Artificial Intelligence in Crypto: The Next Big Thing, or Just a Fad?

Get ready to dive into the exciting world of Artificial Intelligence (AI) and cryptocurrency! With OpenAI's ChatGPT making waves in the AI world, it's about time we take a closer look at the impact of AI on the crypto space. Any token with “AI” in its name has seen a significant rally in the past two weeks. AI's potentially great for crypto, but there aren't yet any investible tokens connected with the technology, for now at least. Speculation is the name of the game in crypto, but are these tokens any good?

Imagine a world where cryptocurrencies are optimized with little to no human involvement. That's right, the power of AI is being harnessed to innovate the way we create, trade and secure our digital assets. AI is a catalyst that many crypto enthusiasts may be overlooking, but we're here to shed some light on the subject.

We’re here to give you an overview of cutting-edge AI applications in the crypto space. We will also discuss SingularityNET ($AGIX) which is the most advanced AI protocol currently.

Take this as an opportunity to stay ahead of the curve and learn about the amazing innovations that are transforming the crypto industry as we know it… but also some of the assets that are best avoided for now.

TLDR

- AI developments in the crypto space have been significantly gaining momentum and are shaping up to completely change the industry we all know and love.

- One AI project, SingularityNET, has rallied 600% from its bottom, but you don’t want to be a buyer now.

- Most AI tokens that are currently available remain questionable and have yet to stand the test of time.

- This sector is in the very early stages of development and the risks are considerable.

- Most AI projects don’t really offer value to those holding their tokens and are likely overvalued.

How exactly is AI being utilized in crypto?

Let’s quickly discuss some key innovations found in the space right now. To start with, recent studies have been looking at using AI to optimize token development. From deciding which chain a protocol should be built on, to its specific tokenomics.Other protocols are using machine learning for optimized security, UI (user interface) and UX (user experience). Hold on, it gets crazier. The power of AI and machine learning can also be used for automated investing. This is the process where the algorithm makes investment decisions without any human intervention. Numeraire (NMR) was one of the first projects to bring this type of innovation into the crypto space.

Ocean Protocol (OCEAN) uses AI in order to monetize data. Other protocols are using AI to optimize logistics and data processing. As you can see, different protocols are utilizing AI in very different ways, this is what makes this opportunity unique.

SingularityNET and its unique approach

Due to the sheer number of innovative applications, in this report, we’ll focus on the most advanced AI protocol as of today. Drum roll please... SingalrityNET!SingularityNET was once an Ethereum-based AI network under the ticker $AGI, before undergoing a hard-fork and migrating to the Cardano blockchain under the current ticker, $AGIX.

In a nutshell, it is a platform for developing and deploying AI services and applications. These can be shared, bought and sold on SingularityNET’s proprietary, decentralized marketplace. What makes SingularityNET unique is that users don’t really need a technical background to benefit from the offered AI services. This is key, as it can onboard a significant number of users.

What’s also interesting about SingularityNET is that the data used for training its AI models is in compliance with the EU’s General Data Protection Regulation (GDPR). This is critical if mass adoption is in its future. Want to know more about GDPR? This article gives you a detailed overview of what exactly this legislation is all about.

This is not a deep dive into SingularityNET. So, we will quickly brush over the main points for the utility of the token.

- Used for accessing AI services on the network for a certain price

- Governance

The problem with SingularityNET and AI protocols in general

Ocean Protocol

Let’s start with Ocean protocol. It is a decentralized data exchange protocol that enables people and organizations to share and monetize data in a secure and transparent manner.Ocean Protocol's data sharing platform benefits greatly from AI. It offers algorithms and models that facilitate quick and accurate data processing, analysis, and decision-making. The value and usability of the Ocean Protocol ecosystem are increased as a result of these AI technologies' assistance in ensuring the accuracy, reliability, and applicability of the data being shared.

OCEAN currently has a max supply of 1.41 billion tokens, and a circulating supply of 434 million. The token is used to facilitate transactions on the network and to secure the network. It doesn’t really do much apart from that. Combined with the extremely high Fully diluted valuation of around 709 million dollars, making it a questionable buy in its current state.

Numerai Network

The Numerai network is powered by the token Numeraire. With the help of artificial intelligence and machine learning, the platform Numerai creates hedge funds and pays data scientists who make predictions with NMR tokens.Numeraire (NMR) is one of the only AI based projects with somewhat decent tokenomics. Data scientists are encouraged by NMR's tokenomics to contribute their best forecasting models to Numerai's hedge funds. When data scientists submit their forecasts, they stake NMR tokens to demonstrate that they have faith in the precision of their model. They gain more NMR tokens as compensation if their model performs well.

The current circulating supply is around 6.2 million tokens. With a max supply of 11 million tokens. The FDV is around 230 million dollars. Considering how innovative the protocol is, this isn’t as bad as other tokens, and potentially has significant upside potential in a macro-economic environment that allows risk assets to thrive. It will undoubtedly be one of the best performing AI protocols. With that being said, almost half of the supply is waiting to be unlocked and could result in suppression of that price potential.

SingularityNET

AI developments in crypto are interesting and innovative. However, most, if not all AI-based projects have very little value in owning their token, as they boast bad tokenomics, very few holders, and are likely overvalued. SingularityNET is no exception.While it is the most advanced in terms of development, its tokenomics are really not that great. It has a maximum supply of 2 billion, with a current circulating supply of around 1.26 billion. This is a worrying sign, as many more tokens will be introduced in the coming months, resulting in significant selling pressure (more on this later). Furthermore, the current SingularityNET marketplace lacks quality AI services that people will actually make use of. Hence, rendering the token essentially useless for now (considering that it's the primary utility of the token).

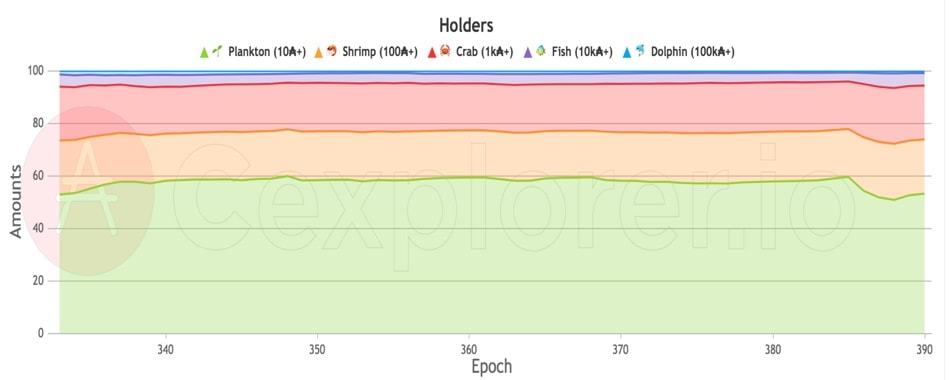

SingularityNET’s on-chain metrics after migrating to Cardano:

This is where it gets interesting... As it can be seen in the chart above, the total number of transactions has seen a sharp decline between epoch 380 and 390. However, the number of addresses has been increasing steadily over time. This can be explained by one very simple dynamic: speculation.

Largely impacted by the introduction of ChatGPT, many crypto investors have shifted their focus to an “AI Narrative” which could potentially play out. They are betting on significant upside in any AI-related projects. This can be seen in the next chart, where it’s clear that retail is aping (buying without any due diligence whatsoever) into anything which includes the term “AI”.

We all know that crypto investors love to take risks and gamble. Sometimes this pays off. However, more typically such investors end up being exposed to significant drawdowns to their portfolio and are left with large bags of useless tokens.

This strategy may have worked previously during the “everything bubble”, but with tight monetary policy, relatively low consumer confidence (when compared to 2-3 years ago), and very tight liquidity, this kind of approach doesn’t make sense right now.

Price Action and Key Levels

For the sake of simplicity, we have combined all relevant information about $AGIX’s price into one chart.

Let’s start off with that never-ending accumulation range of 245 days. “The longer the consolidation, the bigger the expansion,” is one of our favorite sayings when it comes to price action analysis. This can clearly be seen on the chart. AGIX is up almost 600% from its bottom.

This brings us to the next important point, DO NOT FOMO IN. Yes, you may feel as if you have missed out on this move, but do you really want to jump in at such a premium? It is also very important to keep in mind that there will soon be more supply on the market; this will inevitably push the price down to our bidding levels.

The red line is the swing high from the breakout, it should act as a very important level in the short-term. With that being said, $AGIX is up 33% on the day of writing this report and is currently trading very close to that key level.

Keeping it simple: a break of this level would probably send it to the black line, as there is a long wick there and long wicks eventually get filled. A failure to break would probably mean a loss of momentum and it’s very likely that price could trade at the green level ($0.10) over the coming weeks.

This would be a much better level to bid if you – unlike us -- admire the protocol and see an upside for speculating on the AI narrative.

Cryptonary’s Take

AI in crypto has enormous potential to impact the industry and is an emerging trend.The promise of enhancing the functionality and security of protocols is extremely compelling. Along with the sheer amount of innovation AI can offer, we can easily conclude that AI integration in our industry is not going anywhere, and will continue to deliver in the coming years.

It is important to note that it is still in its early stages of development, and risks regarding specific protocols are still very high. Not only that, but the majority of the currently available protocols don't really offer anything of value, don’t solve a real-world problem, and have extremely high FDV (fully diluted valuation; the total supply of a token multiplied by its current price).

Action Points

For the time being, we believe the rational thing to do is to grow your knowledge regarding this new frontier in crypto, and keep a close eye on the developments in the space over the coming months and years.If you really can’t help yourself and are seeing something we’re not, make sure you don’t FOMO into projects at a huge premium but wait for a significant pullback (30-40% at the very least).

Also keep in mind that it’s a fast-moving space, and better tokens and opportunities will present themselves in the future.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms