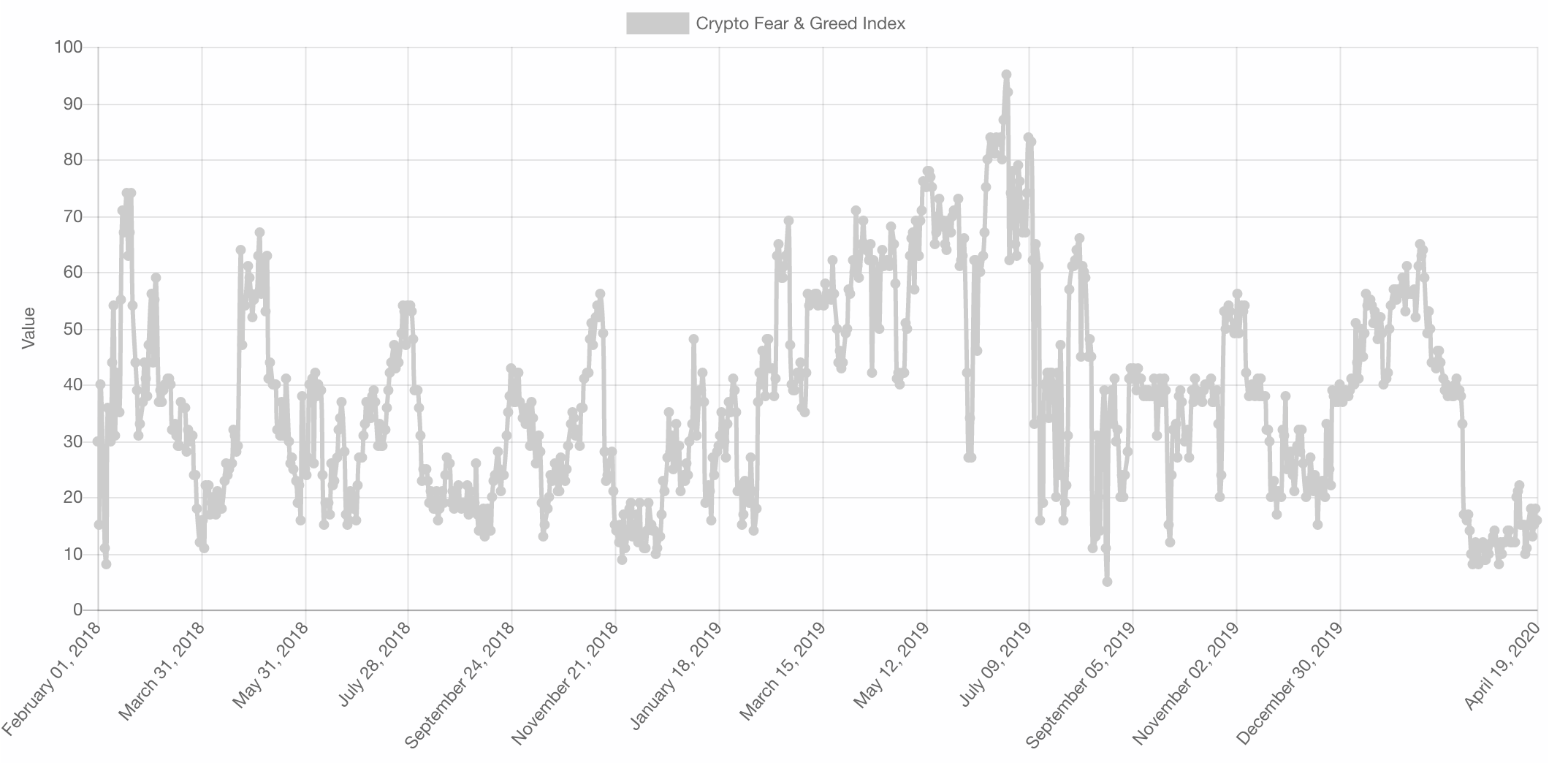

The market sentiment helps us gauge whether fear or greed is the most abundant emotion amongst market participants. Below is the market sentiment since 2018.

[caption id="attachment_15650" align="aligncenter" width="2146"] [Source: alternative.me][/caption]

[Source: alternative.me][/caption]

We are currently in the longest period of extreme fear seen. However, it is important to remember that the current environment pandemic/recession is the first to be experienced by this novel market. Extraordinary times call for extraordinary measures.

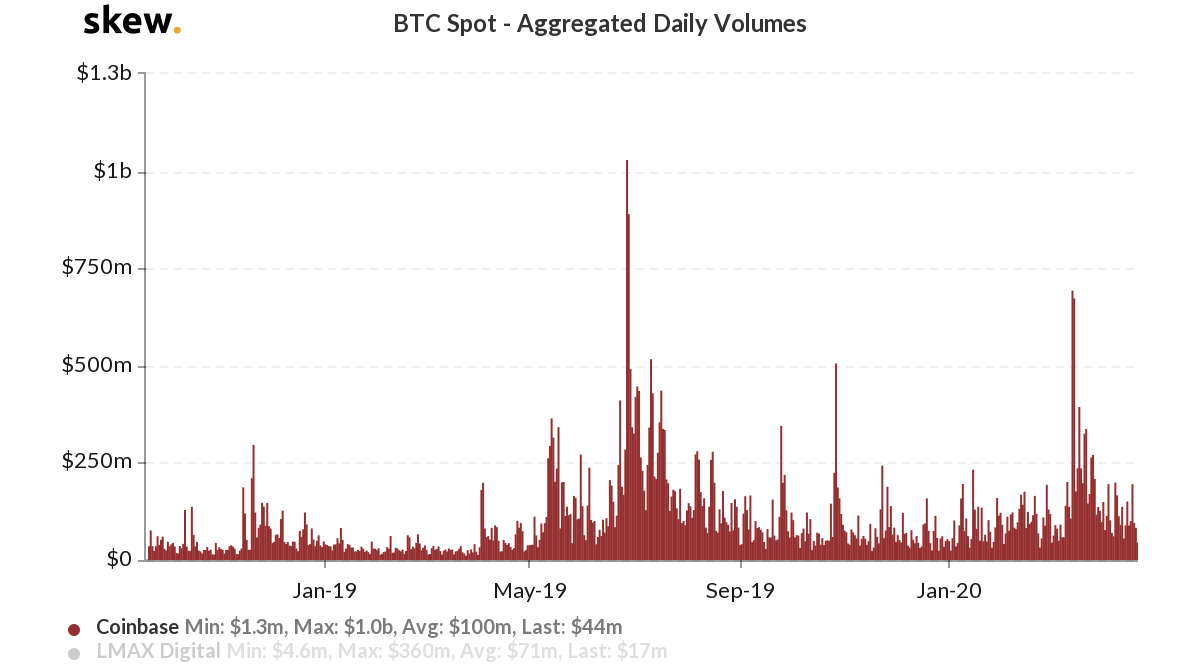

Volume & Open Interest

Since January 2020, we entered a phase of organic trading volume growth that was met by a large spike on Black Thursday that turned the market upside down. The last time this was experienced we entered into a 6-months bear market.

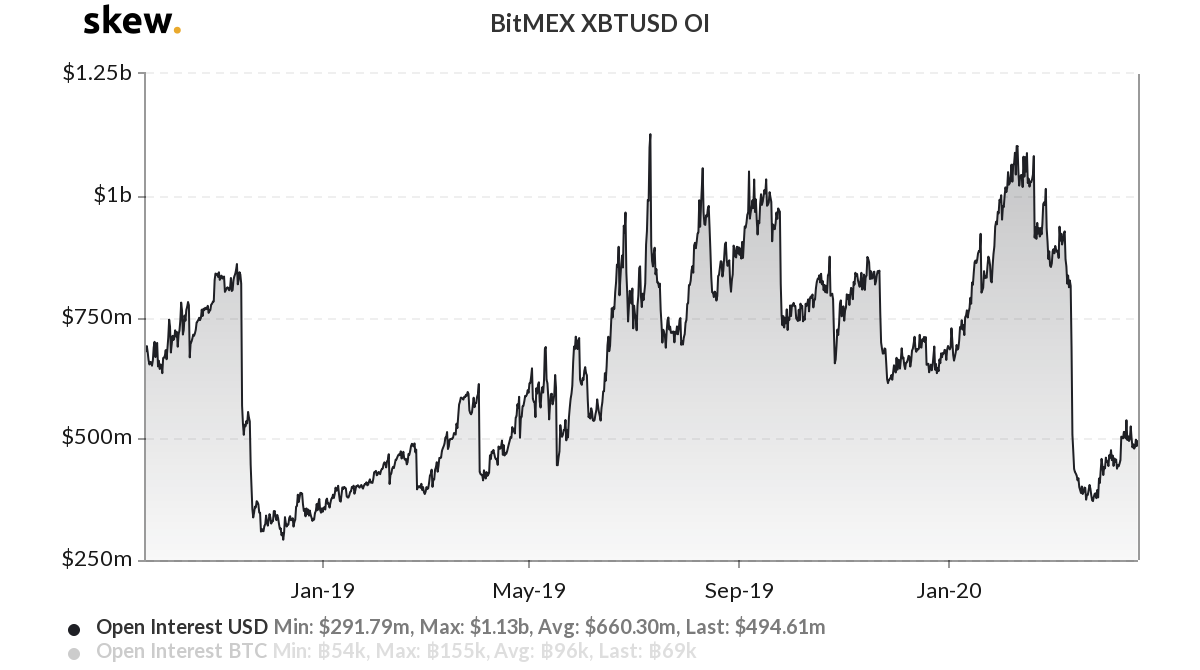

After having sustained above $1 billion in open interest on BitMEX for the longest time, over half of it was shaved off in a single day. A similar moment happened during the Nov 2018 crash which took a long time to recover from in terms of open interest. This is where skepticism takes place and a period of steady growth is required to recover.

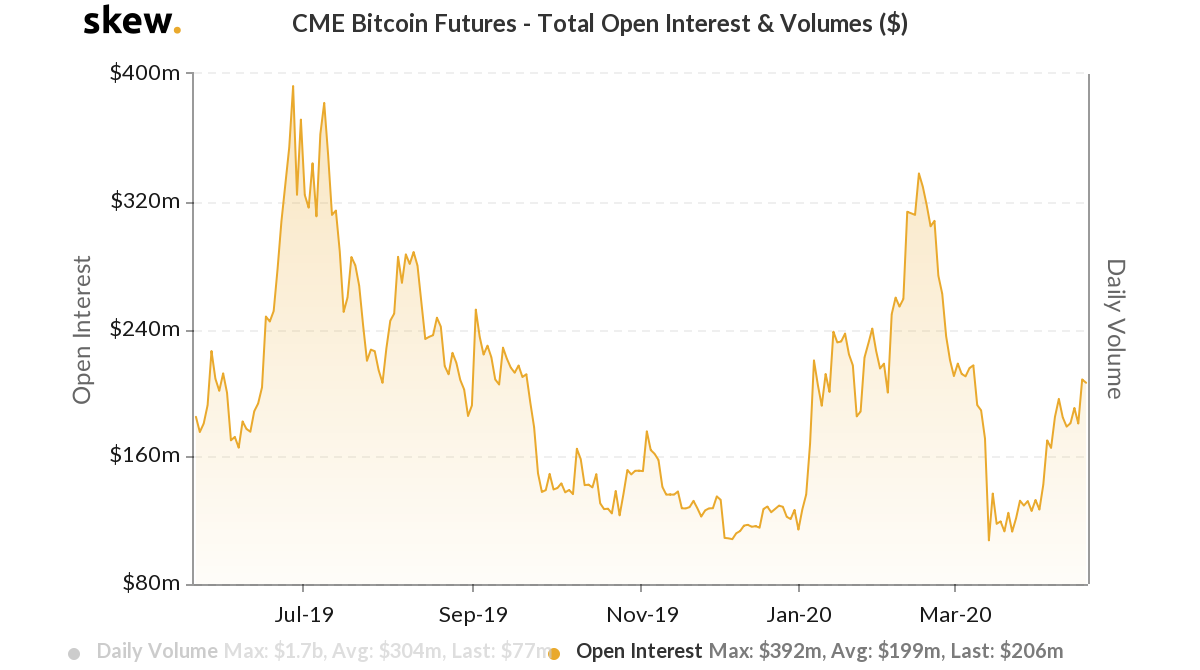

While the BitMEX OI jumped up a little bit, it was small (in percentage terms) when compared to the CME.

The faster rise on the CME calls for more institutional interest in trading Bitcoin futures. Nonetheless it is worth noting that the notional value has not exceeded $500 million in the past which is a very small amount for institutional traders.

The news of RenTec, best performing hedge fund, wanting to enter the Bitcoin futures market is rather positive on that end. The capital influx will take time but it seems to be closer on the horizon which will represent the third capital flow required for crypto growth.

Market Index

Total MCap

[caption id="attachment_15652" align="aligncenter" width="2880"] TOTAL [1W][/caption]

TOTAL [1W][/caption]

A day after the novel coronavirus was deemed a pandemic by the WHO, all markets crashed on what we now have called “Black Thursday”. The Total MCap reflected that as well and dipped into a major long-term value area where price found support in 2018-2019.

That area [87.5B-112.5B] drove enough demand to push the price by almost 100% in a single month. As we look closer at the chart we see that price has been setting lower highs and lows since mid-2019 and these peaks fit within a descending channel.

Currently, price is at the mid-line which has proved to act as resistance throughout 2019. The crash, while having brought an exceptional buying opportunity, created a lot of skepticism which is reflected in the longest period of “Extreme Fear” sentiment the market has been in in recent years.

Alts MCap

[caption id="attachment_15653" align="aligncenter" width="2880"] TOTAL2 [1W][/caption]

TOTAL2 [1W][/caption]

The Altcoins’ MCap reflects a very similar image to that shared by the Total MCap with one exception. If the market is to enter towards more downside, the blood shed seen on Alts will likely result in new multi-year lows.

Large Caps

Bitcoin

[caption id="attachment_15645" align="aligncenter" width="2880"] BTC/USD [1D][/caption]

BTC/USD [1D][/caption]

The image shared by the Total MCap is mainly built from Bitcoin as it represents over 60% of that index and hence the bias is similar on larger timeframes. The closeup of the daily timeframe is rather interesting here.

When we look at the volume of the moves we see a clear increase during downside moves and decrease during upside moves which further reinforces our theory of further downside happening. For those unfamiliar, volume must confirm a trend according to Dow Theory. Whichever way the move is when volume is increasing is the way of the major trend. Additionally, we saw an increase in OI on downside moves which further confirms this theory.

In markets there is no such thing as absolute certainty and hence one must always have a clear cut-off point where their theory becomes wrong. That cut-off point for us, as mentioned, is the mid-line of the large descending channel on the Total MCap.

Ether

[caption id="attachment_15649" align="aligncenter" width="2880"] ETH/USD [1D][/caption]

ETH/USD [1D][/caption]

Ether is the only large cap asset offering a conflicting view at the moment and actually looking bullish. The descending channel is valid on the asset but the mid-line has been crossed and retested which can boost price further towards the $200 mark.

XRP

[caption id="attachment_15655" align="aligncenter" width="2880"] XRP/USD [1D][/caption]

XRP/USD [1D][/caption]

Ether is an exception amongst Altcoins, even the Alt index remains under the mid-line. The third largest asset by market cap, XRP, has also had its fair share of downside during this pandemic, which pushed it to multi-year lows.

Its price has been moving within the confines of a descending channel as well, with a very well respected supporting trendline. Currently XRP’s price is approaching a junction between a key level, $0.20 and the mid-line. If these are crossed we may see a rally towards the upper end of the channel, otherwise we’ll likely see further downside.

Equities

We cannot talk about crypto today without looking at equities with the recent increase in correlation due to the global margin call. For those unfamiliar with the term, it refers to a period of financial downfall where most investors and traders are getting margin called and hence have to get their hands on cash as quickly as possible to avoid liquidations. This causes a correlated crash amongst different markets and crypto was one of them.

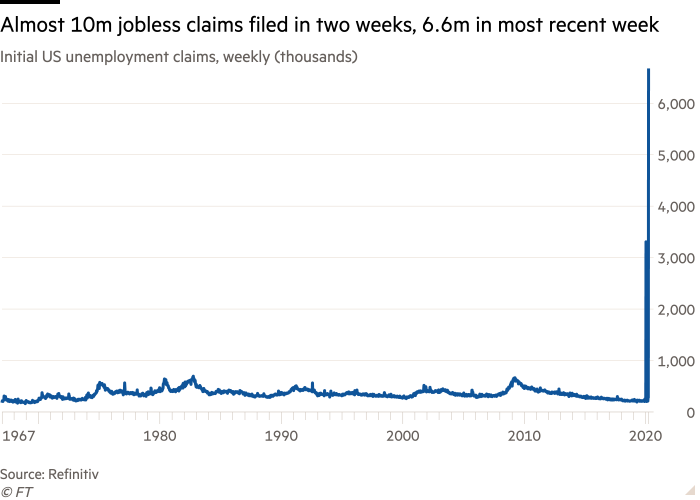

We will choose the S&P500 as a benchmark for the economy and businesses. After a major downfall, the index gained over 30% which seemed rather irrational given that New York announced that they’ll be starting to use public parks as burial grounds and that unemployment claims have sky-rocketed to never seen levels in the past few weeks.

The reason the markets rallied is because the Federal Reserve stepped up and turned on their printing press at full speed.

This will have devastating effects on the US dollar later on. However we’re talking about the present. The $350 billion stimulus package offered to small businesses has already ran out and Congress may not pass a bill for a second one. Small businesses represent 50% of the US GDP and the hand that was going to save them was pulled.

One other argument one may have is that the largest US companies by market cap are having some of their best days from a simple common sense perspective; companies such as Amazon and Netflix.

We will consider Google, Amazon, Netflix, Facebook, Disney (new streaming service), Apple (China manufacturing reopened) and even Clorox as their share prices registered all-time highs during the pandemic. Making the assumptions that these companies are having their best business days as everyone is sat at home, one could argue that this is what’s lifting the economy and the reason behind the “irrational rally”.

However, when putting together their market caps and seeing what they account for in the S&P500, that number comes at just over 16% which we’ll very generously round up to 25%. That means that three-quarters of the top US businesses are struck by this pandemic. Sooner or later, it only seems logical that the market catches up with reality.

Relation to Crypto

The correlation between Bitcoin and the S&P500 has reached a rather high level due to the global margin call as seen below.

[caption id="attachment_15648" align="aligncenter" width="2494"] [Source: CoinMetrics][/caption]

[Source: CoinMetrics][/caption]

If we take the crashes of 1929 and 2008 as templates we see that safe havens such as Gold only rallied after the market bottomed. Hence Bitcoin will likely become a great asset to own coming out of the recession, not in the midst of the crash. All in all, we expect that if equities crash, the effect will ripple (no pun) into the crypto market.