Today, we delve into the concept of layer 3 and its significance in the crypto landscape. What advantages does it offer? How does it address the limitations of existing layers?

To set you up for success, we also highlight some protocols and projects already embracing this paradigm shift. Let's go!

TLDR 📃

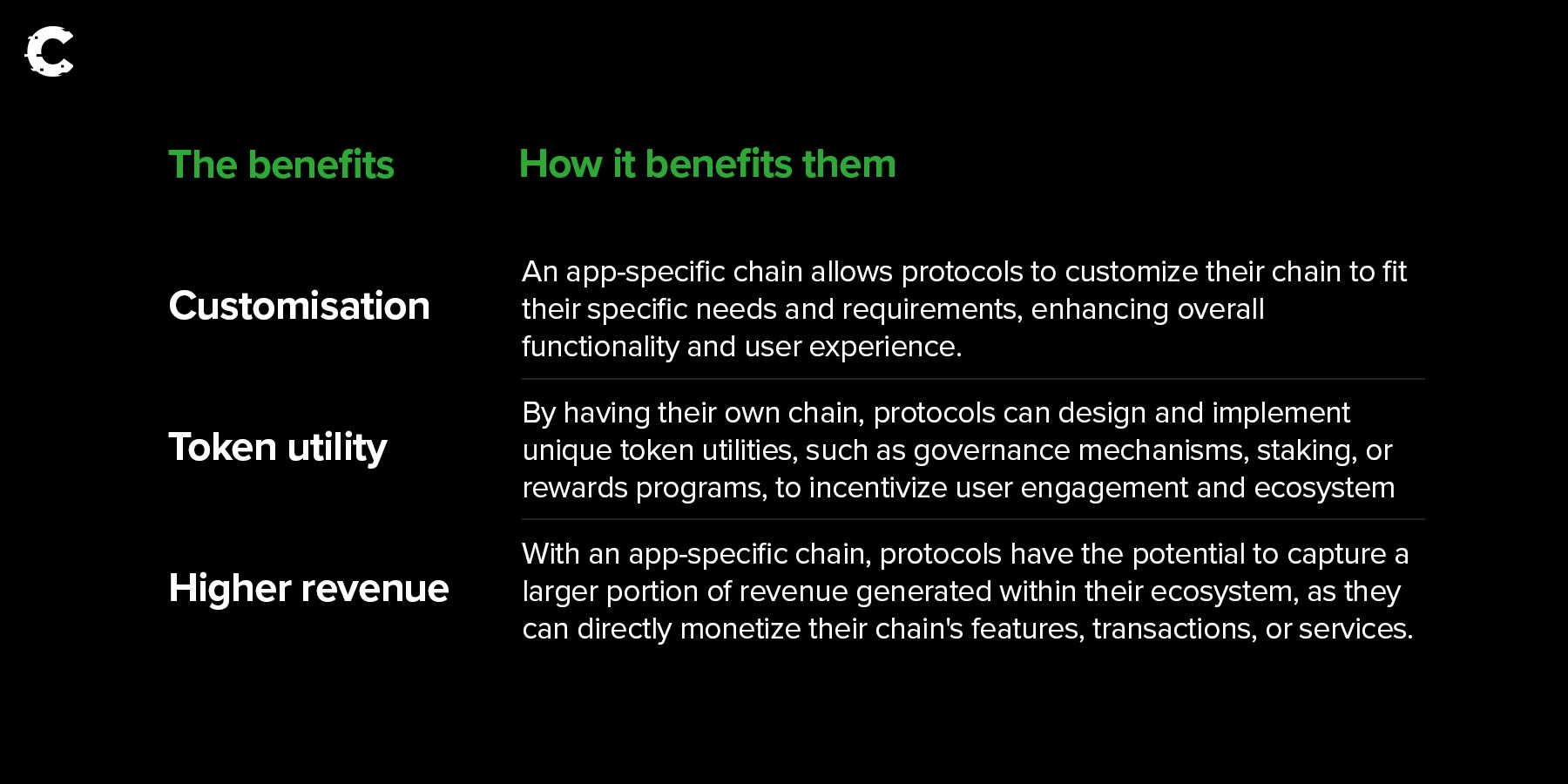

- Layer 3 allows the customisation of blockchains for specific applications to address the limitations of layer 2 chains.

- Layer 2 solutions are releasing toolkits for building layer 3 projects.

- Layer 3 projects can customise their chains, implement unique token utilities, and capture more revenue.

- The shift to app-specific chains will benefit bridges and protocols facilitating inter-chain communication.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

The rise of layer 3 projects 🚀

If you've been keeping up with crypto news, you've probably heard the term "layer 3". But what exactly is it, and why is it such a big deal?Simply put, layer 3 refers to a blockchain built on top of a layer 2 solution like Arbitrum or Optimism. It is a customised blockchain developed for specific applications – hence they are also called app-specific blockchains.

Why build an app-specific chain? Well, layer 3 protocols exist to address the limitations of layer 2 chains.

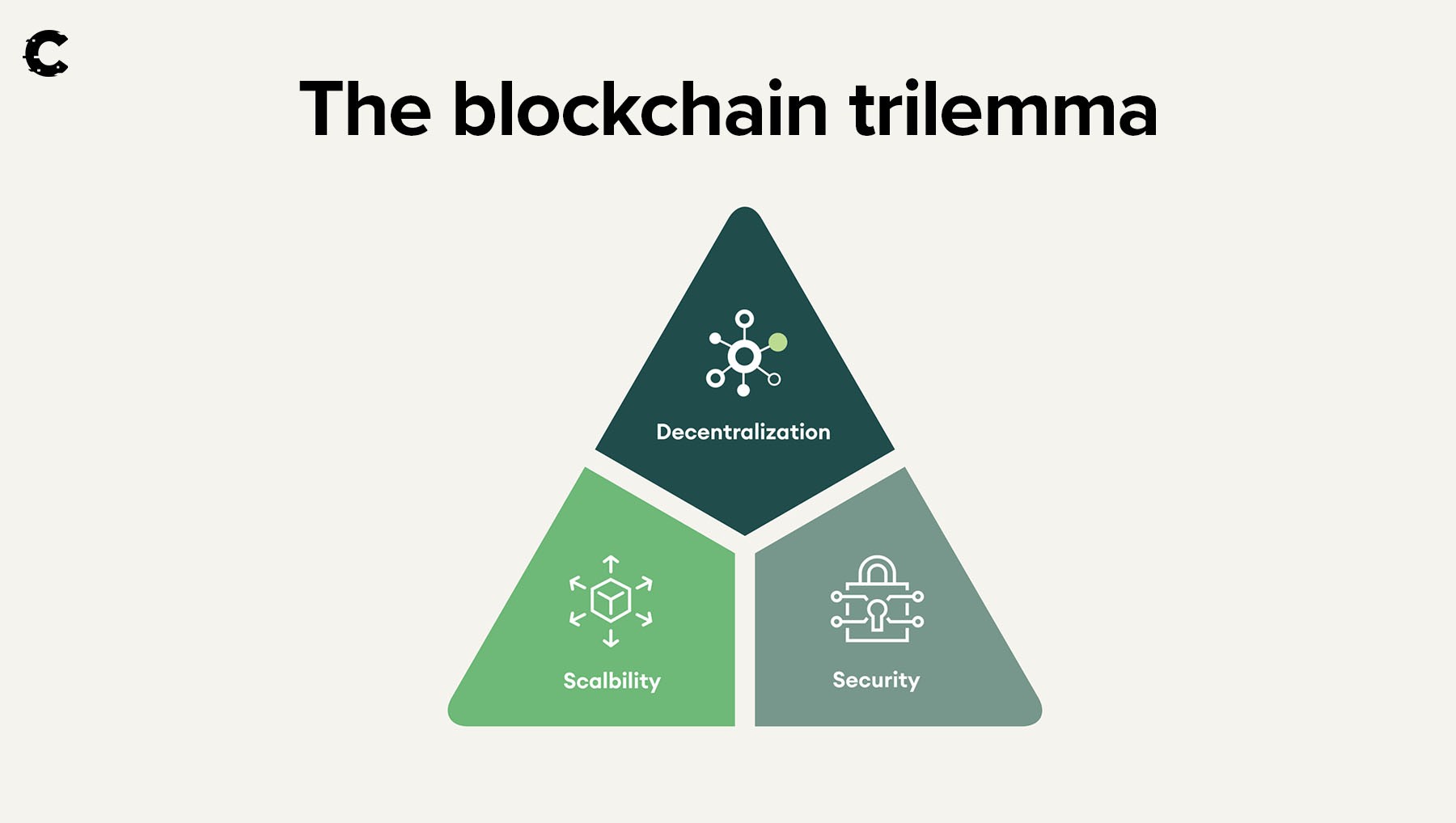

All blockchains are limited by the "blockchain trilemma," which suggests that blockchains make trade-offs across decentralisation, security, and scalability. For instance, layer 2 solutions on Ethereum enjoy decentralisation and security, but sometimes they struggle with scalability.

That's where layer 3 solutions come in!

With app-specific chains, developers can customise a new chain according to their specific requirements without being constrained by the architecture of the L2.

Do you prefer scalability and security over decentralisation? The world is your oyster.

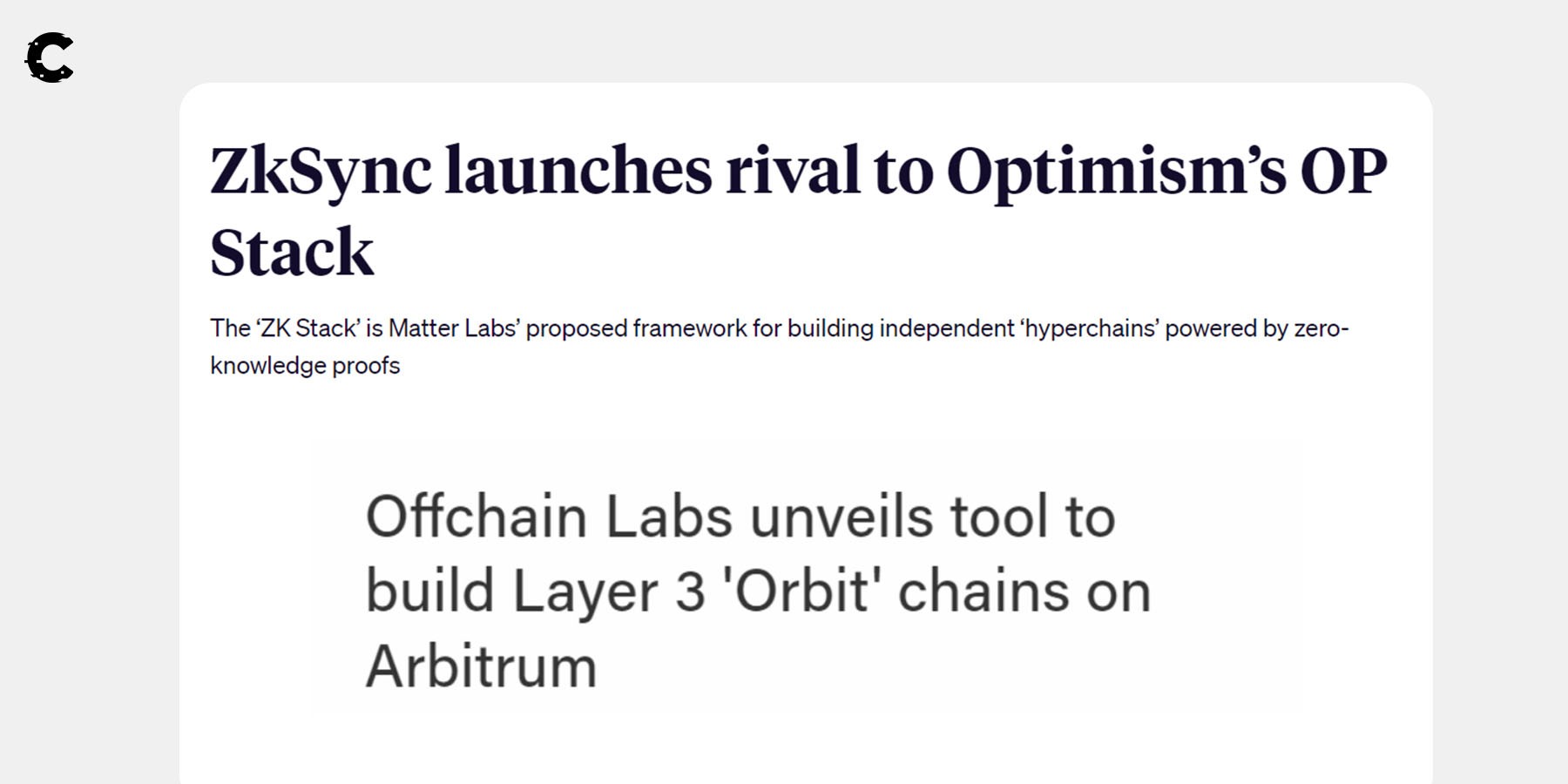

Interestingly, several layer 2 networks are now releasing toolkits for developers to build app-specific chains with their ecosystems. Optimism led the way with the release of its Op Stack toolkit. Coinbase built Base with OP Stack, Now, Arbitrum and zkSync have also joined the competition with "Arbitrum Orbit" and "zkSync Hyperchains", respectively.

The new kids on the block🤑

As app-specific chains become more popular, L2 protocols will compete for L3 projects to launch app-specific chains within their ecosystems. However, while this may seem primarily a competition between layer 2 chains, the actual beneficiaries here will be the new L3 projects.These new kids on the block will have the likes of Arbitrum and Optimism fighting to support them, maybe even paying them to join. Beyond this, these L3 projects will enjoy additional benefits from having their chains instead of being limited by a base chain.

These benefits will, in turn, empower the L3 projects, some of which are already profitable, to generate even more revenue.

Here are some other protocols that are already making this move and deserve your attention:

- UniDex: has introduced an OP Stack-based chain called Magma which will use the UNIDX token for gas fees.

- Aevo: an options exchange built on its app-specific chain using the OP Stack.

- Pika Protocol: its V5 version will launch Pika Chain, utilising the Op Stack for its app-specific chain.

- Syndr: a decentralised options exchange set to launch the first app-specific chain using Arbitrum Orbit.

Bridging the chains in a multichain world 🌉

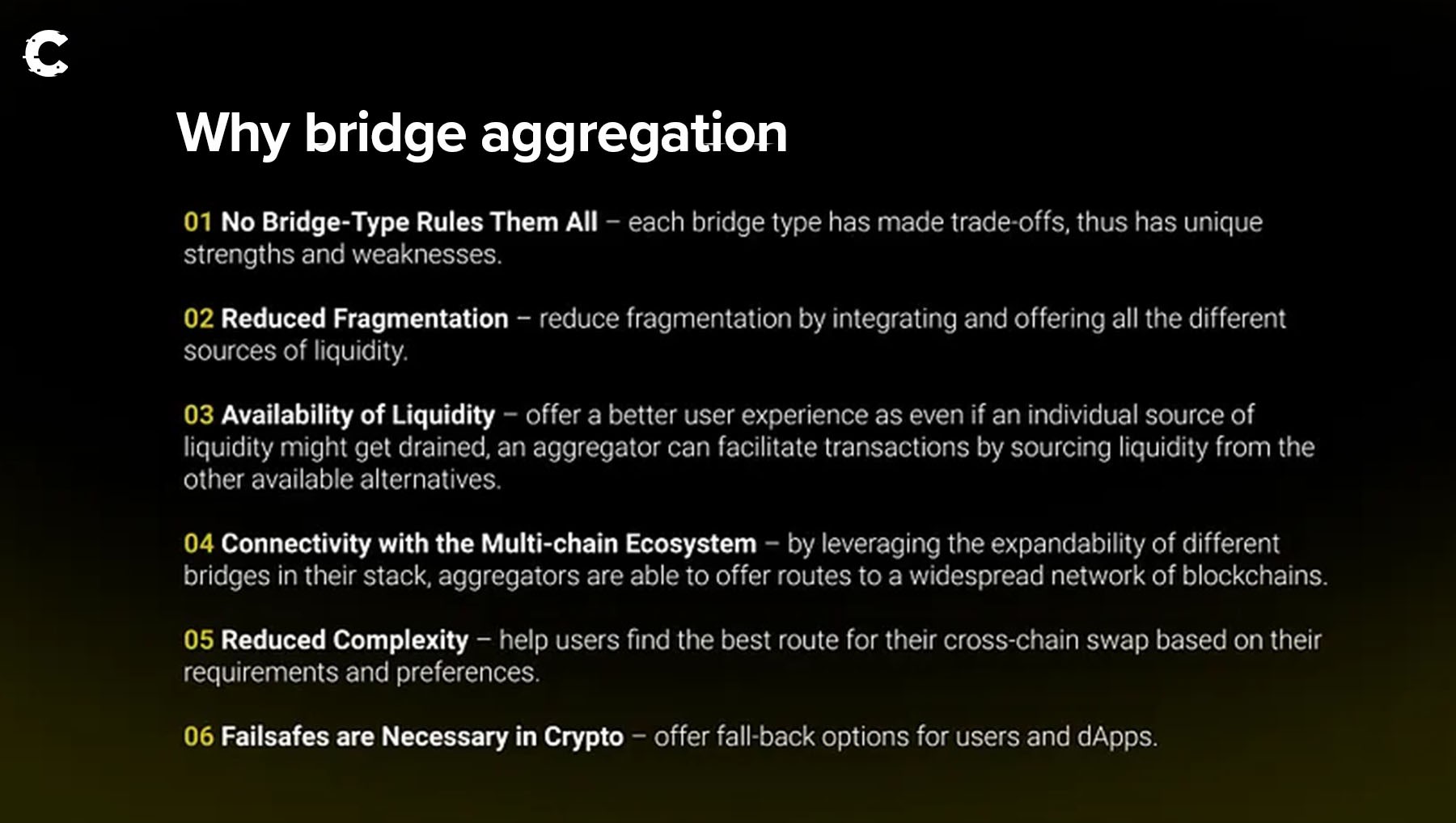

With the rise of app-specific chains, it is evident that we are moving into an increasingly multichain world – nope, we won't have one chain to rule them all.Besides DeFi protocols, another group is set to ride the wave of app-specific chains: bridges and protocols that facilitate communication between these chains.

As more and more chains pop up, users will need to transfer assets from one chain to another. This surge in inter-chain activity creates a strong demand for infrastructure that enables seamless liquidity movement across these chains.

Now, here's an exciting protocol to keep an eye on in this context: LI.FI. Although it doesn't currently have its token, LI.FI operates as a bridge aggregator. It provides users with a user-friendly interface to discover the most optimal method for transitioning between chains.

But that's not all! We're also super bullish on Synapse. Not only is Synapse building its app-specific chain, but it's also poised to reap substantial benefits from this strategic move. We've covered this protocol extensively here, so be sure to check it out for more insights.

Cryptonary's take 🧠

The layer 3 revolution is just starting, but things are already heating up with the launch of layer 3 development toolkits by various Layer 2 solutions.Why do we think it's a game-changer? Well, protocols that take the plunge and build their chains gain a competitive edge and unlock more incredible value. These protocols become an attractive choice by increasing the utility of their tokens and earning higher fees.

Bridges also have a crucial role as the backbone of cross-chain communication. This is why we are optimistic about bridge aggregators like Li.Fi and bridges like Synapse.

Layer 3 projects open up a world of opportunities for the Web3 industry. We can't wait to start unlocking the value.

As always, thanks for reading.🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms