Decentralisation is not a switch but a spectrum.

The more decentralised a project is, the more valuable it becomes. Just look at Bitcoin - the most decentralised - it's also the most valuable.

Arbitrum is moving in the right direction on the decentralisation spectrum, and its token will follow suit.

TLDR 📃

- Arbitrum is making strides towards decentralisation, introducing the BOLD dispute protocol for permissionless validation.

- GMX's V2 launch on Arbitrum could attract more traders due to reduced costs.

- The emergence of Layer 3 solutions on Arbitrum Orbit, like WINR Protocol and Syndr, using ARB for fees, presents an opportunity.

- ARB's price is expected to bounce from its current support, with a potential upside to $1.26 - $1.2850 resistance.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Here's why Arbitrum is poised to break its all-time high 👇

Arbitrum is making a BOLD move🏌️

Arbitrum has taken significant steps towards decentralisation to differentiate itself from other L2s still facing centralisation issues.

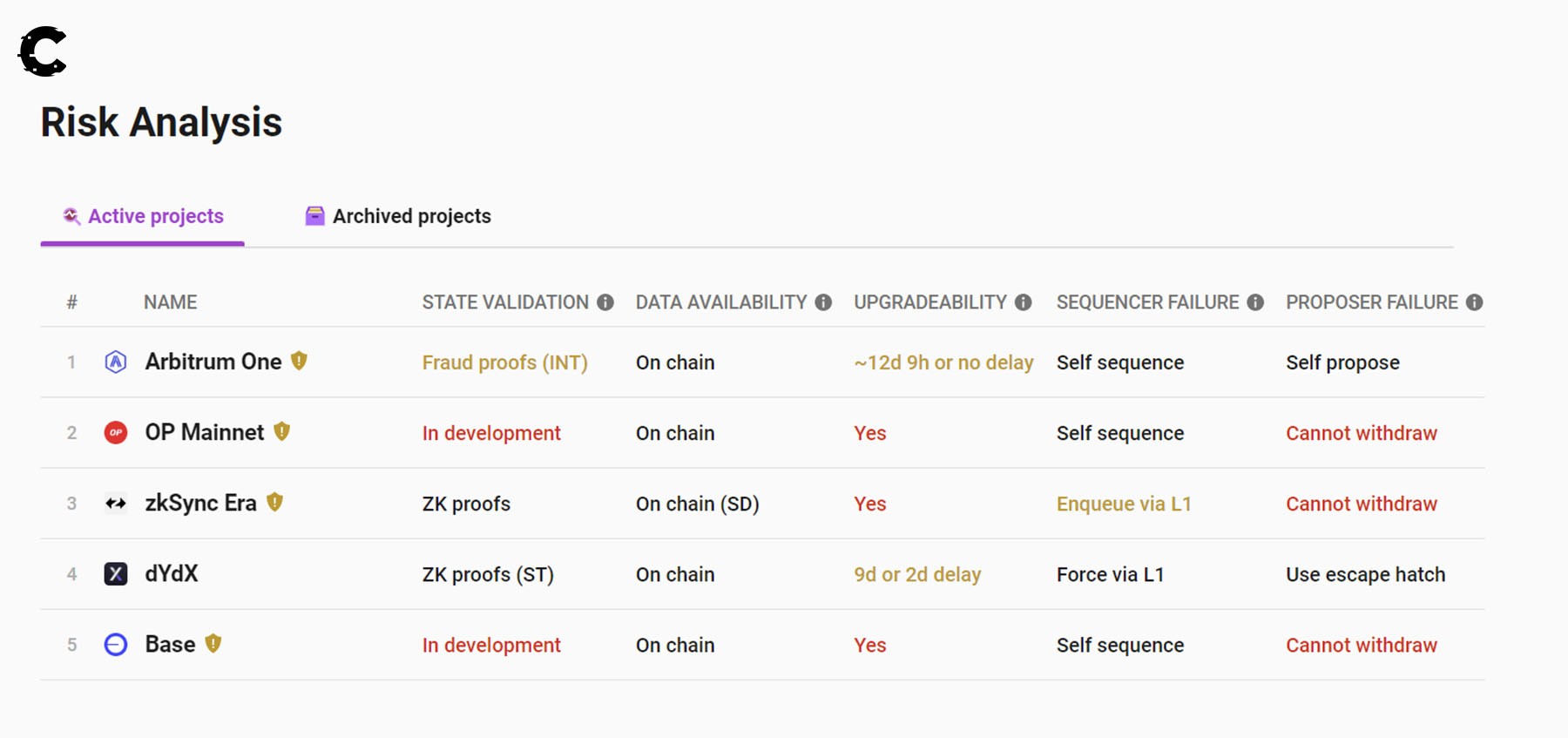

All layer 2 solutions face centralisation challenges due to their novelty. You can see some of these challenges in the table below.

One of the challenges still present for Arbitrum is "state validation."

Right now, only a restricted set of approved individuals in Arbitrum One and Nova can validate transactions using fraud proofs. And only those authorised can confirm if transactions are legitimate, and we're not part of that group.

However, Arbitrum has introduced something significant called "BOLD," to further decentralise the network.

BOLD (Bounded Liquidity Delay) is a "dispute protocol" that lets anyone validate Arbitrum without permission.

This positions Arbitrum as the first Layer 2 solution to achieve such decentralisation. But more importantly, it has a solution for mitigating "delay attacks," a risk that prevented other L2s from pursuing true decentralisation.

Keeping a network decentralised and concurrently secure is a significant consideration, especially when shifting the billions in TVL from Ethereum to Layer 2s. Arbitrum has figured out how to pull it off.

This upgrade will enhance Arbitrum's value, and the gains will also extend to ARB holders.

For one, the Arbitrum DAO might substitute ETH with ARB for staking activities. This move could make ARB more useful since validators need to hold it.

We're closely watching the Arbitrum DAO forum discussions and eagerly await BOLD's launch.

GMX's loss is Arbitrum's win 🏅

While we aren't fond of zero-sum games, in this scenario, GMX's losses translate to Arbitrum's gains.

Here's why!

GMX is Arbitrum's flagship protocol – your destination for trading ETH or BTC with leverage on the platform. Its V2 is now live.

Noteworthy enhancements include adding new tradable assets like SOL, XRP, LTC, DOGE, and ARB. Faster trading, reduced slippage, and significantly lower fees combine to make it a much more enticing choice for traders.

This shift indicates that more traders might join Arbitrum due to GMX's enhanced competitiveness against competitors like Kwenta or Dydx.

Over time, this will likely boost Arbitrum's Total Value Locked (TVL) — a bullish outcome.

However, if GMX reduces its fees, it will generate less revenue, and it’ll need to achieve significantly higher trading volume to offer the same value to GMX stakers.

For every dollar traded on GMX, it will now earn 46% less revenue.

The idea is that over time, this reduction will be balanced out by increased trading volumes, creating a flywheel effect, as depicted in the image.

However, this compensation is likely to take longer. So, we believe that while GMX V2 benefits Arbitrum and its users, it might not be favourable for GMX and GMX holders in the short term.

The L3 race is beginning to unfold on Arbitrum 🏇

Another significant catalyst for Arbitrum’s upcoming breakout is Arbitrum Orbit, a topic we covered in a previous digest.

Back then, we mentioned that the progress of Layer 3s launching on Orbit was relatively slow. However, the situation has changed, and now we see a shift that makes us optimistic.

- WINR Protocol, one of the largest gambling projects on Arbitrum, has announced its plans to establish its own Layer 3 solution to host its crypto casinos using Orbit.

- Likewise, Sanko GamesCorp, another gambling project on Arbitrum, has joined the fray with plans to roll out a chain on Arbitrum Orbit.

And the momentum isn't limited to gambling.

- Syndr, a DeFi Crypto Options & Futures protocol, is also developing an app chain with Orbit.

- Additionally, Volatilis, a DeFi project currently in stealth mode, appears to have selected Orbit for its launch.

Right now, the only element lacking for Arbitrum Orbit is a significant partnership akin to Optimism's collaborations with Coinbase or Worldcoin.

In the meantime, all these Layer 3 solutions on Arbitrum Orbit will have to settle their fees in ARB – and that’s where the opportunity lies.

This is the $ARB trade we have been seeking 📈

Looking at ARB's daily timeframe, we can see its price bouncing from a major support level at this very moment. We believe the ideal accumulation area would be between $1.10 and $1.15.

With the crypto market on the rise and BTC reaching the $30,000s again, ARB will see a clean bounce from its current support region. This bounce will push it to the $1.26 - $1.2850 resistance area. That’s about 10% to 15% in percentages, depending on where you enter.

Healthy price action overall - more upside is likely.

Cryptonary’s take 🧠

Arbitrum stands out as a leading layer 2 solution advancing towards decentralisation. Unlike Optimism, Arbitrum is set to reach another level of decentralisation with BOLD; we favour Arbitrum for its commitment to solid fundamentals.

GMX V2's launch adds to this positivity. It will draw in more traders due to reduced trading costs on the main platform.

With Orbit gaining traction and new Layer 3 solutions emerging, ARB demand should rise. These chains will acquire ARB for transactions.

This is why we predict ARB could surpass its peak this year. If you're not holding ARB, consider accumulating between $1.10 and $1.15. ARB might rebound strongly from its support to reach $1.26 to $1.2850 resistance.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms