Market Direction

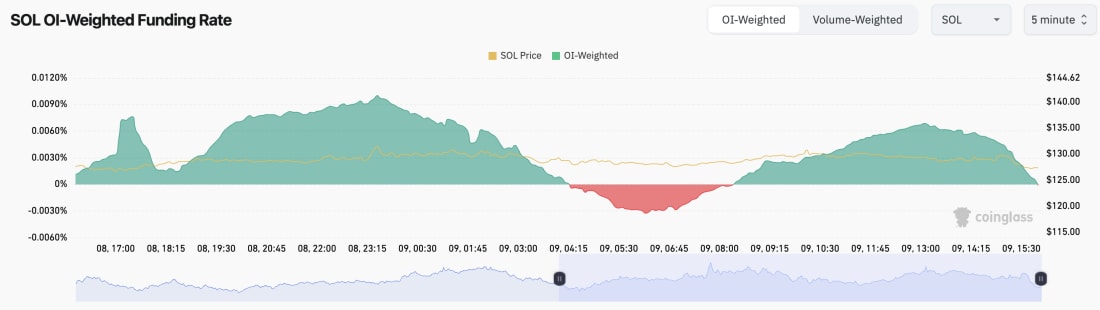

- SOL's Open Interest has increased in the last few days, while the Funding Rate has fluctuated between slightly positive and slightly negative.

- There has been more of a willing amongst traders to Long SOL in recent days.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

SOL's funding rate:

Technical analysis

- SOL is still in it's major downtrend however it has continued to hold the horizontal support zone between $120 and $131.

- SOL looks to be in a precarious position having retested the $120 to $131 region many times now, whilst mostly putting in lower highs.

- SOL has however put in 3 bullish divergences (lower low in price, higher low on the oscillator) in a row. This should be enough for price to be able to reclaim above $131 and attempt a retest at $140.

- If price does breakdown below $120, the next major support is at $103.

Cryptonary's take

Having retested the support many times, we would be wary of SOL in the near term for a potential breakdown. However, if price were to drop below $120 and retest anywhere near $103, we would be strong bidders of SOL. But, we must consider that sentiment is currently very low, so it wouldn't be wise to turn bearish on SOL at the, or close to, the potential lows.Therefore, we advocate for holding our SOL spot bags and just adding to our bags if SOL dips to anywhere between $103 to $120. We still believe that we'll see SOL well above $500 in 2025.