In this report, we analyse the performance of $ADA from March 20 to April 4. We examine the coin’s price movements, trading volume, and market sentiment. Hold on to your seats!

A Washington law firm exposes the Fed’s non-subtle affront against crypto, with the support of chilling remarks from Cardano’s CEO. The chain’s development activity and the TVL (Total Value Locked) of its currency shot through the roof in advance of the Voltaire era. Meanwhile, a Cardano engineer goes anonymous to share concerns, and $ADA is positioned for rapid adoption after Emurgo’s partnership with Thai exchange Bitkub.

We believe $ADA is poised for an upward climb to $0.44 soon, keep reading to find out why.

TLDR

- $ADA failed to convert $0.40 in its last price surge but is expected to test $0.44 if volume is sustained.

- In March, $ADA’s TVL increased 21% to $140M, continuing its impressive growth since the start of the year.

- There’s ongoing speculation that the Fed may consider easing monetary policy in light of recent financial crises.

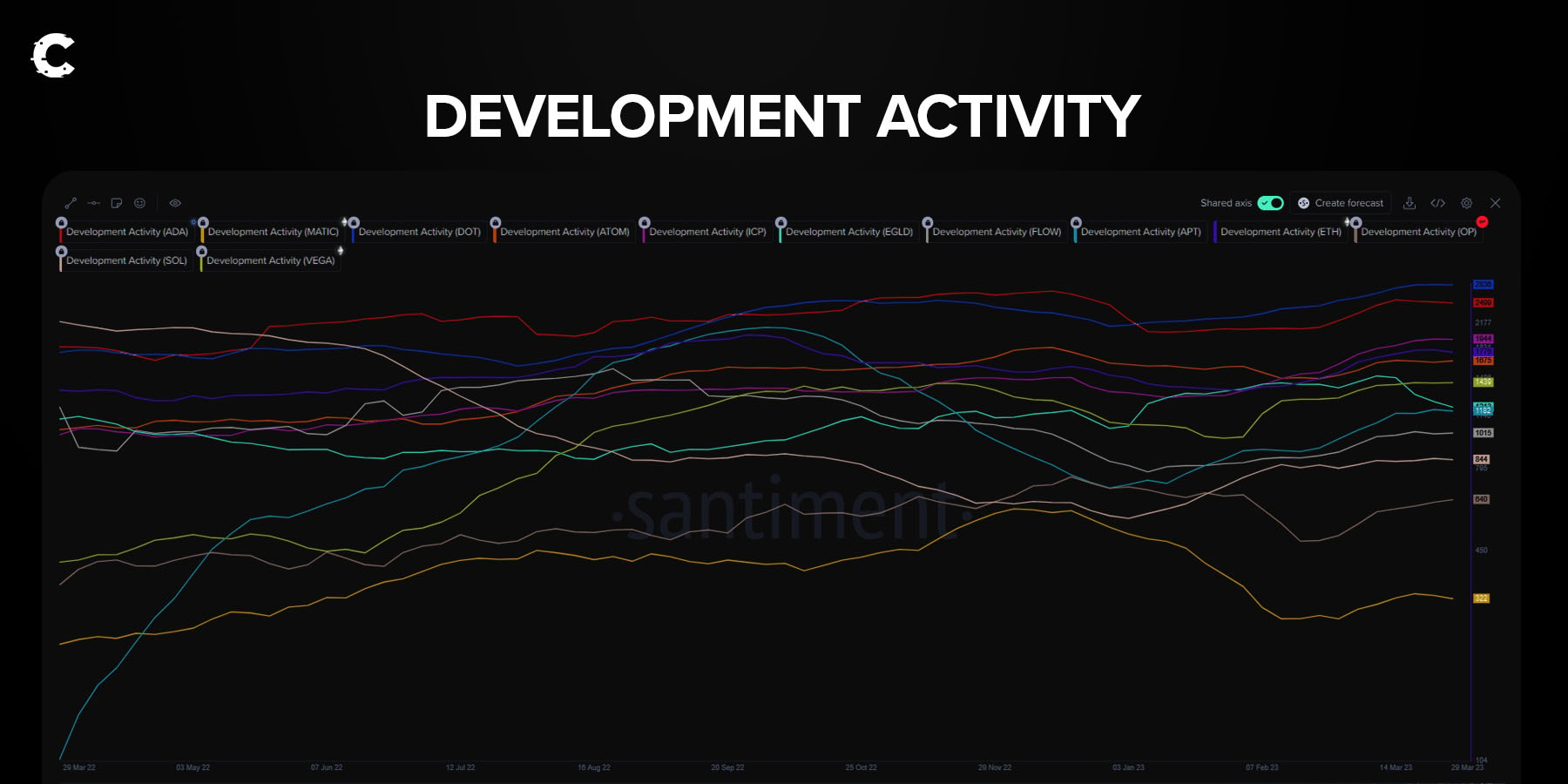

- Cardano remains one of the top protocols by development activity, with the latest improvements expected to bring EVM (Ethereum Virtual Machine) compatibility to the chain.

An object in motion

Cardano is a protocol restlessly on the move. To paraphrase Isaac Newton, it stays in constant motion until acted upon by external influence.One year ago, Cardano ranked as the top protocol in terms of development activity, higher than both Polygon and Ethereum. After an exciting first quarter, Cardano currently ranks in second place.

When comparing the change in value relative to the US dollar, $ADA has dropped only 1.9% over that one-year stretch, while $MATIC and $ETH dropped 32.7% and 47.2%, respectively. Mostly because OG Cardano holders are holding it down.

Forging partnerships in the east

On March 23, Emurgo, one of Cardano’s founding entities, announced a partnership with Thailand’s leading crypto trading platform, Bitkub Exchange. The pair outlined plans to foster the growth of Web3 in the region and introduce the local crypto community to the numerous possibilities of the Cardano blockchain.Southeast Asia has certainly enjoyed the benefits of blockchain adoption in recent years, with enthusiastic take-up of applications from remittance payments to crypto gaming. On a list of 25 countries ranked by amount of cryptocurrency remittances, Thailand was second behind India with over $130M between July 2021 and July 2022.

The country’s leading exchange and unicorn, Bitkub, had a trading volume of $24B in 2022, taking up to 75% of the total national market share. The partnership with Cardano will foster the education of the local community and provide funding for competitions and more web3 careers in Thailand. It’s also set to improve Cardano-based innovation in the DeFi and stablecoin spaces.

Community politics

Cardano CEO Charles Hoskinson is well-known for bluntly sharing his views online. One member of the $ADA community posted an anonymous message on the r/CryptoCurrency Reddit page criticising Hoskinson for his “alt-right” opinions and stating he should have taken “the Satoshi route and remained anonymous.”This person also aired his or her dislike of the CEO’s associations with the likes of Elon Musk and Jordan Peterson. Finally the poster expressed disapproval of contingent staking (a feature in development) for Cardano, highlighting privacy issues.

Hoskinson responded with a 30-minute video condemning the author for their small-mindedness in criticising celebrated professionals so sharply. He also said that the staking feature was essential for the protocol’s development, and there will be no privacy risk involved.

Another update worth watching is the EVM-compatibility upgrade announced on March 30. The Ethereum-based dApp (decentralised application) Milkomeda will allow Cardano holders to interact with the Ethereum Virtual Machine (EVM runs ETH smart contracts) without leaving the Cardano protocol. This will create even more development activity as EVM-based dApps become available on Cardano.

There has been some protest though, especially from those who do not wish to see the coin become an EVM side-chain. However, the increased development activity and liquidity is too valuable to turn down.

The Voltaire era update

Cryptocurrencies such as $BTC and $ETH originally used the proof-of-work consensus model, in which miners compete to solve complex mathematical problems to add new blocks to the chain. However, this model continues to come under fire for its carbon output.The greenhouse problem has motivated innovation in the industry. Crypto pioneers like IOHK adopted a more energy-efficient proof-of-stake model, which in turn inspired the development of even more resource efficient models such as proof-of-capacity.

With this same spirit of innovation, the Cardano development team announced the latest in its five-tier development roadmap; the Voltaire era. Per the Cardano web page, Voltaire will be built upon distributed infrastructure improvements made during the previous Shelley era.

This final improvement will help the blockchain achieve true decentralisation by enabling network users to vote on development proposals and on the general direction of the blockchain. The Voltaire Era is in essence a governance feature that will enable Cardano to become fully self-sustainable.

When the update is live, a portion of transaction fees will be pooled in a treasury dedicated to funding development proposals. The IOHK’s development arm; IOG, will gradually hand off leadership duties to the Cardano community's stakeholders.

There is no specific date yet for when the Voltaire Era implementation will kick off (Cardano is famous for constantly being in development). However, Cardano’s IOG announcement on March 24 implied that the Voltaire implementation would be effected sometime this year.

Combined with the general uptrend of the macro crypto markets, the news of this update boosted the token up some 7% in the last days of Q1.

Hoskinson shared his optimism via Twitter;

“The Age of Voltaire will soon be upon us as an ecosystem. It’s going to unlock the power of the millions of Cardano users and builders… it will also, once again, show the rest of the industry how to do decentralised governance just like we did with staking.”

Regulation! Regulation! Regulation!

Q1 2023 came with a lot of regulatory drama, from Beaxy to Tron, Coinbase and Binance. Regulators have taken a series cracks at the largest crypto companies in a bid to tear them down for allegedly breaking US commodities/securities laws.Binance was the latest in the string of suspects and was charged with “wilful evasion of US law” on March 27. The best case scenario is that the litigation ends in fines, but there are a number of factors to consider. We dive into the details in our very recent Binance vs CFTC report.

While it seems Cardano has not stepped on any regulatory toes, the blockchain is not exempt from the effects of a regulatory clampdown on crypto.

It is a concerning situation considering the recent frequency of accusations, frivolous or otherwise. It stifles adoption rates and discourages blockchain innovation in the US.

On March 29, crypto icons – including Hoskinson, not surprisingly - expressed their agreement with a 35-page critique published by Washington-based law firm Cooper & Kirk.

This document, creatively dubbed “Operation Choke Point 2.0: The Federal Bank Regulators Come For Crypto” ignited a lot of conversation on the topic and had a lot of crypto icons speaking up. Charles for one appealed to the crypto community and to Congress to read the documents to assess the current damage and hopefully work together to bring an end to the hard-handedness of regulators.

Price analysis

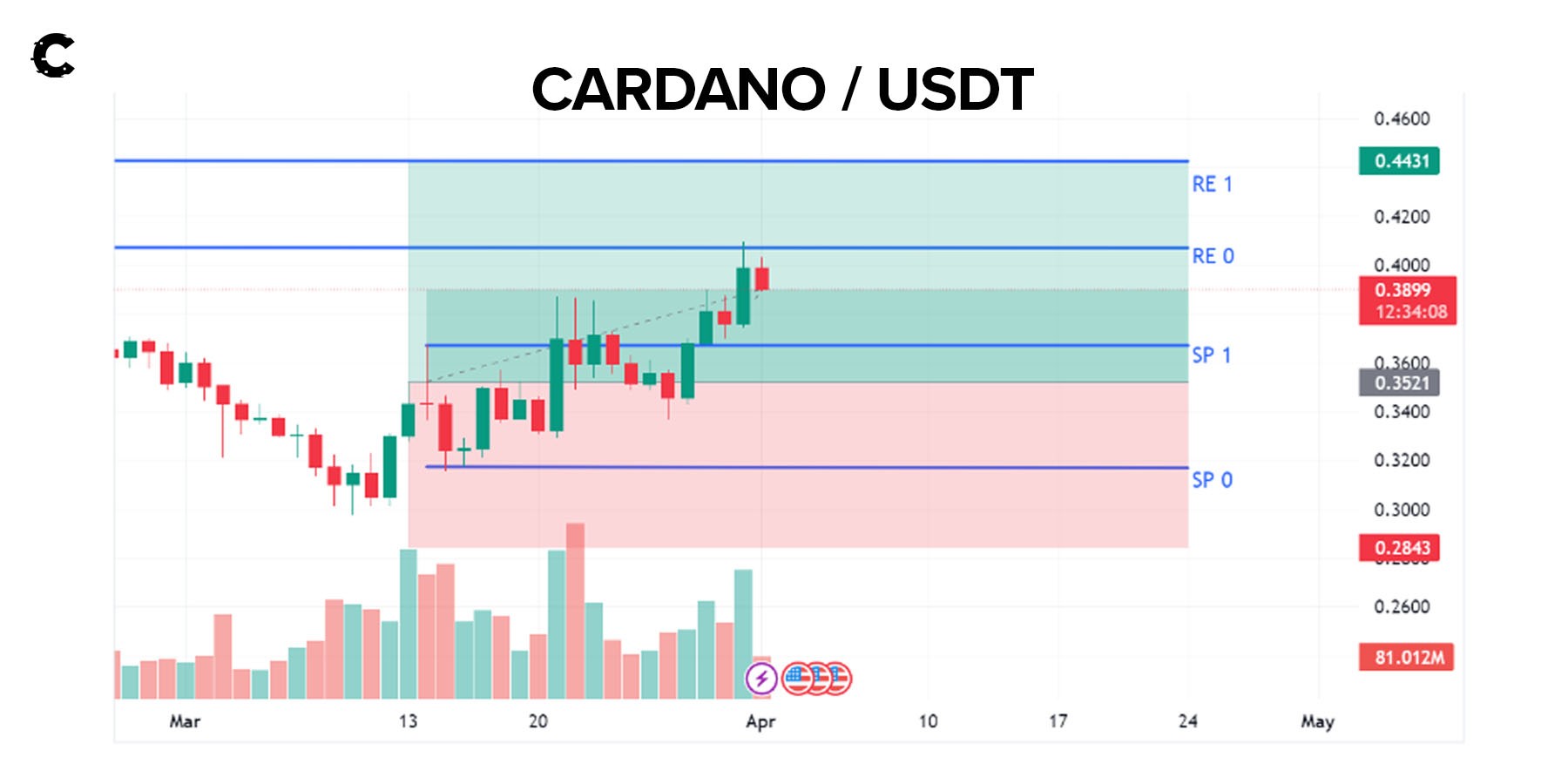

All things considered, March was a good month for $ADA investors. Since our last digest, the coin’s price climbed 10% and currently stands at $0.38 cents. The seventh largest cryptocurrency had a fully diluted market cap of $17B and a $570M daily trading volume at the time of writing.However, the protocol’s most impressive metric is its TVL, which grew from $48M at the start of the year to $143M. That’s almost a 3x improvement.

On the charts, you can see that the price movements were choppy. Ultimately, though, higher highs and higher lows set the coin on a general path of prosperity despite the string of financial sector collapses and the actions of those stiff-necked regulators.

Between March 20 and 27, the coin tested the $0.33 to $0.34 support region, eventually rising to $0.38 to $0.40 in the days that followed.

As with most things crypto-related, volatility is a feature, not a bug, and Q1 was characterised by traders making the best of open market opportunities as liquidity flowed into crypto. Ultimately the banking crisis ignited renewed optimism in digital currency, and we can expect more positive movements in the macro markets.

At the time of writing, sellers were in control. Since $ADA’s spurt to $0.40, there was a mild drop in volume as traders took profits (down from $700M to $400M). But, if the daily candle closes higher than $0.37 the token is expected to continue its trajectory, gain strength to convert $0.42 to support and test $0.45. If this happens, it will mark a significant 27% improvement since mid-February and indicate more green candles for $ADA.

While this may be overly optimistic, it’s important to remember how much of an effect the banking collapses had on crypto.

In the thick of this, total cryptocurrency market cap saw a slight dip to below $1T from $1.2T as $200B of liquidity was either pulled from financial markets or completely eviscerated. Fortunately, this movement has since corrected itself, and the crypto market is once again knocking on the door of $1.2T (>$600B without $BTC).

$ADA was on an upward trajectory at the start of the year. Consider a scenario without the chaos: the coin would have crossed the $0.40 mark in March and possibly $0.50 in April. That arc has changed, but now that the dust from the finance sector drama has settled, $ADA is back on track for a positive 2023.

Cryptonary’s take

Cardano is on the path of purposeful innovation with its latest line of partnerships, and presents a promising opportunity for long-term investment. Its innovative blockchain technology, sustainability and governance feature, make it a strong contender in the crypto space.Especially now that the world is being reminded of the purpose of crypto, $BTC and $ETH have sustained positions, and the new week should see even more impressive sprints as liquidity flows on-chain.

Should the Voltaire era update be successful, Cardano will finally experience true community-centric growth. This would also, importantly, present new use cases for its coin and increase its value.

Recently, $ADA has consistently reached higher price levels after brief rallies. At this point, there’s a slight risk it could drop to $0.35. But volumes are slowly rising, and an upward movement to retest $0.41 may be in the works.

The Risk Strength Indicator (RSI; [ above 70 means an asset is overbought, below 30 means it’s underbought]) is at 50, which is another good sign $ADA is not in overbought-land. So a price reversal from a loss of liquidity is not an imminent risk. In the coming weeks, expect more choppy movements at $0.38 to $0.39, then a surge to find new support above the $0.41 region. $0.40 represents a significant price for $ADA given last year’s levels, and it’s possibly even the last hurdle in the coin’s quest to reclaim $1.

Thank you for reading 🙏

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms