Binance vs. the CFTC: How serious is the legal dispute?

Binance, crypto’s largest exchange, is being sued by the US Commodity Futures Trading Commission (CFTC). The regulator claims Binance violated the law by failing to implement adequate customer identification and allowing American customers to bypass restrictions on trading certain products.

In this article, we'll delve into the details of the case and explore how it will impact the crypto market, and traders and investors who use Binance.

TLDR

- Binance is being sued by the CFTC for violating a set of regulations.

- The main accusation is that Binance allowed US customers to trade derivatives without registering with the CFTC.

- Binance denies the accusations, but the CFTC has strong evidence, including private chat messages from Binance employees.

- If a settlement is reached, Binance may face fines, suspension of activity in the US, and/or possible criminal charges.

- Binance has already experienced large outflows since news of the lawsuit emerged.

What are the accusations?

The CFTC made a slew of complaints against Binance in the case. While not all are worth delving into, the main charges are the following:- Allowing US customers to bypass restrictions using VPNs (virtual private networks) and generating significant revenue from these clients.

- Evidence of manipulation and self-dealing through "house accounts" managed by Binance executives, and failure to take anti-fraud and anti-manipulation steps.

- Failing to implement proper Know Your Customer (KYC) and anti-money laundering (AML) measures.

- Not registering with the CFTC as a futures commission merchant (FCM).

- Not disclosing risks associated with trading cryptocurrency derivatives.

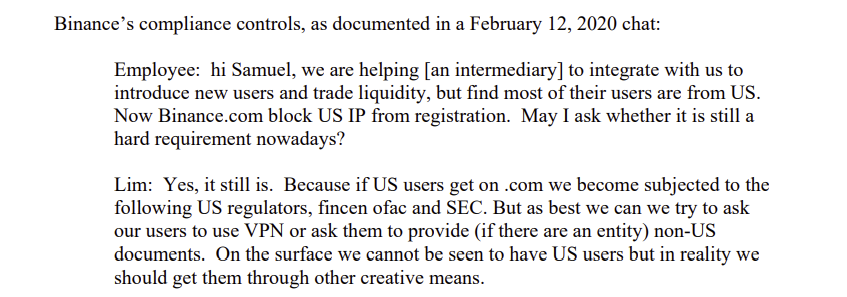

According to the CFTC, Binance's compliance officer even advised US citizens to use VPNs to hide their location when trading on the site.

The fact that the CFTC believes Binance allowed US citizens to trade on its platform gives the regulator power over the company. Even though Binance is not a registered US crypto exchange (unlike affiliate entity Binance US), US regulators are skilled at using the interconnectedness of the financial world to regulate target companies. This is how they plan to claim jurisdiction over Binance and enforce regulations on the exchange.

Another notable allegation is that Binance traded against its own customers using 300 "house accounts" belonging to Binance employees and trading entities indirectly owned by Changpeng Zhao (CZ), the company’s founder.

Finally, the accusation that Binance was financing criminal activity is also significant.

Internal communications apparently reveal that Binance officers, employees, and agents have acknowledged that the platform facilitated potentially illegal activities. In one instance, Binance's compliance officer explained to a colleague that terrorists usually transact in "small sums'' as "large sums constitute money laundering." In another, Binance's compliance officer acknowledged that certain customers from Russia were likely using the exchange to conduct criminal activity.

The potential ramifications

Binance has been quick to refute most of the allegations made by the CFTC. The exchange claims to have a large compliance team of over 750 people responsible for ensuring that AML and KYC rules are followed.However, it appears the CFTC has some rather convincing evidence up its sleeve, including those private chat messages from Binance employees. It will be an uphill battle for Binance, especially considering the weight of evidence against them.

Nevertheless, there’s one situation we can look at to get an idea of where this may go. BitMEX, the largest crypto exchange during the 2017 bull run, also had trouble with the CFTC for very similar reasons.

BitMEX settled with the CFTC by paying a $100M penalty. However, it seems that the CFTC will not be as forgiving when it comes to Binance.

In bringing the lawsuit, the CFTC mentioned that it believes Binance intentionally violated US laws to attract more customers. It viewed this as a calculated business decision where potential revenue would outweigh the eventual fine.

If the CFTC were prepared to settle, Binance would most likely not only have to pay the fine but also cease all operations in the United States, since the CFTC does not appear to be willing to let Binance off the hook that easily.

It's worth noting that there's more to the Binance situation than just the CTFC. Despite damning evidence of money laundering and sanctions evasion, no criminal charges have been brought against Binance or CZ by the US Department of Justice, the Financial Crimes Enforcement Network, or the Office of Foreign Assets Control...yet

Rumours of a criminal investigation against Binance were already swirling back in December 2022. If criminal charges were to be filed, they would have far more serious potential ramifications than the civil case.

Taking a step back

Now that we've discussed how the case could affect the exchange, let's zoom out and look at the potential broader impact on the crypto market. It seems one group will bear the brunt of it: American trading firms.The CFTC presented evidence that such entities, including a Chicago-based firm representing 12% of Binance's volume between 2019 and 2022, used Binance through a VPN for market making and trading Because of the lawsuit, the liquidity provided by these large entities may leave Binance for other exchanges. Market makers are now cautious about risking their licenses or facing legal challenges for using an international platform. Binance has already experienced large outflows since news of the lawsuit emerged.

The only positive aspect of the Binance lawsuit is that it contradicts the assertions made by Gary Gensler, the United States Securities and Exchange Commission (SEC) chair, on crypto assets. The latest CFTC lawsuit labelled cryptocurrencies such as $BTC, $ETH, and $LTC as commodities.

If the lawsuit were to go to court, it could potentially help the CFTC establish these assets as commodities, setting a legal precedent.

Three possible scenarios:

Naturally, it's difficult to predict what the result of the lawsuit will be. However, based on the information presented, we can consider three potential outcomes:Best-case: Binance settles with the CFTC, pays a fine, and agrees to operate under strict US supervision. This would allow Binance to continue its US operations while demonstrating its commitment to compliance with US regulations.

Base-case: Binance faces significant regulatory challenges and a large fine from the CFTC. Binance would be required to halt all US activities. However, the exchange is financially capable of continuing to operate outside the country.

Worst-case: Binance faces criminal charges for money laundering and sanctions evasion by US authorities, in addition to the civil charges filed by the CFTC. Binance and its executives face substantial fines and legal expenses, causing a devastating impact on the company. If key employees are found to have engaged in illegal activities, they may face criminal charges and potentially even imprisonment.

Cryptonary’s take

The CFTC has amassed a significant amount of evidence of wrongdoing by the exchange. While we do not expect Binance to win the case, the impact of the lawsuit remains uncertain.We believe the most likely outcome is that Binance will agree to pay a large fine and be forced to cease operations in the US. This would, however, allow Binance to continue operations throughout the rest of the world.

The resolution of the case could take a long time. Nevertheless, one thing is clear: in the current regulatory climate, Binance may not have a place in the US.

Action points

- Because centralised exchanges are constantly plagued by legal issues, DeFi has the chance to shine. Read our latest pro report where we break down and analyse the latest developments in the space.:https://cryptonary.com/research/banking-on-crypto-escaping-the-failing-usd-system

- Consider purchasing a hardware wallet to protect your crypto. This way, you won't have to worry about exchanges going bankrupt or facing lawsuits. You'll have full control over your assets. Check out our hardware wallet guide: https://cryptonary.com/cryptoschool/tutorial-how-to-use-a-cold-wallet-ledger-nano-x/

- This lawsuit is about more than just Binance, it’s about the classification of cryptocurrencies - which can have major ramifications.https://cryptonary.com/market-notes/the-billion-dollar-question-is-eth-a-security/

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms