Fleeing Western regulatory issues, Binance heads East - but will new troubles arise?

Amidst all these, Binance has a slight window of opportunity to become a DeFi powerhouse but a string of “bad decisions” looms like a dark cloud.

Will BNB sink or swim? There’s only one way to find out! 👇

TLDR 📃

- Binance is shifting focus to Asia due to regulatory issues in the U.S. and EU.

- Binance wants to become a DeFi powerhouse and is taking positions with Binance Labs.

- The company's stablecoin strategy looks reckless and raises some concerns.

- We recommend being cautiously optimistic about the short-term prospects of BNB.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Binance is betting on Asia 🌏

Binance is facing legal challenges in the U.S. with lawsuits from the SEC and CFTC, and there are rumours of a potential criminal case from the DOJ. In the EU, Binance struggled and had to exit The Netherlands and Belgium.

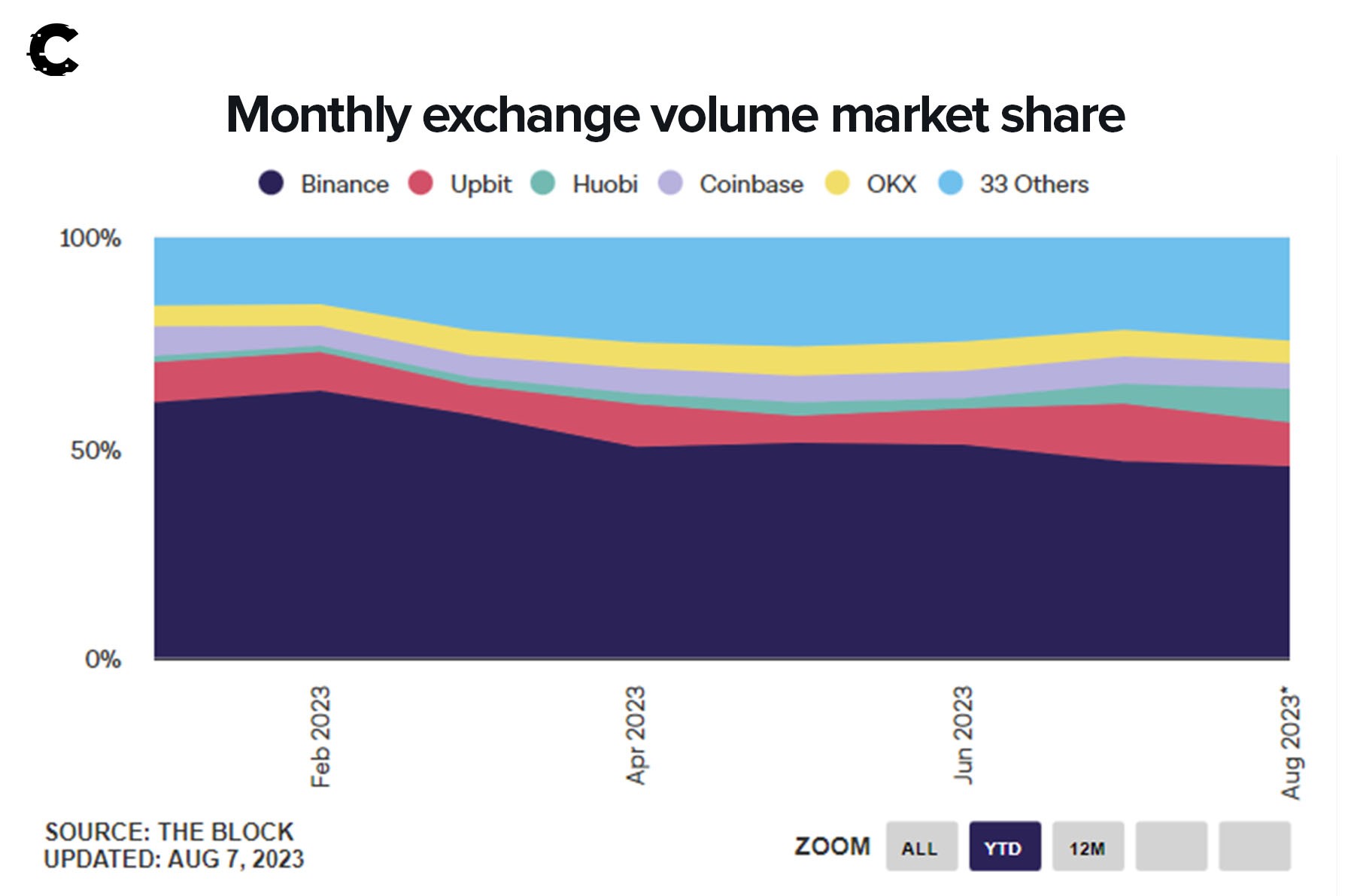

All these headwinds have caused its market share to decline from 63% to 45% this year.

However, Binance is actively exploring opportunities in Hong Kong and other Asian countries despite leaving China, its former biggest market. Last week, Binance launched in Japan, complying with local rules. It acquired a majority stake in South Korea's GOPAX earlier this year and plans to enter Thailand in Q4 2023.

Interestingly, the timing of Binance’s expansion into Asia seems perfect. Huobi, one of the larger exchanges in the continent, has continued to face troubles. For instance, rumours have it that the Chinese police took several executives at Huobi away.

Could a $7.5 billion war chest turn Binance into a DeFi powerhouse? 🏗️

CZ once explained in an interview that he is convinced DeFi could take years to evolve, but it would overshadow centralised exchanges once fully developed.

However, many may not know that CZ already plans to capitalise on this coming shift. Hint: it all started in 2019 when Binance DEX was launched on testnet.

Of course, the project was ahead of its time, and the technology available then couldn’t fully support the vision. Despite this setback, Binance's determination to embrace DeFi remains strong.

The early signs of this transition are already emerging. Binance Labs, the venture arm of Binance, reportedly managing assets worth $7.5B, has been actively making significant strides in the DeFi space through strategic investments.

Binance Labs already owns a stake in the decentralised exchange Pancakeswap, the DeFi lending protocol Radiant Capital, the perpetuals exchange Woo Network, and the DEX aggregator 1inch, among others.

And now, the introduction of opBNB, which we discussed earlier this year, has significantly enhanced scalability.

A dark cloud looms large 🌩️

Binance launched BUSD in 2019 to compete against Circle and Tether, which resulted in a peak market capitalisation of over $20 billion for BUSD.

However, in February 2023, Paxos, the stablecoin issuer, ended its partnership with Binance at the request of the New York Department of Financial Services (NYDFS). With the inability to mint new stablecoins, users started exchanging BUSD for other tokens, and the BUSD era gradually ended.

Now, Binance is searching for new stablecoin partners, but the search is taking unexpected turns.

Binance reportedly partners with two controversial stablecoin providers: TrueUSD and First Digital Labs (FDUSD). While TrueUSD is notable because of its association with the Justin Sun, Binance's recent partnership with a two-month-old First Digital (FDUSD) raises many eyebrows.

That’s not all; the announcement of the partnership coincided with the news of another report that Binance had sold all of its USDC holdings.

The collaboration between Binance and FDUSD appears hasty, given the latter's unproven track record. FDUSD's attestation is provided by Prescient Assurance, a notable cybersecurity company, but it falls short of the rigorous standards expected for auditing stablecoin reserves by a major crypto exchange.

While there's no substantial evidence indicating that these stablecoins are fraudulent or a scam – something we would not suggest – the limited information and history available raise concerns about their credibility.

So, how does all this play into the near-future outlook for BNB 👇

BNB price analysis 📊

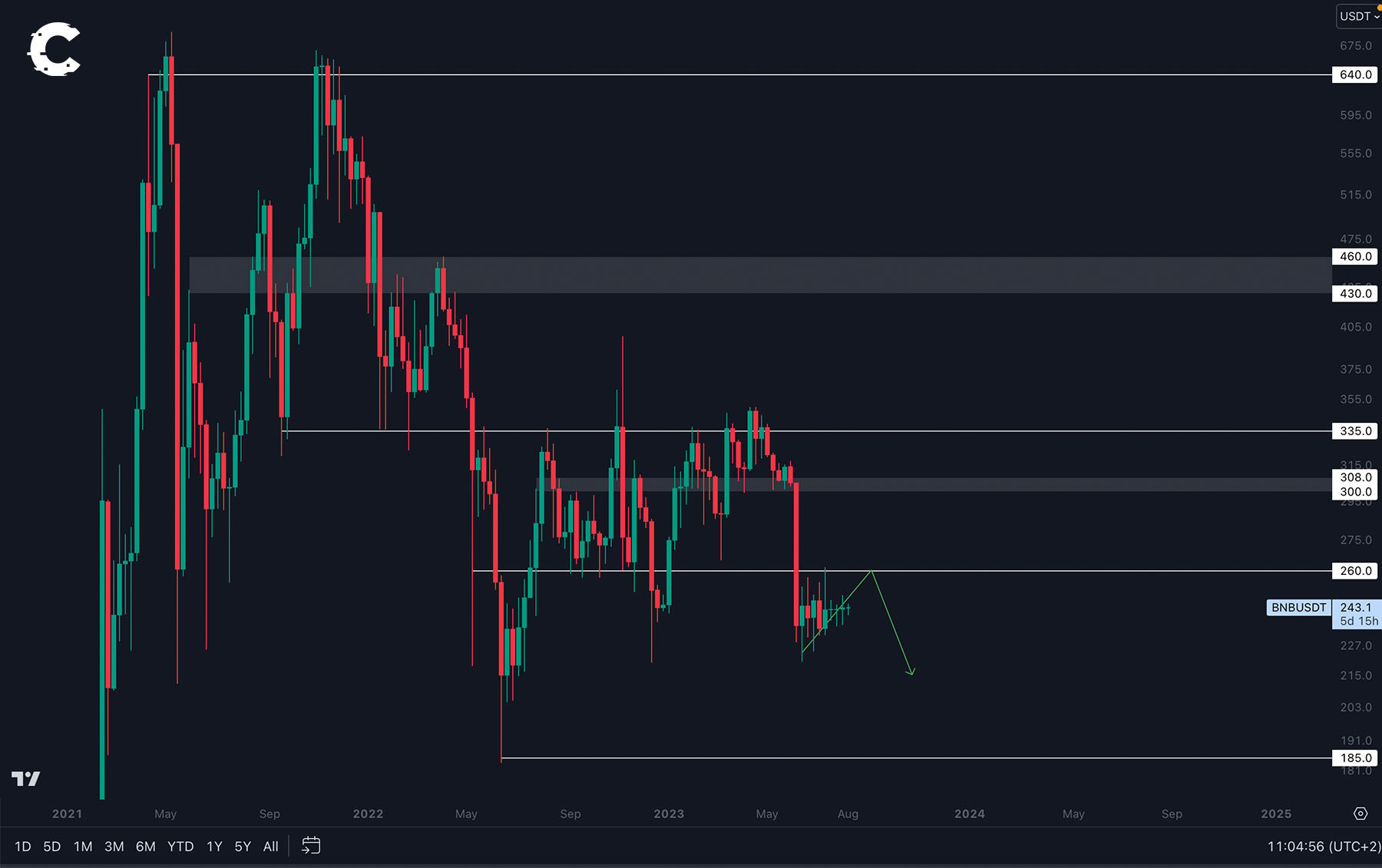

If the word boredom were to be a graph, BNB would be the perfect candidate to represent it.

The last three weeks have been flat - demand isn’t showing, and that’s a clear sign you should stay away from BNB now.

Despite the lack of demand, we could still see BNB hitting resistance at $260 in the coming weeks. The trend is already setting itself up for this level.

However, the chances of breaking past $260 are very slim, and the only catalyst for this scenario would be if Bitcoin finally started moving up.

Check this for more alpha regarding BTC and some opportunities we’ve got our eyes on.

Cryptonary’s take 🧠

Our optimism about Binance's expansion in Asia is strong, but we're mindful of its prior losses in the U.S. and EU.

What excites us the most is Binance's gradual move into DeFi, a shift we believe in and expect to unfold over time. This move holds potential implications for BNB's growth, a long-term strategy that could significantly benefit Binance.

However, the demand for BNB is moderate, with stablecoin risks and regulatory uncertainties causing hesitation.

Partnering with young stablecoin providers, rather than established ones like Tether, puzzles us due to reputation risks and what seems like an unconventional choice.

Our primary focus is closely monitoring this situation, our main concern alongside regulatory issues. As a result, it might not be the optimal time to hold onto BNB for now.

However, things might brighten over time as Binance expands further into Asia and transitions into DeFi.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms