Indecision is the thief of opportunity.The above is a popular quote and is applicable to financial markets as well. When a market is indecisive, such as now, it leads people to question their judgement which in turn leads to "trading the chop" where the most probable outcome tends to be capital reduction. This is why, in periods of indecision, one must form an opinion that has clear invalidations to ensure they don't get caught up in the mistakes led by indecision.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility and only you are accountable for the results.

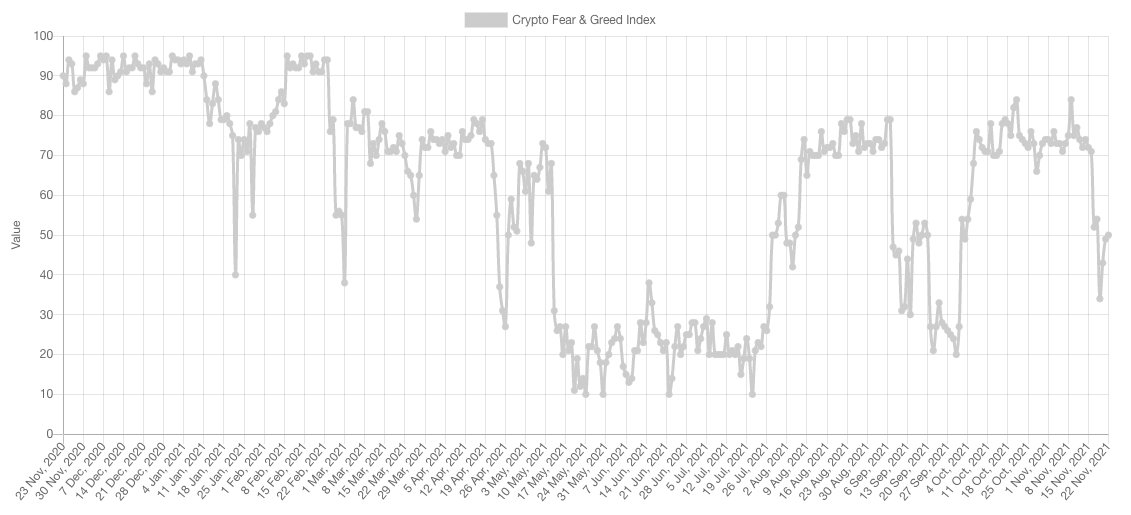

Market Sentiment

The current sentiment reflects the indecision seen by price at it sits at "neutral" levels.

To sum up, a very high funding rate means euphoria is in the market and calls for caution. The best way to gauge the current situation is to look at where price is, the vision for where crypto is going (each person has their own thesis) and then whether the momentum is sustainable or not. In this case here, leverage is not a limiting factor since euphoria is not to be found at this moment in time when it comes to BTC.

Market Indexes

Total Market Cap

The Total MCap is following the squiggly line with absolute precision and is now in the retest phase.

From a key levels perspective we must say that $2.5T is being tested as support after a breakout and hence based on this chart in particular, we cannot assume a bearish outcome in the coming weeks/months.

Altcoins Market Cap

The Alts MCap has closed under $1.5T but it has not created any new low here. Additionally, it has respected the weekly candle closures set in May and August and hence can be construed as a support retest.

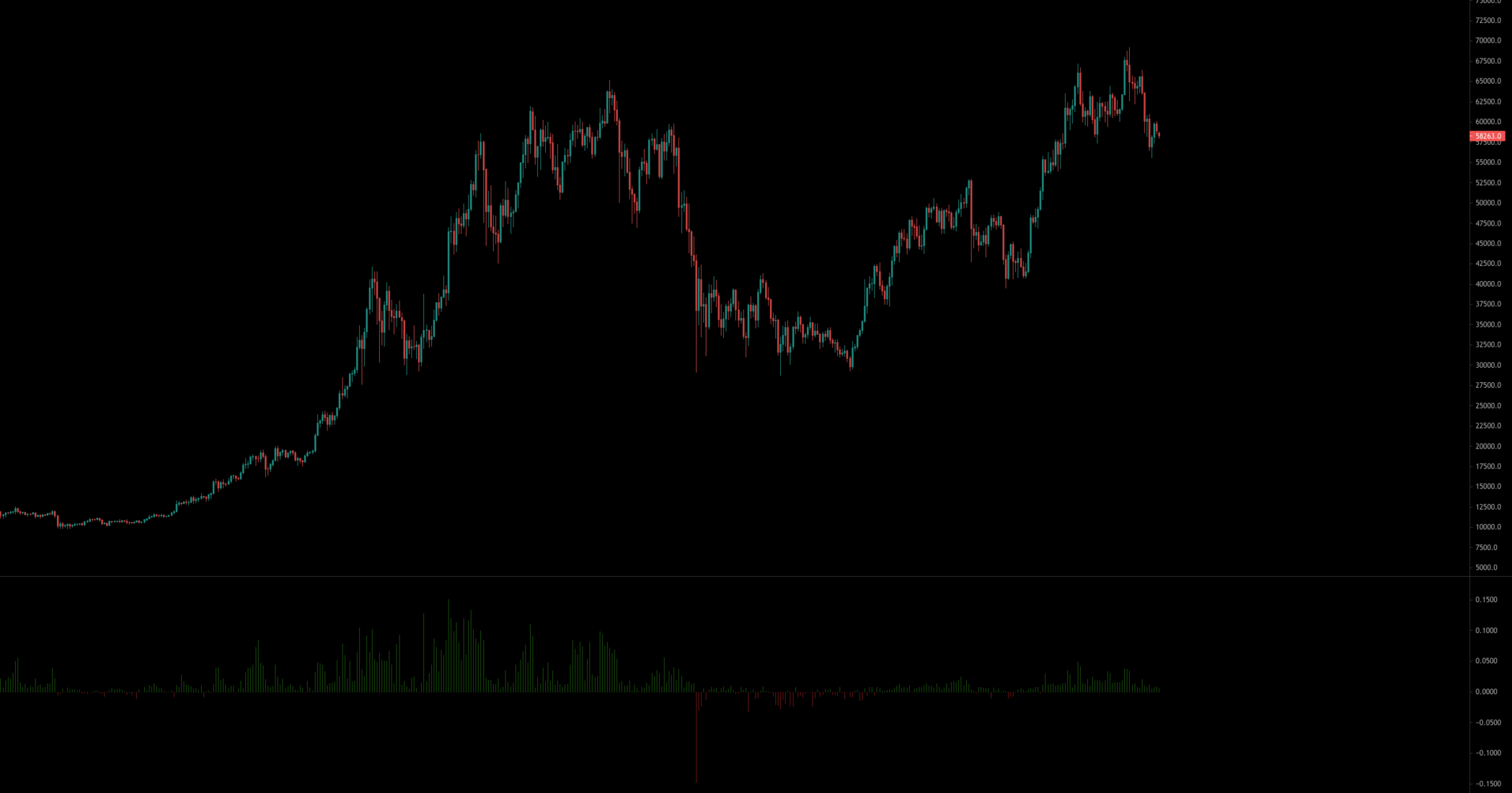

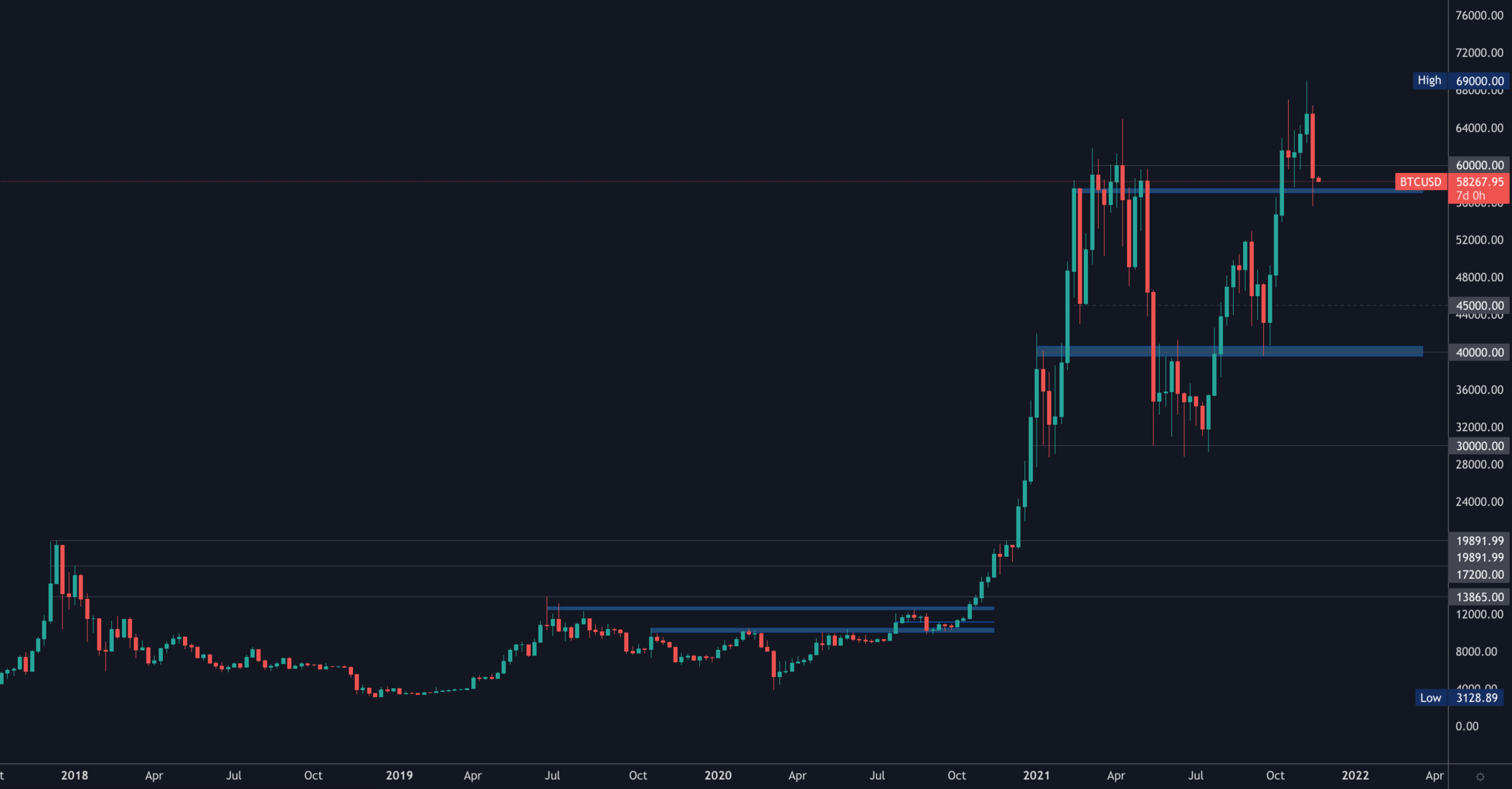

Bitcoin

Bitcoin was in a much better (more bullish) place when it was registering weekly candle closures above $60,000 as it showed absolute respect for previous highs. Now, however, we've seen a weekly candle closure under $60,000.

We will not be disregarding the fact that Bitcoin is trading near all-time high prices and near all-time low sentiment which tends to be a great recipe for upside, but we will remain cautious. BTC has $57,000 as support and it has also registered a lower low on the daily which is a sign calling for extreme caution at these levels.

Ether

ETH is painting a much better picture than BTC. Currently in a zone of price discovery and only retesting $3,930 as support on the weekly timeframe after a breakout last month. So long as this key level remains respected, our target will not fall short of $10,000. This tells us that there's a decent probability of ETH outperforming BTC in the mid-term which is coherent with the ETH/BTC chart below that has only recently turned into a bullish market structure.

DOT

DOT has $40 as support on both the daily and weekly timeframes. While monitoring DOT or other altcoins is important, the ultimate decision maker is BTC and ETH and hence keeping a close eye to their movements will be key.

SNX

No changes to our bias on SNX and awaiting one of the following scenarios to peak our interest:

- $7.50 retest

- $14.10 weekly reclaim

RUNE

The reason we started the analysis talking about indecision is because some charts remain reasonably bullish while others are in danger mode and RUNE belongs to the latter group. Price closed a weekly candle back in the bearish territory under $11.50 which is concerning. For now, we'll have to assume further chop/drop unless we see a reclaim of $11.50 which would invalidate that assumption.

SOL

The most bullish weekly candle closure amongst all charts in this analysis. SOL managed to pull in large demand at ~$200 which has led to a very large downside wick visually proving that demand - still targeting $300.

SRM

The same cannot be said about SRM as the breakdown below $6.20 indicates increased odds of $4.50 being tested.

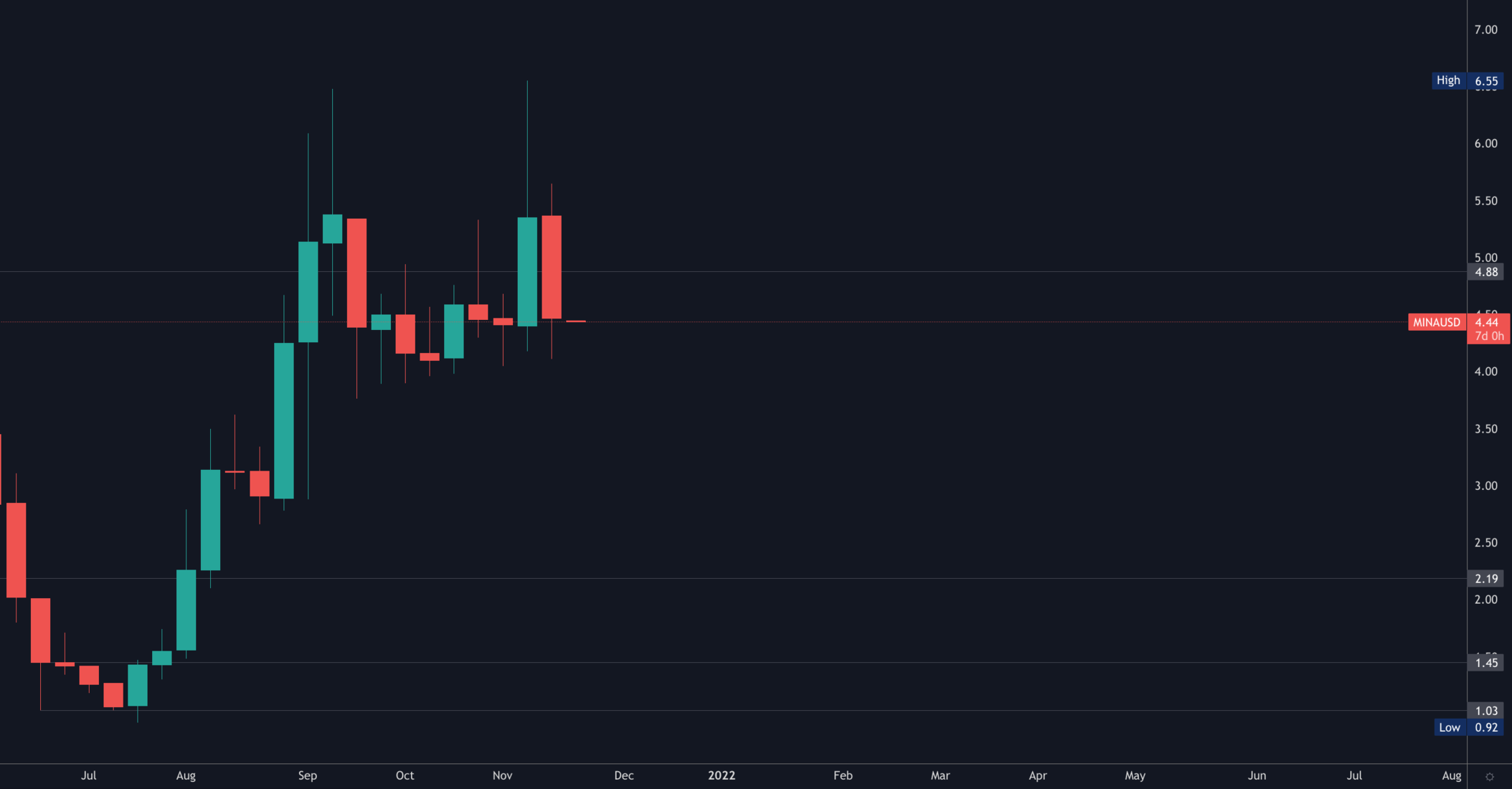

MINA

MINA remains in a bullish market structure but must reclaim $5 for any further upside.

FTT

Underperformance compared to the remainder of the market but at the $50 level of support (psychological & key).

DYDX

DYDX is in an obvious bearish market structure with continuous lower highs and lower lows. The real question though is whether $12.50 holds or not as it is the last line of defense before DYDX enters in the "single digit club". If it does hold and changes the market structure back to bullish then $36.50 would remain on track for the end of the year in our projections.