Weekly Technicals Pro – Volume 91

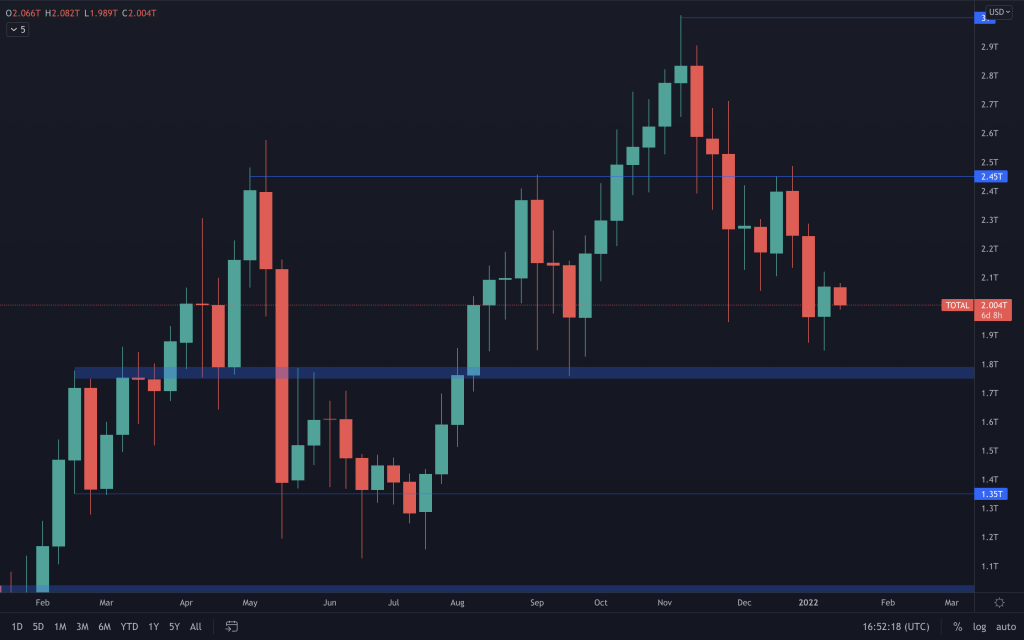

The Total Market Cap has a support level of $2T. With this weekly closure, $2T was reclaimed on the daily and weekly timeframes, putting $2.45T back in the frame. What we are seeing right now is this level be retested. Bulls need to show up, or else we have another lower high on the daily timeframe, which will push this index lower. In summary, $2T needs to hold as support because $1.8T would be back on the cards if it breaks.

Disclaimer: Not financial nor investment advice. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

Market Indexes

Total Market Cap

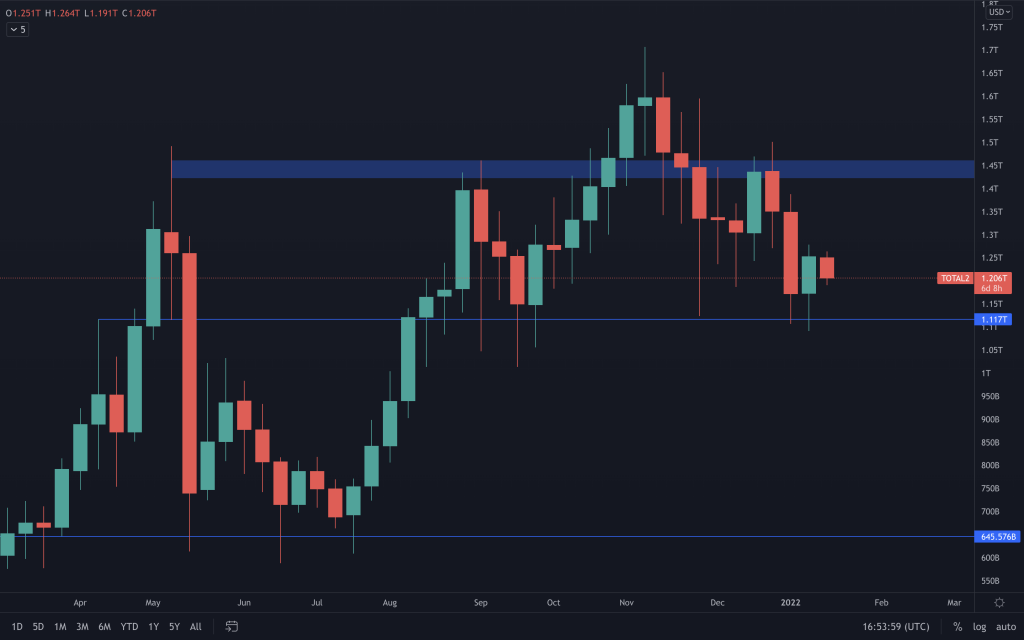

Altcoin Market Cap

BTC

ETH

ETH closed almost perfectly between its key weekly levels. However, it needs to hold onto the $3,200 daily support to avoid the chance of seeing further downside towards $2,800.

DOT

SNX

With a failure to convert the $5.50 resistance into support, SNX remains between $4.45 and $5.50. We're waiting for $5.50 to be converted from resistance into support. Until then, it's all chop.

RUNE

SOL

SRM

SRMs weekly support sits at $2.88. We're still expecting a bottom to form anywhere down to $2.50.

FTT

FTT has performed strongly over the past week, closing with a bullish engulfing, above its intermediate resistance at $43.50. This should help to push the price, at least, to the top of the range ($35-$50).

MINA

MINA is still within its $3-$4 range, and we await a breakout for an indication of where it's headed next. We're expecting Snapps to go live this quarter, which should reflect positively on the price.

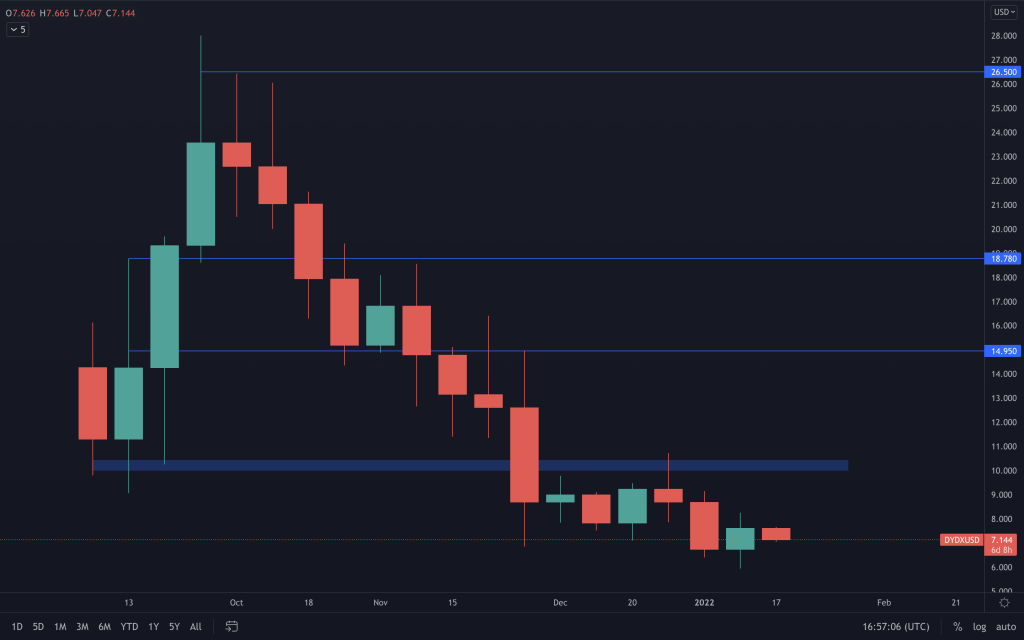

dYdX

dYdX is still in price discovery to the downside. We expect a bottom to form anywhere between $3 and $5.