BNB Digest: Binance Chain's biggest DEX slashes staking rewards

PancakeSwap's core team recently introduced a proposal to reduce the token's inflation rate from its current level of over 20% to a more modest 3-5%. This proposal sparked controversy since it would substantially reduce the amount of CAKE rewards that stakers receive.

TLDR 📃

- The PancakeSwap community is divided as CAKE inflation is reduced, causing stakers to flee in search of better yields.

- Level Finance suffered a $1M hack but is bouncing back with a strong treasury and community support.

- Newcomer Gamma Strategies sees its total value locked (TVL) soar by 74% in just two weeks.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Key developments 🔑

- Binance launches Wrapped-BETH on BNB Chain: The new asset is an upgrade to Binance ETH staking. It lets you participate in on-chain DeFi projects while still receiving compounded ETH staking rewards automatically.

- BNB Chain leads rivals in monthly active crypto addresses: According to the on-chain analytics platform Nansen, BNB Chain had the most active addresses in April, with 10.9 million.

- Binance USD stablecoin activity slides to two-year low: The decline in Binance USD activity follows receipt of a Wells notice from the US Securities and Exchange Commission in February. The regulator listed BUSD as an unregistered security.

Stakers abandon PancakeSwap due to inflation reduction proposal

Ultimately, the proposal passed with a 57% approval rate.

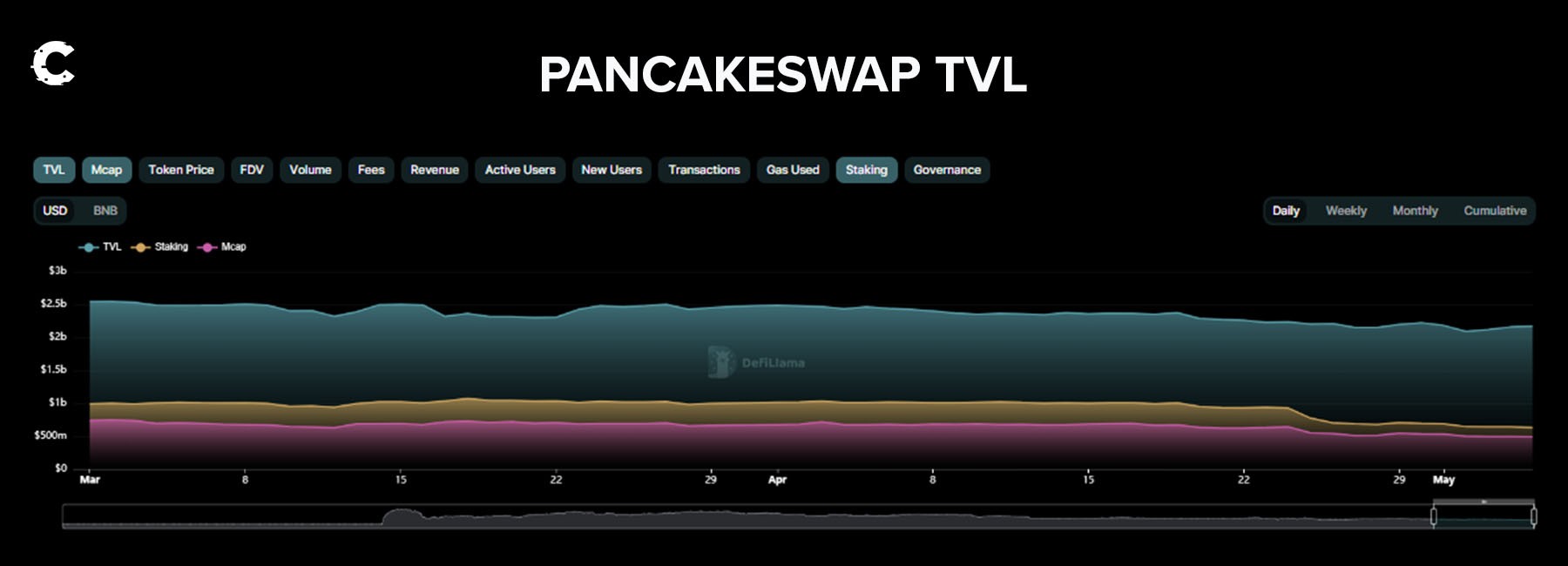

During the debate, the TVL didn't change much. But there was a big drop in staked CAKE (and its price) after the new policy was announced.

It looks like stakers took action and decided to vote with their money, causing the price of CAKE to drop by 25.3% in just two weeks. The total value of staked CAKE decreased from $702M to $631M.

Why Is PancakeSwap reducing its inflation rate anyway?

For some time now, emission rates have been a cause for concern among members of the PancakeSwap community. They argued that the high inflation rate was unsustainable because it relied on a constant flow of new money. And it didn’t benefit long-term CAKE holders.

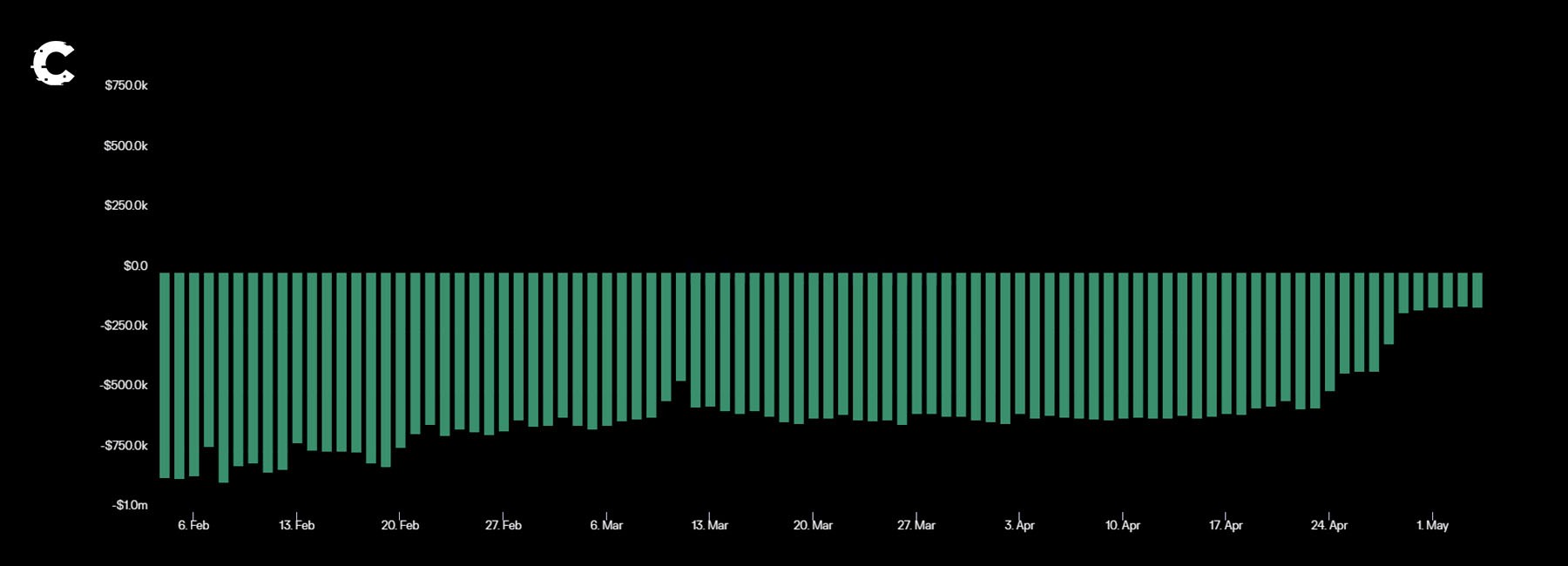

Those concerns are completely valid, especially when considering PancakeSwap's status as the largest DEX on the BNB Chain. In fact, earnings for the platform have been extremely negative over the last 90 days.

Although the proposal passed with a majority of 57%, 34% of Cake holders voted against it. This indicates that there are users who don't agree with PancakeSwap's strategy and might be lured away by other decentralised exchanges like Thena Finance.

Pancake’s move could open up opportunities for new DEXs to appeal to disgruntled stakers.

Can Level Finance bounce back from $1M hack?

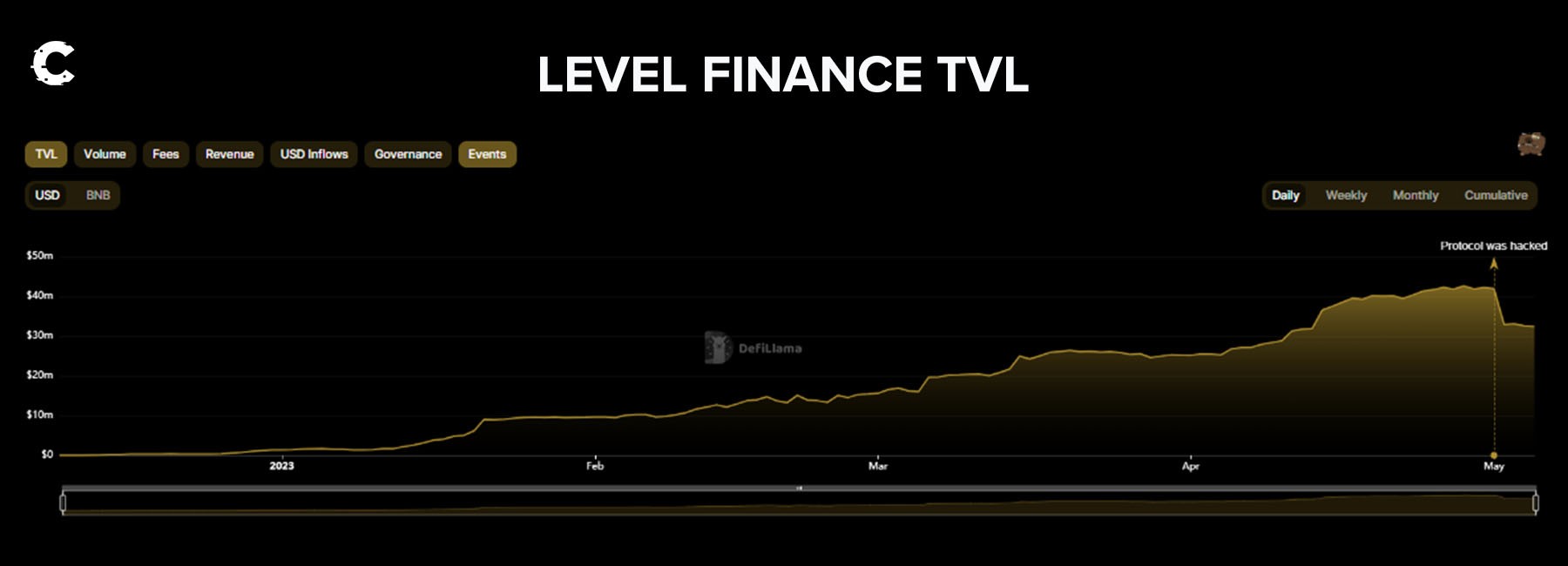

Level Finance, the most popular decentralised perpetual exchange on BNB Chain, has experienced a security breach that resulted in a loss of approximately $1 million. The incident was caused by a buggy smart contract that let a hacker drain 214,000 Level Finance tokens from the exchange.

An exploit targeted our Referral Controller Contract.

- 214k LVL tokens drained to exploiters address. - Attacker swapped LVL to 3,345 BNB - Exploit was isolated from other contracts. - Fix to be deployed in 12 Hrs. - LP's and DAO treasury UNAFFECTED.More details to follow.

— LEVEL Finance #RealYield (@Level__Finance) May 1, 2023

The hack resulted in a sudden increase in selling pressure and panic among investors. LVL’s price plummeted from $8.48 to $2. Buyers quickly stepped in to take advantage of the low prices, but the token is now trading at about $6.5, a 22% decline from its previous value.

TVL, which had been on a significant uptrend for the last few months, declined from $41.9M to $32.4M.

The impact of a hack can be severe, especially if the amount exceeds the project's ability to refund affected users or wipes out the project's treasury. A hack can also damage a project’s reputation, leading to a loss of trust.

Level Finance has a healthy treasury – $8,590,406 in liquid assets, which is plenty to allow the project to continue. The DAO has also proposed several paths to minimise the impact on token holders and the Level community.

The good news is that the hack was confined to one smart contract, so damage was limited.

While the situation appears manageable, keep a close eye on the platform's usage in coming months to determine whether users have lost trust or if it can continue to grow.

BNB price action 💵

BNB remains stuck inside a range: $260 to $335. There have been multiple attempts at breaking above $335 in recent weeks, but none were successful.

That puts BNB on track for its nearest support inside the $310 - $300 region. When paired with current market conditions (BTC at resistance for longer periods), we believe this is the likely outcome for BNB.

An invalidation for this scenario occurs when a weekly candle closes above $335. This will open the door for $430.

BNB’s ecosystem🌎

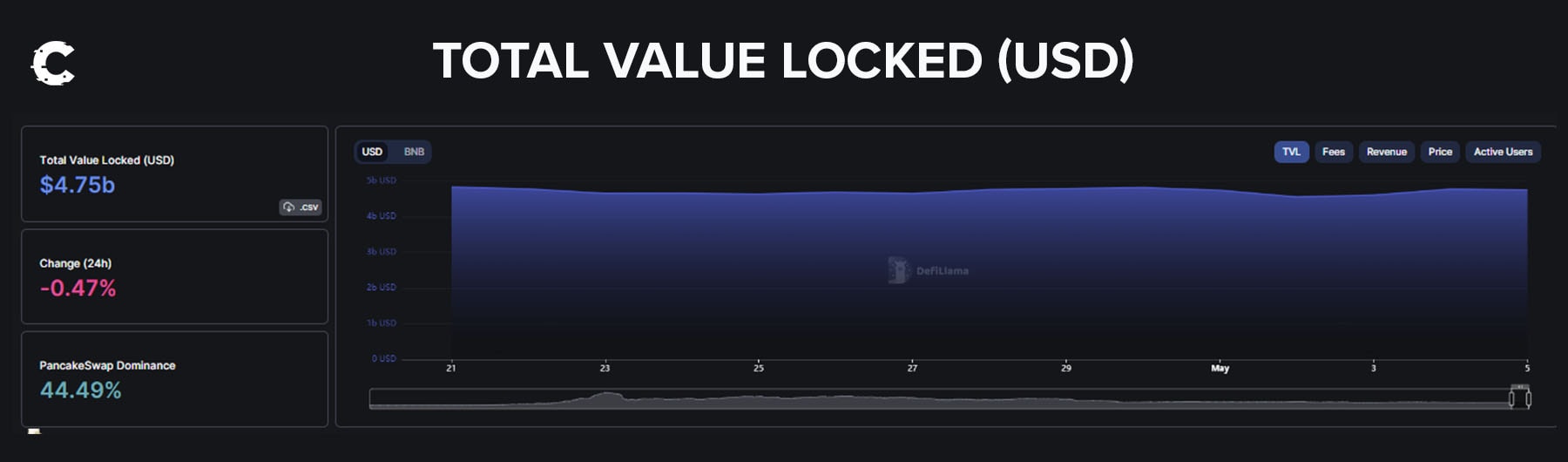

TVL on the BNB Chain has been relatively stable lately. While this suggests that there hasn't been a lot of money coming in, it's not a red flag.It's important to examine where the TVL is flowing. Some protocols may lose TVL while others grow. It's worth keeping an eye on individual protocol performance.

Largest TVL growth:

- Gamma Strategies: If you haven't heard of Gamma Strategies, you might want to pay attention. This asset management protocol recently debuted on the BNB Chain, and it's already causing a stir. Within just two weeks, its TVL has surged by 74%, jumping from $20M to $34.8M. That's an impressive feat in such a short time.

- Radiant Capital: Looking for a promising lending protocol on the BNB Chain? Check out Radiant Capital, which has been expanding rapidly. In just two weeks, its TVL increased by an impressive 45%, growing from $70M to $102M. Keep an eye on this one!

Cryptonary’s take 🧠

Things have been pretty wild in BNB Chain’s DeFi ecosystem lately.We're on board with the idea of reducing emissions as a way for PancakeSwap to clean up its tokenomics, but the fact that such a big chunk of the community was against the proposal suggests that we could see some folks move away from staking in search of better yields elsewhere. Who can blame them? If your yield gets cut by more than 50%, it's natural to look for greener pastures

We think Level Finance can weather the storm. They've got a solid treasury and plenty of community support.

BNB’s price is stuck between $335 and $260, and that's not exactly exciting news for traders. It would be ideal if it could dip into the $310-$300 support range or even break through the $335 resistance level. Unfortunately, it's currently stuck in a dull zone, leaving traders waiting for a definitive move.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms