XRP and Tron technical analysis: Will breakouts happen soon?

XRP’s price consolidation between $0.52 and $0.74 suggests a breakout could be near, while Tron pushes toward $0.18 resistance after a 97% rally. Stay cautious as we monitor key support and resistance levels.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

XRP:

Overview

XRP, despite not being a standout in the current meme supercycle, remains one of the largest cryptocurrencies by market capitalization. This ongoing relevance keeps XRP on the radar for many traders, even though its narrative has not aligned with the dominant trends of this market cycle.With historical ties to institutional interest and its positioning in the traditional financial landscape, XRP still manages to attract attention in the broader market. While it doesn't fit into Cryptonary's preferred assets, we recognize that its technical setup is currently of interest and could lead to significant moves.

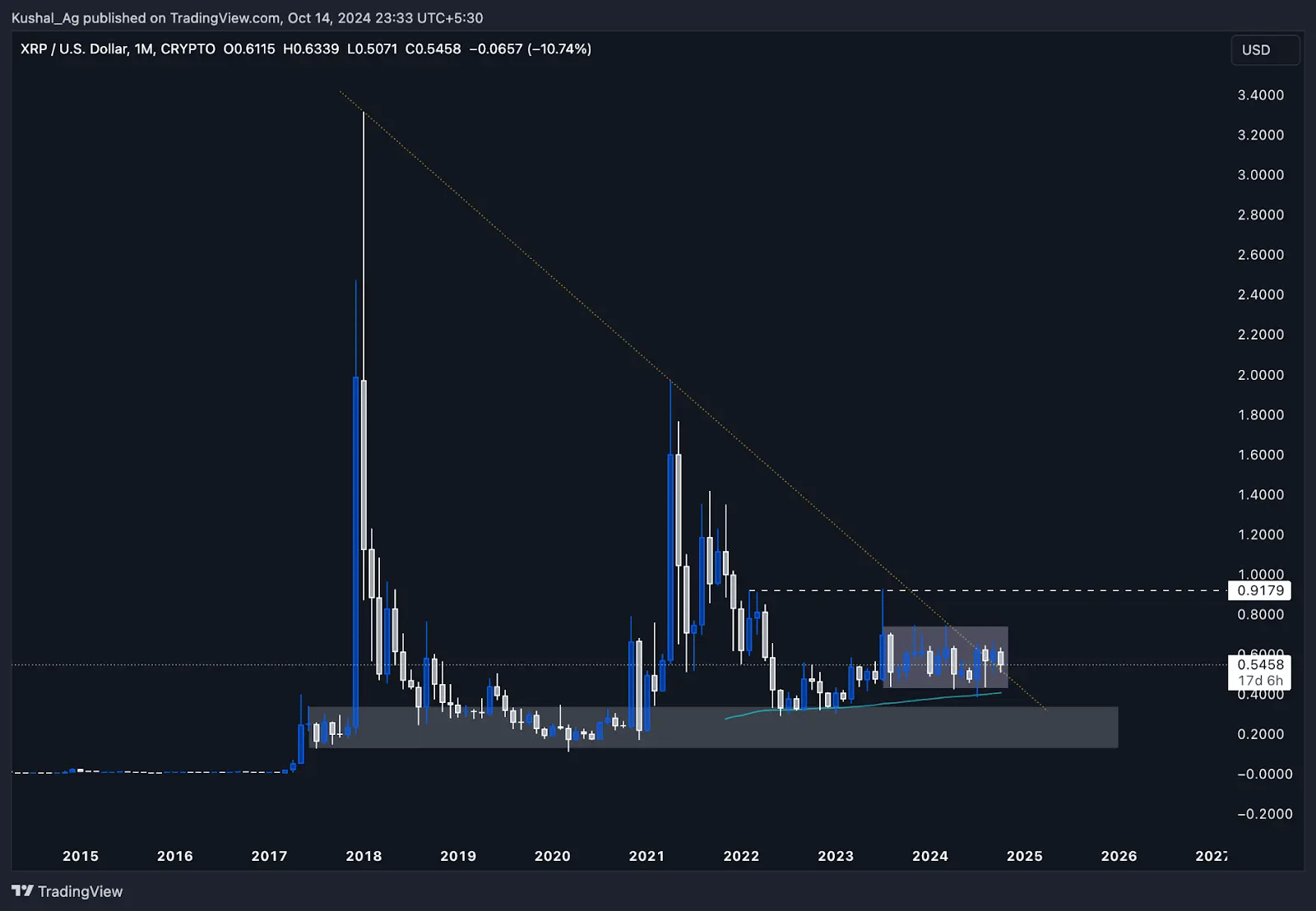

Monthly time frame analysis

On the monthly chart, XRP is currently consolidating within a significant demand zone created in late 2017, just before its explosive 1700% rally. This consolidation has been ongoing for more than three years after XRP retraced nearly 96% from its all-time high of $3.3 in January 2018, down to a low of $0.11 in March 2020.Since then, XRP has reacted positively off this demand zone, giving a 1600% move to $1.9 in April 2021, before retracing once again. Currently, XRP is consolidating just above the 100 EMA on the monthly timeframe, trading at $0.54, with the EMA sitting around $0.4.

Key points:

- All-time high: $3.3 in January 2018

- Major demand zone: $0.11 to $0.34

- 100 EMA on monthly: Currently providing support at $0.4

- Breakout potential: XRP is approaching the breakout point of a long-standing downtrend, marked by a trendline from its ATH of $3.3 to its lower high at $1.9.

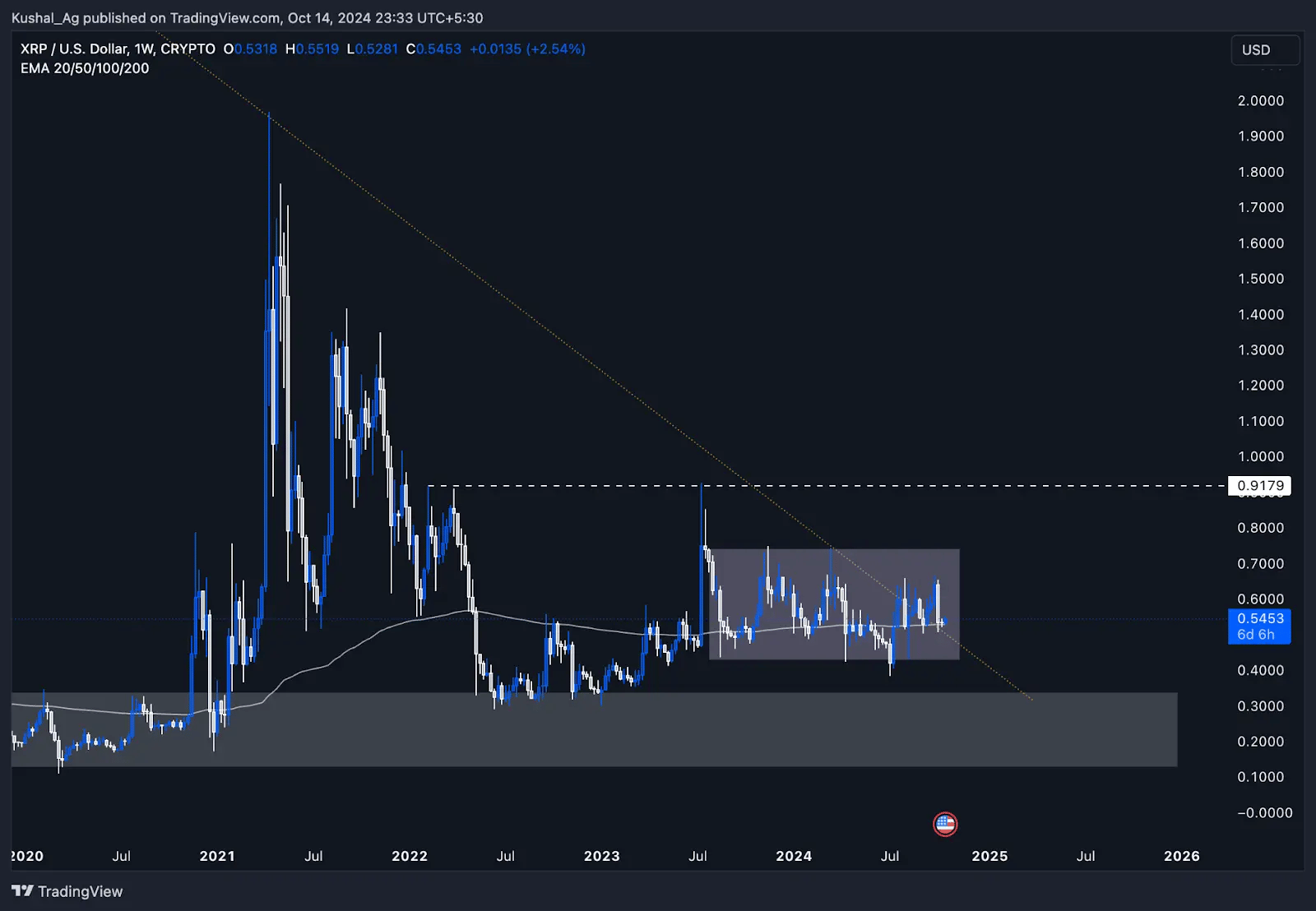

Weekly timeframe analysis

On the weekly chart, XRP has been consolidating between $0.43 and $0.74, with the 200 EMA acting as a significant support at $0.52. This has been a key level for XRP since mid-2023 as it attempts to build a base and hold within this range. The broader demand zone from the 2017-2018 market cycle is also in play here, giving XRP additional support around these levels.Key Points:

- Weekly 200 EMA: Acting as a strong support at $0.52

- Consolidation Range: $0.43 to $0.74

- Next Major Resistance: $0.74, followed by $0.917 on the upside

- Support Zone: $0.43-$0.52 supported by both EMA and demand zone

Cryptonary's take

XRP remains a relevant asset due to its position within the top ranks by market capitalization, despite not being a focal point in this meme-driven market cycle. The technical setup across both the monthly and weekly timeframes shows potential, but it's important to stay cautious.XRP's prolonged consolidation could either break to the upside or test lower support zones once again. For those keeping an eye on XRP, watching how it reacts to its key support levels will be crucial, but as always, caution is advised before jumping into any trades.

Tron:

Overview

Tron ($TRX) continues to be one of the standout altcoins in terms of both longevity and market capitalization, having remained relevant since its launch in 2017. Although it may not fully align with the current meme coin supercycle, Tron's technical setup and price action have shown solid performance, making it an interesting candidate for long-term charting.We will be looking at Tron's price action on the monthly timeframe using a logarithmic chart and the weekly timeframe, highlighting the key levels and trends that could influence its next moves.

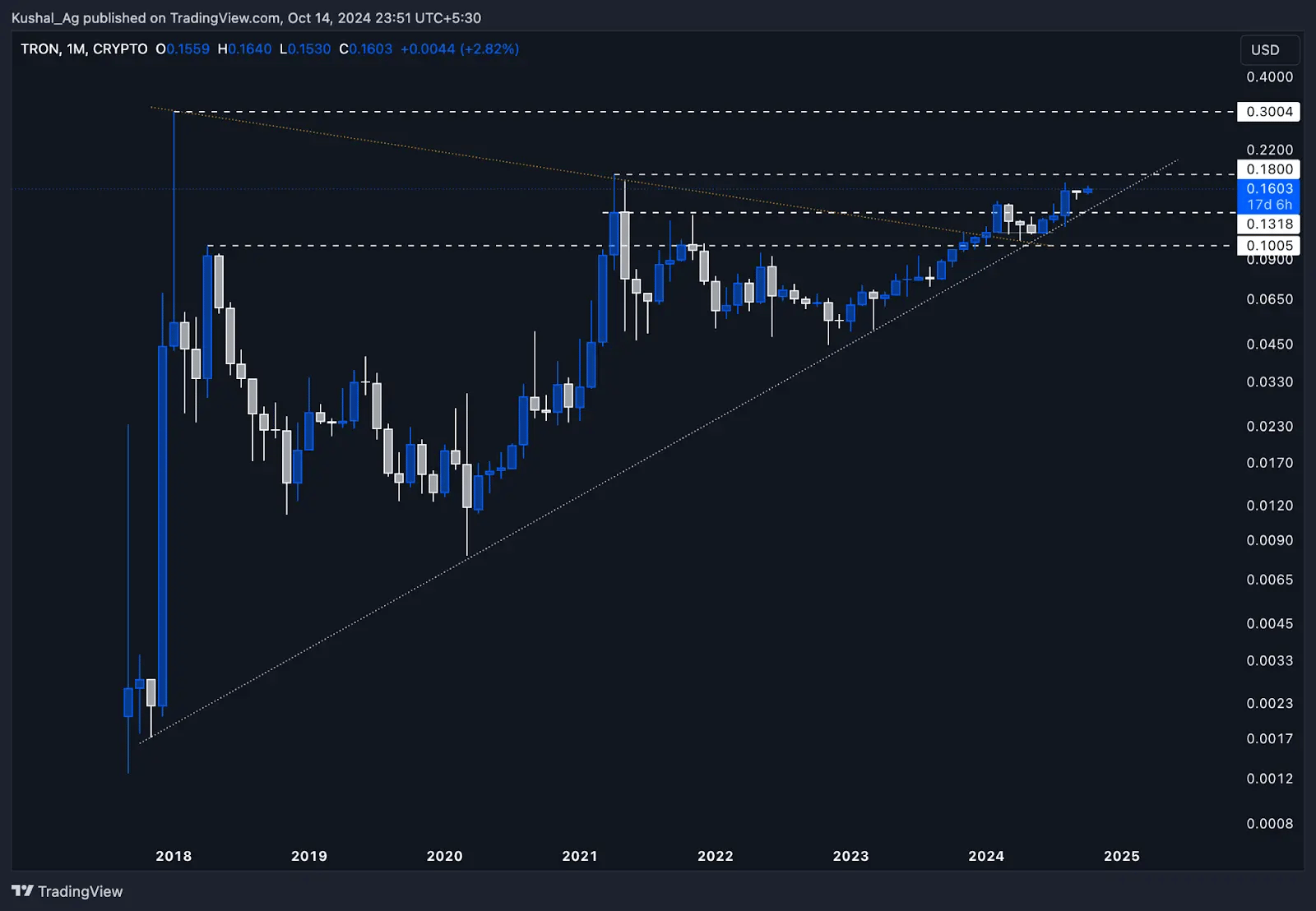

Monthly timeframe analysis (logarithmic chart)

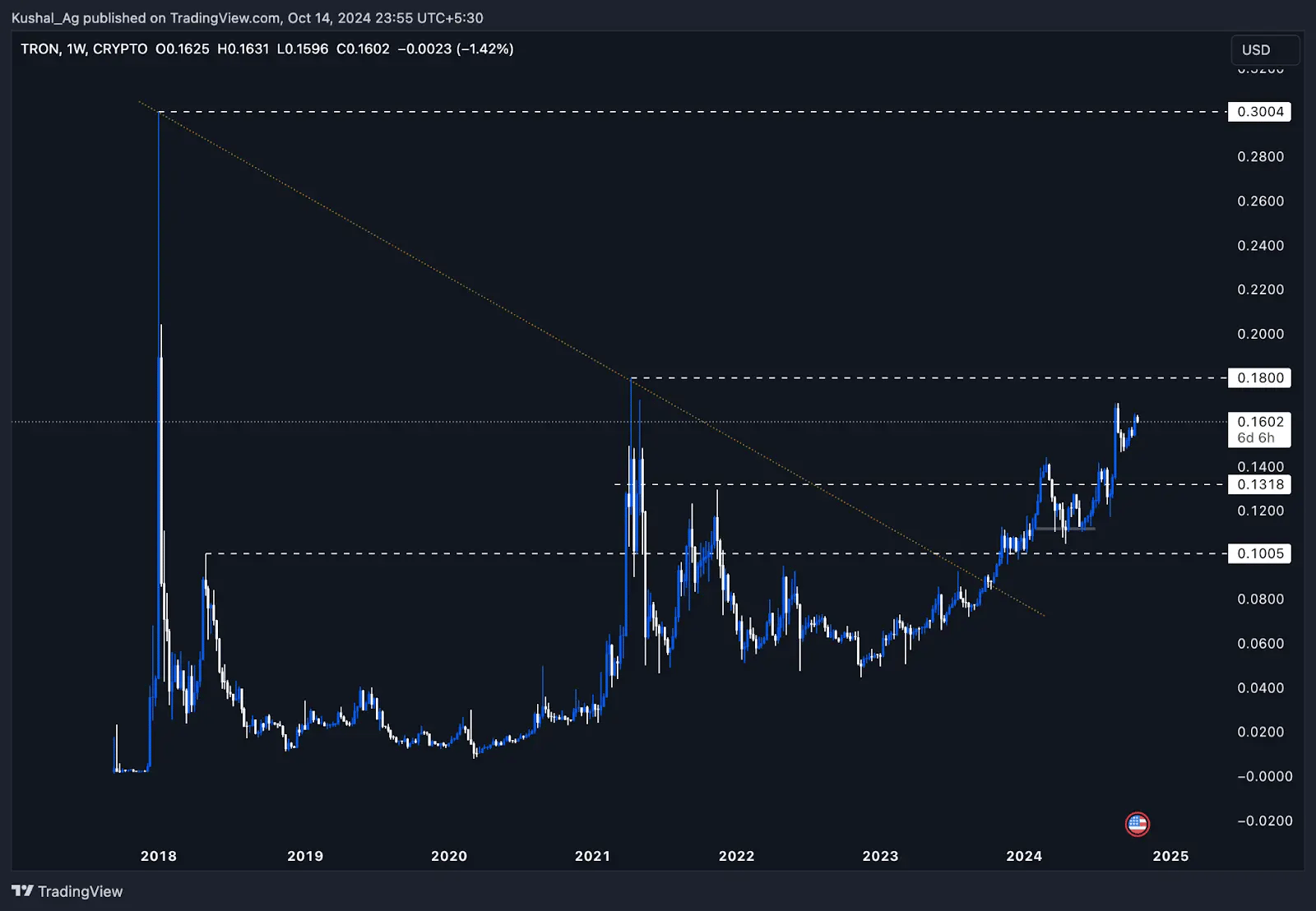

Tron has exhibited an overall uptrend since its launch in 2018 despite its initial extreme volatility. After its 2017 launch, Tron went on to make a 13,000% move in just one month, blasting from $0.0022 to $0.297 in January 2018, marking its all-time high (ATH).However, after this explosive move, the price retraced significantly, but interestingly, Tron has continued to follow a steady uptrend ever since, reflected by the dotted white trendline.

Key points:

- Major ATH rally: $0.0022 to $0.297, a 13,000%+ move in January 2018.

- Long-term uptrend: Tron has been following a steady uptrend since then, consolidating and respecting key levels.

- Pennant breakout: Tron broke out from a monthly pennant pattern in February 2024, which had kept it in consolidation for over five years. Since then, Tron has been trading between $0.10 and $0.13 before giving another move on the upside.

- Key resistance levels: Tron is currently trading near $0.16, with the next major resistance at $0.18. Once this level is flipped, there is a clear space for a move toward the ATH level of $0.29, as there are no significant resistances between $0.18 and $0.29.

- If Tron can flip the $0.18 resistance, it could potentially rally toward its ATH of $0.29 in the longer term.

Weekly timeframe analysis

Shifting to the weekly chart, we can see a clear breakout for Tron in October 2023 from a long-standing downtrend trendline marked by the orange dotted line. Since this breakout, Tron has moved upwards by 97%, rallying from $0.086 to a high of $0.168, and currently trades at $0.16.Key points:

- Weekly breakout: Tron broke out from its downtrend in October 2023 at the $0.086 level, pushing nearly 100% higher.

- Higher highs and higher lows: Tron has been forming higher highs and higher lows since its breakout, confirming its bullish structure.

- Clean space to ATH: There is no major supply or resistance zone between the $0.18 resistance and the all-time high of $0.29, which opens up the possibility of an extended move if Tron can hold its current support levels and break past $0.18.

Support and resistance levels

- Support: $0.1 and $0.13 levels act as strong supports on the downside, with the 200 EMA on the weekly timeframe currently holding the price up.

- Resistance: $0.18 is the next major resistance. A clean break above could lead to a run toward $0.29.

Cryptonary's take

Tron may not fit the thematic focus of the meme coin supercycle, but from a technical perspective, it presents a solid and consistent price action pattern. With its long-term uptrend intact and the potential for a breakout from key resistances, Tron's price action on the monthly and weekly timeframes is worth monitoring closely.As always, while Tron is presenting a favourable setup, traders should exercise caution, as broader market conditions will also impact its price movement.