BNB Digest: What is BNB Greenfield and why is it important?

The clever folks at Binance knew we needed a new way to store data, one that ditched central servers. Enter BNB Greenfield, now live on testnet.

TLDR 📃

- BNB Greenfield, a decentralised data storage solution, is now live on testnet! Users pay for storage services with BNB tokens, increasing BNB utility.

- Radiant Capital is the fastest-growing DeFi protocol on BNB Chain with nearly $100M TVL.

- BNB must turn $335 into weekly support to unlock more growth.

- Binance Labs announces 12 finalists for the MVB Program, while PancakeSwap proposes a deflationary model for CAKE tokenomics.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Key developments 🔑

- BNB Beacon Chain to undergo scheduled upgrade: Binance's got it planned. At block height 310,182,000, they'll enhance security for the bridge between BNB Beacon Chain and BNB Smart Chain. Cool, huh?

- Validators vote to slash gas fees by 40% on BNB Chain: The reason? Those budget-friendly Ethereum layer 2 networks are turning up the heat on the competition!

- Binance completes 23rd quarterly burn: The latest record-breaker, Binance's largest burn ever, torching over 2 million BNB—valued at a staggering $670 million.

What's all the fuss about BNB Greenfield?

So, what's the deal with Greenfield? You pay storage providers in BNB tokens to store your digital data. You pick the provider based on reputation, price, or any criteria that floats your boat. Your data gets split into smaller bits and stored off-chain.

You're in control: set permissions, payment methods, and access your data via APIs. It's like crypto for data—you decide who gets their hands on it!

The cherry on top? BNB is used for payments, giving it a nice price boost.

Here's what you can do with Greenfield:

- Web Hosting: Pick any storage provider and host a censorship-resistant site that anyone can access.

- Data Swapping: Let dApps on BNB Chain swap data using Greenfield as the go-to data layer—no more messy on-chain data.

- File Sharing: Share files securely and decentralised. So many possibilities!

Why's BNB Greenfield a game-changer?

- More control: Decide who accesses, uses, and profits from your data.

- Censorship-resistant: Even without full on-chain storage, it's better than centralized cloud providers.

- Extra utility: Want to use Greenfield? You need BNB!

The fastest-growing BNB Chain DeFi

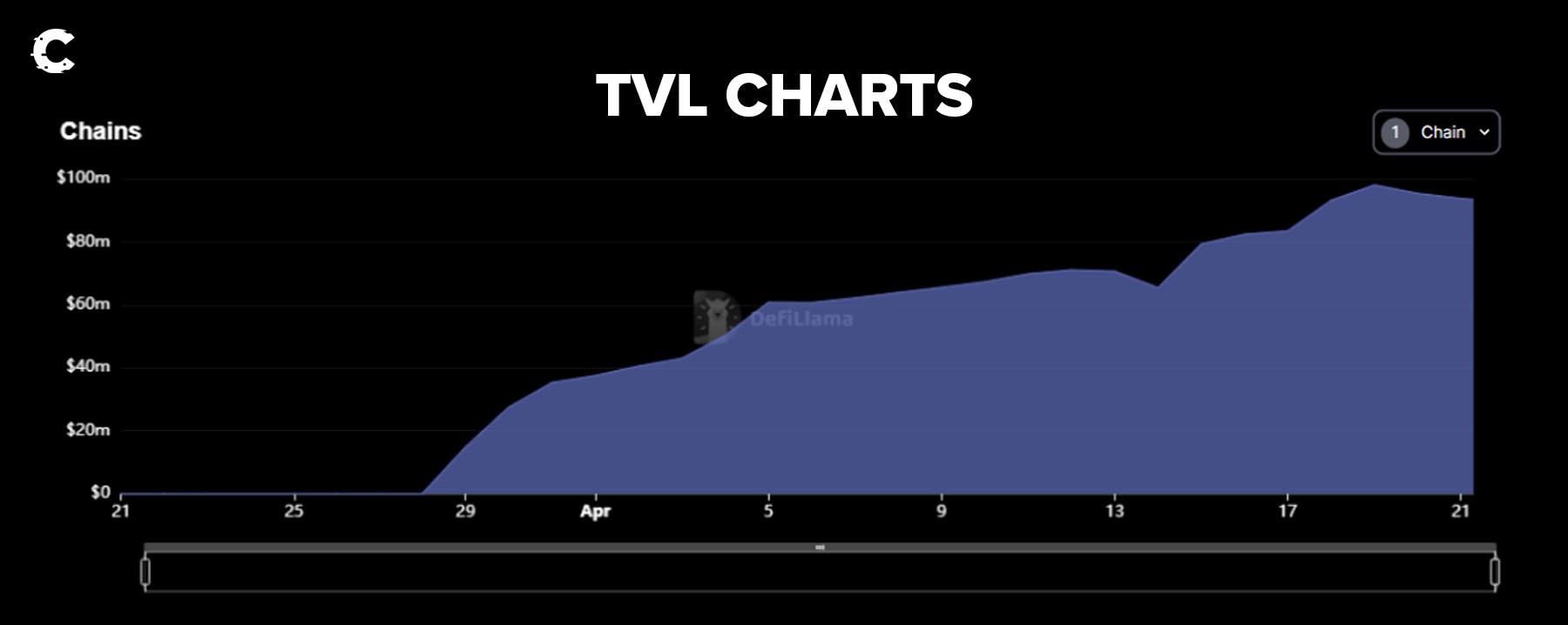

In our last digest, we mentioned Radiant Capital as a fast-growing DeFi protocol on BNB Chain. One week later, they're still killing it!

Since launching on March 28, Radiant has racked up nearly $100 million in total value locked (TVL)—talk about explosive growth!

Here's the secret sauce:

Radiant lets users deposit major assets from any big chain and borrow supported assets across multiple chains, thanks to LayerZero tech. Lenders earn interest, while borrowers get liquidity without selling assets or closing positions. Neat, right?

Their rapid growth secret? Smart moves. Before BNB Chain, they deployed on Arbitrum and used their native token, RDNT, to lure users. It paid off, but they had to sacrifice some revenue by giving out tokens.

Despite a rocky V1 launch, Radiant's V2 fixed issues like unsustainable emissions, insufficient runway, and low on-chain liquidity incentives. Earnings soared, and investor confidence grew.

Expanding to BNB Chain for the V2 launch was another genius move. Major competitor Aave hasn't arrived there yet, and Venus Protocol, the biggest lending protocol on BNB Chain, faces community concerns.

So, what's next for Radiant? They're eyeing other blockchains and adding more lending and borrowing tokens. Plus, a V3 upgrade will boost cross-chain interoperability with tighter LayerZero integration. Details are scarce, but we're all ears!

BNB’s price action 💵

So, BNB finally broke above $335 recently, but.. it didn't last long and now it's back below it again.

For things to really get going, BNB needs to turn that $335 mark into solid support on the weekly timeframe. If that happens, we'll be looking at a price jump to $430. But if it doesn't, well, BNB will keep sliding down towards the $310 - $300 zone in the next few weeks.

BNB’s ecosystem 🌎

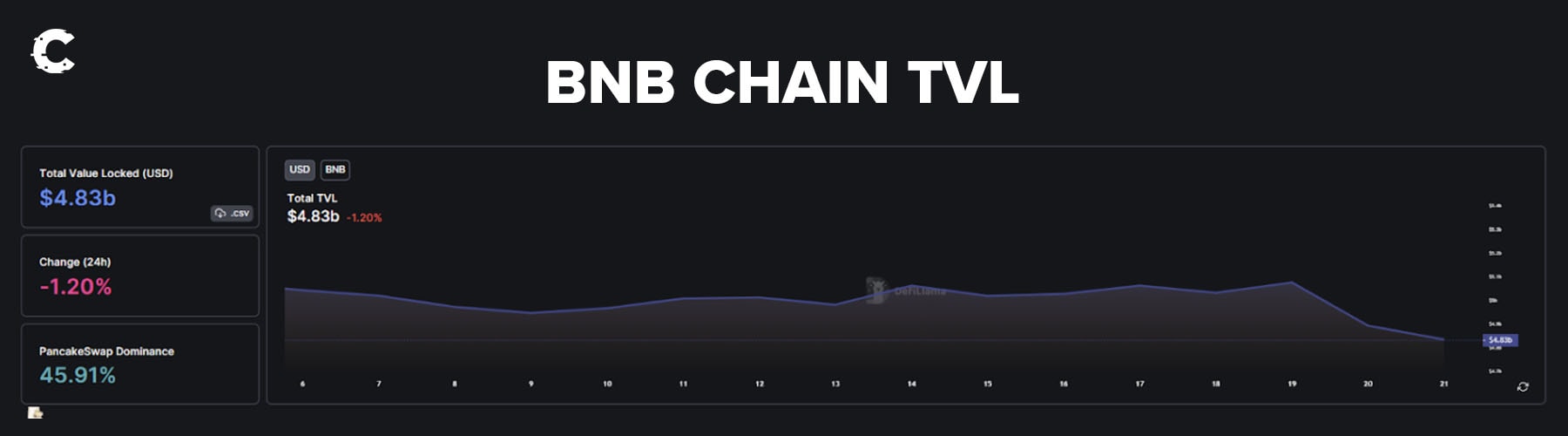

So, the recent dip in BTC led to a drop in most asset prices, including the TVL on BNB Chain. It fell from $5.04B on April 6th to $4.83B, which is a 4% decline.

But hey, let's talk about two TVL growth champs:

- Radiant Capital:This BNB Chain superstar has seen its TVL skyrocket from $60 million on April 6th to $93 million on April 21st. Even though it launched just a month ago, it's already the second-largest lending protocol on the chain.

- Level Finance: This decentralised, non-custodial perpetual DEX has shown an impressive product-market fit. In just over two weeks, between April 6th and April 21st, its TVL shot up by 39% from $27M to $39.8M. Not too shabby, right?

Other news 📰

- Binance Labs Announces 12 Finalists for MVB Program

- PancakeSwap proposes a deflationary model for CAKE tokenomics

- Venus Protocol proposes delving into Real-World Assets

Cryptonary’s take 🧠

BNB Chain is doing a great job sticking to its 2023 tech roadmap. They've already launched the BNB Greenfield testnet, and they've cleverly reduced gas fees by 40% to compete with the likes of Arbitrum and Optimism.Now, BNB is at a crucial point, and it's important to avoid further ranging. If it manages to turn $335 into support on the weekly timeframe, we could see some sweet gains. However, if it doesn't, prices will slide down.

As for DeFi on BNB Chain, TVL growth has been a bit sluggish overall. But, there are two standout performers: Radiant Capital and Level Finance. These two have nailed their product-market fit on the blockchain and are consistently growing their TVL at a rapid pace.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms