It makes you feel stupid, disappointed, and angry all at the same time.

Yet, when you dip your toes in the NFT segment, you are going into shark-infested waters rife with scams, cash grabs and outright fraud.

Yet, NFTs have delivered some of the biggest ROIs in crypto.

If you want more of the NFT rewards and less of this risk – this NFT digest is for you.

TLDR 📃

- The NFT market has witnessed notorious scams such as Cryptozoo, Pixelmon, Hapebeast, Moonbirds, and Mekaverse.

- False promises, deceptive marketing, poor-quality artwork, and instances of insider trading characterise these NFT scams.

- Yet, other NFT projects have reputable teams, historical significance, and a strong market presence.

- Navigating the NFT market requires diligent research; let's get you started with five promising NFT projects that aren't likely to run off with your money.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Top 5 cash grabs in NFT history ⚠️

Let’s start by examining 5 of the biggest cash grabs in NFT History.

1. Cryptozoo

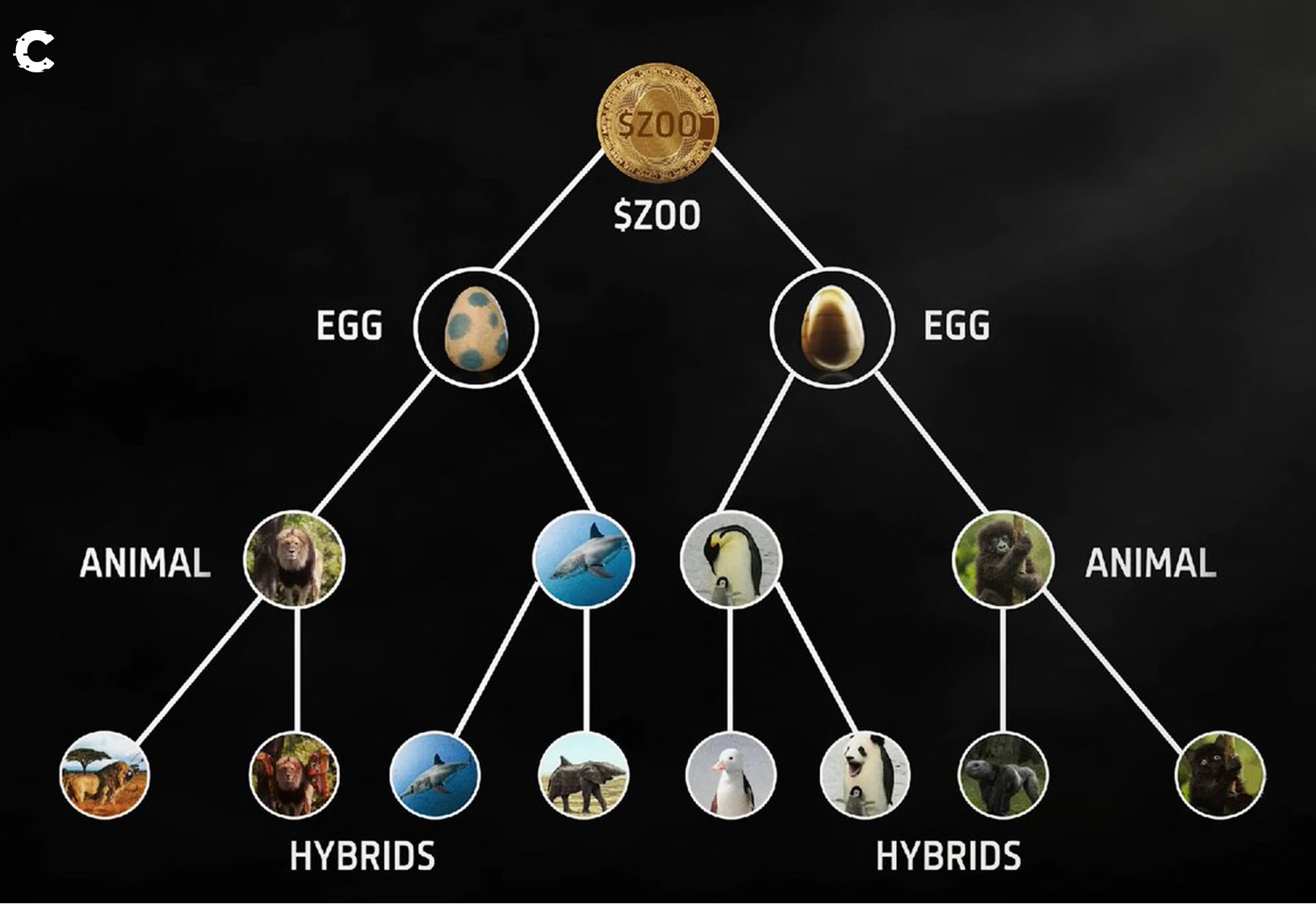

Cryptozoo is an NFT collection created by Logan Paul. Logan first mentioned CryptoZoo on his podcast "Impaulsive", where he introduced CryptoZoo as "a really fun game that makes you money."

Launch day came around, and the project sold 10,000 Egg NFTs within minutes, netting the team over $1 million.

Following the mint, the team announced one delay after another, and to this day, the game has not been launched. To make matters worse, the art Logan claimed to be handmade by ten artists over six months turned out to be poorly photoshopped Adobe stock photos.

2. Pixelmon

Pixelmon's goal was to develop the highest-quality game in NFT history. It was backed by an incredibly talented marketing team and numerous teasers of tastefully designed characters.

In February 2022, the NFTs sold out, raising $70 million during the mint event.

Then came a week-long delay, and finally, the art was revealed.

They were TERRIBLE!

To add insult to injury, it turned out the Pixelmon art was literally purchased from the Unity store. It was so bad that Pixelmon memes took over NFT Twitter for weeks.

3. Hapebeast

The first Hapebeast trailer took the Web3 world by storm. To be eligible to mint, you had to obtain an “allowlist spot”, and demand was through the roof.

This project also benefitted from user-generated marketing. Thousands of people made fanart, raps and marketing threads on Twitter. Individuals were active on Discord 24/7, with the team releasing periodic sneak peeks, hyping the public even further – this was to be the real deal.

And it was for a while. The hype eclipsed Azuki (which was minted at the same time). Hapebeast sold 8000 NFTs in under 20 minutes, netting $6 million for the team. On the secondary market, hype and speculation pushed Hapebeast NFTs from 0.3 ETH to 9.5 ETH, with buyers gambling in the hope of making generational wealth.

Until it all came crashing down!

The Hape NFTs revealed displaying subpar art and numerous flaws within the collection. The ears going through hats became a viral meme.

The floor price crashed immediately, with minters and secondary speculators losing thousands of dollars. The team subsequently left the NFT space with their proceeds, and the collection currently trades at a 0.15 ETH floor today.

4. Moonbirds

Moonbirds was the secondary NFT collection from Kevin Rose and the Proof Team. Proof Pass was an established success, so excitement was through the roof when they announced a larger secondary collection.

Moonbirds launched as 10k NFTs for an eye-watering price of 2.5 ETH per NFT and sold out immediately, netting the team $70 million.

Then the problems began.

Just 2 hours post-reveal, the COO, Ryan Carson, was caught effectively front-running the public.

Things went from bad to worse, with the team giving celebrities free Moonbirds and the celebrities deceptively withholding that they received the Moonbirds for free.

The final straw came when the first rewards rounds were unveiled — mostly free pins, socks and a fanny pack.

But it gets worse. Moonbirds moved its IP model to CC0. Meaning holders no longer had exclusive IP Rights to their Moonbirds, an irreversible decision they made without consulting holders first.

At the time of writing, Moonbirds is at 50% of the mint price, with most holders down thousands of dollars.

5. Mekaverse

Launching in Oct 2021, Mekaverse was destined to be the new top project. Mekas captured a community of NFT art lovers and Japanese manga culture enthusiasts.

For weeks attention was focused on the collection as individuals fought for a whitelist. The 8888 NFTs sold out in no time, raising $4.5 million for the team. Speculation on the secondary market was rife, with the floor climbing from 0.2 ETH to 8.5 ETH in 3 days.

After the reveal, users discovered that NFTs were identical, the memes started, and the floor price immediately crashed.

In addition, many NFT owners on Twitter claimed that the project was rigged. They cited unusual, rare collection purchases that could only have been made with insider information.

This insider trading cemented Mekaverse’s fate, with people forced to sell for a $10k loss just days after mint.

5 NFT projects that won't disappear with your money💰

Now, let’s spotlight 5 NFT projects with a high-fidelity index.

Digital Art

We recommend a focus on Digital Art, especially generative art. The market is thriving with Sotheby's recent adoption of Artblocks engine to facilitate in-house generative art mints, bringing respectability to the whole sector.

Our picks in this sector are:

- Themes and Variations

Themes and Variations were minted earlier this week. This is the first and only long-form generative art project by 99-year-old Vera Molnár, with the sale also marking the first-ever Dutch Auction at Sotheby's.

- Autoglyphs

As the 1st on-chain generative artworks on Ethereum, Autoglyphs will forever hold grail status. This is compounded by the fact the iconic Larva Labs team created the project.

- Early Art Block collections

Art Blocks is the platform that introduced NFT generative art to the world, and as such, its early artworks hold a special place in the hearts of collectors. We recommend Squiggles by Snowfro if you are looking for an affordable choice. If you have the proper budget, Fidenza by Tyler Hobbs and Ringers by Dmitri Cherniak as great starting points.

PFPs

With existing PFP projects, the preference should be for collections with no external risk or heavily financially backed by reputable teams.

Our current picks are:

- Cryptopunks

Cryptopunks is the collection that began the whole NFT craze and will forever hold blue-chip status. As a long-term investment, it doesn’t get any safer than this in the Web3 space while there is still space for appreciable upside.

- Pudgy Penguins

Run by Luca Netz, Pudgy Penguins is the project furthest along regarding IP and brand development.

After buying out Pudgy Penguins for $2 million and assembling a solid and experienced team, they currently have a very successful Amazon Toy Line, 600k followers on Instagram and over 4B GIF views (in comparison, Pokemon has 5B).

Cryptonary’s take 🧠

The NFT market is rife with scams, cash grabs and instances of fraud, but the savvy investor can still make millions.

Here are five tips for avoiding scams.

- Thoroughly research the team.

- We recommend minting over buying on the secondary market.

- Avoid projects with artificial numbers on social accounts (especially Twitter).

- Avoid projects that fail to provide detailed sneak peeks.

- Complicated roadmaps and NFT games are usually a red flag.

As always, thanks for reading. 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms