So what’s happening this week?

The US government sold 9,800 $BTC and is planning to sell another 41,500 $BTC over the next twelve months while the price is reaching the $30,000 resistance level. Is this rally coming to an end? Let’s look at the data.

TLDR

- The US government is showing a public “anti-crypto” face while their hidden actions point to another agenda.

- $BTC is inches away from $30,000. We still expect a pull-back, but this will be short-lived.

- The market will soon enter the dangerous “highly speculative” phases.

- $OFI, from the Bitcoin ecosystem, has rallied by 325%!

- Share this report with your family and friends!

Disclaimer: Not financial nor investment advice. Any capital-related decision you make are your responsibility and yours only.

US government selling BTC 🇺🇸

The US government announced their most recent sale of 9,800 $BTC (netting $215M+) from the $BTC they seized from Silk Road (website on the dark web that served as an online black market for buying and selling illegal drugs and other illicit goods using Bitcoin as payment).Earlier in March, 49,000 $BTC were transferred from one of the IRS’s addresses to Coinbase. Yes, the US government uses the very exchange one of its agencies is attacking.

#PeckShieldAlert 49k $BTC (worth $1 Billion) from wallets related to US Government law enforcement seizures have been transferred to #Coinbase (~9.8k $BTC, worth $217M), bc1qf2…fsv (30k $BTC) & bc1qe7…rdg (9k $BTC) #SilkRoad pic.twitter.com/4MzlvDzkut

— PeckShieldAlert (@PeckShieldAlert) March 8, 2023

They plan to sell another 41,500 $BTC ($1.1B+) over the next twelve months. What does this all mean? Does the US government need an extra billion? Don’t they have an infinite money printer? Here’s what we think.

Over the past few weeks, US officialdom has been on the attack against crypto. From the shutdown of a crypto-friendly bank with no proof of high systemic risk, to Coinbase being threatened by the Securities and Exchange Commission (SEC), and now the government selling seized $BTC.

Despite the recent sale, the government still holds over 200,000 $BTC, representing about 1% of the total supply. This is what’s only public knowledge; they could be holding more in undisclosed sums. For perspective, they also hold 3.9% of the world’s gold supply.

The other element is the share of the worldwide mining hash rate (computing power) that the US attracted after the Chinese ban on mining. The US has managed to increase its share of the hash rate from under 10% in 2020 to 37.8% in a mere two years; making it the largest Bitcoin producer in the world.

These “hidden” facts contradict the US government’s public actions, proving that they may have an ulterior motive of being prepared for a financial system shift that includes crypto. and simply running a “FUD” campaign against crypto to prevent large capital flows from dollars to crypto after the start of their banking crisis.

$BTC: Will $30,000 be the top? 📈

Let’s wind the clocks back to January 25, the day we published the very first Bitcoin digest. We showed you why $BTC was “primed for a major pop,” and the change in market structure from bearish to bullish was our proof. The price back then was $22,600, it has since rallied by +25%.If you were a Cryptonary Pro member and read our “9 Crypto Predictions for 2023”, you would have seen our $30,000+ prediction when price was under $17,500. 👀

That’s enough history. Where are we today?

As you can see, the price reached our first target on the chart. Does that mean $30,000 won’t be hit? Quite the contrary; take a look at how the whales removed their sell orders from $29,000, and opened the road to $30,000.

[caption id="attachment_268474" align="aligncenter" width="1824"] BTC/USD orderbook visualised on a chart[/caption]

BTC/USD orderbook visualised on a chart[/caption]

[caption id="attachment_268473" align="aligncenter" width="1783"] BTC/USD orderbook visualised on a chart[/caption]

BTC/USD orderbook visualised on a chart[/caption]

We still expect a pullback from $30,000, as per our previous digest, that can fall as steeply as $25,500. What is surprising, however, is that the state of the market is indicating that more upside is possible despite this strong rally. Let us share those points with you.

Futures market health 🚑

You’d expect a lot of reckless traders and gamblers to have entered the market after such a rally. If that were to be the case, the market would be what we call “over-leveraged” and on the brink of failure until the leverage resets in the system.[caption id="attachment_268471" align="aligncenter" width="1559"] BTC/USD with the open interest for all futures contracts presented at the bottom[/caption]

BTC/USD with the open interest for all futures contracts presented at the bottom[/caption]

[caption id="attachment_268483" align="aligncenter" width="2341"] BTC/USD with the open interest for all futures contracts presented at the bottom[/caption]

BTC/USD with the open interest for all futures contracts presented at the bottom[/caption]

Surprisingly, this is not the case. We can see this with the decrease in open interest (the total number of outstanding contracts in the market that have not yet been settled or closed) while the price increases. This divergence shows that the leverage in the system is minimal and actually decreasing.

A new bull market? 🦬

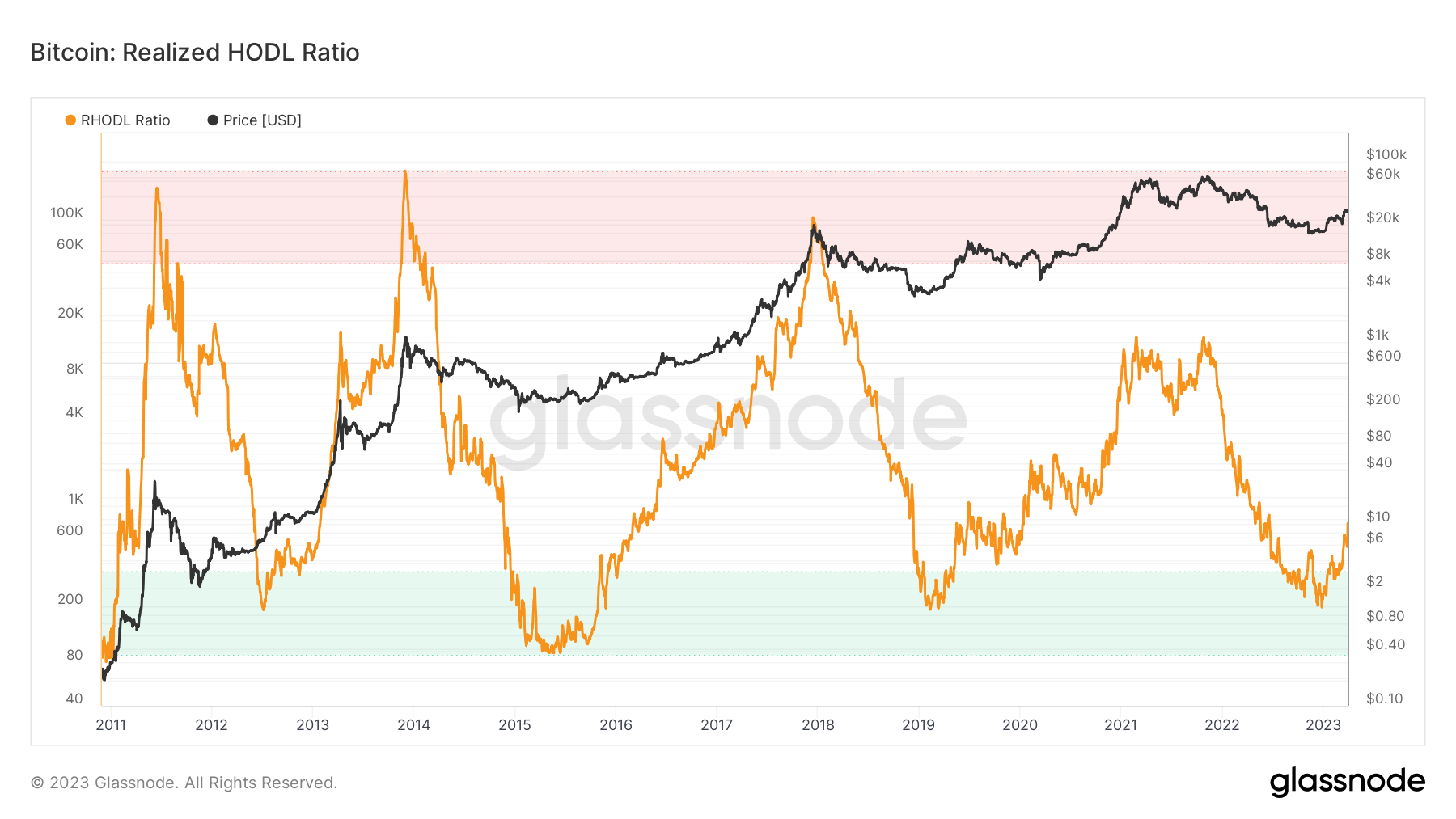

This indicator, the RHODL ratio, has correctly predicted the last three bull markets. What is it?

In simple terms, the RHODL Ratio is a score that helps us understand how people treat their $BTC. Some people like to hold onto them for a long time (HODLers), while others prefer to trade or exchange them more often.

- A low RHODL ratio means most investors are simply holding onto their coins, with little to no speculation happening in the market. This is a great time to buy.

- A high RHODL ratio means the market is overheated with too much speculation. This is a great time to sell as prices are pumped by not-so-smart money.

The Bitcoin ecosystem 🖼️

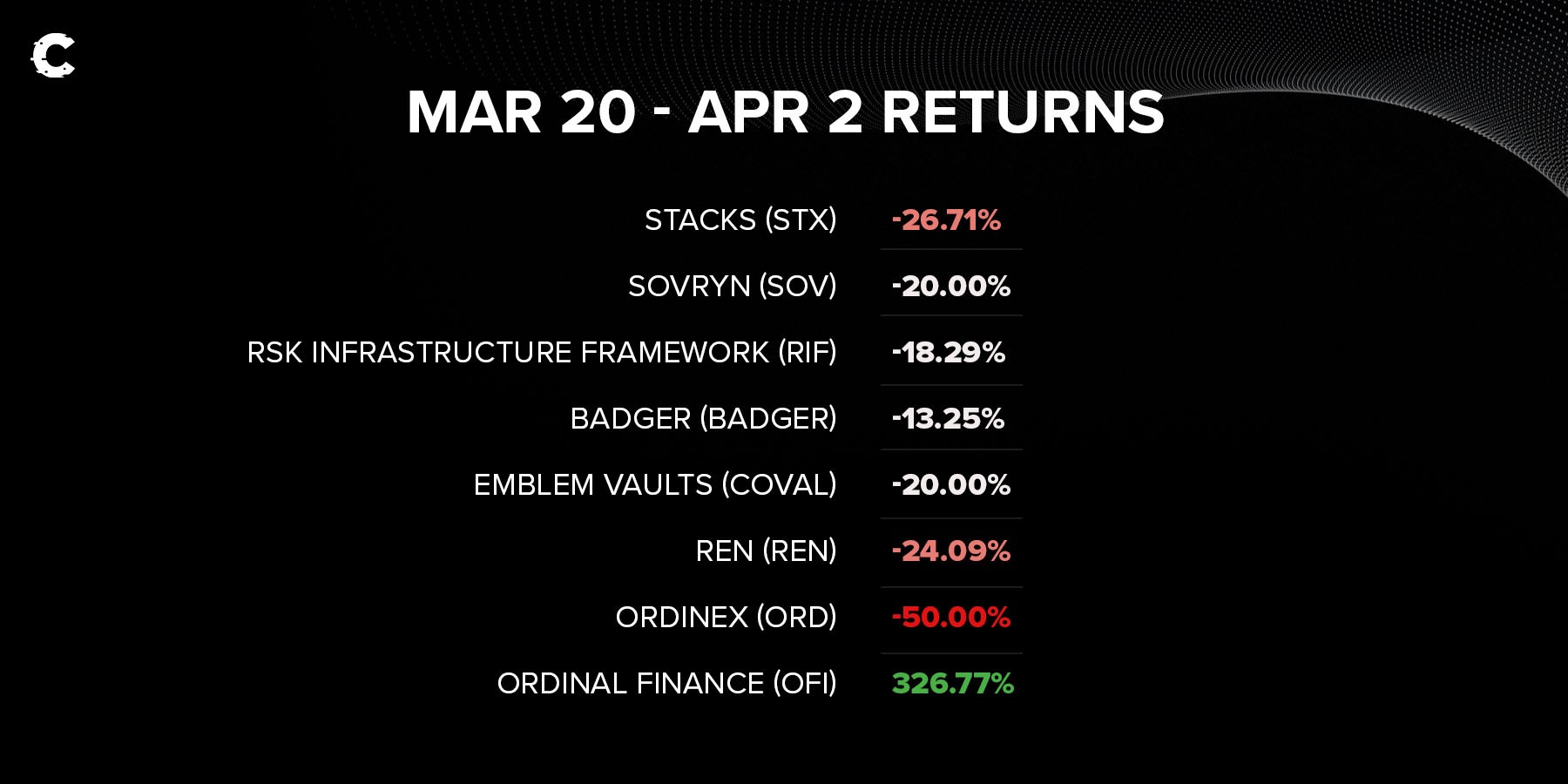

Whether it be Ordinals (NFTs) or Bitcoin-Fi, both sectors have been very dull and quiet in the last week. But there’s one exception: $OFI.

This one asset has been on an absolute tear! Its market cap increased from a mere $900K to $4M+. The reason? They ran a competition that will reward whales, incentivising people to buy as much $OFI as possible. But this is a non-sustainable path and the price of OFI will soon reflect that with a drop.

Cryptonary’s take 🎯

The market has been rising because of big investors and smart money, which is the most reliable part of any price increase. But now, things are changing as these big investors step back and wait, while smaller traders start to pop in.You can think of any positive market movement as having two parts:

- Driven by smart money: This is the beginning of any rally, with big investors buying at high volumes, and it usually lasts the longest.

- Driven by stupid money: Smaller, less experienced traders join, causing lots of ups and downs, and quick price jumps. Big investors start selling to these smaller traders. This period doesn't last as long.

Thank you for reading. 🙏🏼

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms