Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility and only you are accountable for the results.

Market Sentiment

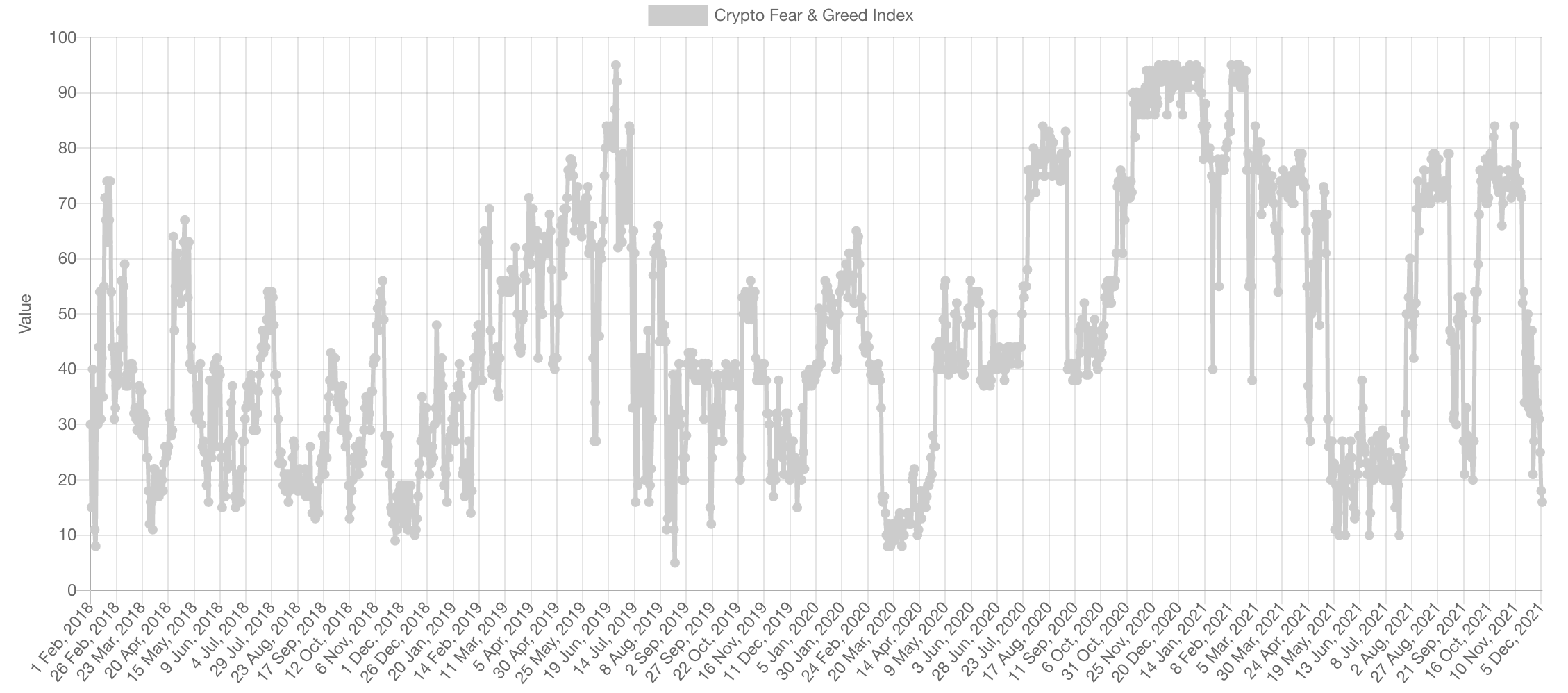

The sentiment is currently sitting at Extreme Fear. Historically, buyers during extreme fear sentiment in the 10s have ended up being profitable.

Market Indexes

Total Market Cap

The Total MCap has broken under $2.45T which sets the stage for two key levels: $1.75T & $2T - both of which are likely to be tested before further upside.

Altcoins' Market Cap

The Alts MCap is in a similar boat where it is now back in a range starting from $1.115T to $1.5T. The breakout from this range will tell us where the market heads to next in its upcoming leg.

Bitcoin

Bitcoin has seen an invalidated breakout to ATHs and now $57,000 & $60,000 have turned into resistance. In terms of supports, there are two, one of which has already been tested: $40,000 & $45,000.

Ether

Perhaps the most surprising chart of all the market-wide correction has not broken the structure for ETH. The ATH breakout and retest remains fully valid as long as $3,930 holds as support for ETH on the weekly timeframe.

DOT

Ever since DOT broke $40, $28 became the next logical target which has now been achieved.

SNX

SNX has registered a new low which is of course not a positive development for price. Currently, price is back in the [$5.50-$7.50] range so we'll have to monitor and check how it resolves.

RUNE

RUNE invalidated the breakout into bullish territory multiple weeks ago and the assumption since price broke under was "chop & drop" which has been seen here.

SOL

The only other asset besides ETH to have maintained the bullish market structure consisting of higher highs and higher lows.

SRM

SRM has broken $4.50 which opened up the door to $3.79 and wicks down towards $3 are on the cards here.

MINA

MINA has broken down from the consolidation which puts the next level on the weekly at $2.20.

FTT

FTT held $40 thus far, if that breaks then a test of $25 would be on the cards, otherwise $50 is still on.

DYDX

DYDX has opened up the door to downside price discovery. We'll be intrigued to enter longs once the market structure starts stabilising and starts to create higher highs and higher lows.