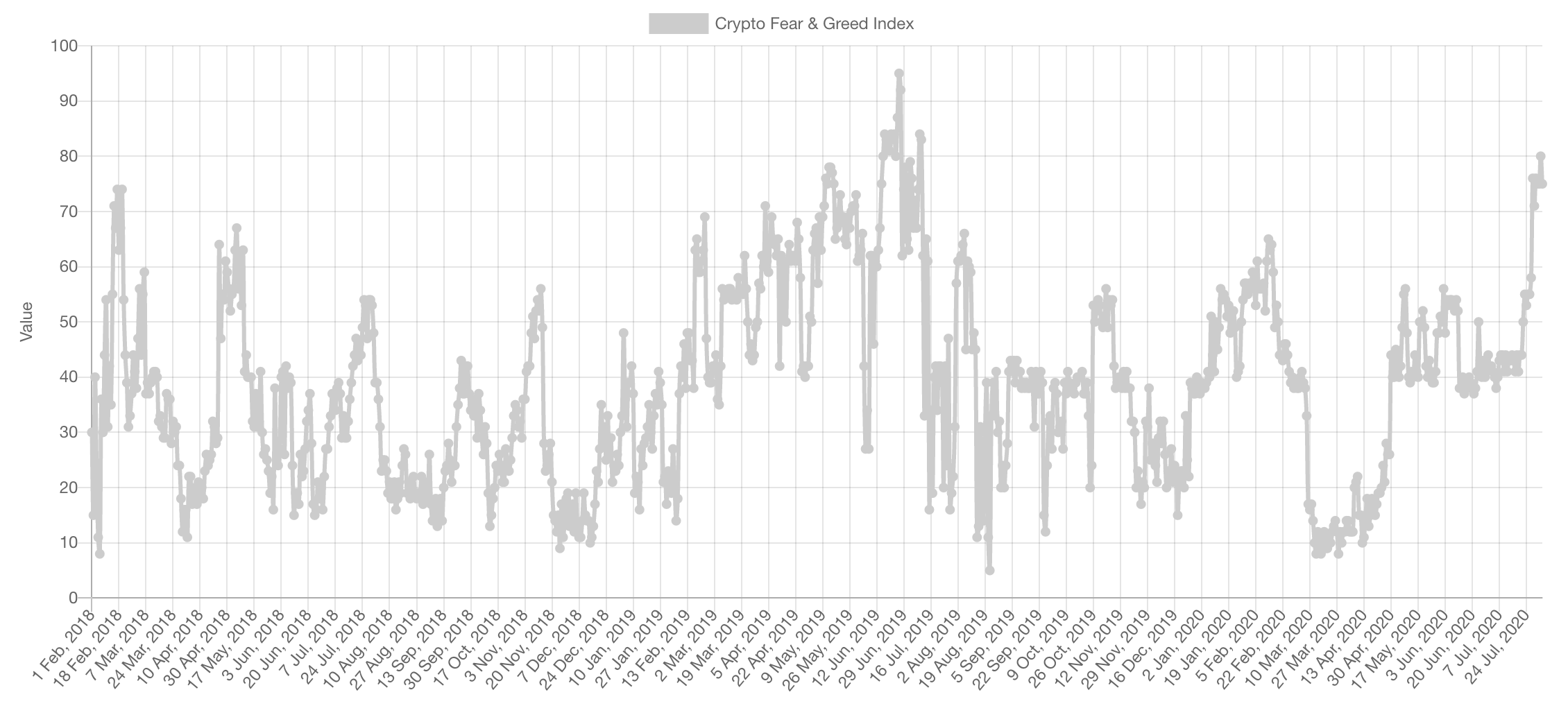

After an exciting week of relentless upside, it is without a doubt that market participants have become greedy. The latest large wick down that liquidated many longs has reduced that greed slightly and reminded traders that markets move both ways; as some seem to have forgotten.

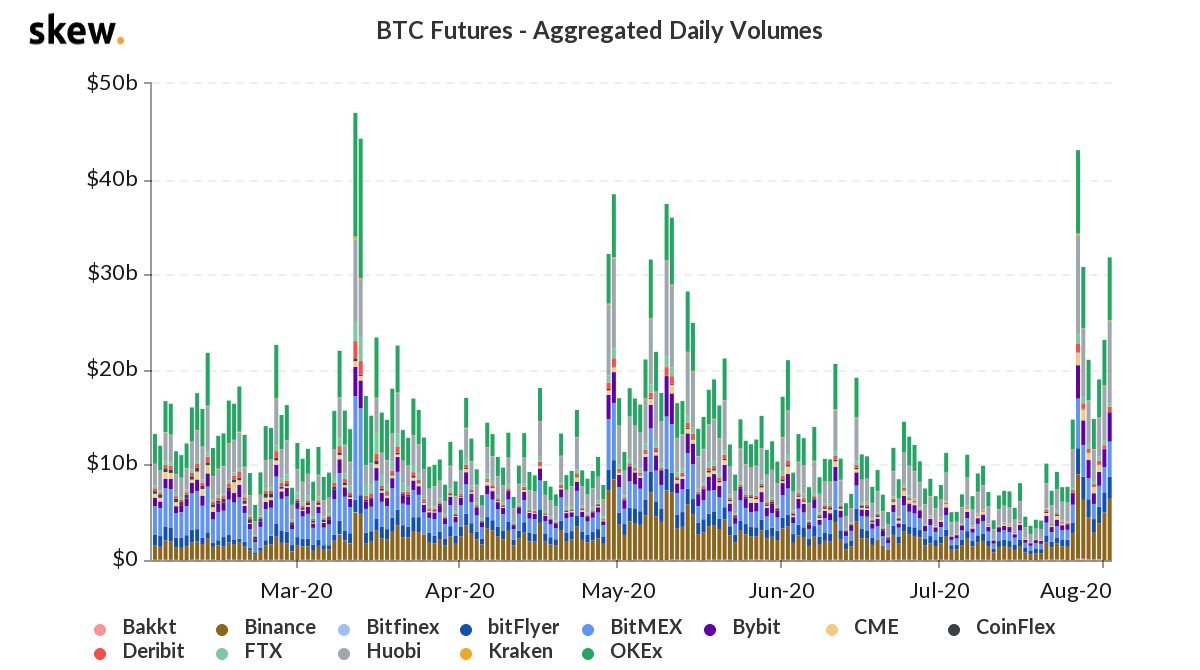

Volume

After a severe volume drought, the market broke out of its tight range and so did the volume. A move without volume always bring questions about its strength, this isn’t the case here.

Market Indices

Total Market Cap

After the descending channel breakout we’ve identified weeks ago, the market has picked up very nicely. The market was recently able to cross the $287B and $326B resistances which will now be considered support. The next level we are looking at is in the $400Bs as explained a while back.

Altcoins Market Cap

Altcoins also broke out of their descending channel and rallied towards $110B and took it out of the way. The next level is the liquidity zone at $140B beyond which few levels lie.

Bitcoin

Bitcoin made a $3000 move in no-time. Price cut through the previous October 2019 and February 2020 highs with ease. It then rallied towards $11,500 and found resistance as well as many over-leveraged longs got rinsed which maintains a healthier landscape for further rallies. The next level to take out is $11,500 beyond which the June 2019 high becomes within reach.

Ether

Ether has simply “melted faces” in the past few days/weeks. Since the descending channel and bull flag breakouts it has reached two of our targets in a very short period of time: $280 & $360. Now is the moment of truth where if $400 is crossed, $500+ becomes possible and a new era starts?