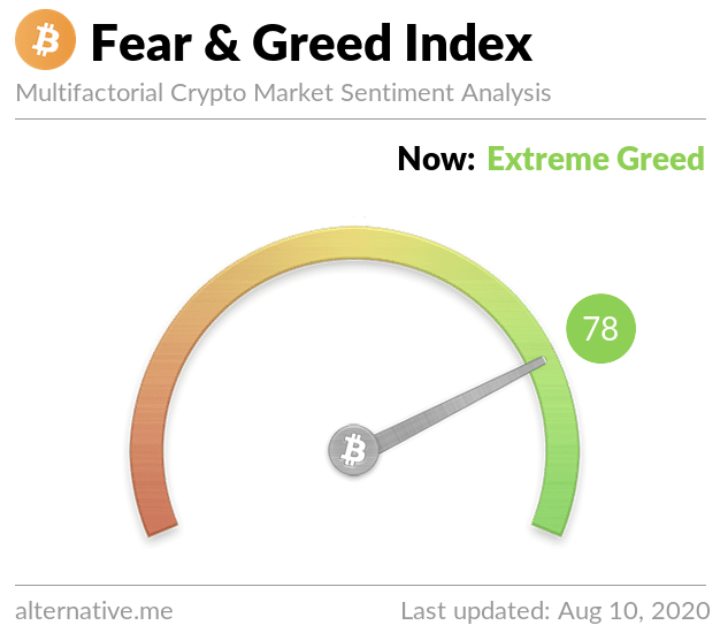

Given the bullish moves undertaken by the crypto market in recent days, it is unsurprising that market participants have become extremely greedy as indicated by the indicator. This tends to emerge prior to a pullback/correction.

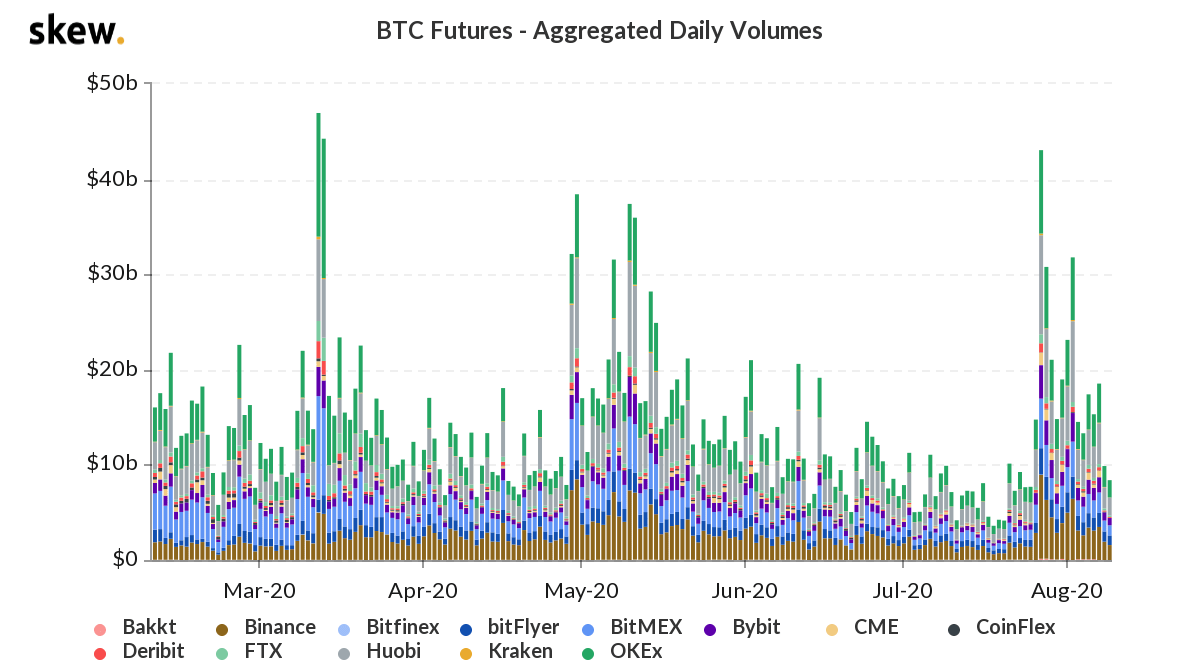

Volume

Trading volumes have yet again dried up, especially on large caps such as BTC and ETH. This has caused their stagnation/consolidation after a large run-up which has made shorting volatility via MOVE once again very lucrative.

Market Indices

Total Market Cap

Major weekly resistance crossed. Would be highly convenient for the 2019 peak to be reached and rejected for a deep retest before price climbs higher. This would reset the greed currently present and make this rally more sustainable.

Altcoins Market Cap

Alts are at resistance but nothing major since $110B has been crossed. Potential pullbacks are on the cards after the massive rallies but it seems that there is more in store.

Bitcoin

The giant is stalling but even in that circumstance was able to cross the previous weekly closures of mid-2019. Going forward, pullbacks to the $10,000 area are possible, which is in line with the CME gaps in the high $9,000s. Either way, the market is strong and seems ready for another leg up in the near-term towards $14,000.

Ether

ETH, alongside Bitcoin is also stalling inside of the [$360-$405] region. We are anticipating a breakout above which would likely boost price to mid-$500s.

Altcoin Mania

DOTPERP

An asset we have researched and shared with our members is Polkadot (DOT). In addition to strong fundamentals, price action was in a bull flag in discovery which boosted price by +30% in less than 36 hours.

This asset is not yet available to buy on the spot market legally but futures are being traded on FTX (exchange dead now).

KNCPERP

The second asset we have decided to freely share is KNCPERP which we are currently looking at. Performance has been lagging behind other DeFi projects and has now crossed an important counter-trendline which may send this one nicely higher.