XRP technical analysis: Can it break $0.74 resistance soon?

XRP continues to consolidate between $0.52 and $0.74, drawing attention as it nears a potential breakout. Traders are watching key support and resistance levels, as XRP’s prolonged consolidation could lead to significant price movement soon.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Overview

XRP, despite not being a standout in the current meme supercycle, remains one of the largest cryptocurrencies by market capitalization. This ongoing relevance keeps XRP on the radar for many traders, even though its narrative has not aligned with the dominant trends of this market cycle.With historical ties to institutional interest and its positioning in the traditional financial landscape, XRP still manages to attract attention in the broader market. While it doesn't fit into Cryptonary's preferred assets, we recognize that its technical setup is currently of interest and could lead to significant moves.

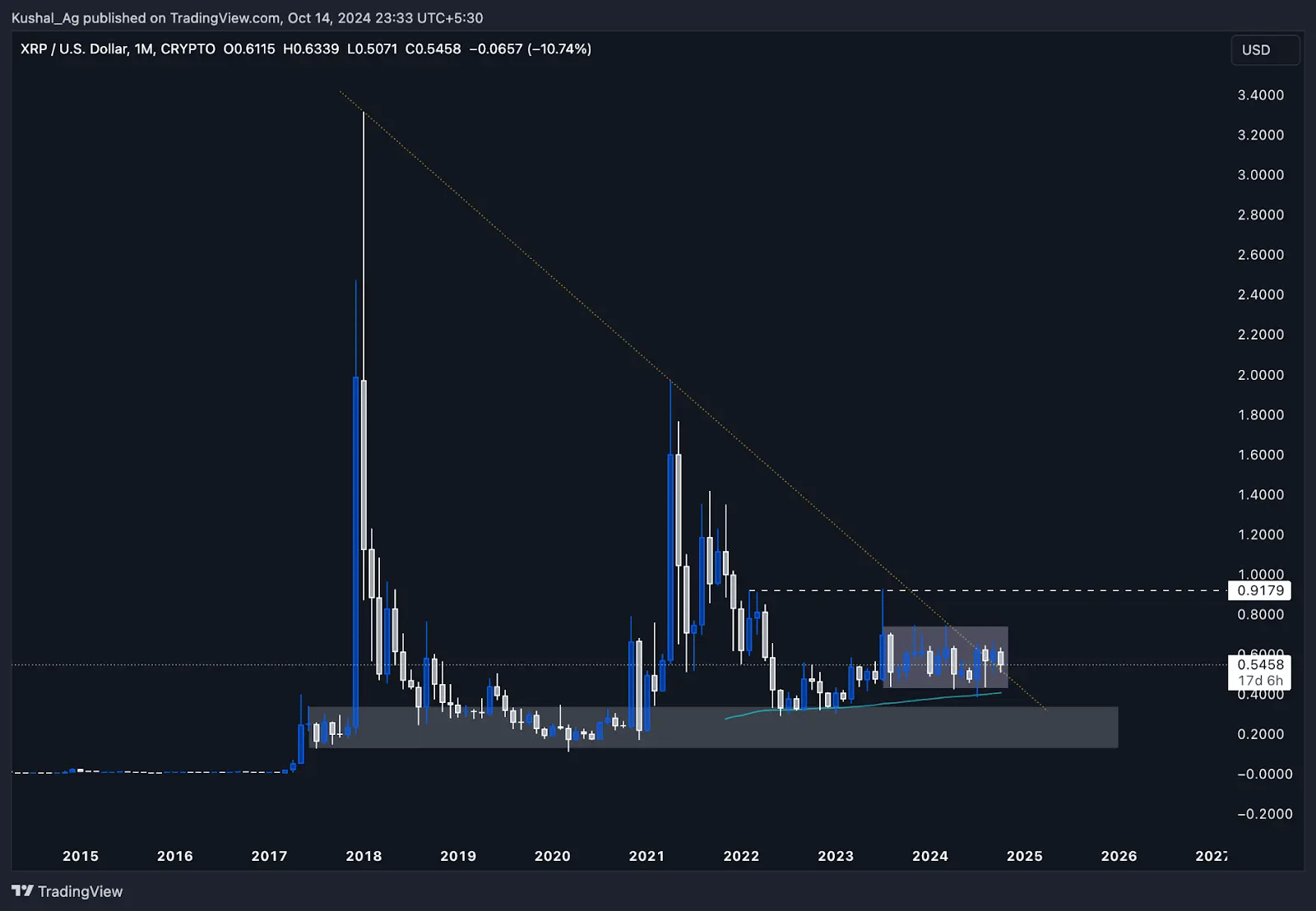

Monthly time frame analysis

On the monthly chart, XRP is currently consolidating within a significant demand zone created in late 2017, just before its explosive 1700% rally. This consolidation has been ongoing for more than three years after XRP retraced nearly 96% from its all-time high of $3.3 in January 2018, down to a low of $0.11 in March 2020.Since then, XRP has reacted positively off this demand zone, giving a 1600% move to $1.9 in April 2021, before retracing once again. Currently, XRP is consolidating just above the 100 EMA on the monthly timeframe, trading at $0.54, with the EMA sitting around $0.4.

Key points:

- All-time high: $3.3 in January 2018

- Major demand zone: $0.11 to $0.34

- 100 EMA on monthly: Currently providing support at $0.4

- Breakout potential: XRP is approaching the breakout point of a long-standing downtrend, marked by a trendline from its ATH of $3.3 to its lower high at $1.9.

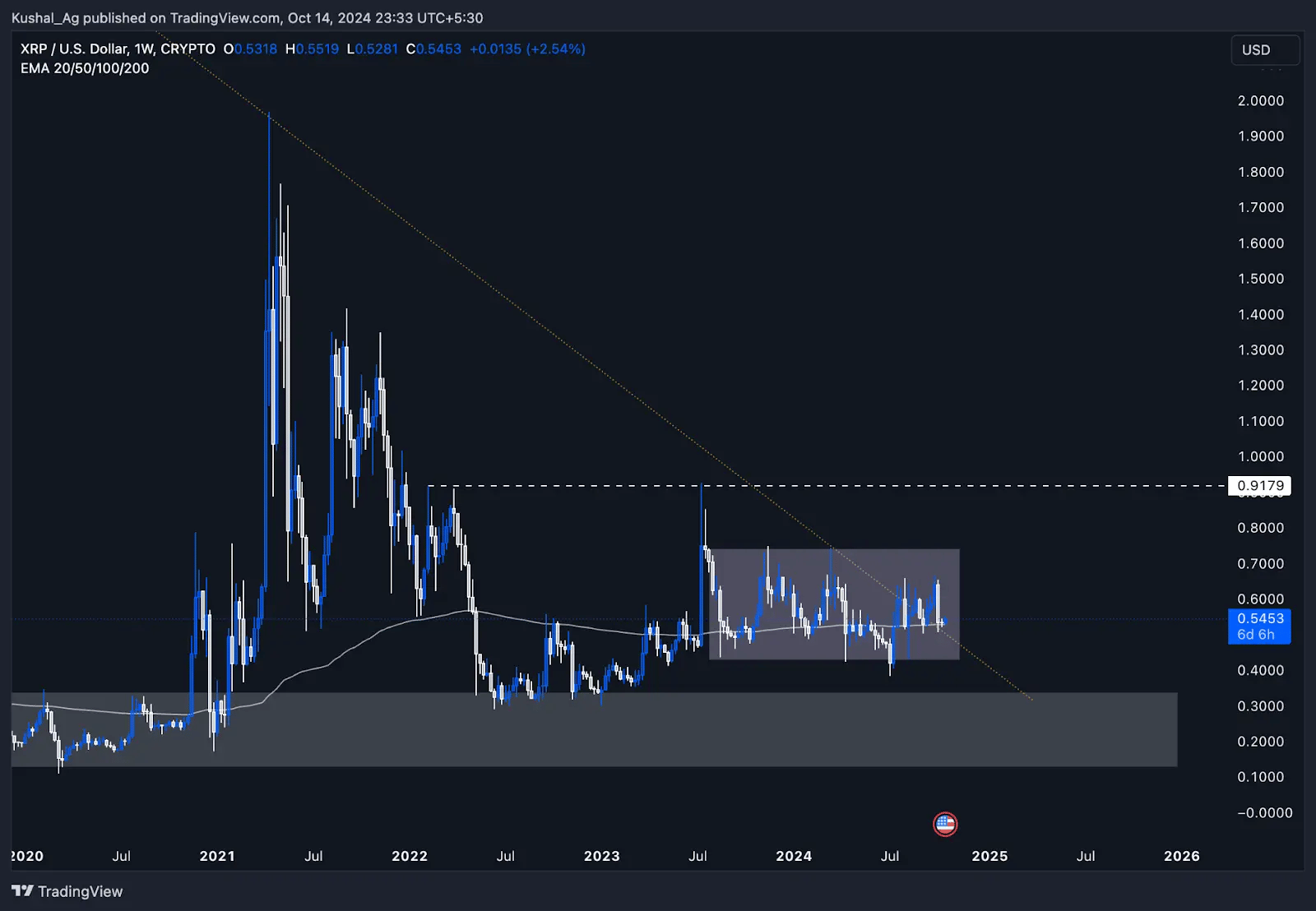

Weekly timeframe analysis

On the weekly chart, XRP has been consolidating between $0.43 and $0.74, with the 200 EMA acting as a significant support at $0.52. This has been a key level for XRP since mid-2023 as it attempts to build a base and hold within this range. The broader demand zone from the 2017-2018 market cycle is also in play here, giving XRP additional support around these levels.Key Points:

- Weekly 200 EMA: Acting as a strong support at $0.52

- Consolidation Range: $0.43 to $0.74

- Next Major Resistance: $0.74, followed by $0.917 on the upside

- Support Zone: $0.43-$0.52 supported by both EMA and demand zone

Cryptonary's take

XRP remains a relevant asset due to its position within the top ranks by market capitalization, despite not being a focal point in this meme-driven market cycle. The technical setup across both the monthly and weekly timeframes shows potential, but it's important to stay cautious.XRP's prolonged consolidation could either break to the upside or test lower support zones once again. For those keeping an eye on XRP, watching how it reacts to its key support levels will be crucial, but as always, caution is advised before jumping into any trades.