Disclaimer: Not financial nor investment advice. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

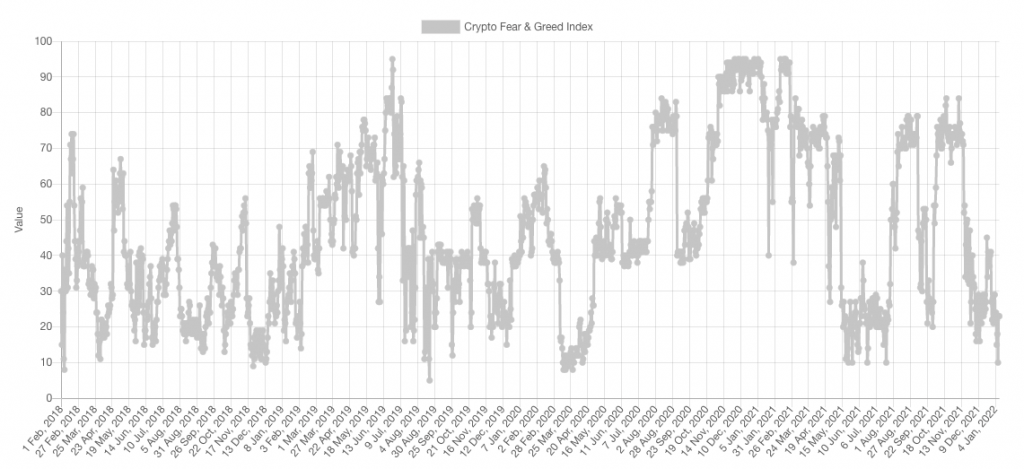

Market Sentiment

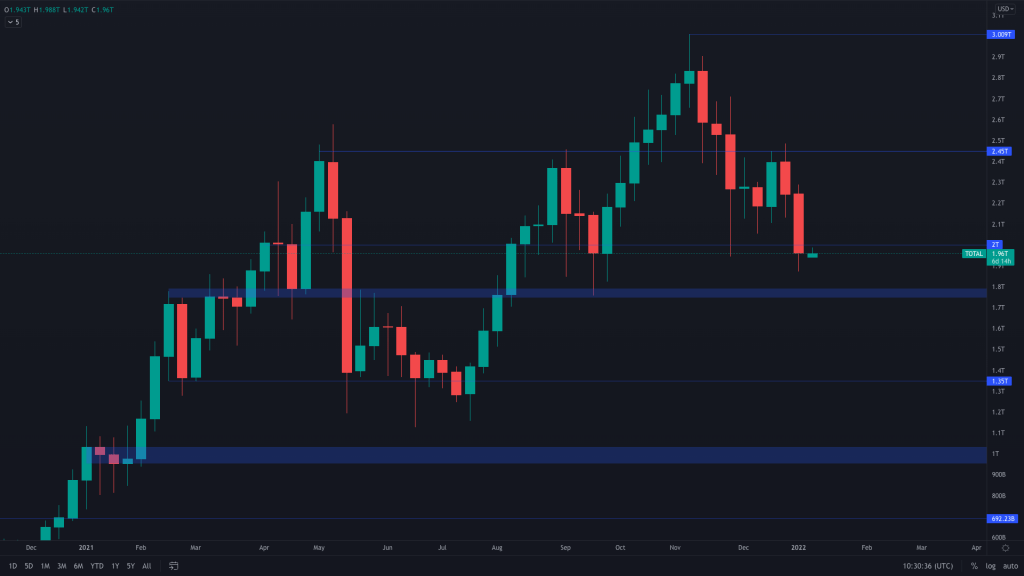

Total Market Cap

With the formation of a weekly lower high, coupled with the failure to reclaim $2.45T, we've seen an immediate decline in the Total Market Cap. The weekly candle closure was under $2T (which is only a psychological level, and we only note this on the daily timeframe). Still, the critical level here is the $1.75T to $1.8T technical support. We'd expect to see this level tested with the market still looking bearish. We highly suggest reading the journal titled 'Are we headed to Goblin Town?'.

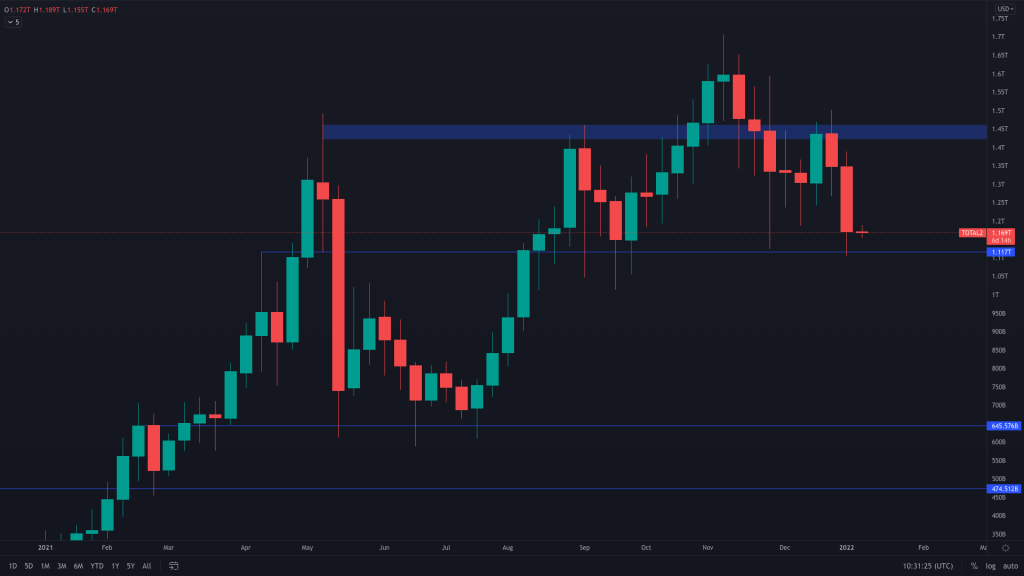

Altcoins Market Cap

The Altcoins Market Cap tested its weekly support level($1.117T) and closed above. However, should we see the Total Market Cap go down to test support, this index would not be immune, and we would expect to see it move closer to the $1T level.

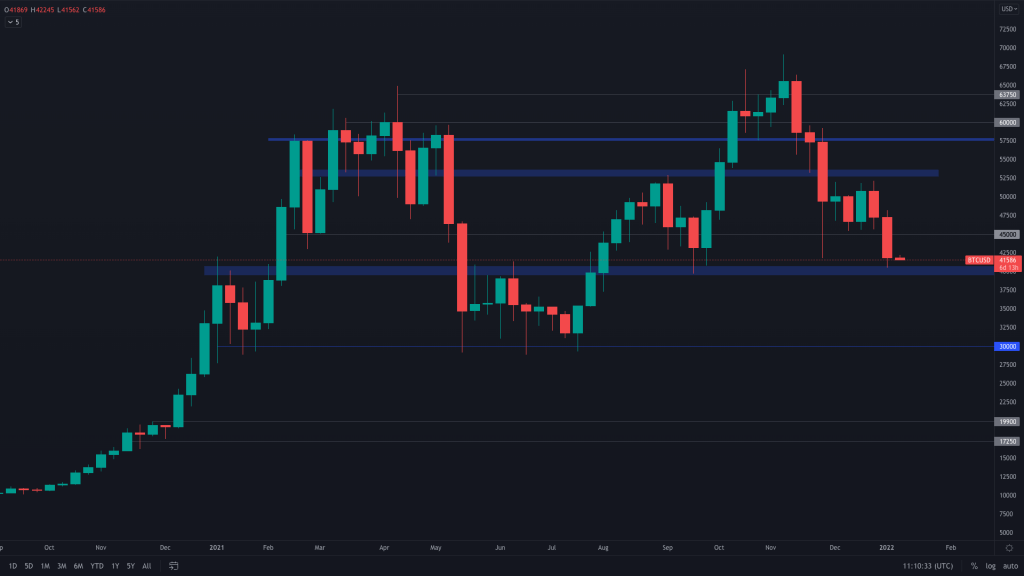

BTC

Bitcoin lost $45k as support and moved towards the lower end of the range, which it tested this week.

Whist $45,000 held some weight as support, Bitcoin tested it many times and, as we stated last week, the more that this level is tested, the fewer buy orders there are remaining, and the price eventually moves below support. This was the case here. Price action is still volatile and the market has seen a lot of 'chop and drop'.

If we assume that the Total Market Cap will hold its support level of $1.75T and couple it with the Bitcoin chart, we may well see the price dip slightly underneath this support level ($39.5k-$40.5k).

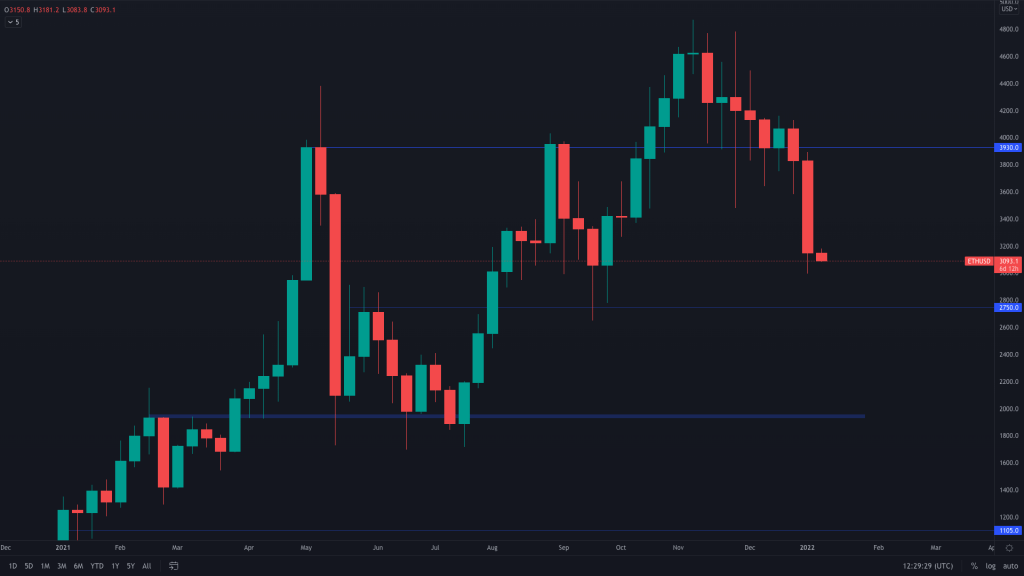

ETH

Ether (-18%) declined more than Bitcoin (-12%) on the week and closed right underneath the daily support at $3,200. With the loss of the daily support level coupled with the accelerated move towards the lower end of its range, it's increasingly likely that ETH will dip lower towards $2,750 in the near future.

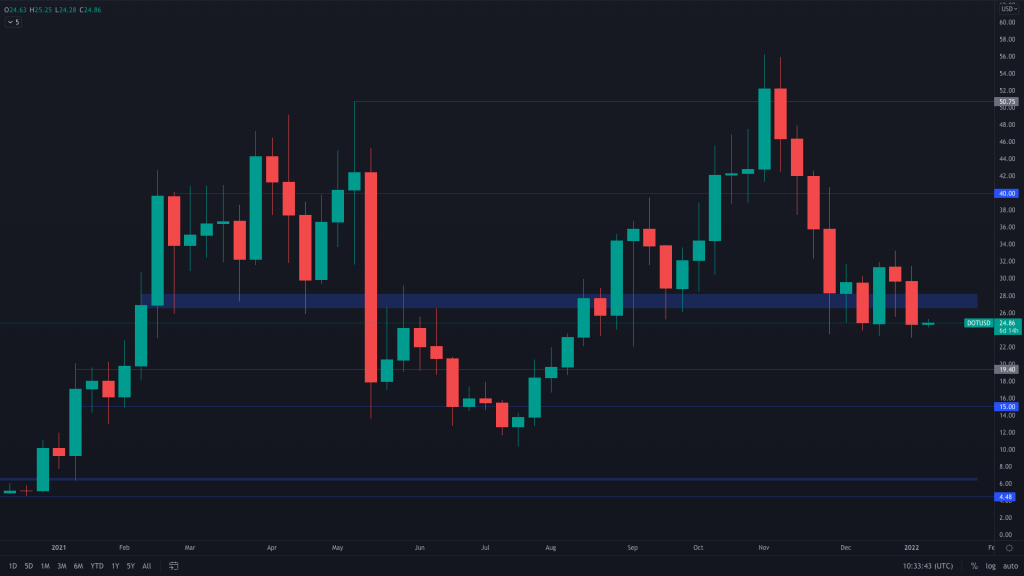

DOT

DOT closed underneath the liquidity area once more as it moved with the rest of the market. This sets DOT up for a test of $20.

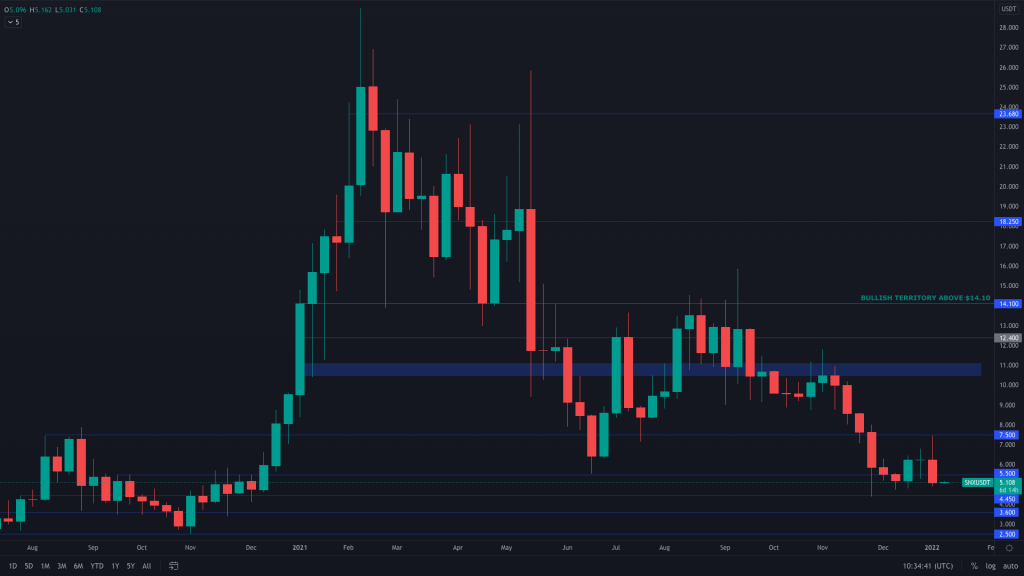

SNX

Last week we saw a great rally up to $7.50, only to be rejected and close underneath $5.50 support. We can't ignore the large bearish engulfing candle and the creation of a lower high. SNX has $4.45 as a support nearby, but any break below that would see it visit $3.60.

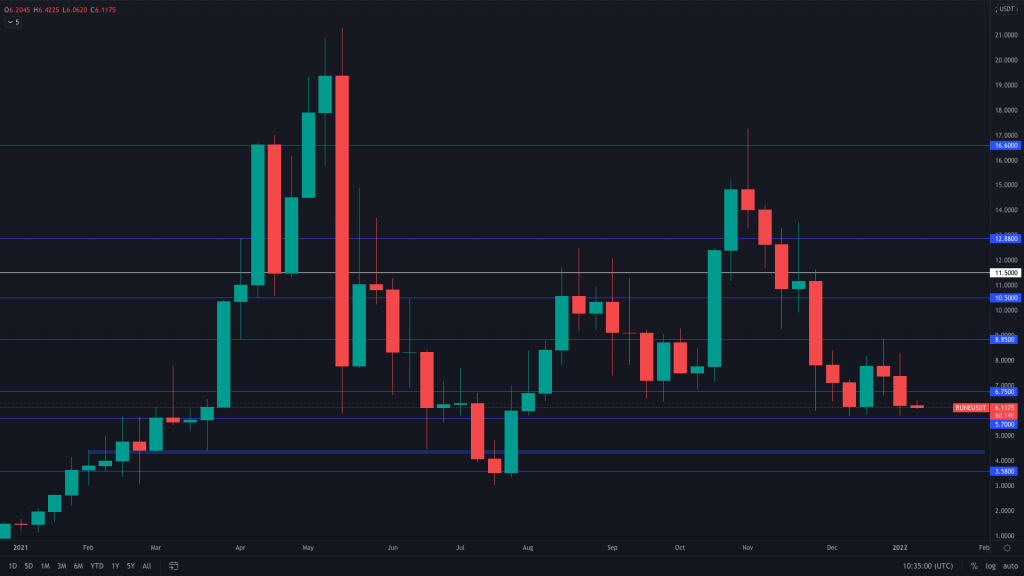

RUNE

We've now seen RUNE retrace the green candle from 2 weeks ago, and close below $6.75, putting it in the $5.70 to $6.75 range. We'll be monitoring RUNE on the daily timeframe to see if it closes below $5.70, as it would suggest that $4.40 is next.

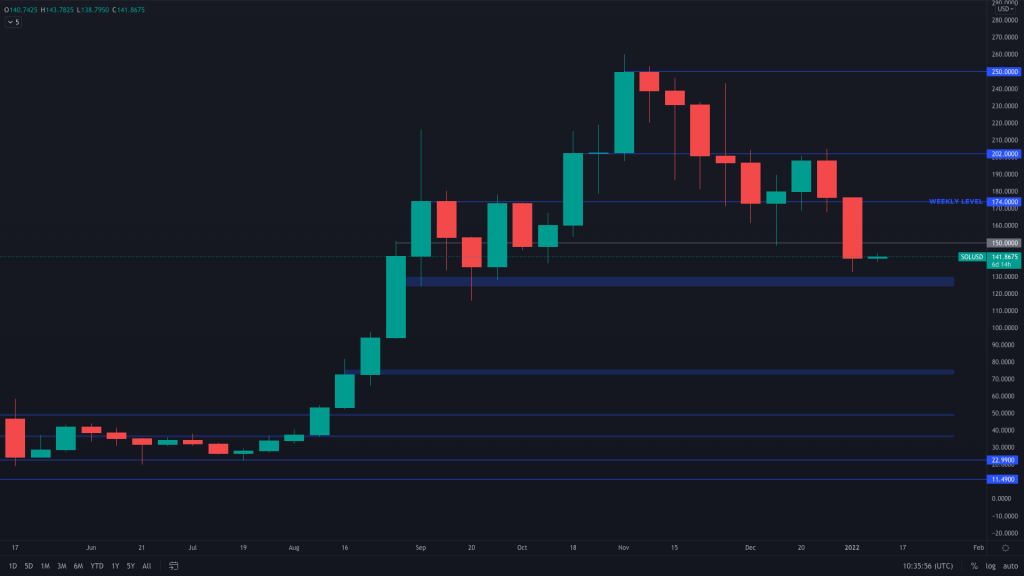

SOL

SOL headed straight towards $125-$150 as we expected, and the weekly candle closed midway between these two levels. We'll be watching whether SOL can maintain this level as support on the weekly timeframe. As long as Bitcoin holds the $40k level, we'd also expect this level to hold here.

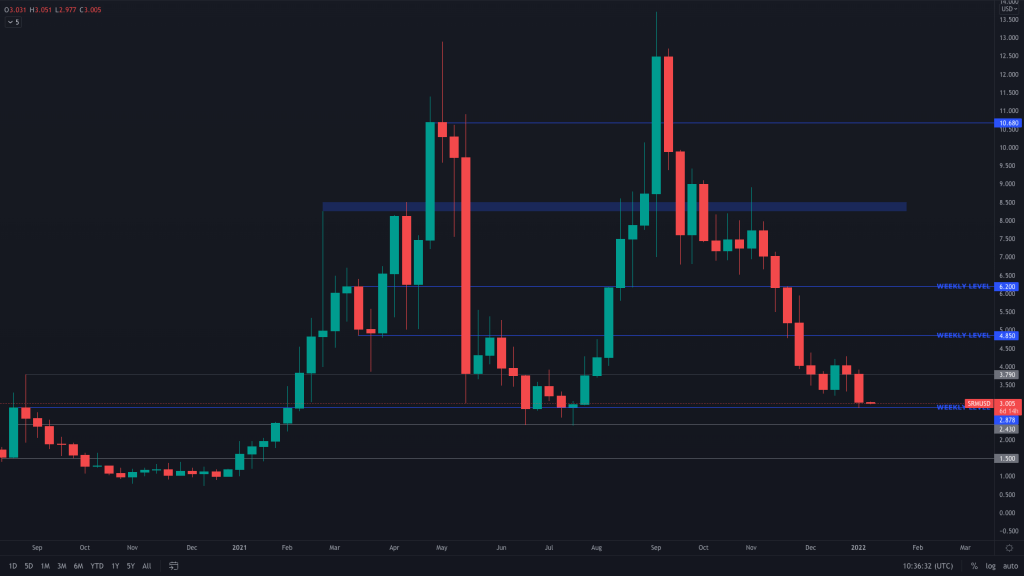

SRM

SRM failed to hold $3.80 and headed straight for its support below. $2.88 is its support, and we're expecting a bottom to form anywhere between here and $2.50.

MINA

MINA has closed another candle within the $3-$4 range. Should the market dip further we will have to see whether MINA can maintain this level as support.

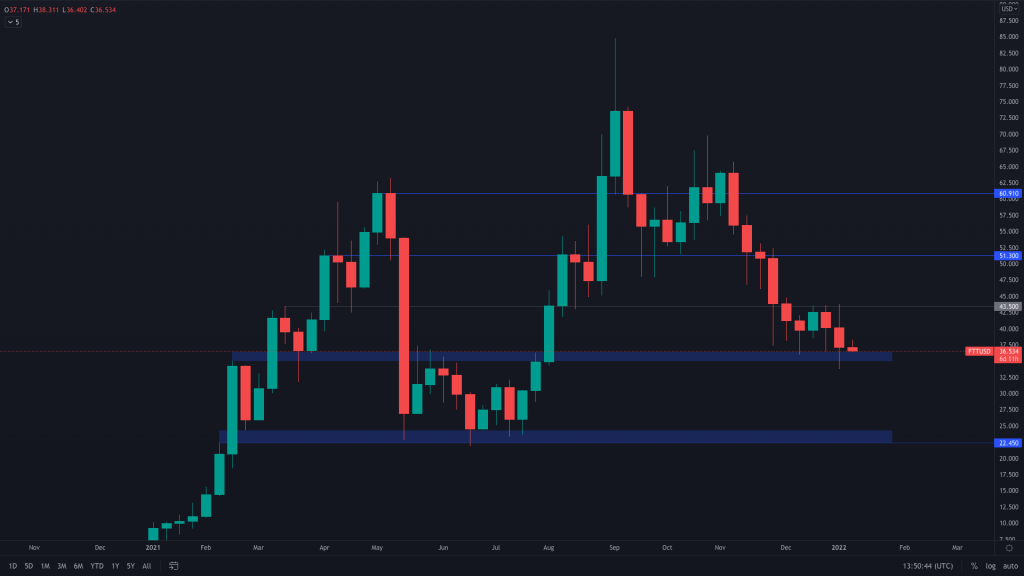

FTT

FTT is still trading within the $35-$50 range but with a bearish market structure. However, it's held up quite well when compared to the rest of the market and the weekly candle has held support. Should FTT lose this support, it does open the door to a test of $22.50.

dYdX

dYdX continues to decline in price along with the rest of the market. We're edging closer to our expected bottom of $3-$5.