- What, another one?! America’s 14th-largest bank is collapsing - and yes, that strengthens BTC’s case.

- Balance on exchanges and overall profit-taking are on the rise. Are these bear footprints we see?

- BTC’s price is headed to $24,250 unless bulls step in and reclaim $30,000.

- Ordinals (BTC NFTs) numbers look great but they’re fishy - and we can tell you why.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Financial fumble 💱

It's actually a sh*t stock, not a sh*tcoin. You're looking at the stock price of First Republic Bank of San Francisco, California. With over $200B in assets, it’s the 14th-largest bank in the US. Crazy, right?

In the past two months we've seen the collapse of Credit Suisse, Silicon Valley Bank, Signature Bank, Silvergate Bank, and now First Republic.

The case for Bitcoin has never been clearer. If you don’t own some BTC then you’re shooting yourself in the foot. Just saying.

Now, just because things are looking bright in the medium- to long-term, that doesn’t mean the short term is all cherry cola and bubblegum. Let’s explore some metrics.

Balance on exchanges ⚖️

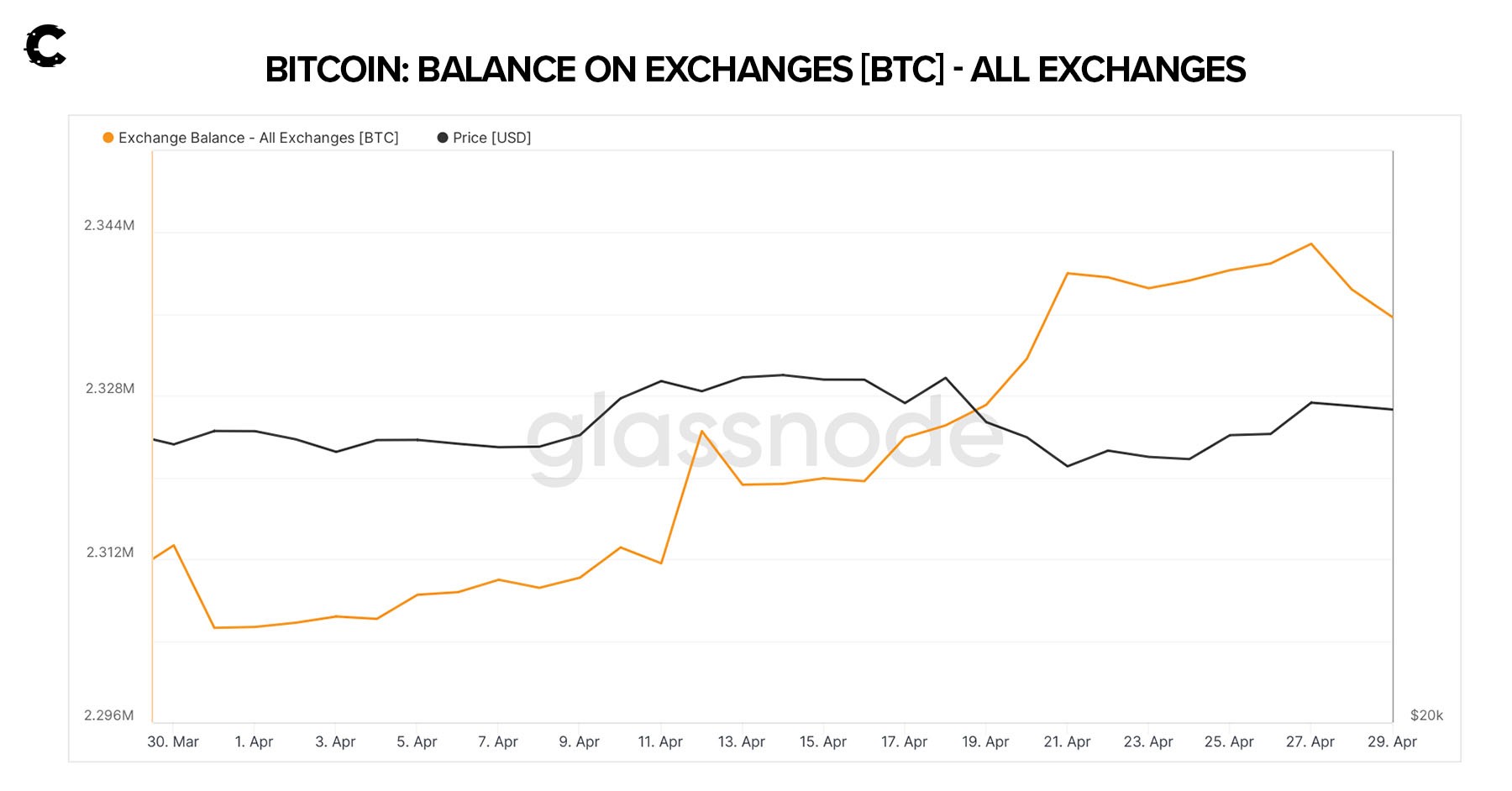

Balance on exchanges is the amount of crypto sitting on trading platforms.A rising balance is a bearish sign. It means the market is pessimistic and prices might fall. That's because more crypto on exchanges usually means more people are selling.

If the balance drops, that’s a good sign. It means people are holding onto their assets because they expect prices to go up. Easy, right?

Now, in April we saw a 30,350 BTC ($850M) increase on exchanges. It's not the end of the world, but it's worth noting - and it suggests a slowdown in buying and even an increase in profit-taking.

State of the profits 💲

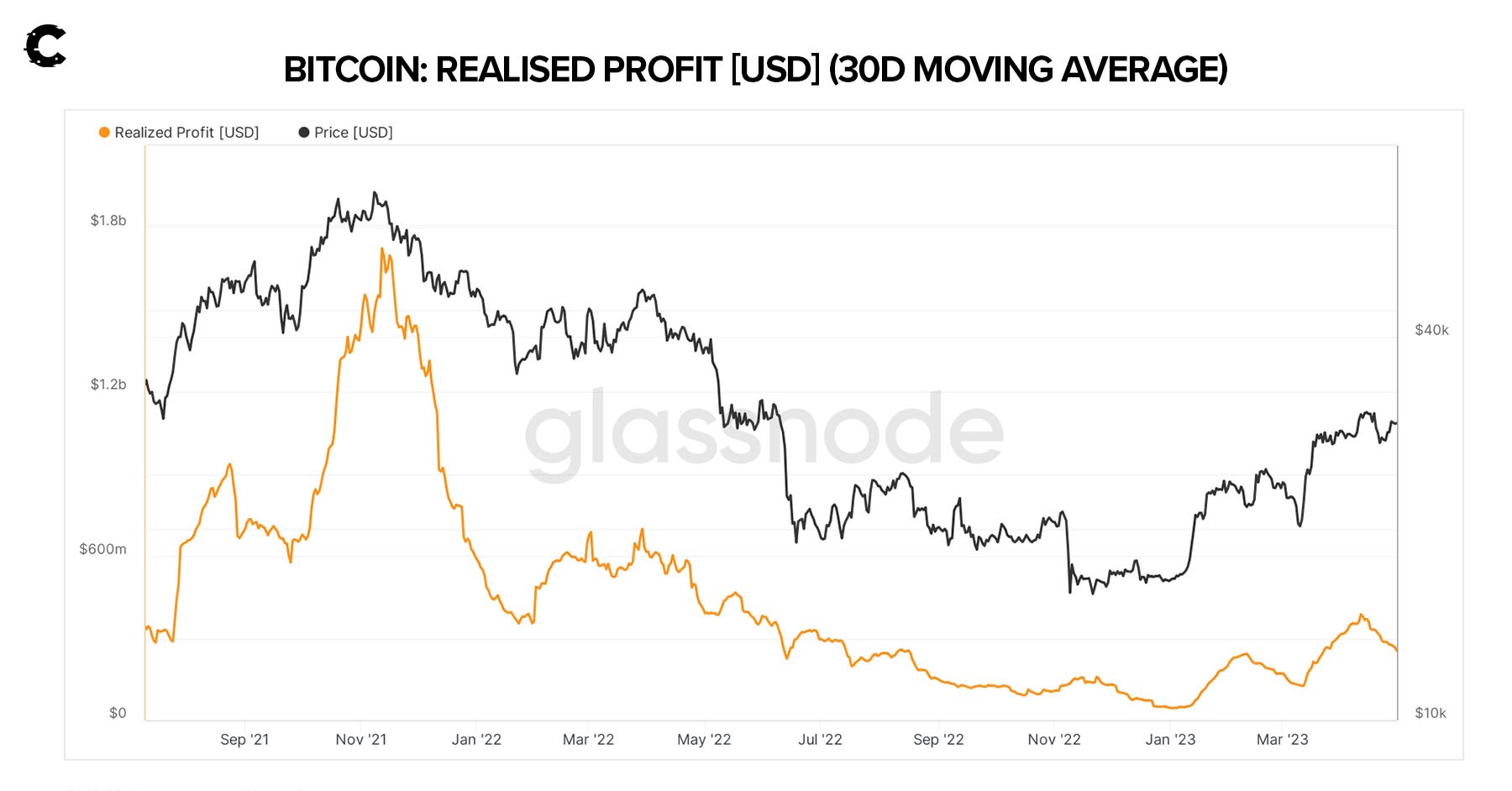

Coins are heading to exchanges, and the market isn't as bullish as it was earlier this year. Let's check out the "profit situation" with these two cool on-chain metrics:- Realised profits: This metric shows the overall profit made by Bitcoin holders when they sell their coins. In simple terms, it's the difference between the buying price and selling price of Bitcoin for all transactions. When this number is high, it means people are cashing in on their gains, which can provide insights into market sentiment.

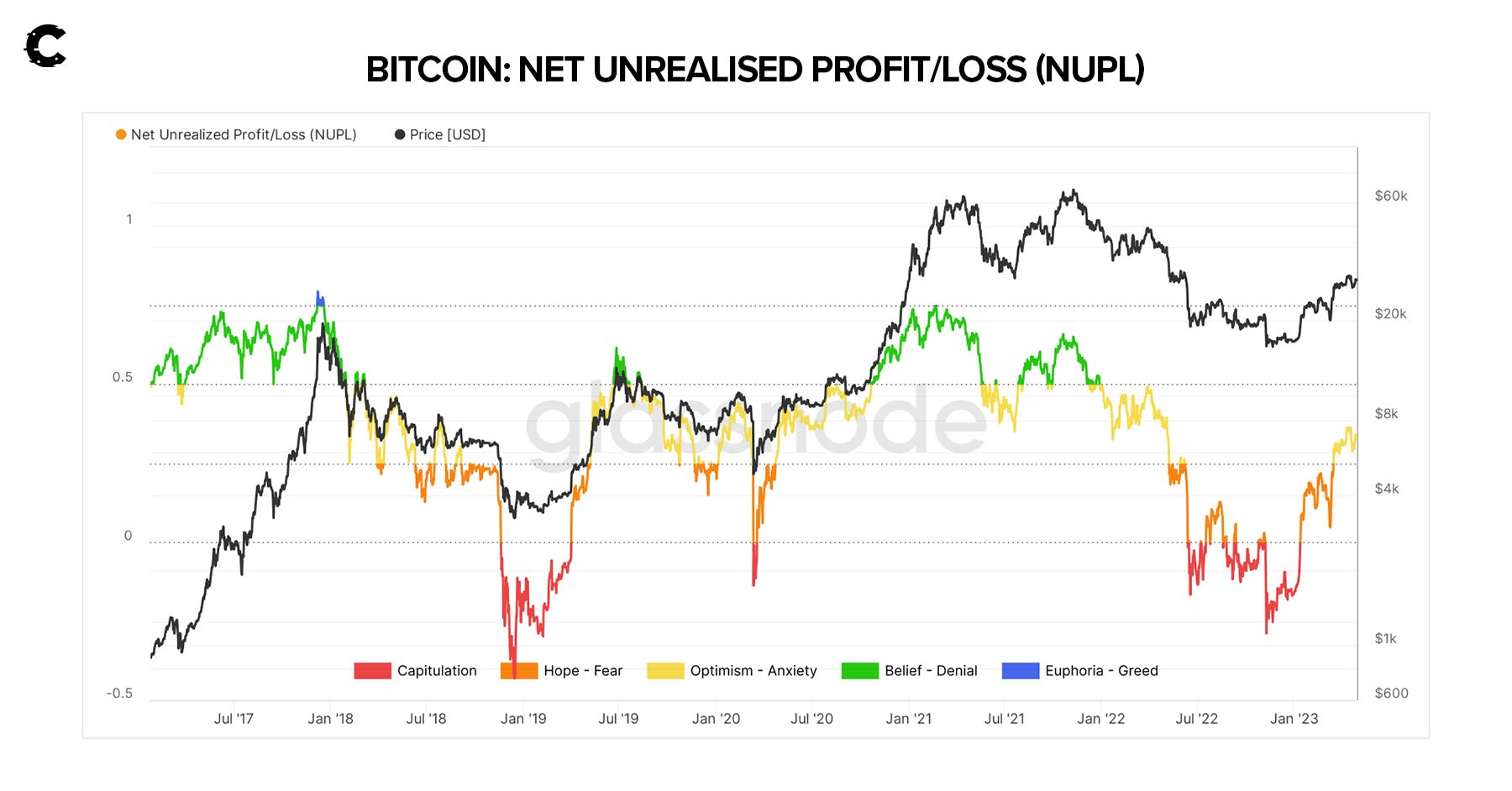

- NUPL (net unrealised profit/loss): This metric gives us a snapshot of market sentiment by comparing the unrealised gains and losses of all Bitcoin holders. It's calculated by taking the difference between the current value of all coins and their initial purchase price. A positive NUPL means that most holders are in profit, which can signal bullish market sentiment. A negative NUPL indicates that many holders are at a loss, suggesting a bearish sentiment.

Realised profits

Lately, there's been an increase in realised BTC profits - a measure of overall profit when Bitcoin holders sell their coins. It's not a huge deal, but it’s worth mentioning.

NUPL

Honestly, today's buying opportunity isn't as attractive as it was at the beginning of the year. We were super bullish in January, but things have changed, and the opportunity isn't as juicy.

Sentiment is in the "optimism/anxiety" zone, sort of a limbo space. We think the bottom is set at $15,500 unless something worse than the FTX collapse occurs (unlikely).

As early buyers, we're holding on and staying positive. But if we were buying now, we'd use a different approach, like slowly dollar-cost averaging and keeping cash on hand for potential dips.

Price analysis 📉

We’ll keep the analysis simple, short, and sweet.

Two weeks ago, BTC had a bearish engulfing candle on the weekly timeframe. This usually signals a local top in a rally. We've also seen a shift in market structure from bullish to bearish, with a lower low and now possibly a lower high.

Given these factors, we expect to see a drop to $24,250 soon. The only thing that can help bulls continue the rally without a pullback is if BTC reclaims $30,000.

Ordinals: Don’t trust the data 🖼️

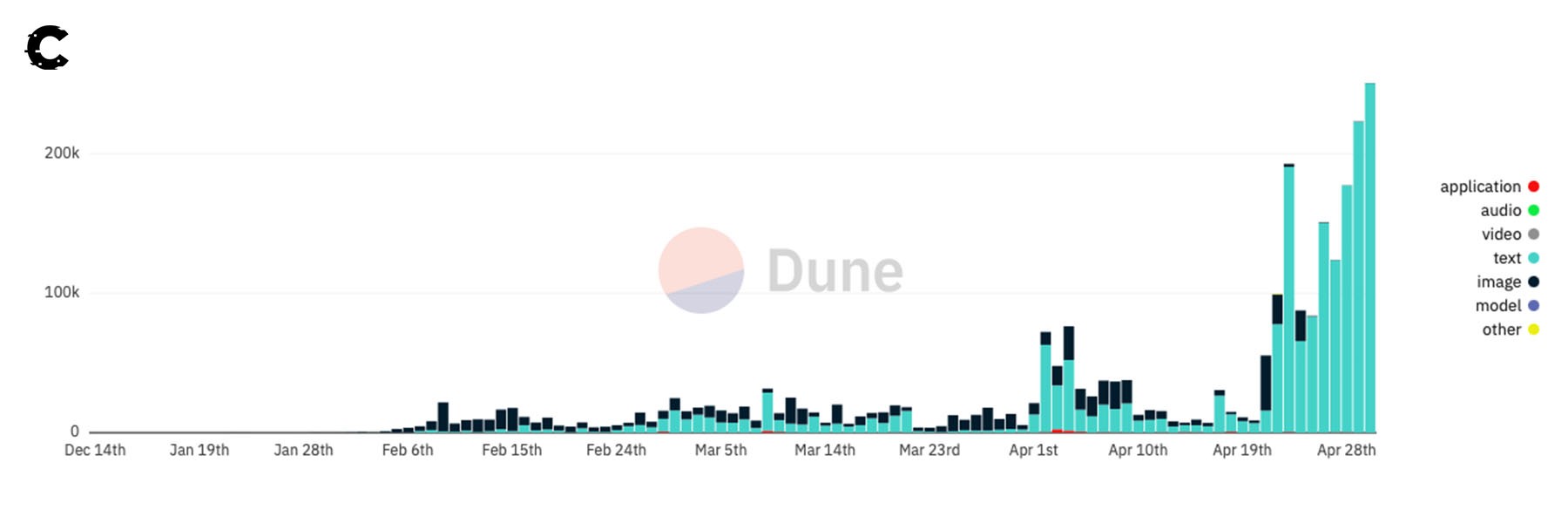

We usually like data. But sometimes there’s more to the story.We’re seeing a significant increase in Ordinals volumes and new mints (inscriptions). We’re even setting all-time highs.

[caption id="attachment_272174" align="aligncenter" width="1800"] Ordinals inscriptions by type.[/caption]

Ordinals inscriptions by type.[/caption]

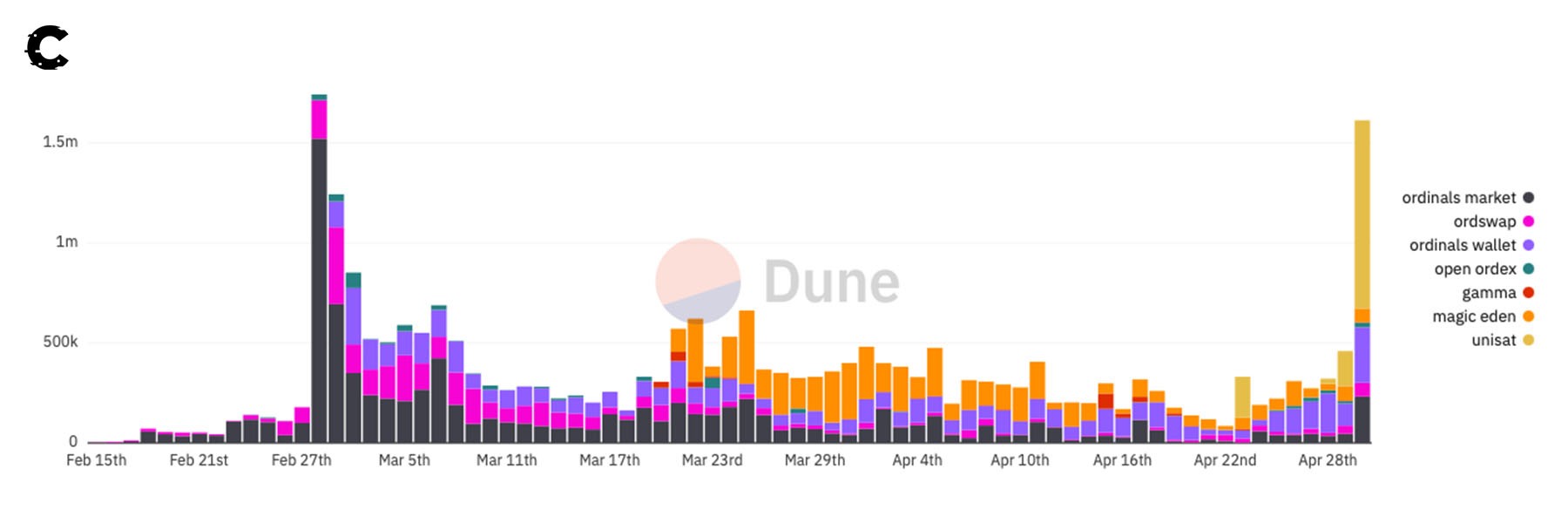

Marketplace volumes show a similar trend.

[caption id="attachment_272175" align="aligncenter" width="1800"] Volume by marketplace.[/caption]

Volume by marketplace.[/caption]

But digging deeper, we found something fishy:

- Most new mints (inscriptions) are text, not images. That’s unusual for an NFT market.

- Most of the volume comes from a new exchange called "UniSAT".

Cryptonary’s take 🧠

Let's wrap up this Bitcoin Digest! Overall, the Bitcoin situation is a mixed bag. We've seen major financial institutions collapsing left and right, which is pretty crazy. That makes the case for Bitcoin stronger and clearer. But the short-term outlook is not so rosy.The balance on exchanges has gone up, which usually means more people are selling and less optimistic about the market. Plus, realised profits and NUPL suggest that sentiment is stuck in limbo with the bottom set at $15,500. And let's not forget the price analysis, which indicates that a drop to $24,250 is likely unless BTC reclaims $30,000.

If you're already an early buyer, it might be worth holding on and staying positive. But if you're looking to buy in now, it's probably best to take it slow and dollar-cost average while keeping some cash on hand for potential dips.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms