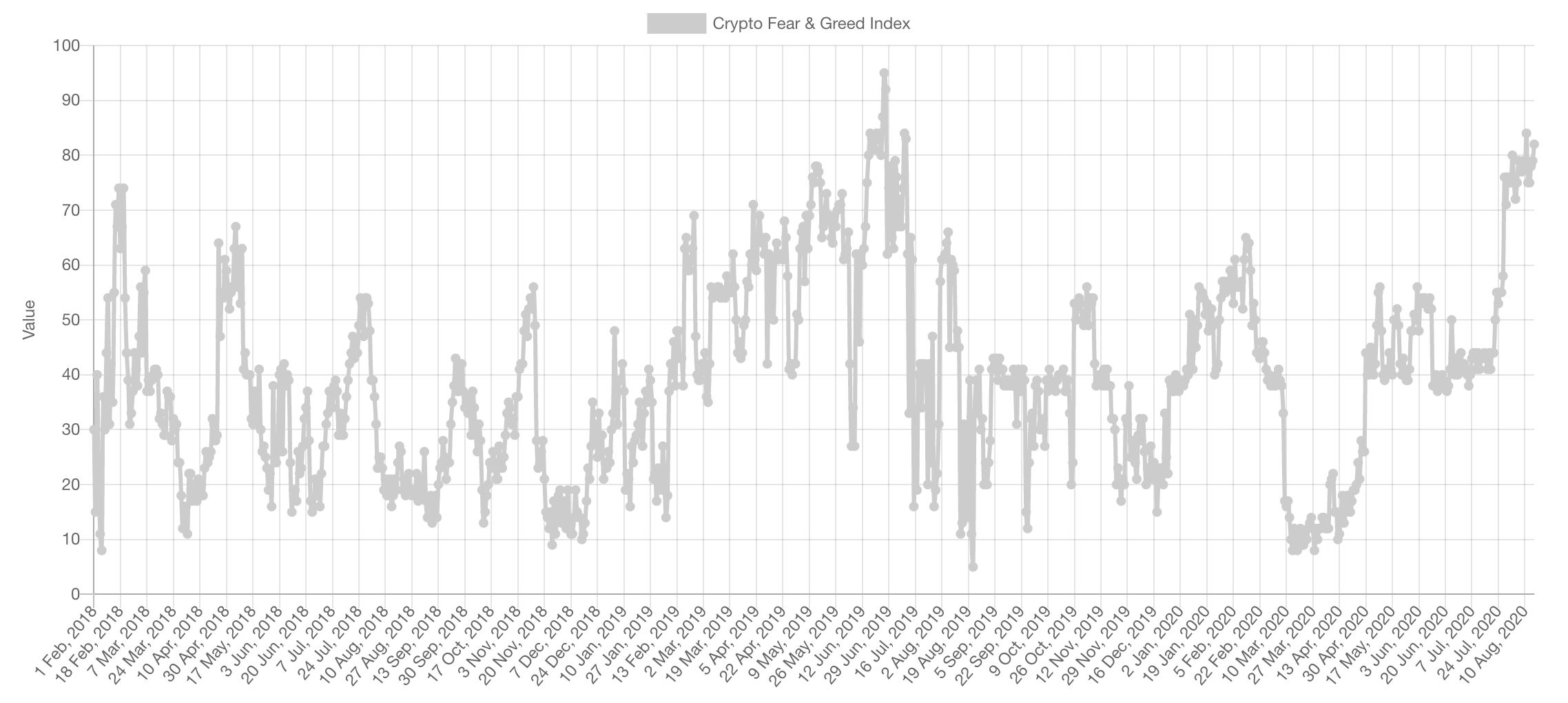

Long story short, the current greed levels of investors/traders is just under the all-time high which keeps us cautious of any future moves because it is very rare where these sustain.

In addition, volumes on Bitcoin have dropped which tends to be the calm before the storm. Does that mean we have flipped bearish? Read on.

Market Indices

Total Market Cap

After breaking out of the 12-months long descending channel, prices went parabolic for the entirety of the crypto-market. While the sentiment is extremely greedy, we have not flipped bearish by any means but do believe a shake-out is on the line. For us, we consider dips very valuable and will be buying if those take place. The chart is parabolic, the macro environment is right and $445B seems very possible in the near-term.

Altcoins Market Cap

Altcoins have not only broken out of the descending channel but they’ve broken $110B and the previous June 2019 high. In summary, we are rooting and believe $190B is next with a potential shake-out first to reset the extreme greed the market is in.

Bitcoin

The king of this market is currently at resistance, crossing it will directly give $14,000 but we do believe (as previously stated) that a shake-out will happen first which may begin by trapping some longs. A subject we will delve into in Cryptonary Pro.

ETH

DeFi has been hot, money flowing in to many different flavors of nothingness-coins, where will that money ultimately flow to? The Parent Company of DeFi: ETH.

After the $405 weekly break, Ether has officially entered bull-territory. If the pullback theory does happen, $360 is what we’d be looking for at first.

XRP

The third largest asset by market cap that has remained under the radar lately. Ready to moon? Seems so. Why? Check out what we published in our public Discord channel here.

Cryptonary Pro

We will let our recent wins and precise market analysis speak for themselves:

LTC: $51 —> $65

ETH: $240 —> $405

XRP: $0.25 —> $0.30 —> ?

XTZ: $3.7 —> $4.5

RUNE: $0.75 —> $1

DOT: $235 —> $360

SRM: $0.75 —> $2+ (in less than a week)

As promised you can now read the full fundamental report we have written for Algorand (ALGO) and see the value we bring to our members for yourselves. This is only a very brief look into the types of insight we share with our Pro members.