TLDR 📃

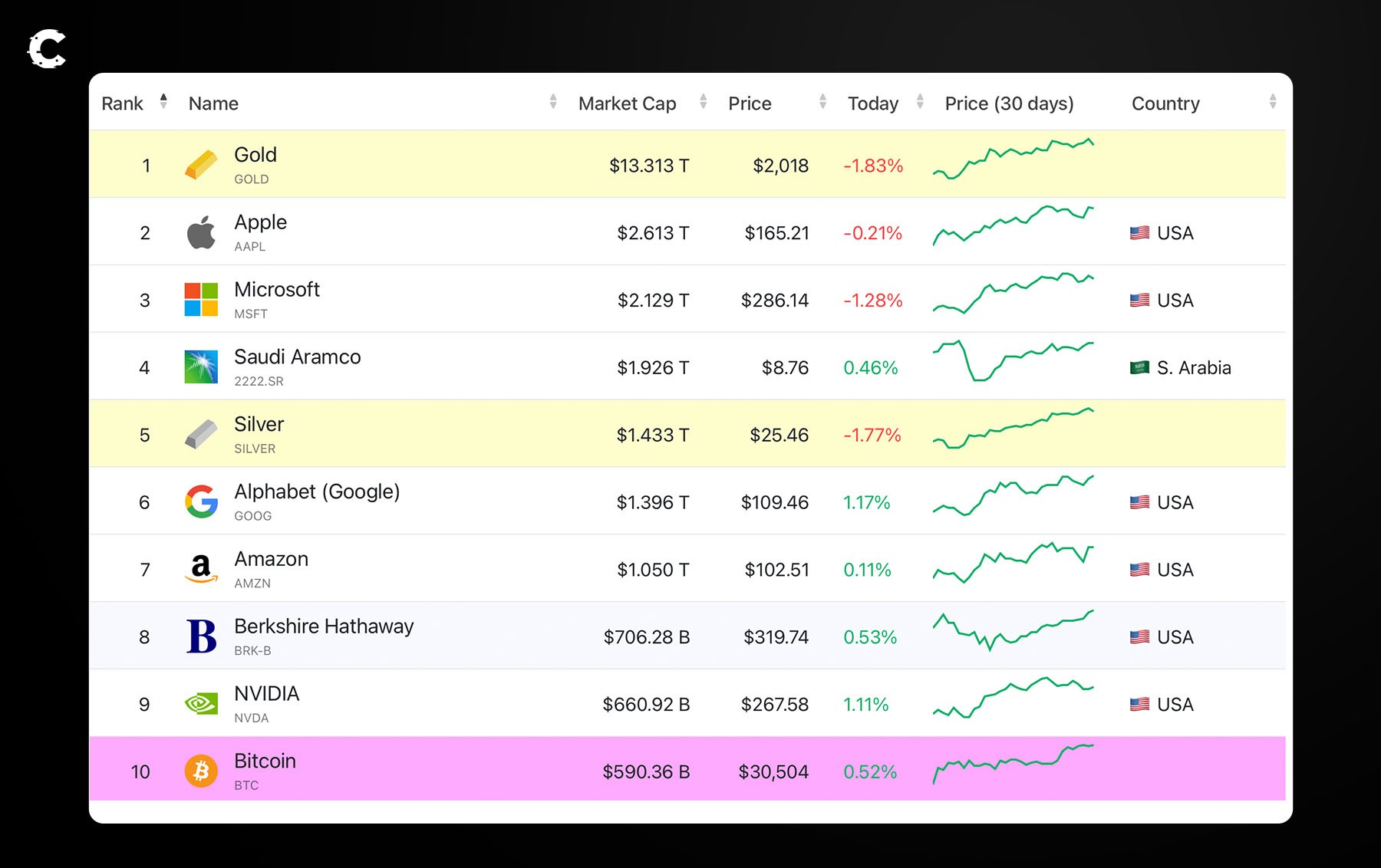

- Bitcoin market cap has edged past Tesla's, earning BTC a spot on the top 10 list of the world's largest assets.

- BTC's price has surpassed the $30,000 target. Next stop, $42,000 - as long as supports hold.

- Stats reveal “greedy” behavior among the Bitcoin faithful. Beware of a bursting price bubble if the market correction comes.

- Whales are HODLing and observing for now, but some sharks are starting to sell.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Bitcoin regains top 10 crown👑

BTC played musical chairs with the 9th and 10th positions on that list a few times in 2021 and 2022. This year, Tesla and Bitcoin have traded places several times, with their market caps dancing around the $600 billion mark.

Here's the thing – we don't think Bitcoin has even scratched the surface of its potential value. In fact, we're pretty confident that it'll find its way into the top 5 within the next decade.

Montana bill boosts Bitcoin and supports miners ⛏️

Have you heard about Montana's new crypto-friendly legislation? The state is making a big move toward embracing cryptocurrency by legally recognising digital assets like Bitcoin, stablecoins, and NFTs as personal property. This is a significant step, and the bill has already passed both the Senate and the House!It looks like Montana is joining the ranks of Texas, Arizona, and Florida in supporting the crypto revolution. The main goal of this new bill is to safeguard the rights of individuals and businesses to mine digital assets. It even prohibits unfair energy rates for crypto miners.

This change could potentially boost Montana's hash rate, which was at 0% compared to Georgia's 33% in 2022. The US is the biggest Bitcoin producer in the world. Montana's legislation shows that despite some tough talk from regulators, the US is continuing to become a bigger player in the world of Bitcoin.

“Be fearful when others are greedy”

Check out this chart—it's been tracking investor sentiment since 2018, with 0 meaning "Extreme Fear" and 100 being "Extreme Greed".

Currently, we're at 58, a number we haven't seen since 2021. The market's getting a bit greedy, which means rising prices. The current 58 rating isn’t extremely high, but it’s worth noting. High levels of greed don't usually stick around for long. Price bubbles collapse as investors realise they've pushed too far.

Market analysis 📊

Price chart

Our $30,000 price target has been met and exceeded. 🐂

Now that $30,000 has become support instead of resistance, things are looking rosy.

As long as the BTC price stays above $30,000, we're on track for $42,000. Right now, that seems likely. And as you can see below, this rally's got some legs to it, so it's looking pretty sustainable. It's only if the price drops below $30,000 that we forecast a $24,250 target.

Futures market health

Jargon alert: WTF are “funding rate” and “open interest”? Let's break it down.

- Funding rate is the payments swapped between folks betting on Bitcoin's price to go up (longs) or down (shorts) in perpetual futures contracts.

- Open interest is the total number of open futures contracts at any given time, showing how active the market is.

Today's funding rate is low, so we're not in the grip of hype just yet. Open interest's been dropping while prices are on the rise, which means traders are closing their positions – because they're betting against the rally.

But if Bitcoin keeps going up (likely), open interest will rise too as traders start jumping on the rally bandwagon. Their purchases could give the market a final boost before a correction.

TLDR: If open interest and the funding rate are high, it's a sign the trend's going to run out of steam. We're not there yet, but it looks like we're on the way. Tread carefully!

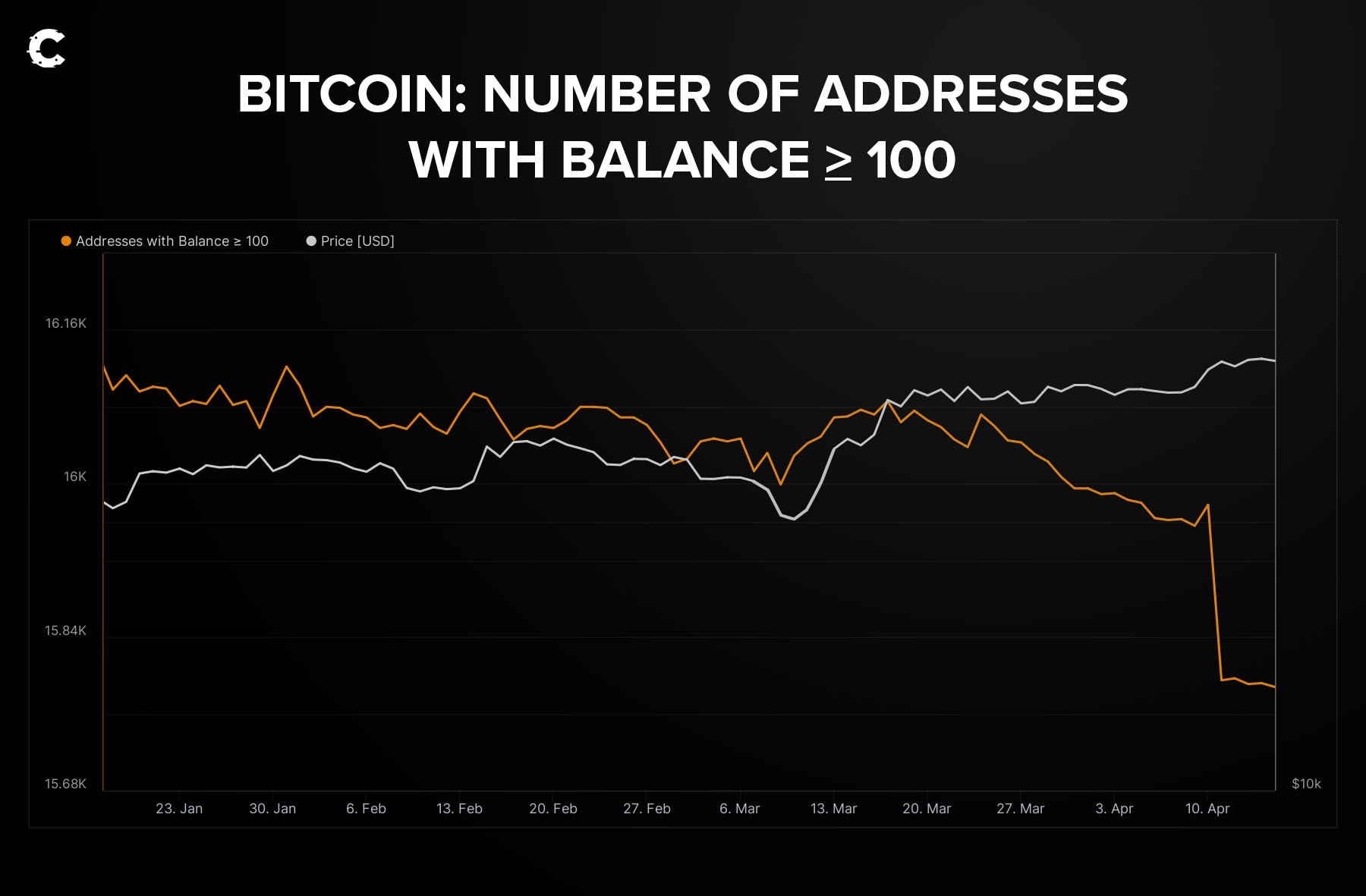

Smart money 💵

During this rally, the biggest Bitcoin whales (those holding 1,000 - 10,000 BTC) haven't budged: They're HODLing strong. There have been some sellers among the smaller whales, or "sharks" – those with at least 100 BTC in their wallets.

You can see the sell-off in the orange line. Keep in mind, that's just 190 sharks and a 1.2% price drop. So far, so good - but we need to keep watching whales and sharks because their selling (if it happens) will disrupt the rally.

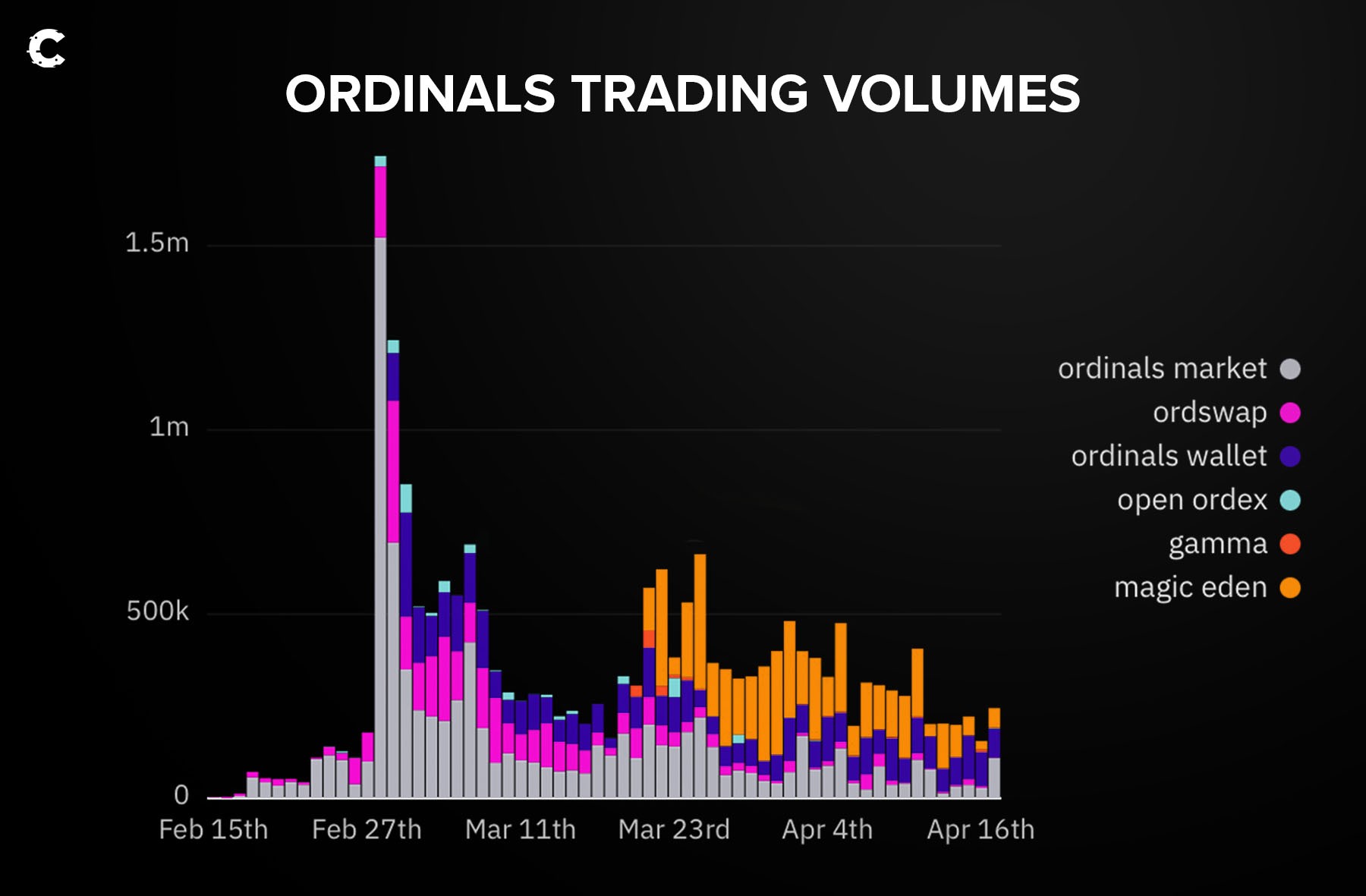

Bitcoin ordinals (NFTs) 🖼️

It looks like ordinals still aren't the talk of the town – volumes have been dropping since their peak back in February. Ethereum NFTs are seeing more than $30 million in daily volume, but ordinals can barely scratch $300k. Let's be real, Bitcoin isn't the most exciting place for NFT fans.

Speaking of which: If you're on the lookout for some really interesting opportunities in the world of Ethereum NFTs, we've got something for you to read. Check it out over here!

Cryptonary’s take 🧠

Bitcoin is making waves in the financial world lately, and it's pretty impressive to see. With all the new laws and regulations being put in place, it's essential to keep up to date with what's going on and be willing to adapt.We stand by our prediction that the next BTC price target is $42,000. But we need to watch the $30,000 support level. If prices drop below that, the rally will be over and the price could drop to $24,250. We think the support will hold and we will soon be looking at more growth and new highs.

Keep an eye on the futures market's health too. High open interest and funding rate could signal exhaustion, leading to a trend reversal. We're not in over-hype territory yet, but it's always wise to be prepared.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms