With key executives leaving the ship, a DOJ investigation looming, declining market share… and maybe a prison sentence for CZ.

However, Binance is not throwing in the towel; it may claw back victory from the jaws of defeat.

Let’s navigate the troubled waters of Binance and see what the future holds for BNB.

Start here 👇

TLDR 📃

- Several top executives, including the General Counsel and Chief Strategy Officer, have left Binance.

- These resignations may be linked to Binance CEO Zhao's response to an ongoing investigation by the Department of Justice (DOJ).

- The DOJ investigation could lead to charges against CZ and potential imprisonment.

- We are avoiding exposure to BNB at this time due to the ongoing DOJ investigation and expected underperformance.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Top Binance execs jump ashore amidst DOJ investigation 🚩

Binance has again been facing more pressure as top executives, including General Counsel Hon Ng, Chief Strategy Officer Patrick Hillmann, and SVP for Compliance Steven Christie, have informed Zhao this week that they are leaving the company.

While Binance claims these resignations were mere coincidence, insiders suggest a different tale. They hint at a correlation between these departures and Zhao's response to an ongoing Department of Justice (DOJ) investigation.

The DOJ investigation has been looming over Binance since 2018 and recently gained momentum. In December 2022, Reuters reported that the DOJ believed it had enough to justify taking aggressive action against the exchange. Such actions included filing criminal charges.

If the DOJ proceeds with a lawsuit, the consequences for Binance will dwarf the ongoing regulatory battles with the SEC and CFTC.

Unlike civil cases around compliance and misconduct, a criminal investigation focused on money laundering carries far more significant ramifications.

Consider the infamous case of BitMEX, a crypto exchange that faced DOJ charges. BitMEX had to cough up a staggering $100 million in fines, while its founder, Arthur Hayes, was sentenced to two years of probation.

The DOJ's investigation is a major concern for Binance as it extends beyond a simple lawsuit with fines. It could lead to charges against CZ and possibly imprisonment, causing significant turmoil.

While details about the unfolding DOJ case are scant, the recent departures at Binance raise poignant questions.

CZ vehemently denies any correlation, yet, it is difficult to overlook the lingering uncertainty and the potential interplay with the DOJ's investigation.

Binance’s market share plummets📉

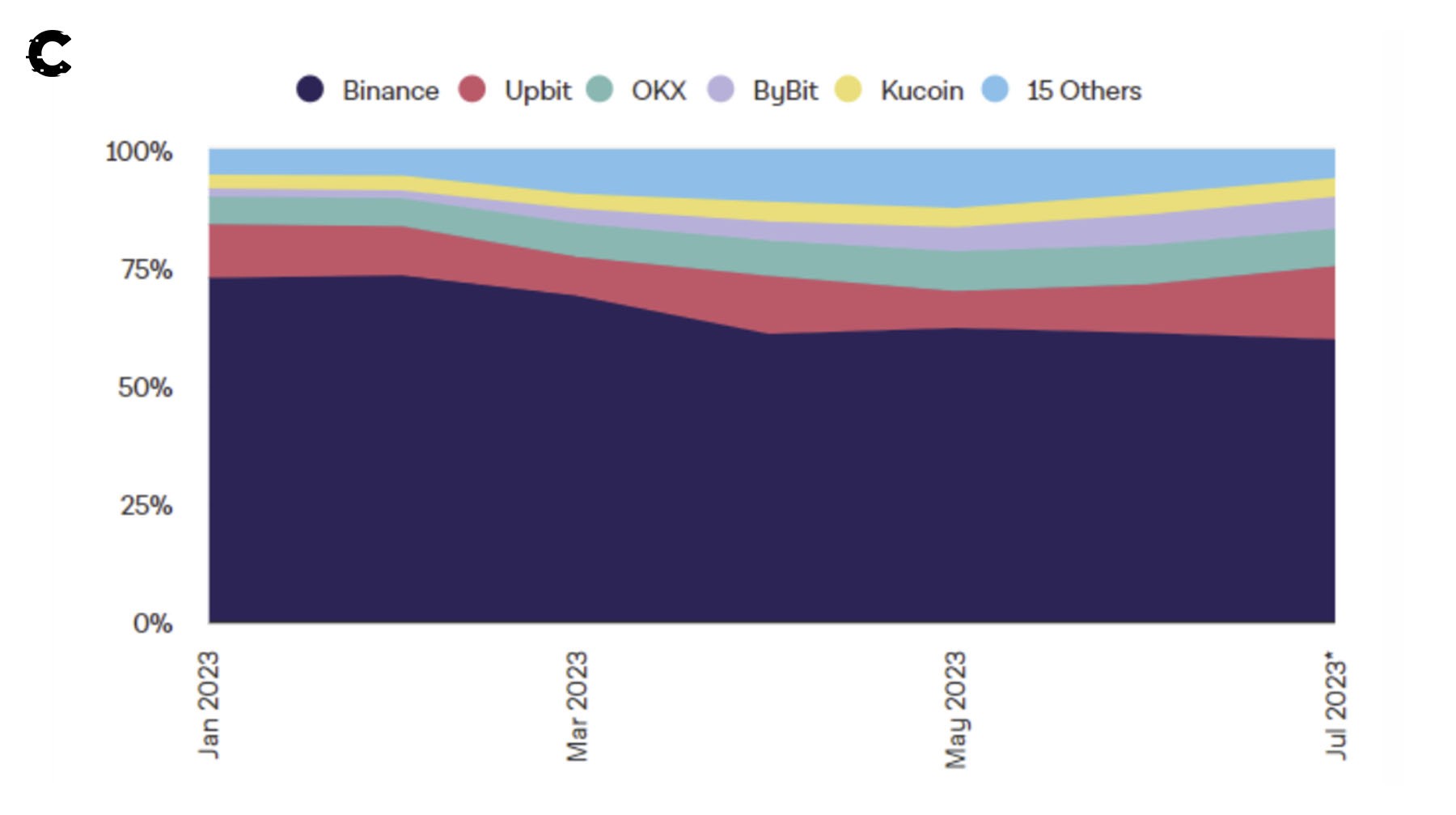

Amidst the flurry of lawsuits and investigations, Binance grapples with a disheartening decline in market share. Its market share sunk to its lowest point since the start of the year.

Binance remains the dominant leader among non-US exchanges, but it now holds a 59% market share, slipping from the 72% market share it enjoyed earlier.

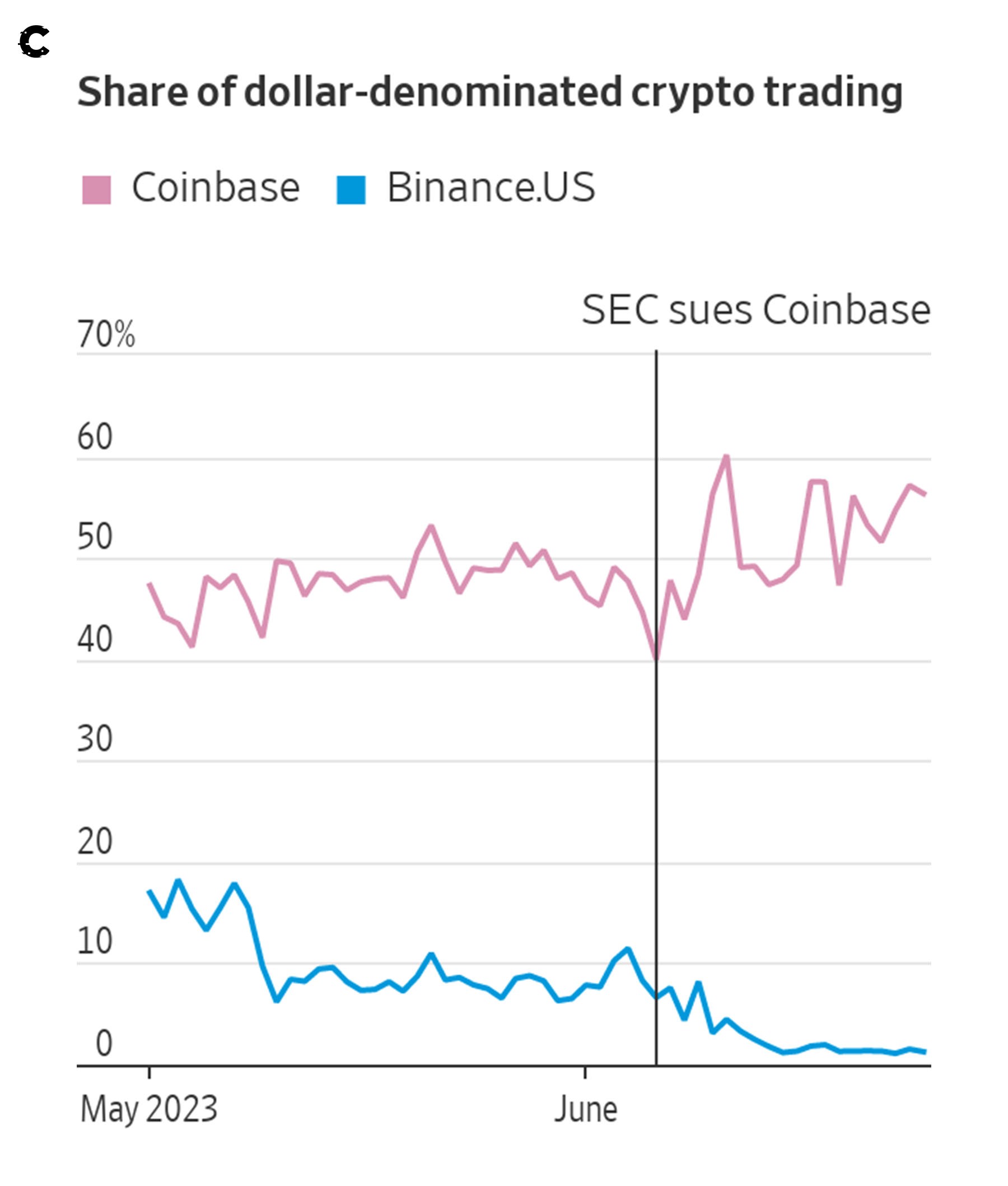

The decline in Binance's market share is even more pronounced in the U.S. market, particularly when compared to Coinbase. Despite both exchanges being sued by the SEC, Binance U.S. has suffered a much more significant impact.

To grasp the disparity in impact, let's examine the charges levied against each exchange. Binance faces weighty allegations, whereas, Coinbase's charges seem less severe.

The gravity of the charges against Binance, uncertainty surrounding the ongoing DOJ criminal case, and external pressures like the recent shutdown in the Netherlands, will continue to contribute to the negative impact on the BNB Chain.

So what does this mean for $BNB? 📊

Since there is considerable uncertainty surrounding the DOJ investigation and limited information has been shared regarding the internal discussions between the DOJ and Binance, we can only make educated guesses about the trajectory of BNB.

Worst case

Combined with a market-wide bearish sentiment, BNB could fail to reclaim $260. As a result, its next stop would be $185, potentially even lower if the lawsuit becomes unfavourable for Binance.

Base case (most likely)

The market either consolidates or pumps, but BNB is left in the dust due to its market share becoming less and less dominant. We could see a rejection from $260, followed by slow and sideways movements throughout the next few months.

Best case

If Binance reaches a settlement with the DOJ or receives positive news regarding the lawsuit, BNB could experience a rally in conjunction with the overall market.

This could potentially drive its price to $300 or even $335 if the market exhibits strong bullish performance. However, it is important to note that for this possibility to materialise, BTC would need to break resistance. For further details on this, you can find more information here.

Cryptonary’s take 🧠

Overall, the departures at Binance and the declining market share indicate that for Binance, the worst is still around the corner.

With the ongoing DOJ investigation looming over the company, we prefer to avoid exposure to BNB now, as we expect it to underperform the market.

However, we do not believe that the current situation with Binance will significantly impact the broader market or BTC. In fact, we think that the likely event of Binance closing in the U.S. and facing a fine has already been priced into the market.

The only scenario that could potentially affect the broader market would be if CZ faces criminal charges, and if Binance International is also affected.

Nonetheless, if Binances manages to work out a settlement with the DOJ, it could be an opportunity to buy BNB, and prices could rise up to $300.

Most importantly, remember that the situation is still unfolding; we can only make educated guesses about BNB’s trajectory at this point.

As always, thanks for reading.🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms