Listen, if we had to put a number to it, we’d say there’s a 60% chance of the market riding a bullish wave, breaking resistance, and heading to the sky. Still, this is not market as usual. We are still in a bear market, and the most rational thing to do is to be cautious and patient. The fact remains getting too greedy can lead to your downfall. Trust us; we’ve seen it happen before 😂.

Now, prices.

TLDR 📃

- Bitcoin must break a key level for more upside to continue to $40,000.

- The market may see more upside, but it’s crucial for you to take profits on the way up.

- Many altcoins are about to close this week’s candle as a “Hanging man”. Despite this, Bitcoin looks ready to rock. See how that’s in contradiction?

- ETH remains on track for $2,000.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R: R trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Total market cap

The Total Market Cap (TOTAL) index represents the entire cryptocurrency market. We track this index to understand the overall market and predict where it will go next.

Altcoins market cap

The Altcoins Market Cap (ALTS) index represents the entire valuation of the altcoins market: all coins other than BTC.

Ethereum | ETH

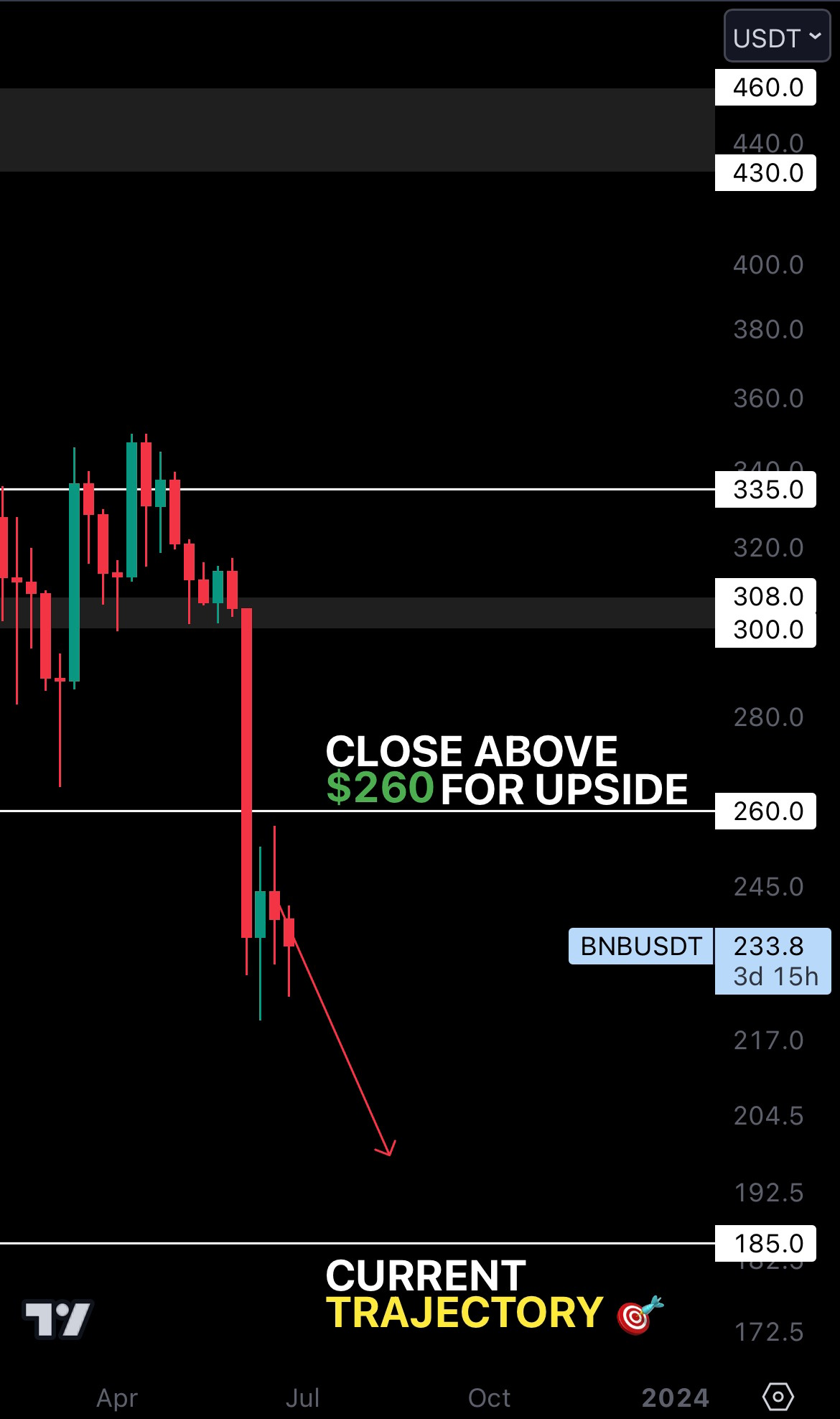

Binance | BNB

Ripple | XRP

Cardano | ADA

Dogecoin | DOGE

TRON | TRX

Solana | SOL

Litecoin | LTC

Polkadot | DOT

Bitcoin | BTC

Can Bitcoin break resistance and go higher?We believe so. At least, that’s what we hope for, but only time will tell.

See the grey region? That is Bitcoin’s current resistance area between $28,750 and $32,000. We’ll need it to break $32,000, the top side of this region, to confirm a move to $40,000. In the meantime, there’s a slim chance that it tops here, which is why we’ve taken a safer bet by only investing $15,000 this month in Skin in the Game. Still, something is exciting happening on the monthly timeframe as we speak. If validated, the bullish scenario suddenly has higher odds of success.

Not only that, but Bitcoin’s dominance has also been on the rise. This has directly impacted its price, which we’ve seen taking off from $25,150 to over $31,000 in only eight days. Let’s take a look at the chart:

Our eyes are on 53%. This is where Bitcoin could potentially take a breather, leaving altcoins in the spotlight. However, we believe its dominance will continue rising to 58% in the remaining months of 2023. This puts Bitcoin in the “outperformer” category, with only a few solid exceptions in the altcoins market, which we’ll take advantage of.

Cryptonary’s take 🧠

Patience is still required until the market picks a clear direction. With Bitcoin at resistance, making decisions with your sentiment leaning on the bullish side can be especially difficult. In this market, your priority should always be to preserve capital - nothing more. And hey, something is brewing on Bitcoin’s monthly timeframe, which makes us believe July will be a bullish month for crypto. Luckily for you, we will publish a report covering that on July 1st, so make sure you tune in!Action points 📝

- Bitcoin needs to break $32,000 before going higher. Until then, it is at risk of topping inside the $32,000 - $25,150 region. Mindlessly increasing your exposure comes with many risks, which could bite you back at some point.

- With Bitcoin’s dominance on the rise, chances are Bitcoin will take the spotlight in all of Q3 - or at least most of it. Altcoins will rise slowly but drop like there’s no tomorrow. That makes them dangerous to play with.

- Got questions? Hit us up on Discord in the “🌎・general” or “🆓・alpha” channels. We’re happy to help.

Cryptonary, out!