Cardano Digest: Cardano bets on dApp developers

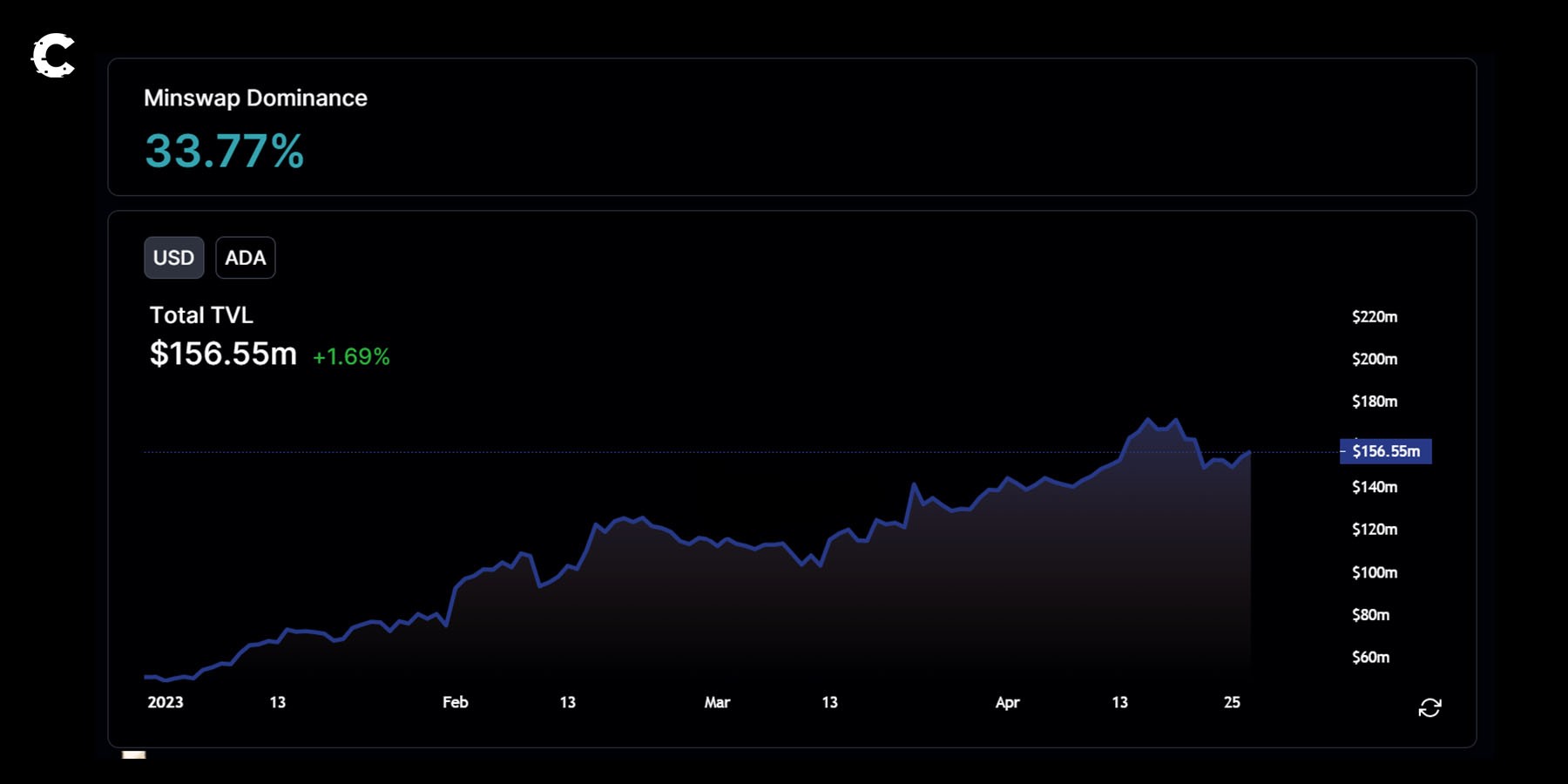

The quarterly results are encouraging despite this week’s 10% drop in TVL, which correlates with lower prices due to macro market sentiments. The long-term view is positive due to the growth and popularity of DeFi protocols such as Minswap, Indigo, and Liqwid, which contribute 67% of Cardano's TVL.

TLDR 📃

- Cardano’s DeFi sector shows continued growth as TVL reaches a yearly high of $167M.

- Deployed on Ethereum side-chain Milkomeda-C1, the DJED stablecoin helps bridge the gap between Cardano and the lucrative Ethereum ecosystem.

- AnetaBTC is cBTC on Cardano, sparking dreams of BTC liquidity for Cardano-based DeFi apps.

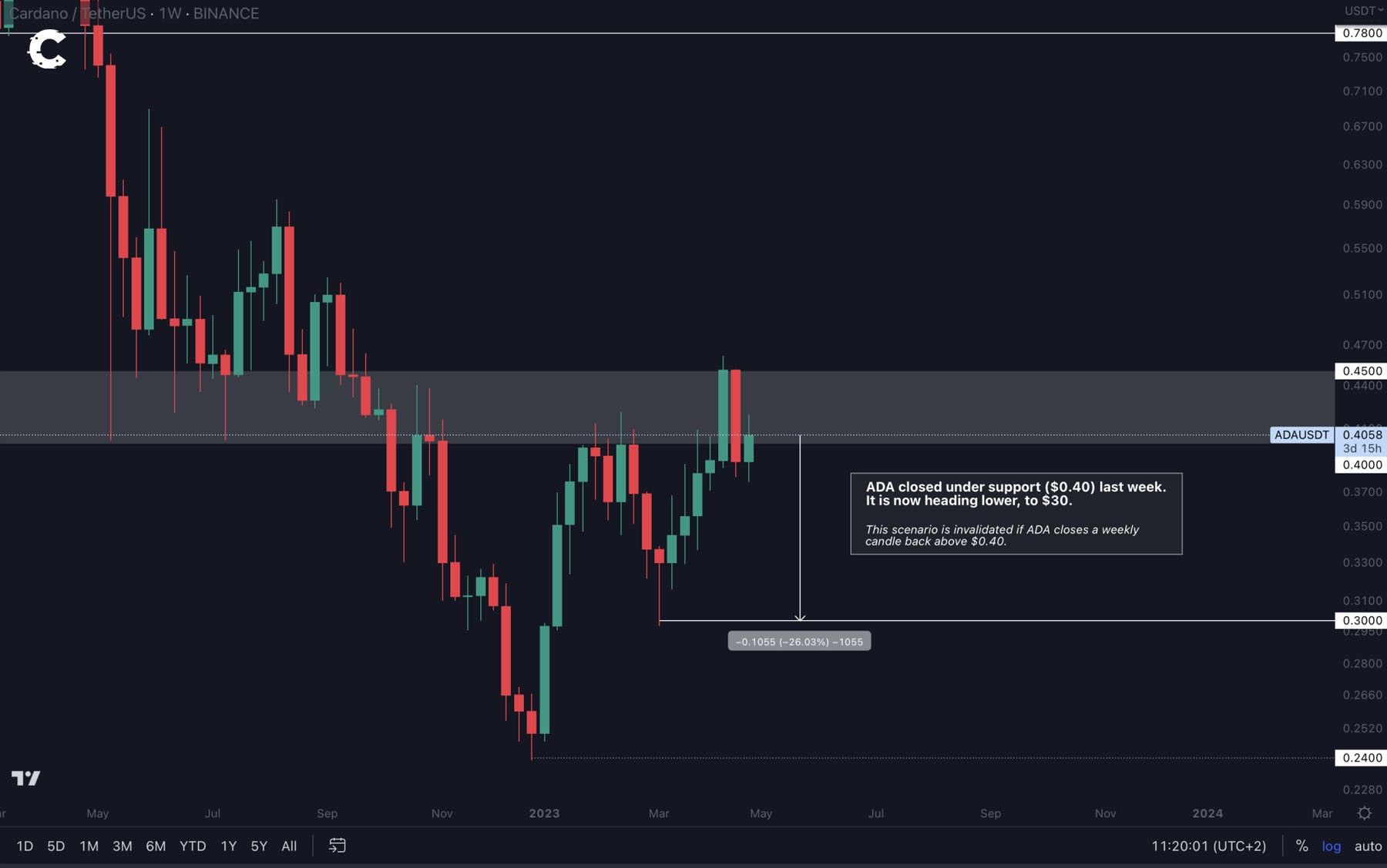

- ADA’s price can’t seem to pass $0.41 despite impressive quarterly TVL growth.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Cardano’s TVL growth 📈

Total value locked on Cardano’s shows a a whopping 150% increase in Q1, from $48M in January to $156M.

Major developments for developers 🔨

Simplifying development with Aiken: Cardano launched its new programming language, Aiken, on the 21st. The language is being presented as an easy-to-use alternative to Plutus for creating smart contracts. The Aiken development environment extends a red-carpet welcome to developers with its ability to decompile and interpret Plutus code.DJED brings Cardano and Ethereum closer: Cardano's new DJED stablecoin has been deployed on the Ethereum-compatible sidechain Milkomeda-C1. This brings a Cardano-based stablecoin into the ETH ecosystem. Add DJED to the new Aiken language, and we could see more EVM-based dApp developers start to target the Cardano ecosystem - good news for Cardano’s DeFi ambitions.

Cardano’s wrapped BTC: On 22 April, AnetaBTC launched a public testnet to mint cBTC on Cardano. It’s an on-chain solution that allows users to unlock the power of BTC on Cardano, boosting the ecosystem's DeFi potential with BTC’s liquidity. The ability to make BTC transactions with Cardano dApps could be a game-changer.

Coingate integrates with BinancePay: Voltaire and CIP-1649 upgrades are currently underway, but it is the integration between Coingate and BinancePay that represents a significant opportunity for Cardano. Finalised in late March, the partnership calls for settling altcoin transactions with ADA at 0.03% starting in Q3. This development could help bring the benefits of crypto to more people around the world.

Price analysis 💵

Our $0.55 target was invalidated by a loss of momentum in major markets. Global crypto market cap briefly tested $1.18T before dropping to its current levels, and frankly, only a climb above this region will convert today’s pessimism into green candles.ADA faced severe resistance as well in the [$0.40-$0.45] range and is now retesting it as resistance which means $0.30 is next up... Only a reclaim of $0.40 can invalidate this bearish outcome.

Cardano volume experienced high volatility, dropping from $588M to $390M as active traders pulled out to wait for clearer opportunities - a good call, given the difficulty in predicting the market's next move.

Cryptonary’s take 🧠

Let's face it, Cardano has been on a rollercoaster ride in Q1, but it's come out with a jaw-dropping 150% increase in total value locked! Even with the recent 10% dip in TVL, we can't help but stay optimistic about the future, especially with DeFi darlings like Minswap, Indigo, and Liqwid making waves in the Cardano ecosystem.But wait, there's more! Cardano has been busy cooking up some exciting developments to keep us on our toes. They've launched Aiken, a user-friendly programming language to make smart contract creation a breeze, and they're bridging the gap between Cardano and Ethereum with DJED stablecoin. Oh, and did we mention the testnet for wrapped BTC (cBTC) and the Coingate-BinancePay integration? Talk about some game-changing moves!

Now, let's chat about ADA's price for a sec. It's been facing some tough resistance in the $0.40-$0.45 zone, and there's a chance it could slip to $0.30. But don't lose hope just yet! A bounce back to $0.40 could turn things around and squash this bearish trend.

So, what's the takeaway here? Times are uncertain for sure but until further notice, bears have the upper hand.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms