TLDR 📃

- Bitcoin's rally to $30,000 halts, potentially dropping to $24,250 or even $20,000. New lows? Unlikely (sorry, bears). It's speculators' buzz causing this volatility – not cool.

- Mega-whales holding 10,000+ BTC remain calm observers, signalling confidence in Bitcoin's long-term value.

- The global economy's in a pickle. Time for alternatives to failing fiat currencies? Singapore's recent announcement legalises buying and selling Bitcoin without a license.

- Bitcoin Ordinals inscriptions smash records, but marketplace volumes? Bit of a damp squib.

- We nailed the $20,000 to $30,000 run-up – reckon we'll be spot on about this drop too?

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Bitcoin is the way 🧭

People are flooding the streets of Argentina as inflation skyrockets to a whopping 104% and poverty levels reach 40%. But it's not just Argentina – Zimbabwe, Turkey, Lebanon, and Venezuela already faced similar issues. In Venezuela, cash is discarded in the streets – it's barely worth the paper it's printed on.Rising poverty isn't due to lower productivity, but to salaries that just don't stretch far enough. The fiat currency crisis is real, and it's spreading fast.

In tough times, folks need a reliable asset. The dollar used to be the go-to, but with recent jabs from the Chinese Yuan, people are having second thoughts. Enter gold, silver, and Bitcoin – the new lifesavers. Sure, the dollar value of 1 BTC matters to investors and traders today, but there's a bigger mission at hand – protecting wealth from the crumbling fiat system.

Meanwhile, Singapore, a haven for the ultra-rich, announces it's officially legal to buy and sell Bitcoin without a license. A hint for the wealthy to ditch their fiat currencies, perhaps?

Let's dive in to the USD price of BTC and see where it's headed after the impressive $20,000 to $30,000 run – which, by the way, we totally called!

BTC price analysis 📉

What happened?

In January 2023, Bitcoin's market structure switched from bearish (lower lows and lower highs) to bullish (higher highs and higher lows), sending prices skyrocketing by a smashing +100% in just a few months. We saw it, called it, and bought it with a target at $30,000 – which we also nailed.Last week, Bitcoin broke through $30,000, turning resistance into support. If maintained, this could have spurred another rally up to $42,000. But alas, it wasn't meant to be. Bitcoin slipped back under support, forming a bearish engulfing candle – the most ominous candlestick of them all.

What’s next?

Time for a new game plan! Bitcoin could drop to $24,250, and even $20,000 if the bulls don't step up. We'll keep a close eye on the price and update you weekly. For now, $24,250 is the next stop.Just a heads up – a decline doesn't mean Bitcoin will plummet to $10,000. The bottom's already in at $15,500 post-FTX collapse. It'd take something worse than the 3AC/Celsius/FTX disaster to go lower, and if that happens, we might as well pack up and leave the industry!

