With an expansion into the gold and silver market, is Chainlink set to take off with its new ties to traditional finance? Let's find out!

TLDR

- Chainlink released its Q1 product update, outlining recent developments and a huge target market (derivatives, interest rate swap markets… the list is endless).

- The launch of NFT floor price feeds with Coinbase is set to make NFT-Fi more efficient.

- Chainlink integrates on the centralised side of Ainslie Bullion, a leading Australian precious metal broker.

- Working towards a multi-chain future, Chainlink is testing a new cross-chain interoperability protocol.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Chainlink Product Update Q1 2023

Chainlink released its Q1 product update. The main goal is to enable huge transactional value by connecting to Web2 and bringing that utility on-chain:- Connecting more chains: adding more supported chains to the Chainlink ecosystem is the (relatively) easy part.

- Bringing more use cases on-chain: this is the difficult task, explained below.

It’s all about delivering data on-chain for dAapp (decentralised application) developers to use and create new products. The goal is to bring all data available to TradFi and make it available for use in DeFi economy too.

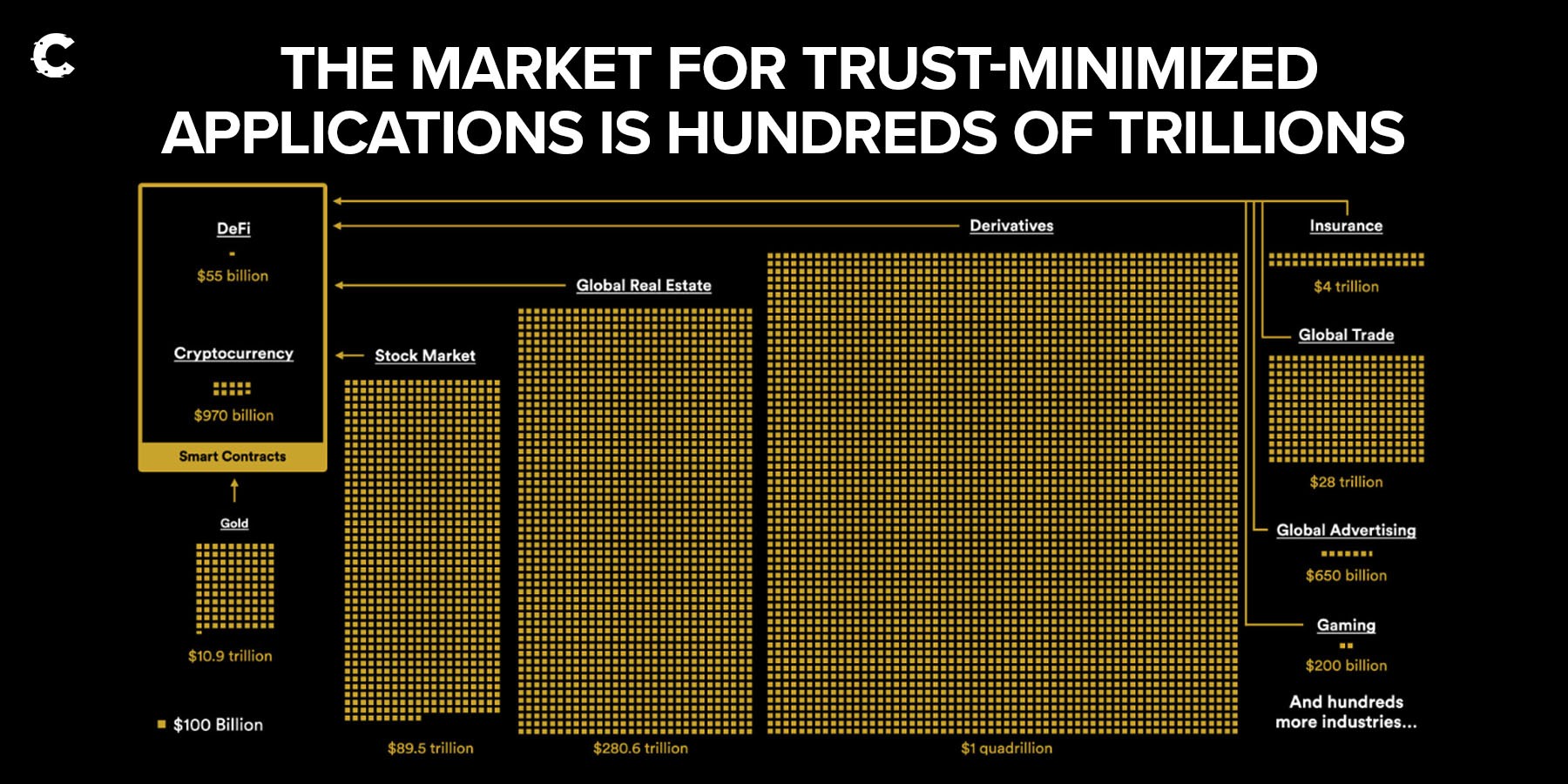

Chainlink's economics use cases include derivatives, interest rate swap markets, stocks, and insurance – all key anchors for economic activity and banking. These markets are worth trillions of real dollars and quadrillions of dollars of notional value.

X-Chain Interoperability Protocol

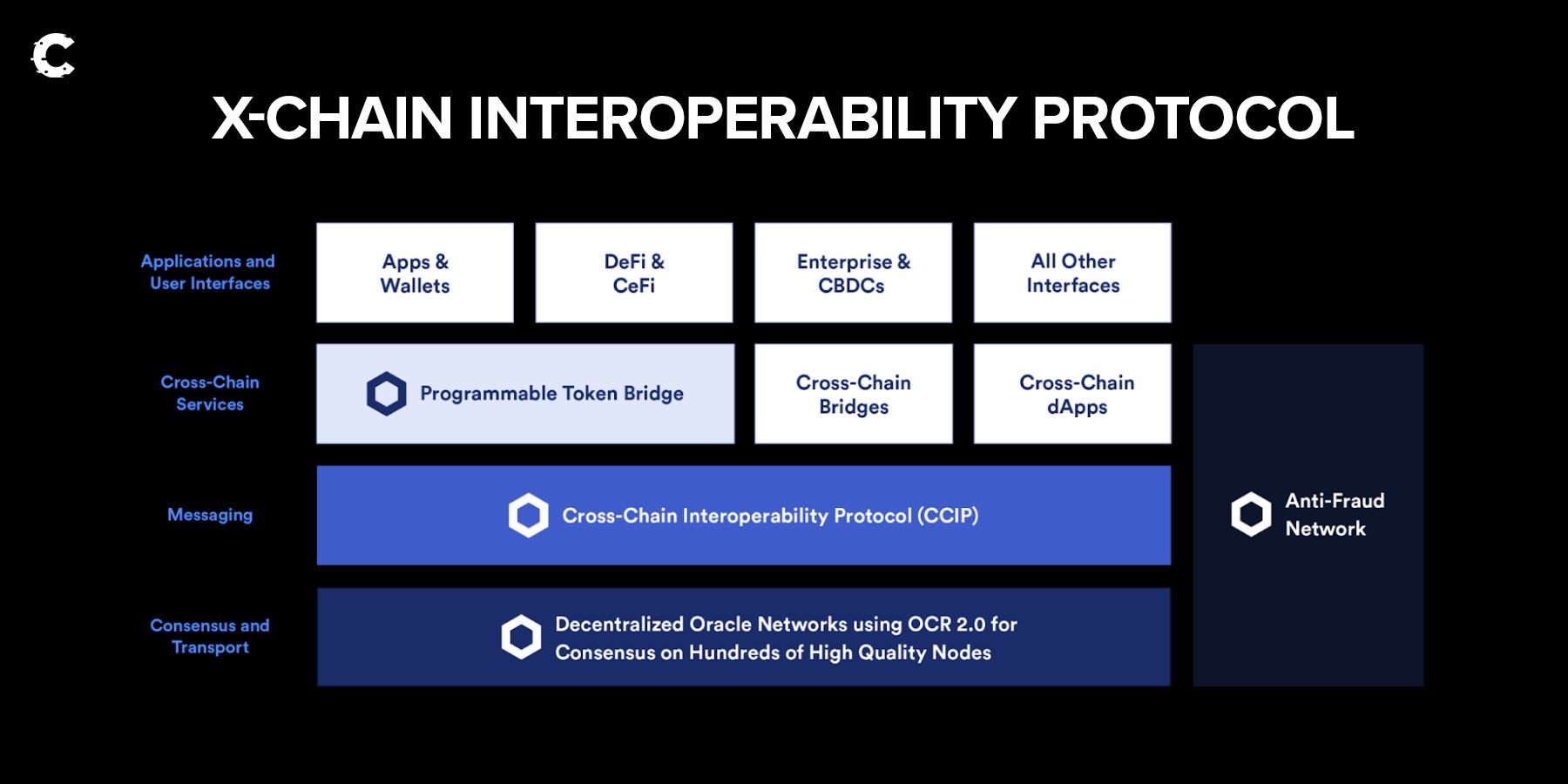

Chainlink has also been working on its cross-chain offering. This already provides services across 16 different chains.Using a methodology similar to LayerZero (a cross-chain messaging protocol), Chainlink is implementing a cross-chain messaging service. This includes token transfers, programmable token transfers and messages.

For example, if $USDC is transferred from a dApp on Ethereum to a dApp on Avalanche, a message triggers further actions on the Avalanche dApp.

Protocols testing the new network include Synthetix and Aave. This new development will make Chainlink a direct competitor to cross-chain messaging services like Synapse Protocol. However, Chainlink will cover many more ecosystems with its 16 connected chains. It will be interesting to monitor developments in this area and any issues found in testing.

Direct Integration with TradFi

There are many Chainlink use cases. One of the standouts is its recent integration with Ainslie Bullion, a leading Australian precious metals broker. Chainlink price feeds aggregate precious metal prices from thousands of sources. Ainslie Bullion leverages this data to provide the most accurate prices instantaneously.

Ainslie already has an on-chain presence through its $AUS and $AGS tokens (tokenised bullion backed by real gold and silver, respectively). However, integrating Chainlink price feeds into the TradFi side of its business showcases the utility Chainlink can bring to companies outside of crypto.

NFT Floor Price Feeds

Despite the current bear market conditions, NFTs are still a popular and much-hyped sector. The building continues, and the NFT market’s latest endeavour is NFT-Fi.NFT lending markets are becoming more popular, but require stable price data to work properly. Chainlink has been working with Coinbase to provide accurate floor prices. This helps avoid unnecessary liquidations etc., due to inaccuracies in pricing. For those interested, you can find more information on NFT-Fi here.

Next Steps

Some important developments to keep an eye on:- Expansion of real-world asset classes, for example, non-US assets.

- Staked $ETH APR feeds. This is very important for the Ethereum economy both now and post-Shanghai.

- Expansion of Chainlink automation. For example, enabling smart contracts to react to an event on another, unrelated smart contract in a different protocol/blockchain.

Other News

- StarkWare partners with Chainlink to accelerate app development.

- MakerDAO integrates Chainlink Oracles to support $DAI price stability.

- Chainlink partners with PwC Germany to accelerate blockchain adoption.

- Chainlink Labs set to participate in ETHSamba hackathon.

$LINK Price Analysis

We've highlighted all the important levels for $LINK. The asset is currently forming a symmetrical triangle. This pattern is neutral, meaning there are equal odds for both scenarios, bearish and bullish.

We believe this could offer a solid opportunity once a breakout occurs, but that will take more time.

For a break to the upside to be validated, $LINK will have to close a weekly candle above $9.50, and see an increase in volume. As for the bearish scenario, $LINK will have to close a weekly candle under $4.85.

We’ll track this chart for potential breakouts in the coming weeks/months, so stay tuned.

With many external factors continuing to influence the market’s movements, we highly recommend that you stay up to date with the latest price action through our daily Technical Analysis.

Cryptonary’s Take

To say Chainlink’s developers have been busy is an understatement. They continue to deliver top-quality and essential services. The advance into TradFi and the expansion of their services to include off-chain companies is crucial. Cooperation between these enterprises and blockchain-based products is nothing new.However, Chainlink is one of the few protocols with utility most centralised companies can understand. Chainlink remains the top dog in the oracle space!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms