21.

SOL

Pure vertical-ness that targets $300. To share our 2c, entries here have a very poor R:R and have a completely different risk profile to even people whom entered at $200.

SRM

Awaiting a breakout from [$6.40-$8.50].

MINA

MINA has reclaimed $5 which sets the stage for $10.

FTT

FTT remains highly indecisive though it did register a bearish engulfing candle which is concerning and hints that $50 is very probable - we're not betting on that though as we're holding FTT from much lower.

DYDX

As projected in Multi-Format Thursday, DYDX retested ~$12.50. There seems to be demand at $12.50 but there must be a reclaim of $18 to confirm a local bottom.