Futures are f*cking this market 🤯

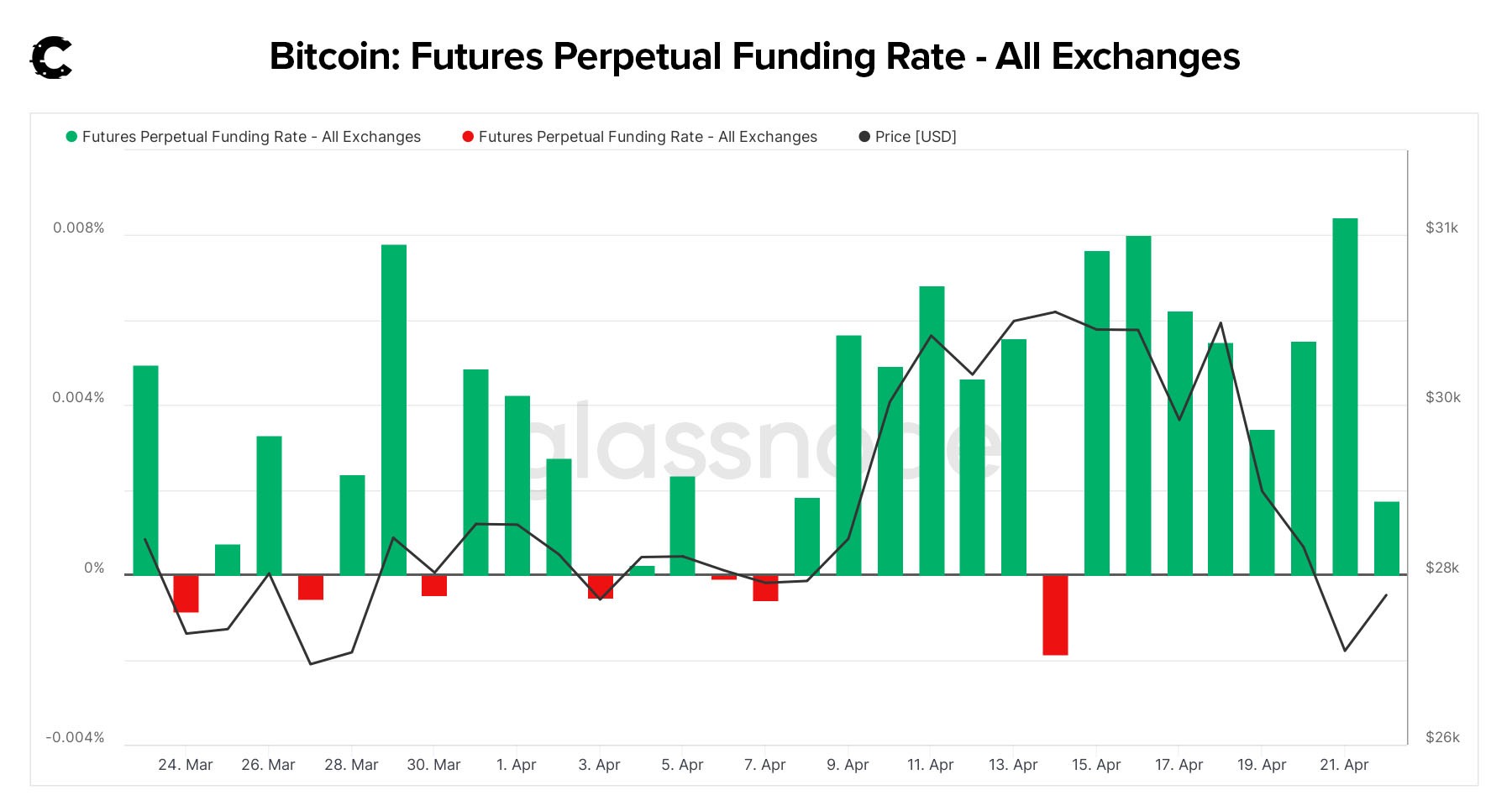

Perpetual futures, a crypto favourite among speculators, help us gauge market hype based on their behaviour. We're focusing on the funding rate today – the payments exchanged between those betting on price rises (longs) and falls (shorts) in perpetual futures contracts.

Typically, when the market dips, overconfident bulls back down, closing positions or opening shorts, causing the funding rate to decrease – sometimes even dropping below 0%, quite an anomaly. But today's funding rate remains positive despite the downturn, meaning speculators are in for a harsh reality check as the dip continues to deepen and their confidence wavers.

Enough of the dumb money, let’s look at what the smart money’s doing.

Smart money 💵

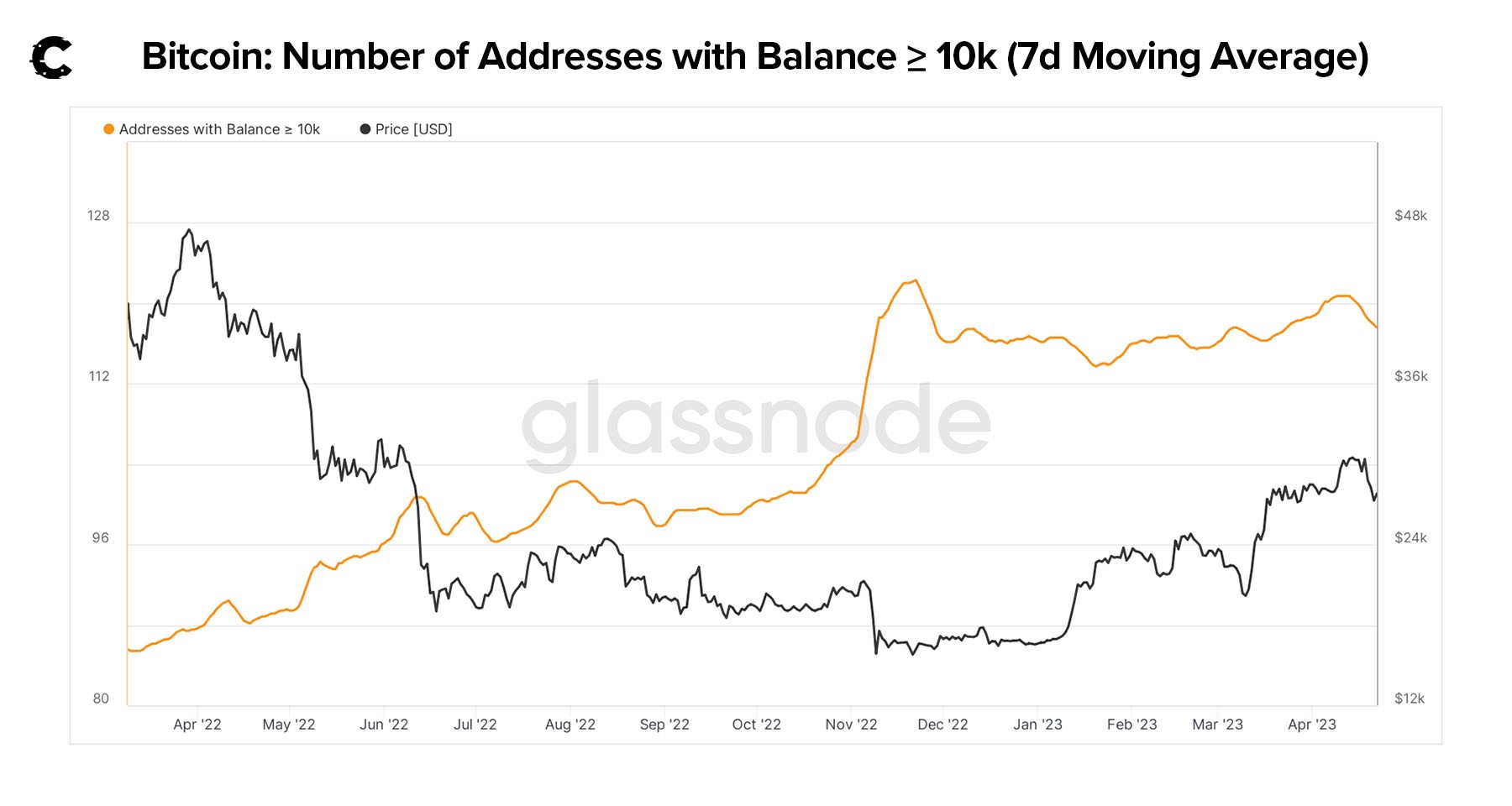

Mega-whales holding 10,000+ BTC (worth $270M+) have remained mere observers since the beginning of the year. Their ranks grew, especially around FTX's collapse, but have held steady since.

These wealthy individuals are usually quite savvy. They likely believe the bottom was set at $15,500 in November 2022. They aren't interested in trading short-term price fluctuations. They see these movements as trivial in the bigger picture.

We've discussed both the speculators' actions and the composed approach of the mega-whales – so, which camp do you belong to? Comment below!

Ordinals are the only gainers? 🖼️

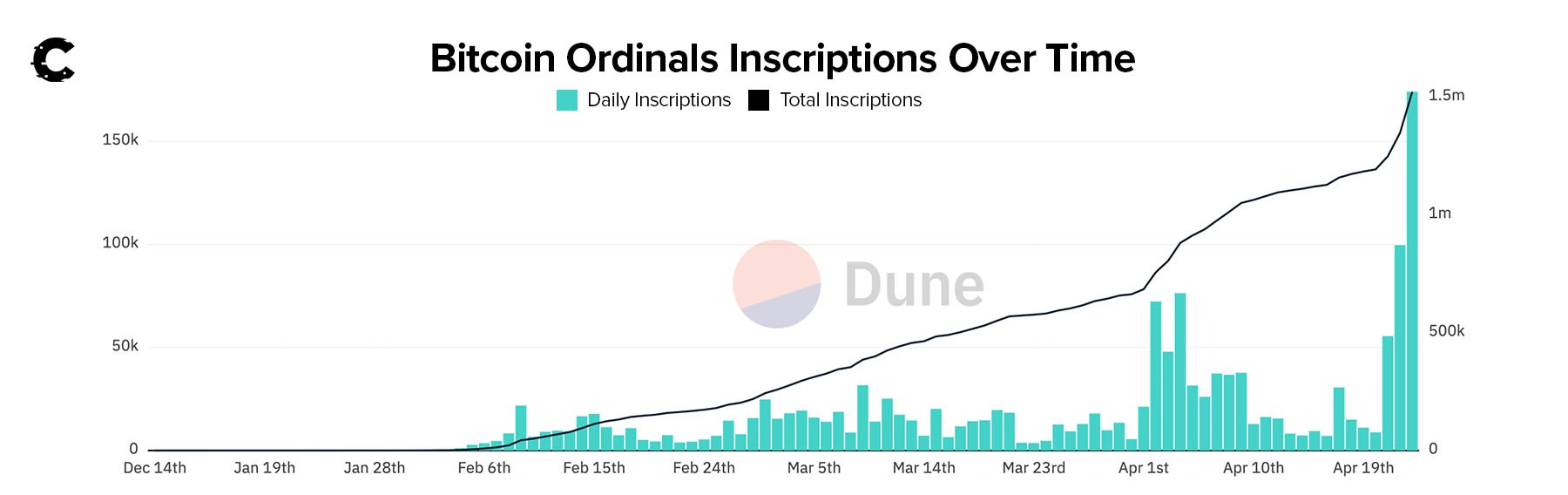

[caption id="attachment_271353" align="aligncenter" width="1800"] Bitcoin Ordinals inscriptions over time. Source: Dune.com (dgtl_assets).[/caption]

Bitcoin Ordinals inscriptions over time. Source: Dune.com (dgtl_assets).[/caption]

Let’s get into the only number reaching new highs now. 👇🏼

Ordinals inscriptions (mints) are soaring with a new daily high of over 150,000!

You’re wondering if this means Bitcoin NFTs are a fantastic investment, right? Well, even though heaps of new NFTs are being minted, marketplace volumes are pretty much lifeless. So it seems like they might not be the hot investment we'd hoped for. At least, not for now.

Cryptonary’s take 🧠

The bottom line is that Bitcoin experienced a rapid rise to $30,000 before facing potential drops to $24,250 or $20,000.Despite this, its long-term outlook remains positive as an alternative to failing fiat currencies, supported by Singapore's recent legalisation of Bitcoin transactions. Speculators contribute to short-term volatility while mega-whales stay calm, signalling confidence in Bitcoin's future.

Keep an eye on Bitcoin's progress and exercise caution in the ever-evolving crypto landscape.

As always, thank you for reading. 🙏🏼

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms Venezuelan Bolivar notes thrown in the streets.

Venezuelan Bolivar notes thrown in the streets.