But in 2021, BNB Chain seized an opportunity to triumph over Ethereum, wielding cheaper fees and faster transactions like a battle-hardened warrior.

Yet, the tides turned in 2022, when Ethereum fought back with layer 2 solutions such as Arbitrum and Optimism to scale to new heights.

Undeterred, BNB Chain returns to the battlefield, armed with opBNB, a next-generation layer 2 that’s potentially faster and cheaper than both Arbitrum and Optimism.

Will BNB Chain undercut Ethereum this time around? Let's find out 👇

TLDR 📃

- BNB Chain launched opBNB, its own layer 2 solution, to compete with Arbitrum and Optimism.

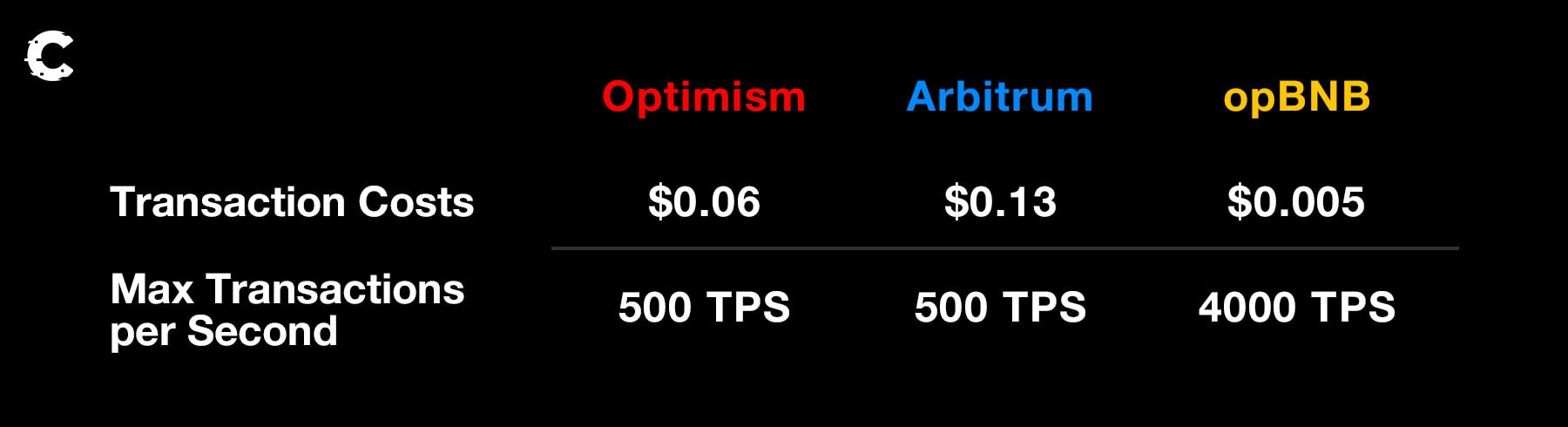

- opBNB supports over 4,000 transactions per second, with an average cost of under $0.005 each.

- Thena Finance has shown interest in launching on opBNB, taking advantage of lower fees and faster execution speed.

- BNB Chain faces challenges in competing with Ethereum due to regulatory pressure on Binance.

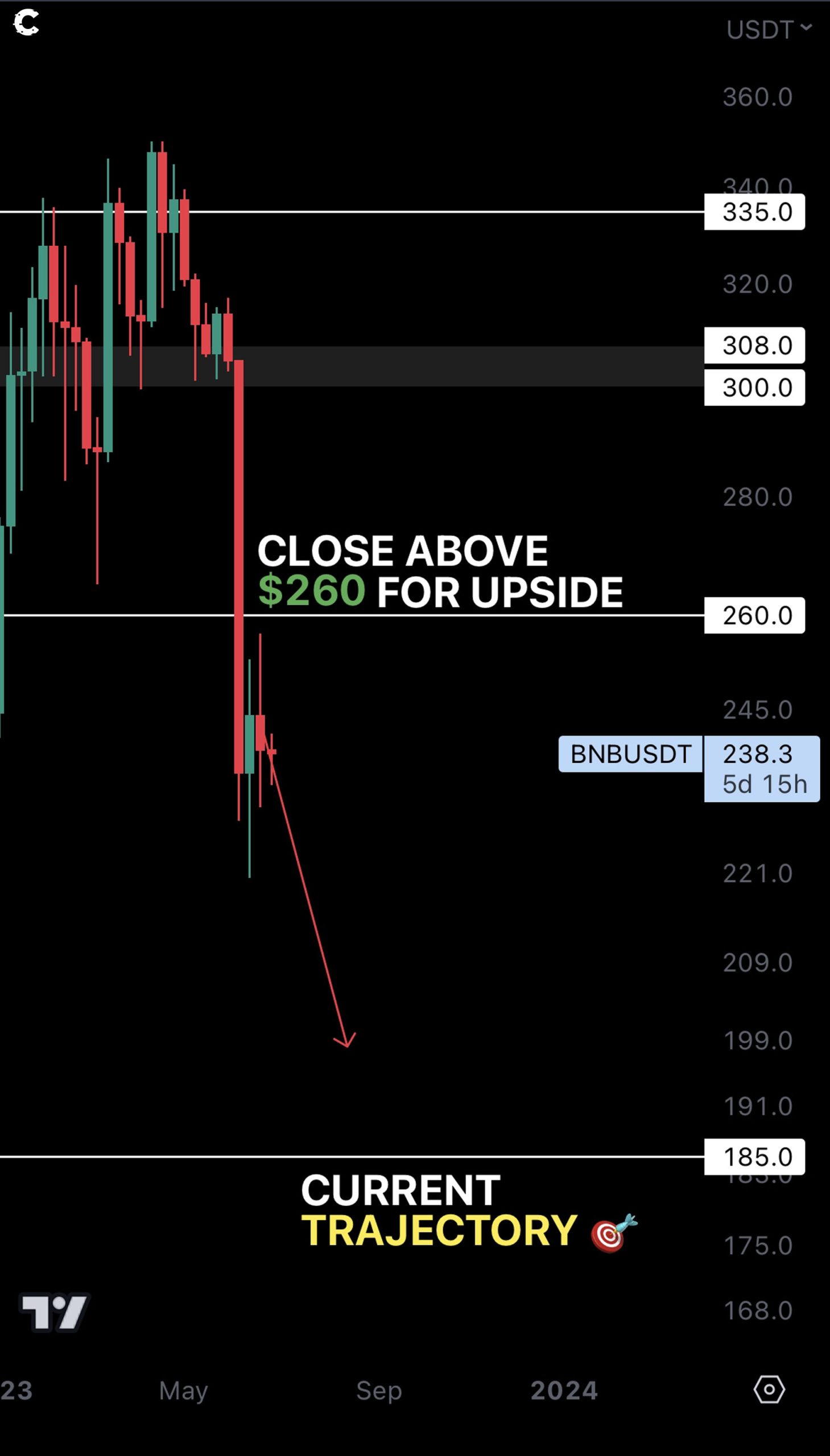

- BNB needs to reclaim $260 or risk further decline to $185, making it a risky investment.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make is your full responsibility.

What exactly does opBNB bring to the fight? 🗡

Ethereum got back in the lead with scaling solutions like Optimism and Arbitrum; we’ve covered those here and here. Well, BNB Chain, determined not to be left in the dust, unveiled its very own scaling solution: opBNB.opBNB is built on the OP Stack, and it's compatible with Ethereum and other EVM Chains, as well as popular layer 2 solutions like Arbitrum and Optimism. This compatibility makes it super easy for developers to build their applications on it.

BNB Chain already supports an impressive 2,000 transactions per second. With opBNB, it can handle over 4,000 transactions per second, all at a jaw-dropping average cost under $0.005 each. That's a steal compared to the options like Arbitrum and Optimism.

With this move, BNB Chain is effectively attempting to replicate the same winning strategy it employed against Ethereum in 2021.

With this move, BNB Chain is effectively attempting to replicate the same winning strategy it employed against Ethereum in 2021.

You can now test opBNB on the testnet to experience it firsthand. The network is anticipated to launch on the mainnet in the third quarter of this year – fingers crossed!

opBNB can strengthen DeFi on BNB Chain 💪

opBNB's entry into the arena isn't just a victory for BNB Chain alone, it's a win for Binance's entire DeFi ecosystem. By delivering faster speeds and cheaper transactions, opBNB is set to make DeFi on Binance more competitive.One DeFi protocol that truly grasped the significance of this game-changing move is the DEX, Thena Finance. Thena Finance has already dropped hints about its plans to launch on opBNB. The plan is to build a perpetual exchange to challenge renowned names like GMX and Dydx.

On the current BNB Chain, a product like that would not necessarily be competitive, but on opBNB, the fees will be much cheaper and the execution speed faster. This could be a bullish catalyst for Thena Finance.

While Thena Finance is the first project to hint at a launch on opBNB, we can expect many other projects to make the move as well. It's definitely worth keeping an eye on projects that are going to make this move.

BNB Chain vs Ethereum’s scaling solutions 🤼

The question remains whether BNB Chain can compete with Ethereum, and win. Alas, the weight of regulatory pressure on Binance adds another layer of challenge. It seems that BNB Chain is fighting battles on multiple fronts.Let us delve into the numbers, shall we?

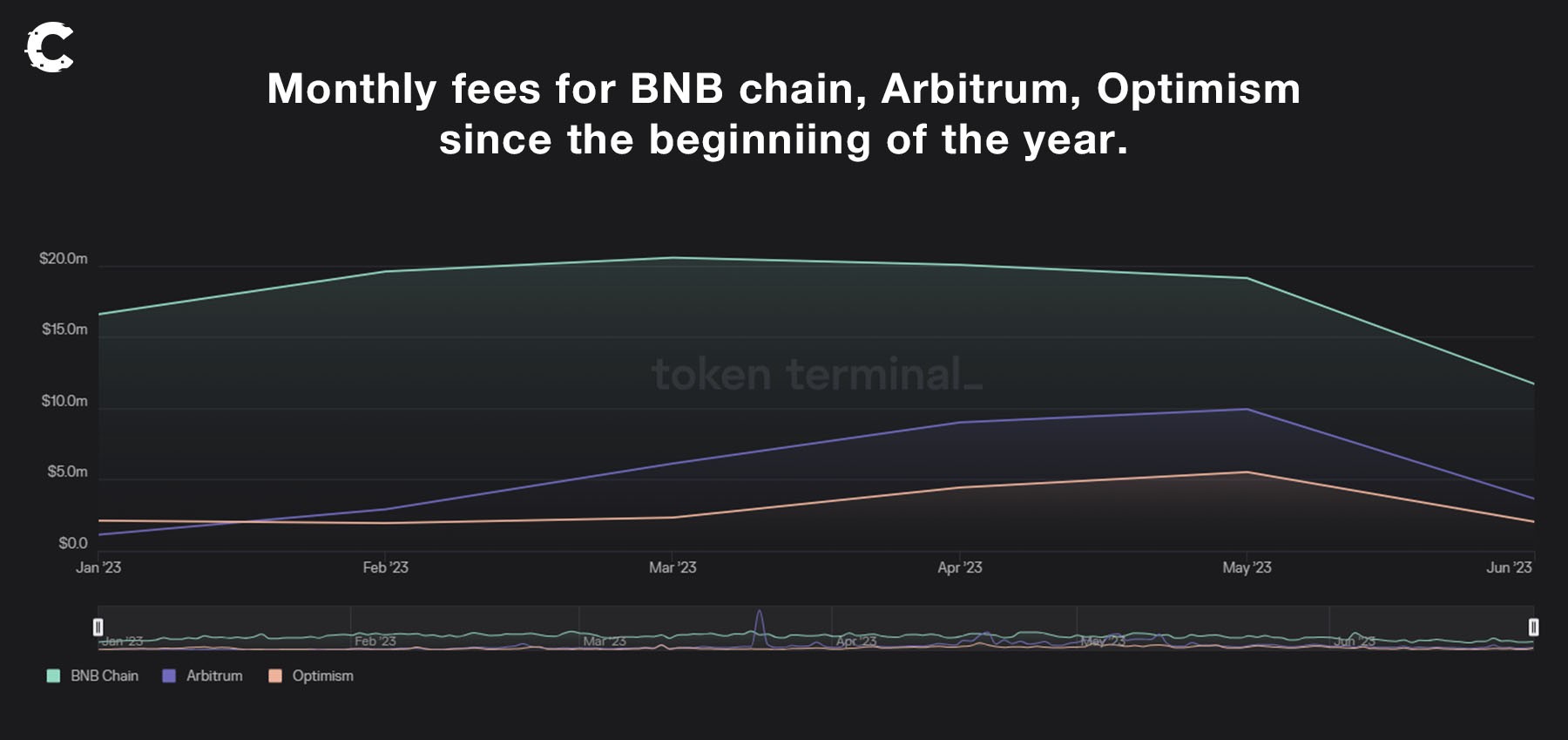

When examining BNB Chain's fees, we see a notable decline from $16.6 million to $11.7 million since the beginning of the year. In comparison, Arbitrum's fees grew from $1.1 million to $3.7 million during the same period, resulting in a narrowing gap. This trend is worrisome if it persists.

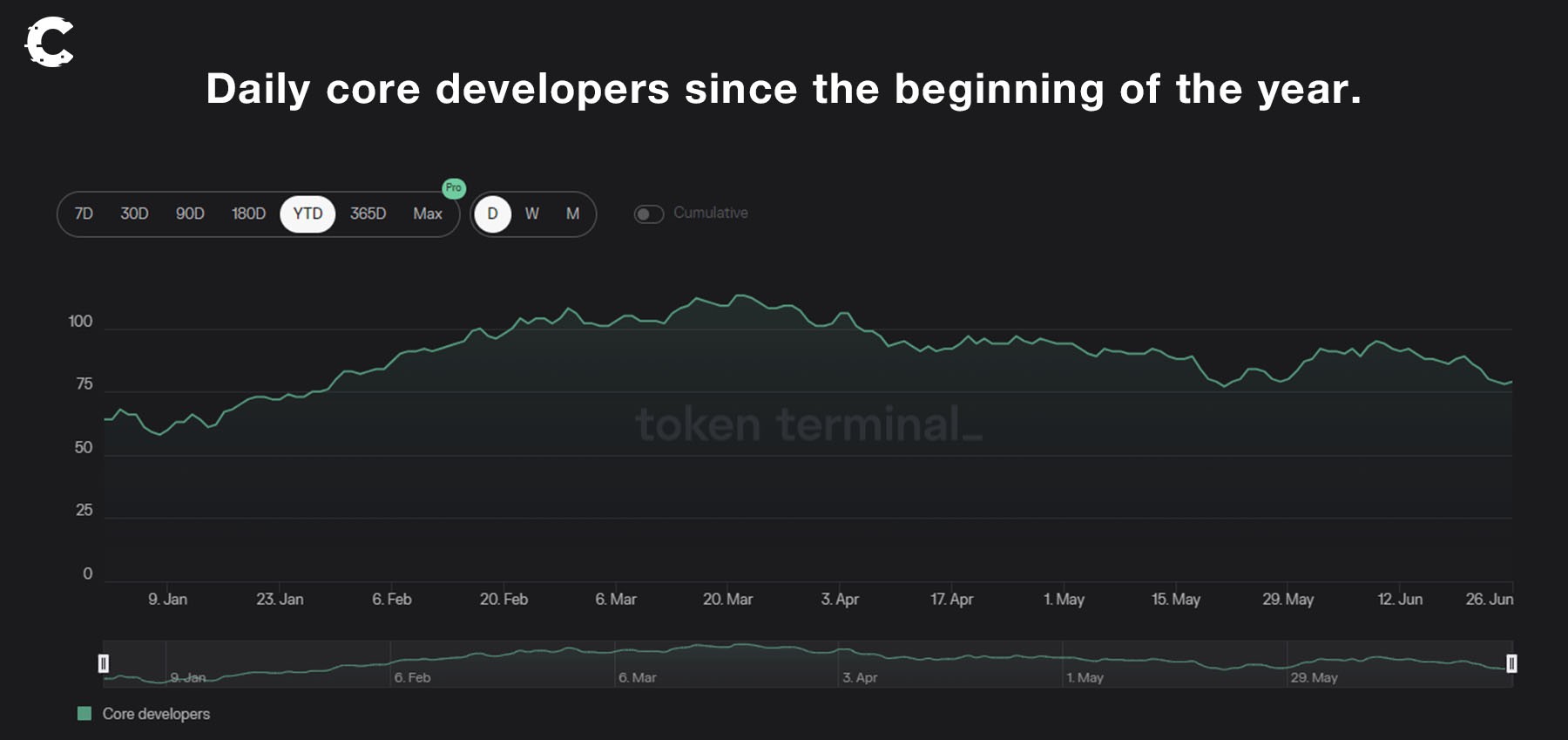

When examining core developers for BNB Chain, we see an increase from 68 to 79 year-to-date (YTD). However, developer activity declined from 109 in March to the current level due to regulatory issues faced by Binance. This trend is concerning, and it is hoped that it stabilizes instead of further declining.

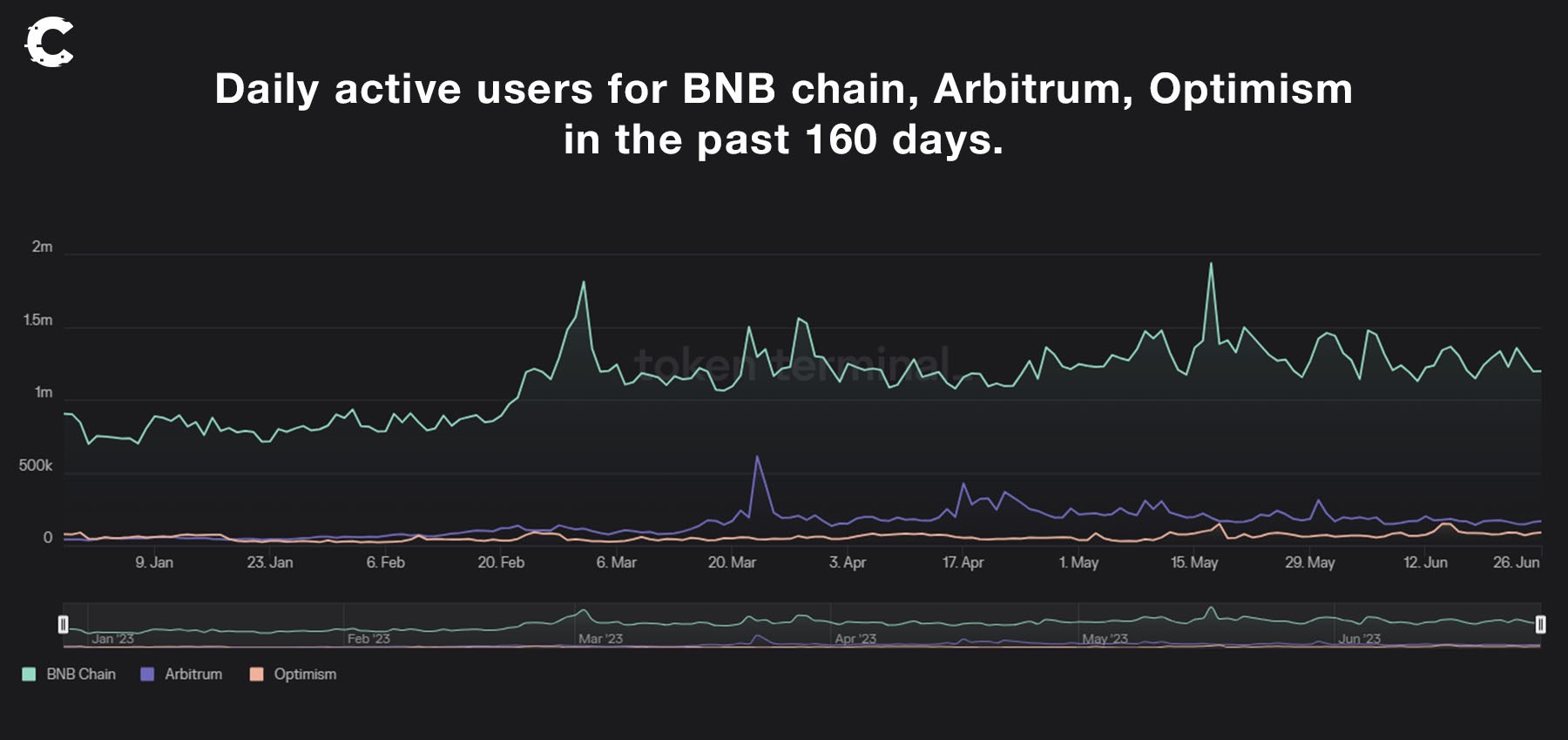

However, BNB continues to surpass its competitors in terms of daily active users, maintaining a clear lead with 1.2 million active users. In comparison, Arbitrum only manages to reach 167,000 users. This suggests that despite the regulatory uncertainty, users have not abandoned the chain.

The key to this saga lies in the upcoming arrival of opBNB.

Can this new force lend its aid to BNB Chain, mending the metrics that have suffered in the face of regulatory pressures?

The fate of BNB Chain hangs in the balance.

So what does this mean for $BNB? 📊

In a midst of a full-on market pump last week, BNB didn't perform well. We understand this is a result of its lawsuit with the SEC - the lawsuit took some of the investor trust and threw it out the window.

The deal is simple: either BNB reclaims $260 and flips it back into support, or we're on for $185.

If we had to guess, it would be hard to impossible for its price to continue rising right now given its fundamental state, and that makes it an unreliable investment - at least at this time.

Cryptonary’s take 🧠

BNB Chain appears to be employing a similar strategy to its past success, offering a comparable but more cost-effective and faster experience than competitors. This approach is expected to help BNB Chain maintain its relevance over time and provide a significant boost to its DeFi ecosystem.However, uncertainties surrounding Binance may hinder its success. While BNB Chain has the potential to provide a better experience, Binance's reputation has impacted BNB's performance.

For now, we recommend definitely trying out BNB Chain's testnet and keeping an eye on the ecosystem development there. However, we advise against investing in BNB, as our Skin In The Game report highlights other opportunities that we believe have a greater potential for growth.

May the winds of fortune guide you towards the path that leads to your desired destination.

As always, thanks for reading.🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms