It’s a sad truth that many crypto projects build great things but bad token economics (tokenomics) hold them back. Even when fundamentals skyrocket, the token remains stuck in a range.

As you might have guessed, that’s ATOM’s chart above.

Forget the bear market, ATOM never performed well; not even during the 2021 mania.😞

Sure, it pulled a 40x, but that’s nothing in crypto; but even ETH pulled off a 60x ($80 to $5,000).

But FINALLY, the Cosmos team plans to make a change, and they mean business!

Are you excited? We sure are - LFG 🐂

TLDR 📃

- Cosmos (ATOM)’s poor tokenomics is a major drawback, but there’s an audacious plan to fix it.

- If Cosmos gets a refix, this could be one of the biggest comeback stories in crypto.

- In the meantime, exciting developments are expected to bring new users and assets into Cosmos.

- Injective Protocol's pump might be the first of many as Cosmos eventually rises to its potential among first-generation blockchains.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

An audacious plan to fix ATOM’s tokenomics 🛠

Last year’s attempt to fix Cosmos via an ATOM 2.0 proposal was an abject failure – an unsurprising turn of events because the proposal tried to change too many things with one vote.

Now, the ATOM Accelerator program has set up a new advisory board to influence changes to both the ATOM token and the Cosmos Hub.

But it’s not just the tokenomics that need a fix. The Cosmos ecosystem is paradoxically both connected and fragmented.

For instance, the Cosmos ecosystem is expansive, with many different projects built on the Cosmos SDK, yet, ATOM gains little direct benefit.

In fact, the market cap of Cosmos-based L1 tokens is at least 2x larger than ATOM’s market cap.

The solution that will fix Cosmos must include the following:

- Redesign ATOM tokenomics, specifically inflation, budgets, and security.

- Develop a mechanism that can reduce validator stake centralisation.

- Develop a vision for the Cosmos Hub in a rollup-centric world (a nod towards Ethereum Layer-2s).

What happens if Cosmos gets a refix? 🎆

ATOM has lots of potential, and a revamp could transform it from an ugly duckling into a beautiful white swan, if all goes well.

Without a refix, things would get increasingly worse.

Don’t take our word for it. Here’s what the charts tell us.

ATOM had jumped into bear territory since the 2021 bull market ended and has stayed there ever since. Worse, the overall structure hints at more downside.

Diving into the more local region, we can see that the price of ATOM formed resistance right at the diagonal channel, and we have three tests to confirm it as resistance.

This will be the definitive factor for ATOM's price action in the short term. Only a break of the diagonal channel will result in a change of structure and a price surge.

Nothing indicates that ATOM will break out soon, so we expect a rejection after testing resistance again at some point in the coming months, after which it can continue falling toward support at $4.75 - $4.15. Note that this will not happen if the market sees a major rally.

The price analysis above paints a grim picture, but it’s important to remember; ATOM does not define the health of the Cosmos ecosystem.

While we wait for a tokenomics revamp, the developments in Cosmos’ DeFi scene suggest that it is not all gloom and doom in the Cosmos. Stay with us.

Wormhole (Portal) launches a new chain ⛓

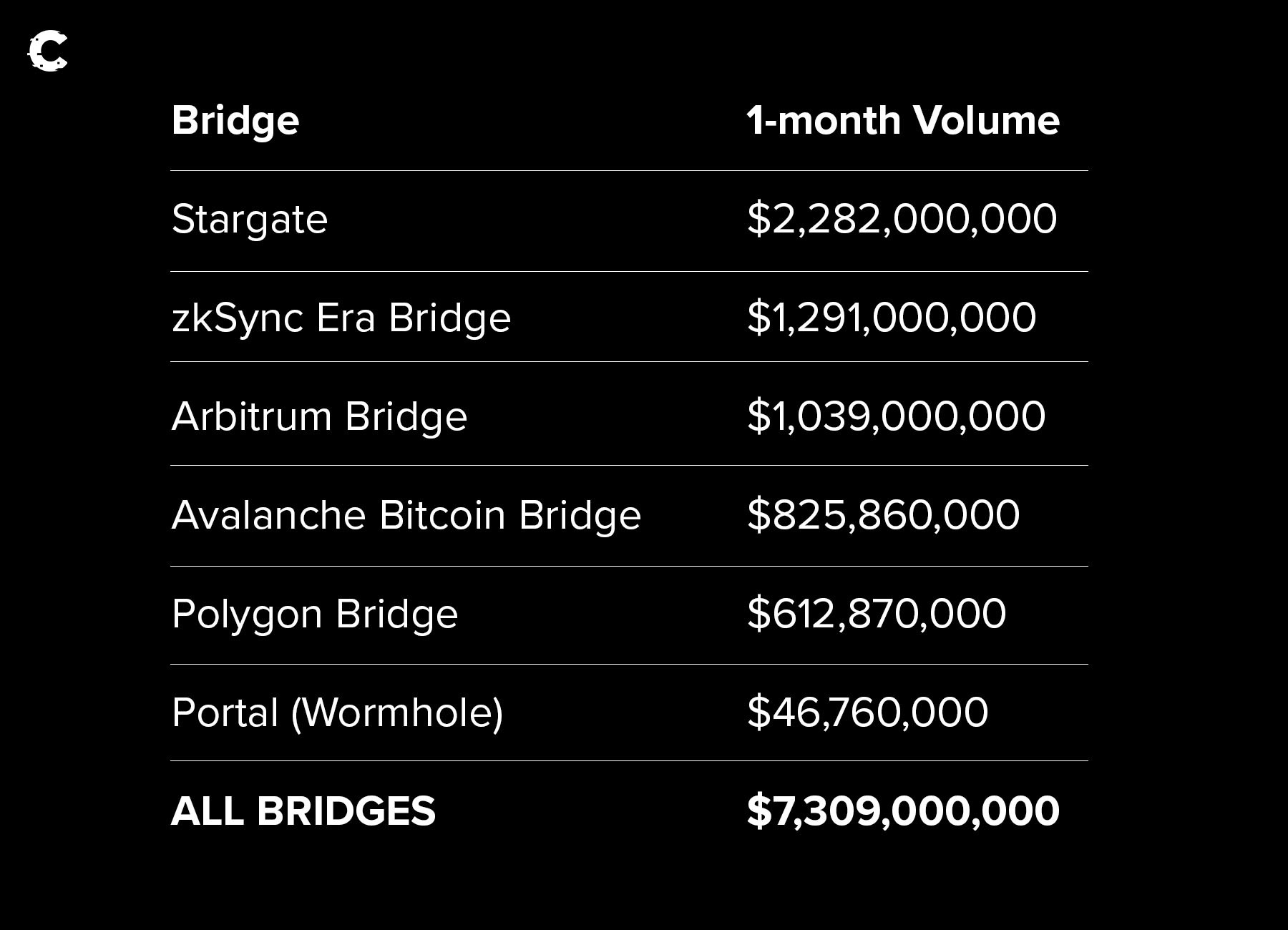

Bridges remain the most used method of moving assets between chains. Over $7.3 billion in volume has passed through bridges in the last month.

Recent figures show that most bridge traffic remains mainly to and from Ethereum Layer-2s. However, a well-known bridge Wormhole recently launched a new blockchain, Gateway, powered by Cosmos.

And why is this a big deal? Well, Gateway will bring new users and assets into the Cosmos ecosystem. Cosmos dApps can tap into Wormhole’s expansive liquidity network across over 23 chains through Gateway.

Wormhole had previously integrated with Injective Protocol, an L1 built using the Cosmos SDK. However, this new integration gives all Cosmos protocols and dApps access to the Wormhole bridge.

By the way, if you are an airdrop hunter, Wormhole does not yet have a token.

But you could still secure the bag by jumping on the new Gateway chain.

Injective's userbase is trending up ↗️

Injective (INJ), specialising in DeFi and Web3 gaming applications is another ray of light shining through the Cosmos ecosystem. It has been one of 2023’s top performers, up a massive 530%+ YTD.

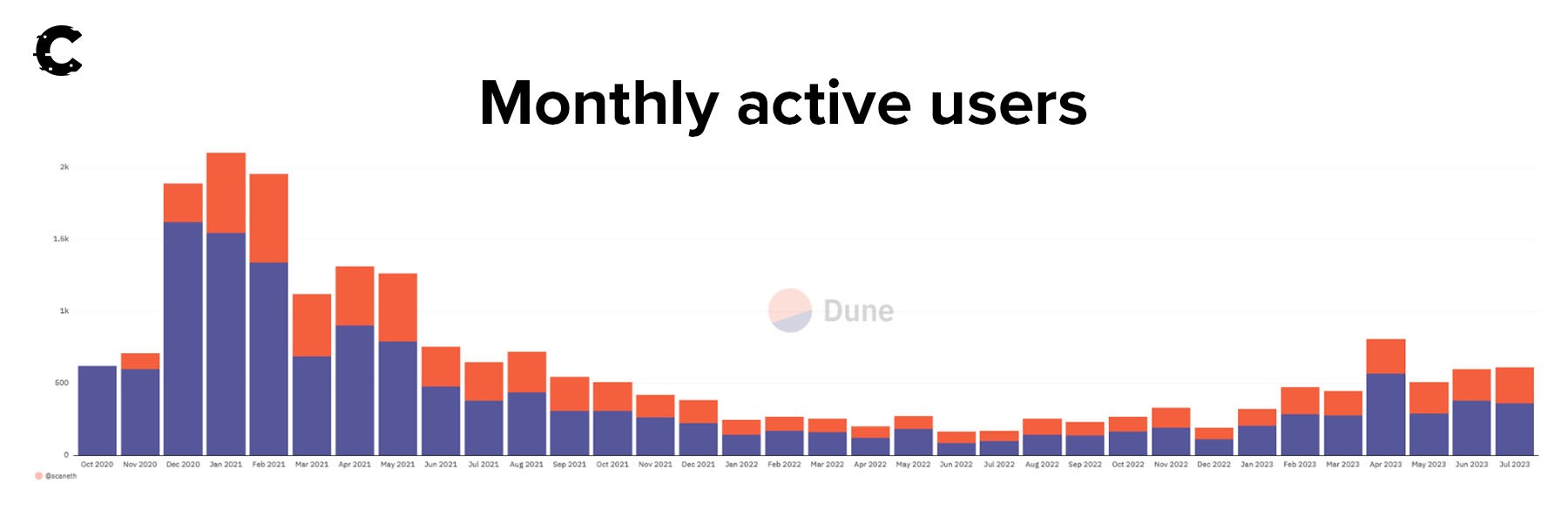

Injective’s userbase has been growing in recent months after a prolonged trip to the downside after the 2021 bull market petered out.

Much of this growth can be attributed to Helix, a perpetual contract DEX built on Injective.

Capitalising on the Ripple win over the SEC and the degenerate nature of crypto participants, Helix most recently listed XRP-PERPs.

In the case of Injective protocol, first came the token pump, and the users followed.

Only one obstacle keeps INJ from surging to the $17 - $13.60 resistance region, and that's the possibility of a double top.

After testing the previous high, its price is experiencing some selling pressure, which could easily bring it back to support between $4.90 and $3.75.

Nevertheless, both scenarios end with INJ making new weekly highs and forming a top at $17 - $13.60 at some point in the coming months. The price action has been quite choppy until now, so it will likely be a slow ride to the upside.

So, the fundamentals align with the technicals; what’s the outlook?

Cryptonary’s take 🧠

If Cosmos ecosystem was valued as a single protocol, it would have a market cap on par with Solana’s.

Often overlooked, this interconnected network of blockchains is constantly expanding.

Protocols like Injective are creating products and providing cheap and cost-effective DeFi services. We do not think that Cosmos-based protocols will rival Ethereum Layer-2s.

But there is a clear demand for interoperability beyond the Ethereum ecosystem – and that’s where Cosmos shines.

Injective Protocol is on our radar, but we’ll mostly be watching how the new advisors reimagine ATOMs tokenomics, and improve Cosmos Hub’s role within this huge ecosystem.

As always, thanks for reading. 🙏

Cryptonary, out!

Other News

- Synthetix is targeting a Q4 2023 launch for Synthetix V3 and a new frontend, Infinex.

- Neon Labs releases EVM environment to bring Ethereum DApps to Solana.

- Pendle launches Pendle Earn, a “basic” version of the Pendle yield product.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms