Meet Jeremy Sturdivant, the unsung hero of this tale.

[caption id="attachment_273444" align="aligncenter" width="1800"] Jeremy Sturdivant[/caption]

Jeremy Sturdivant[/caption]

Jeremy Sturdivant

Thirteen years ago, he made a whopping 10,000 BTC on this day, just for delivering a couple of pizzas. Fast forward to today, and that's worth a staggering $260M+! Hope you HODLed, Jeremy!

But this brings us to some burning questions:

- Is Bitcoin intended as a medium for everyday transactions, like paying for pizza?

- Should it be a digital version of gold?

- Or should it have its own DeFi ecosystem like Ethereum? Something we’re seeing today.

TLDR 📃

- Bitcoin? That's your Internet Age Gold 🖥️

- There's a fresh fault line in the UK banking sector—it's continuing to unravel 🇬🇧

- Tether is taking a leaf out of our book (you might find this strange, but it's true) and piling BTC onto its balance sheet 💵

- There's a nascent BTC buying frenzy brewing, and whales are joining the party 🐋

- BTC's short-term outlook? It's a bit bearish, but the bottom's in sight at [$24,000-$25,000] 📉

- Fancy trying your hand at Ordinals? Why not? Drop in $50 or $100 and give it a whirl "for the tech" 🖼️

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make is your full responsibility.

The “no BS” answer

We talked about Bitcoin as everyday digital cash and as digital gold. Fun fact: these two roles can coexist. Remember how gold used to be a safety net and a shopping coin?Gold had its issues, though. You couldn't just go around splitting a gold coin in half, right? But with Bitcoin, giving someone "half a Bitcoin" is a piece of cake.

Now, onto Bitcoin's Achilles' heel - scalability. Yes, the high fees and network limitations are a headache. But, enter the superhero: Lightning Network, swooping in to save the day.

Does this mean Bitcoin's ready for the big leagues as the next global reserve currency? Hold your horses.

Fiat currencies have been in use for over 500 years, changing every ~century due to inflation or a similar failure. Why is inflation important? If your $100 is worth more next year, you'd keep it under your mattress, right? That's no good for the economy. This sneaky 'ponzinomics' trick gets us spending, and that's what keeps the GDP ball rolling. Too much of it though and you deal with a problem, just like the US 🇺🇸 is right now.

Bitcoin's scarcity means it might not be great as an everyday currency. But it's definitely the internet's gold and it's leading the way for a new financial system run by code - something we need more of. One example of why? Check this 👇🏼

News that fuel BTC 📰

- NatWest, a UK-based bank, now wants customers to give a 24-hour notice if they plan to withdraw over £2,000 in cash. They also want documentation. Hold up, isn't it supposed to be the customer's money? Who made the bank the boss to decide whether you can keep your cash at home or in the bank? It's a scheme to keep money within the bank so they can continue skimming off the top through loans (yup, they're using your money for that too). Your money should equate to your freedom. Luckily, people are waking up and getting seriously fed up with banks - and this is happening in the wealthiest countries in the world.

- Tether, that slightly infamous company behind the USDT stablecoin (just for the record, we reckon they're legit), has started buying BTC. They plan to use 15% of their profits to buy more Bitcoin. Guess what? Two years ago, we here at Cryptonary started doing something similar. We put 12.5% of our revenue into Bitcoin to beef up our rainy day funds.

Whales are coming in, slowly but surely 🐋

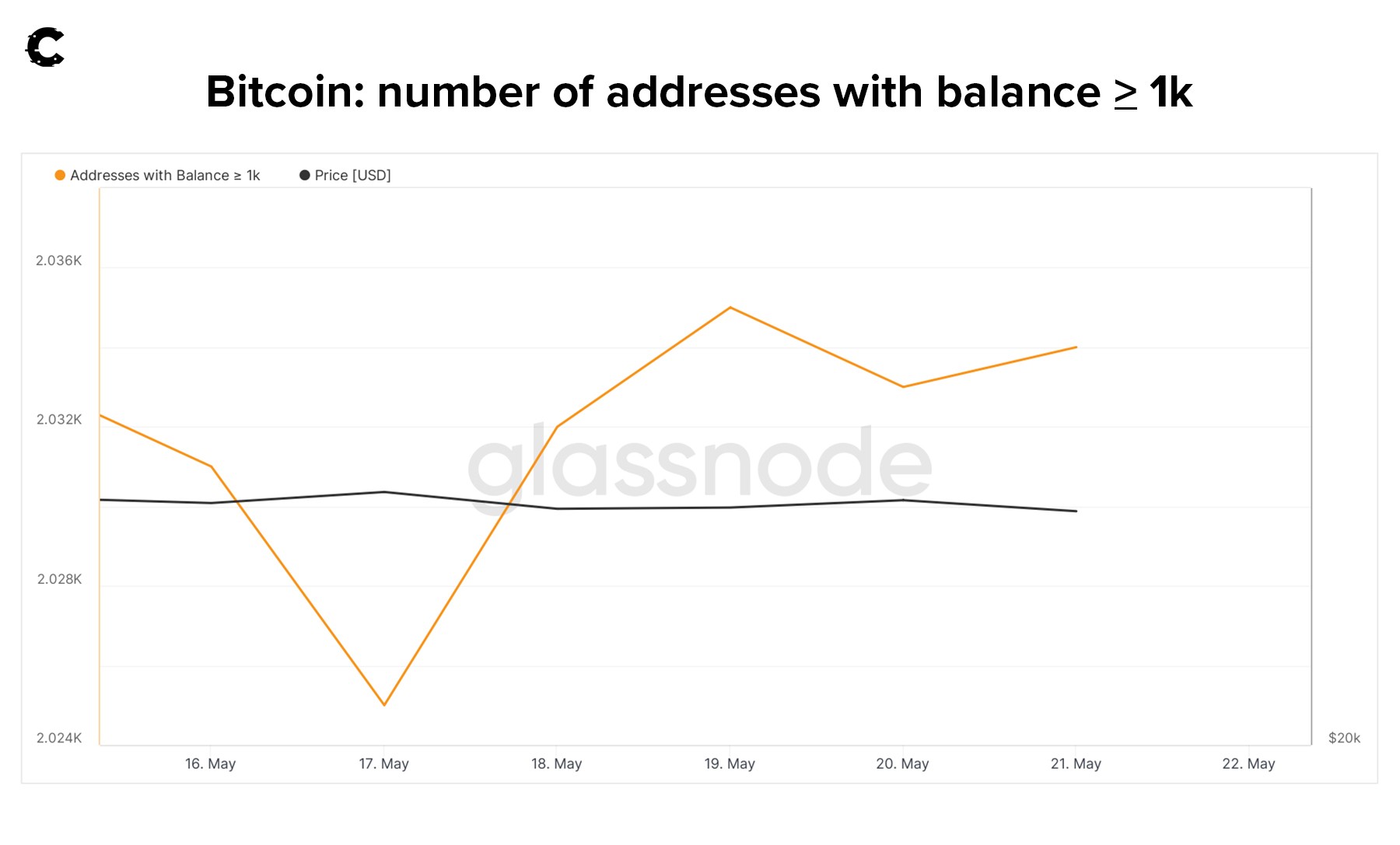

Got some hot news for you! We've recently spotted 9 fresh addresses joining the 1,000 BTC club and just one new address in the 10,000 BTC club. So, how big are they exactly? Tough to say. What we do know is, they've bagged at least 19,000 BTC (that's $500M!) in the past week alone.

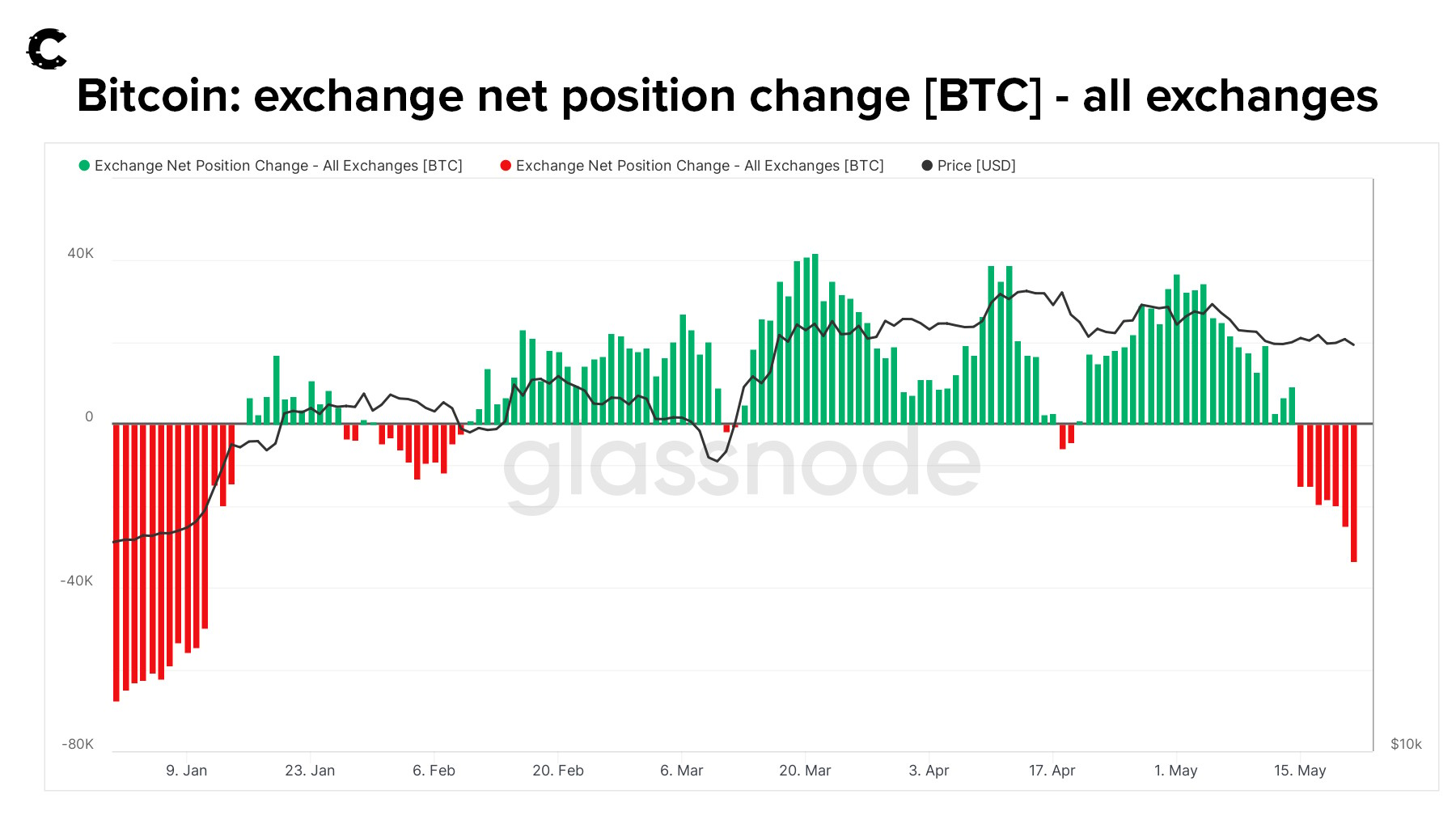

Here's a fun fact: In the crypto world, the only time you wanna see red is when checking out the net position change on exchanges.

Why's that? Let's explain:

- Red 🟥: This means there are more withdrawals than deposits (net withdrawals). In simpler terms, folks are buying BTC and stashing it away in their wallets. That's bullish for Bitcoin.

- Green 🟩: This signals more deposits than withdrawals (net deposits). It typically means BTC is being deposited to be sold, which is bearish.

Speaking of which, where's Bitcoin's price heading next?

Price analysis 📉

The bottom is near, but we’re not quite there yet and we actually expect to see a lot more net withdrawals from exchanges the closer we get to [$24,000-$25,000].

Over the past week, the Bitcoin market's been pretty chill, no big price changes. But the structure? Still bearish, especially with Bitcoin recently hitting a low of $25,825.

All signs suggest we’ll see a drop to around $24,250.

But don't forget, these predictions come with a twist. If Bitcoin bucks the trend and jumps from resistance to support at $30,000, all bets are off. So, keep watching the market closely.

Okay… we did skip one point… on purpose

Alright, let's address the elephant in the room. Yes, we've championed BTC as digital gold and talked about why it's not quite suited for daily transactions. But what about the BTC ecosystem, similar to Ethereum's?Hold up, we haven't brushed this under the rug. We were among the first to spotlight Ordinals (check our post from February 19th for proof).

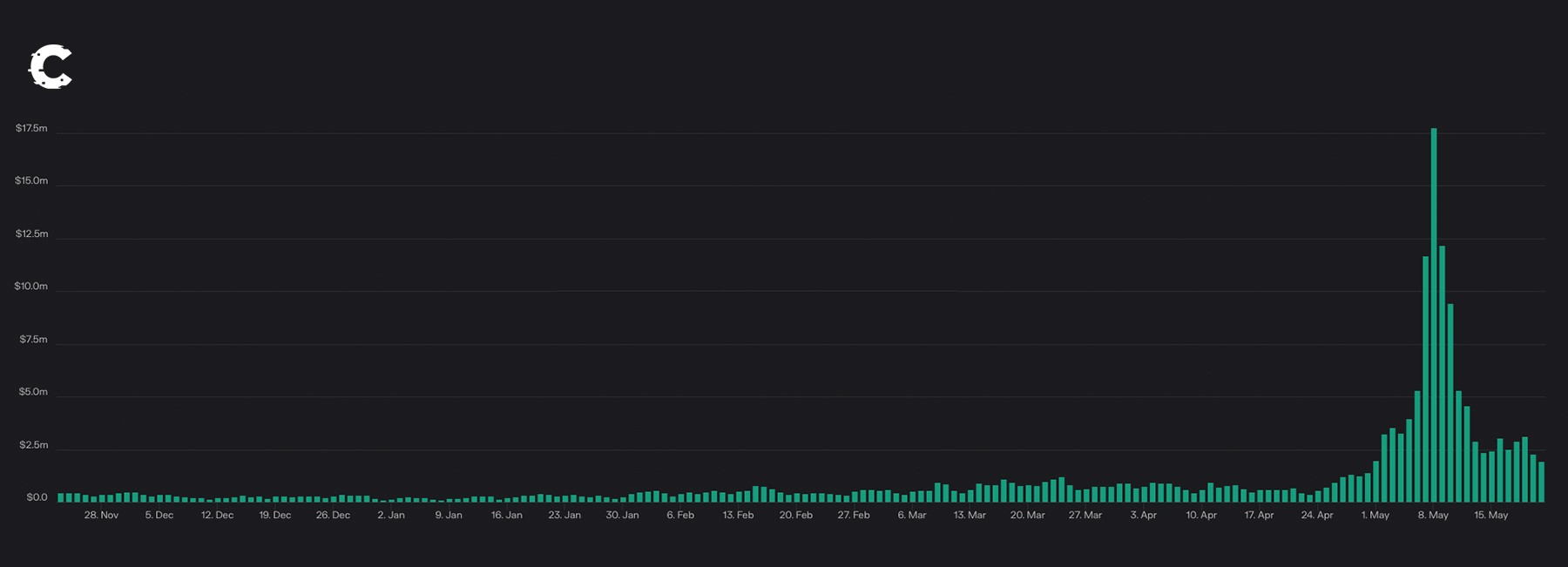

Here's the deal: Ordinals are intriguing, but let's be real, they should remain just that—an experiment. This emerging "ecosystem" of tokens and NFTs created a pretty penny for miners, but it also clogged up the network, rendering it practically useless.

The average fees have now come back down to around $2.5M per day, but it wasn't long ago that they skyrocketed past $10M+ daily.

[caption id="attachment_273439" align="aligncenter" width="1800"] Bitcoin fees[/caption]

Bitcoin fees[/caption]

Sure, miners need to turn a profit but if BTC's price dips below $10,000 and loses its "digital gold" status, they wouldn’t want that new “ecosystem”. Why? Because their fees are paid in BTC. Sure, miners had a whale of a time, but they're savvy enough to know it's not sustainable.

Now, just because it's not sustainable doesn't mean you should ignore this ecosystem. Quite the contrary, explore and experiment with it.

Over the past week, MagicEden has made some serious moves, shrinking UniSat's volume share from ~90% down to 40%, while claiming a whopping 54% themselves. Have a look at the NFTs on MagicEden, experiment with this fresh technology, and form your own opinion. You can browse the MagicEden collections here. To get started, simply download one of these three wallets: Hiro, XVerse or UniSat's own wallet.

Cryptonary’s take 🧠

Let's cut to the chase on this week's Bitcoin recap!The "10,000 BTC pizza" story? Lesson learned: invest in tech you believe in, but never more than you can forget about for a good ten years.

Recent actions by NatWest and Tether are stirring up the crypto world. One shows us why we need code-driven finance, while the other is our tried-and-true Cryptonary method.

We're also spotting big crypto whales 🐋 dipping their fins into the market again. This suggests they agree with us that a bottom of [$24,000-$25,000] is near. Unless major news hits, expect a bounce.

Do you want to preserve or moderately grow wealth? Bitcoin is your ticket. But if you're not there yet and still need to make a return, build up your wealth by building businesses and checking out our Alpha reports.

As always, thank you for reading 🙏🏼

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms