This is massive for crypto, and not in a good way. Could the SEC ban staking and stablecoins altogether? Could this kill crypto?

Let’s break down the reasons behind the SEC's recent crackdowns and the implications for the crypto landscape.

TLDR:

- The SEC recently fined Kraken for failing to register its crypto asset staking service. However, the SEC's complaint was against Kraken's specific approach to staking rather than staking services in general.

- Blockchain firm Paxos received a Wells notice from the SEC regarding its stablecoin, BUSD. Despite plans to litigate the case, Paxos announced that it would stop issuing BUSD. (A Wells notice is a formal notice from the SEC informing the recipient that it’s planning to bring enforcement action against them).

- Rumours that the SEC targeted Circle and attempted to shut down USDC are false.

- The best case scenario is that the SEC's actions against Paxos and BUSD are isolated issues with their specific design. The base case is that the SEC is concerned about stablecoins but will not target all providers. The worst case is that the SEC sets a precedent against all stablecoin providers and classifies them as securities.

- The crackdown on centralised providers may lead to increased adoption of decentralised alternatives, making crypto more resilient and the SEC's actions less significant as the market grows.

Kraken staking

Kraken, a popular cryptocurrency exchange, recently agreed to pay the SEC a $30 million fine for failing to register its crypto asset staking-as-a-service business. This move has caused anxiety among investors. However, it's important to note that the SEC's complaint was against Kraken's specific approach to staking. This could mean that other staking providers with different designs could avoid SEC scrutiny altogether.Coinbase, another crypto exchange that provides staking services, recently published a blog post arguing that it would not be subject to securities regulations. It also hinted that it would be willing to take legal action if the SEC pursued it in the same manner as Kraken.

“Staking on Coinbase continues to be available and staked assets continue to earn protocol rewards. What’s clear from today’s announcement is that Kraken was essentially offering a yield product,” Paul Grewal, Coinbase’s chief legal officer, said in a statement.

“Coinbase’s staking services are fundamentally different and are not securities. For example, our customers’ rewards depend on the rewards paid by the protocol, and commissions we disclose.”

In this case, the SEC's actions are less severe than they appear for the crypto industry, as large corporations like Coinbase are confident they will be able to defend themselves in court.

Paxos and BUSD

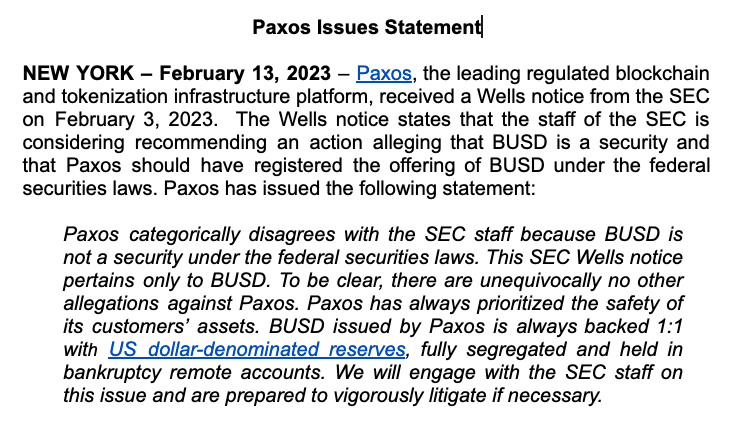

Blockchain firm Paxos received a Wells notice from the SEC over allegations that its stablecoin, Binance USD (BUSD), was being marketed as an unregistered security. This alarmed many in the industry as it may suggest that all stablecoins could be classed as securities, making it illegal to issue them as they are today.Paxos disagrees with the SEC and plans to "vigorously litigate" the case. However, the firm also announced that it would stop issuing BUSD.

There are rumours that BUSD was singled out because it was only allowed (based on an agreement with the New York Department of Financial Services) to be created on the Ethereum blockchain. This could explain why Paxos was targeted, as they broke their agreement and allowed Binance to offer a wrapped version of BUSD on other chains like BNB (called Binance-Pegged USD).

There were also concerns that Binance-Pegged USD was not entirely backed by dollars, which may have drawn the attention of regulators.

The SEC hasn’t provided insight into why it went after BUSD. Therefore, it’s difficult to speculate whether their reasoning applies to other stablecoins. However, given BUSD’s unique design, it is possible that, like Kraken, it’s an isolated issue.

Circle and USDC

Rumours that the SEC targeted Circle and requested to shut down USDC also frightened investors. However, this story proved false, as Circle's Chief Strategy Officer indicated that the business hadn’t received a Wells Notice.Coinbase posted a Twitter thread explaining why it believes USDC is not a security. The thread highlights the differences between the stablecoins offered by Circle and Paxos.

It focuses on the fact that USDC is regulated as a stored value instrument rather than an investment contract. A stored value instrument stores funds for future use (e.g. prepaid cards and electronic wallets). It cannot be a security because it doesn’t involve an investment of money with the expectation of profit. It is simply a means of storing and transmitting funds.

That other stablecoin providers have not received SEC warnings is a good sign, as it could mean that the SEC doesn’t have an issue with all stablecoins.

The future

As there’s still much uncertainty and not all details have been made public, there are three potential scenarios:Best Case: The Paxos and BUSD case is an isolated issue with the BUSD’s design and Binance-Pegged USD. The SEC will not hurt the stablecoin space but will force Binance to redesign its stablecoin.

Base Case: The SEC is concerned about stablecoins and has singled out Paxos as the weakest link in the chain. It is using the BUSD case to warn other stablecoin providers. There will be less innovation in this space, although major firms like Circle and Tether will continue to provide stablecoins.

Worst Case: The SEC uses the BUSD case to set a precedent against all stablecoin providers and classifies them as securities. This would destroy the operations of companies like Circle and harm the crypto industry as a whole.

Cryptonary’s Take

The SEC's recent measures result from FTX’s collapse and indicate that authorities will continue to focus more on crypto.In the case of Kraken, the recent regulatory actions were related to the exchange specifically and not to "staking" in general.

When it comes to stablecoins, the SEC's reasoning remains unclear. However, it appears the focus may be limited to BUSD rather than more commonly-used stablecoins like USDC and USDT, which would be a positive outcome.

These actions against centralised providers could increase the adoption of decentralised alternatives. Lido and Rocket Pool offer decentralised staking, and Aave and Curve plan to launch decentralised stablecoins this year.

We expect the SEC to investigate more crypto companies this year, but the chances of it bringing crypto to its knees are small. As the market grows and provides stronger and more decentralised alternatives, the SEC's actions will become less significant.

Action Points

- We recently published this article about Mango Markets, where we break down how to determine whether an asset is a security.

- We expect decentralised staking solutions to become increasingly relevant as the SEC takes action against centralised staking. Check out this article on decentralised staking alternatives.

- As an investor, you should probably avoid holding BUSD, and store your stablecoins in USDC (given that it has stated it has no regulatory issues and it did not receive a Wells notice).

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms