Weekly Technicals Pro – Volume 94

The weekly closure is a positive development for price action as we've now seen the Total Market Cap reclaim the $1.75T-$1.8T key level with a strong bullish candle. The bearish market structure does remain intact at this moment in time, and to invalidate this, we're looking for a break in said structure. By this, we mean that we're looking out for the formation of a higher-low (likely around support) or for the index to trade above the previous lower-high ($2.12T), which would also reclaim the $2T level. Any loss of $1.75 will put the Total Market Cap back in the $1.35T - $1.75T range and risk further downside. The Total Market Cap is in the $1.75T-$2T range.

Disclaimer: Not financial nor investment advice. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

Market Indexes

Total Market Cap

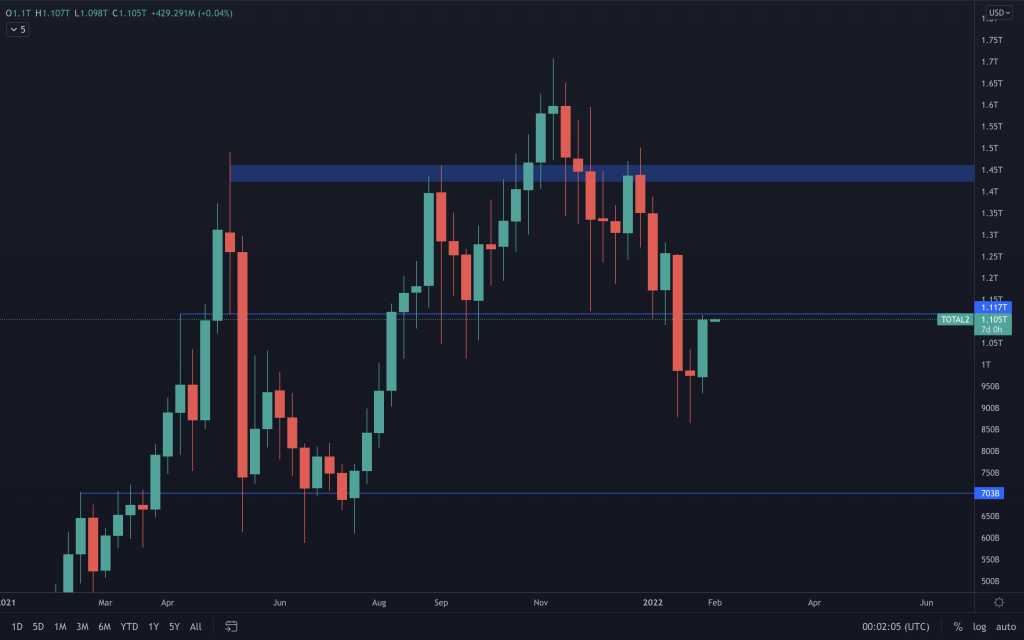

Altcoins' Market Cap

In contrast to the Total Market Cap, the Altcoins' Market Cap has closed underneath its weekly resistance level of $1.117T, leaving it in the $703B - $1.117T range. Should the rest of the market continue to move up, we would certainly see this level reclaimed and turned into support in the near future.

Bitcoin

Bitcoin closed the week out strongly and, in doing so, has reclaimed its key level. That level here is $40,000, which puts Bitcoin back inside the $40,000 - $45,000 range once more. To alter its market structure (in a similar situation to the Total Market Cap), BTC would need to create a higher-low at around $40,000 or continue to move up and reclaim $45,000. It's not completely in the clear yet, and any loss of $40,000 risks further downside to $30,000.

Ether

Ether has performed exceptionally well since pushing up through $2,750 and, much like all of the above charts, finds itself faced with overhead resistance at $3,200. A reclamation of $3,200 should see ETH push up past the previous lower-high. Of course, if ETH was to remain bullish, it's possible that we may see the formation of a higher-low first.

DOT

DOT has a little more work to do if it wants to alter its market structure. We've seen a weekly reclaim of $19.40, which puts DOT within the $19.40 - $28 range, and that should set it up for a run at the liquidity area at $26.50-$28. With the majors at resistance, it's possible that DOT may not take the direct route. That's also presuming that their supports hold.

SNX

SNX closed the week above $5.50, which sets it up for a run at $7.50 once again. With the majors being at resistance, SNX's performance will rely on those for now.

RUNE

After 14 days of sideways consolidation, RUNE finally broke out to the upside and is advancing to resistance at $5.70. For RUNE to be better positioned to avoid further downside, it needs to, at the least, reclaim $6 on the weekly timeframe.

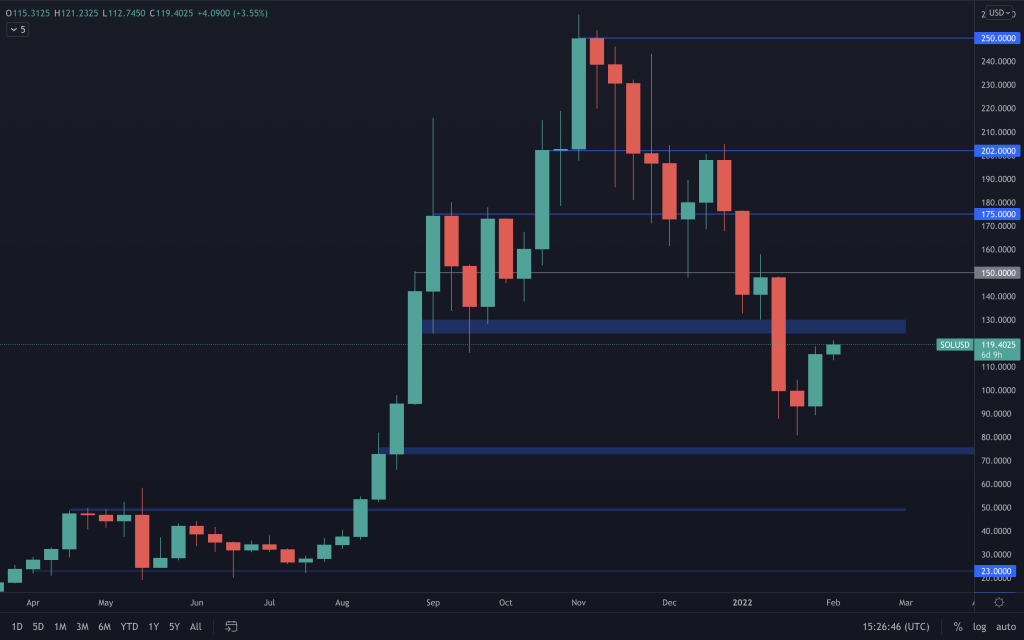

SOL

Along with the rest of the market, SOL has also seen a recovery but remains within the $75-$125 range. We've seen $100 hold as support on the daily timeframe, which has since seen the price move towards the top of the range. Like most altcoins, SOLs short-term performance will depend on what happens next with the majors. Altering the market structure on the majors will likely see confidence returning to the market instead of the uncertainty we've seen.

SRM

SRM bottomed around $2 and has since continued to recover. What really matters is seeing a weekly reclaim of the $2.88 level. Until then, further downside is possible.

FTT

Do you remember that $35-$50 range we talked about FTT being in for a few months? Well, it's still there. If FTT manages to breakout to the upside, $60 would be next and, beyond that, all-time-highs. Until then, we simply expect it to remain in this range.

MINA

MINA closed the week strongly along with the majority of the market, as its price pushed up into its resistance. For now, it hasn't reclaimed it, and $3.15 is the level that it needs to close above to do that. With the majors at a decisive point, MINA will likely react along with them.

dYdX

What a week for dYdX (+33%). We've now seen the push up that we'd mentioned in our daily market analysis, and the price has now tested resistance around $7.60. Price currently remains in a downtrend, and our region of interest hasn't changed ($3-$5). Don't forget, we already have our airdrop for exposure to dYdX, which is why we continue to hold out to see if that region is met.