You see, what’s happening in the market now is definitely a key point of interest. BTC touched a previous high, ETH is close to hitting $2,000; of course, you’d want to get involved.

But acting without a plan is dangerous. We’d even argue that it’s sloppy, and that’s not how we operate here at Cryptonary.

To help you make informed decisions, we wrote a playbook on how best to ride the bull.

SPOILER: You just need a little bit of patience. 😉

TLDR 📃

- Bitcoin is facing resistance. It needs to break through one key barrier before we can head to $40,000 and higher.

- ETH is headed for $2,000.

- Despite more upside possible across the board, altcoins are trading in bearish market structures, and more capital is flowing into Bitcoin.

- Simply put, BTC is set to outperform.

- We came up with a simple action plan on how to handle the current situation at maximum efficiency.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Total market cap

The Total Market Cap (TOTAL) index represents the entire cryptocurrency market. We track this index to understand the overall market and predict where it will go next.

Altcoins market cap

The Altcoins Market Cap (ALTS) index represents the entire valuation of the altcoins market: all coins other than BTC.

Cryptonary's portfolio

ETH | Ethereum

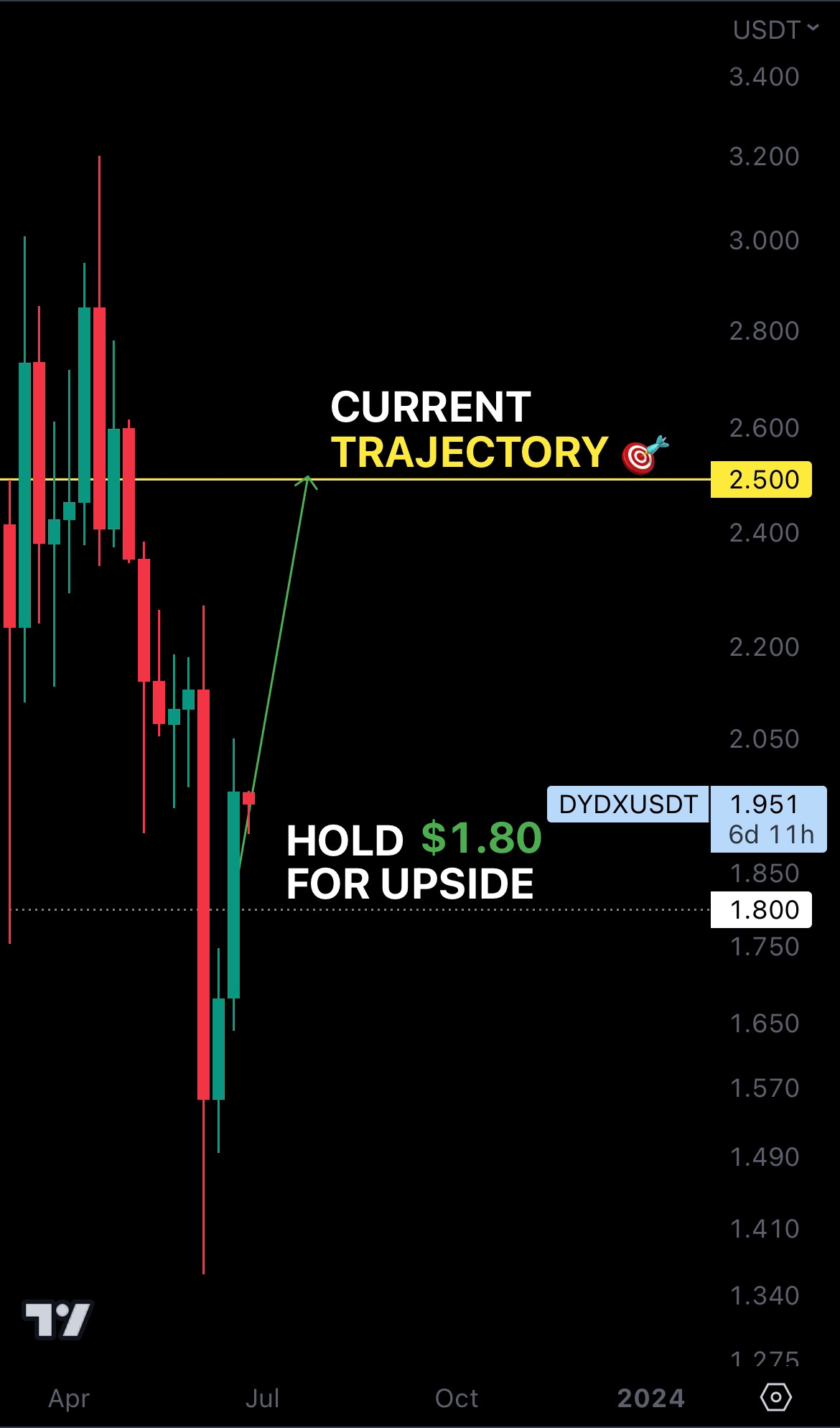

DYDX | dYdX

HEGIC | Hegic

Cryptonary's watchlist 🔎

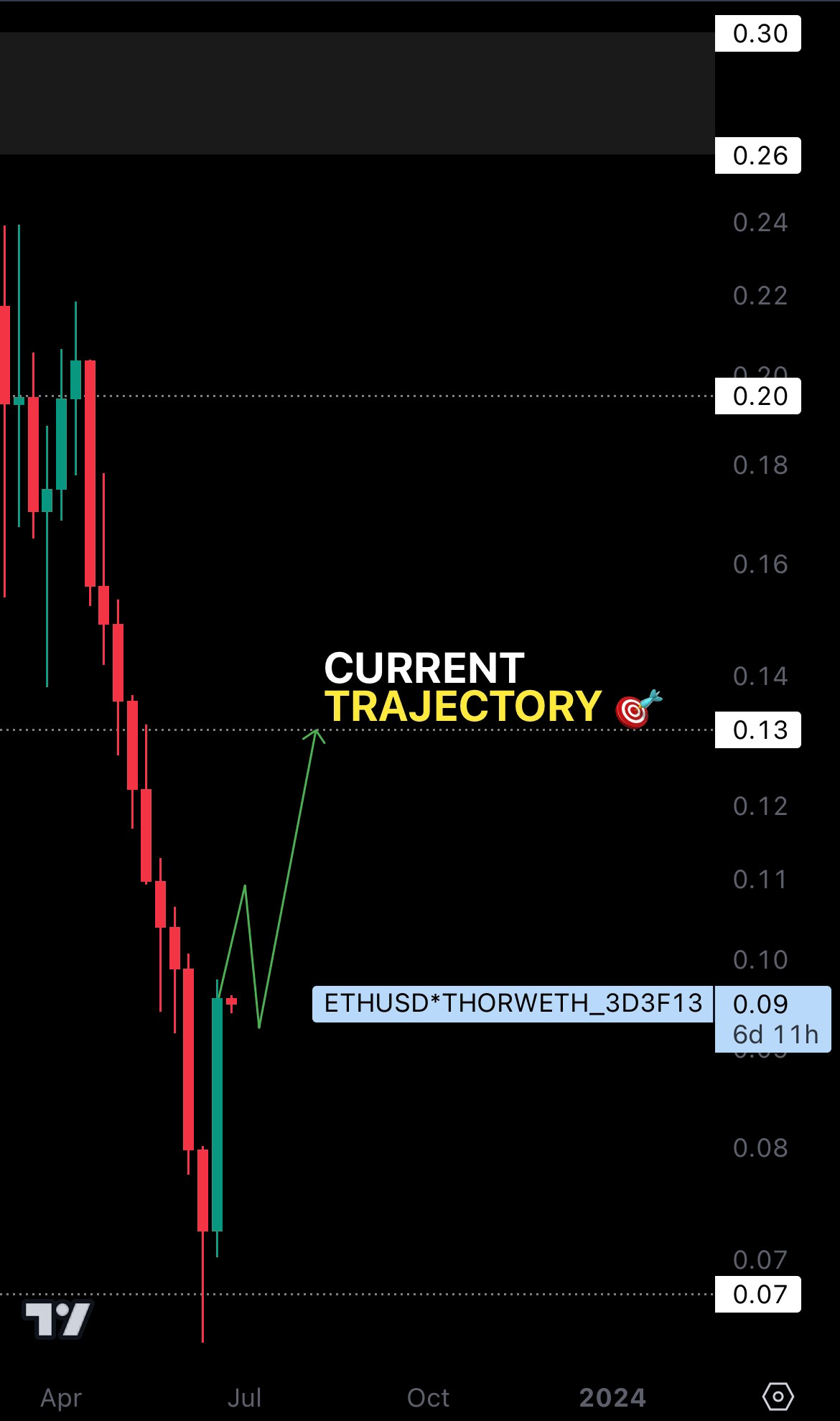

RUNE | THORChain

DOT | Polkadot

SOL | Solana

MINA | Mina Protocol

Astar | ASTR

THOR | THORSwap

OP | Optimism

LDO | Lido DAO

SPA | Sperax

When making our picks, we always look at the market structure first. Here, we clearly see a bearish market structure on the weekly timeframe, and that won’t be of any help if more upside comes in SPA’s way.

A bearish market structure consists of lower highs (LHs) and lower lows (LLs), and we can see those appearing after SPA drops under its previous low (HL). Either we see a shift in market structure from bearish to bullish, or SPA is headed for $0.004550.

Our take? The bearish case is more likely. In fact, most altcoins are now trading in bearish market structures, so we’ll have to see that change before we can really confirm an altcoins run.

BTC | Bitcoin

Could this be the final run?

If we had to compare our past sentiment and the market’s sentiment on Bitcoin, we’d say there has been a pretty solid change in the past weeks.

Bitcoin had a new weekly high three days ago, and the bullish pressure doesn’t seem to be easing.

However, appearances can be deceiving. Remember what happened last time?

Bitcoin has tested the $32,000 - $28,750 region before, and it was unable to break past it. So, we’re not going to go over the edge here and say that $40,000 is our next stop. There’s still a very important obstacle to tackle before things take off – and that’s $32,000.

However, while Bitcoin breaking $32,000 will surely drive a rally in your favourite picks, they aren’t the ones who will outperform.

Bitcoin’s dominance has been on the rise for a while now, and we’re sensing BTC won’t yield the floor any time soon. Therefore, most of the capital flowing into the market will flow right into good ol’ Bitcoin, leaving the altcoins market thirsty while BTC zooms away to $40,000.

This is your playbook for what happens next.

- Wait for BTC to break $32,000 on the weekly timeframe.

- Once that happens, start buying.

- Use $28,750 as an invalidation. Although $32,000 would be the best option here, it would be way too close to our target.

- Taking profits on the way up ensures we keep our gains, not just observe them for a limited time. This is a key action plan.

Cryptonary’s take 🧠

There’s no denying that the market is looking ready to hit prices we haven’t seen in more than a year. However, that’s not guaranteed, either.

Confirmations play a vital role in our success as investors or traders. Without them, we’d be going in blindly, gambling away our money like it’s our hometown’s local casino.

We’re taking the safer approach here and saying that $32,000 needs to be taken out first before more upside suddenly starts to become promising. That’s our confirmation, and we’ll be waiting patiently for it.

Action points 🎯

- Bitcoin breaking past $32,000 is crucial. You can start increasing your exposure at this point, but only if you know what you’re doing.

- Altcoins are still in a bear hug. Preserve your capital for when the altcoins run eventually starts.

- Keep a long-term view We’re investing $10,000 every single month - how about you check our plan for June here?

- Got more questions? Hit us up on Discord in the “📉・technical-analysis” channel.

As always, thanks for reading. 🙏

Cryptonary, out!