So, what’s going on this week?

Whales are observing watching the market develop from the sidelines as they exercise caution despite the rally. Banks are shutting down and causing waves in the crypto industry, all while President Biden decides to tax Bitcoin miners.

TLDR

- President Biden wants to introduce a 30% tax on Bitcoin mining.

- The banking system is failing and the Federal Reserve is coming at the rescue. If they start printing, BTC may go into a colossal bull market.

- Bitcoin Ordinals (NFTs) continue to take off with over 450,000 minted.

- Our $30,000 BTC target stands.

- Share this report with your family and friends!

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

US Banking Collapsing

In recent weeks, we’ve seen two US banks collapse:- Silvergate: This was the preferred bank for most cryptocurrency operators. However, depositors have been fleeing and the bank's share price has plummeted. For more details, read here.

- Silicon Valley Bank: This is the 16th largest bank in the United States, and it has collapsed due to a bank run (a phenomenon in which a great many depositors attempt to withdraw their money at once, usually caused by a rumor that leads to widespread panic). The Federal Reserve has decided to bail out SVB. A potential sign of the printing press being plugged in again. One of the affected companies that held deposits there is Circle, the company behind the USDC stablecoin. They held 8.25% of their USD backing there, which has led to the stablecoin losing its peg from the $1 mark. The stablecoin has since recovered as SVB assets were guaranteed by the Fed.

- Signature Bank: Another crypto-friendly bank that was shut down by state regulators, setting the record for the third largest bank failure in US history. This bank is also being bailed out by the Federal Reserve.

30% BTC mining tax

President Joe Biden aims to impose a 30% tax rate on electricity usage for $BTC mining. The White House claims that the activity is hindering the transition to a low-emission energy future. The excise tax will go into effect on December 31, 2023, and will be gradually implemented each year. The first year will see a 10% tax rate being introduced, the second year 20%, and the third year will conclude with the 30% rate. This bill tax can lead to one of two cases, or a combination of both:- Miner exodus: The United States has been able to increase its global mining market share from a mere 4% to almost 40% (meaning 40% of newly produced BTC is "Made in the USA"). The introduction of this tax rate will make it more expensive to produce BTC in the US than in other countries, leading to lower profit margins (if any) for US miners. To save their businesses, they'll have to relocate.

- ETH preference: The Ethereum network uses 99% less energy than Bitcoin. If Biden's plan to reduce mining activities and their accompanying eco-damage is successful, this can lead to investor preference of ETH over BTC. While we believe ETH will surpass BTC in market capitalisation in the upcoming years, we doubt this will be the cause of it.

Bitcoin NFTs | Update

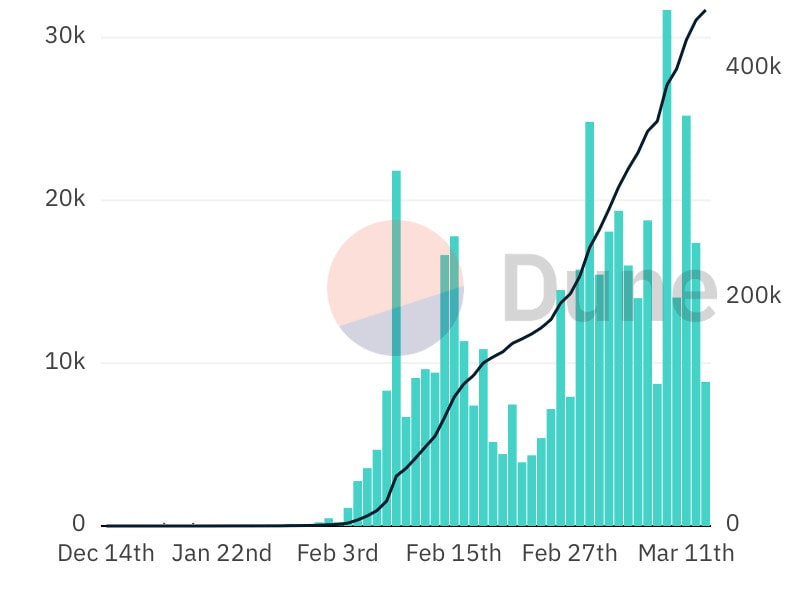

Bitcoin Ordinals continue to ramp up as the number of inscriptions (i.e. mints) crosses the 450,000 mark.

In our previous digest, we mentioned Yuga Labs' upcoming mint for their Bitcoin Ordinals project "TwelveFold". We also stated that "Bitcoin Ordinals lack the technology, but there will be a few collections that become timeless. If the latter happens, then TwelveFold may be one of them".

Here are the mint numbers for you to judge:

- Total Sales: $14,700,000 (735 BTC)

- Highest Sale: $142,200 (7.11 BTC)

- Lowest Sale: $51,000 (2.55 BTC)

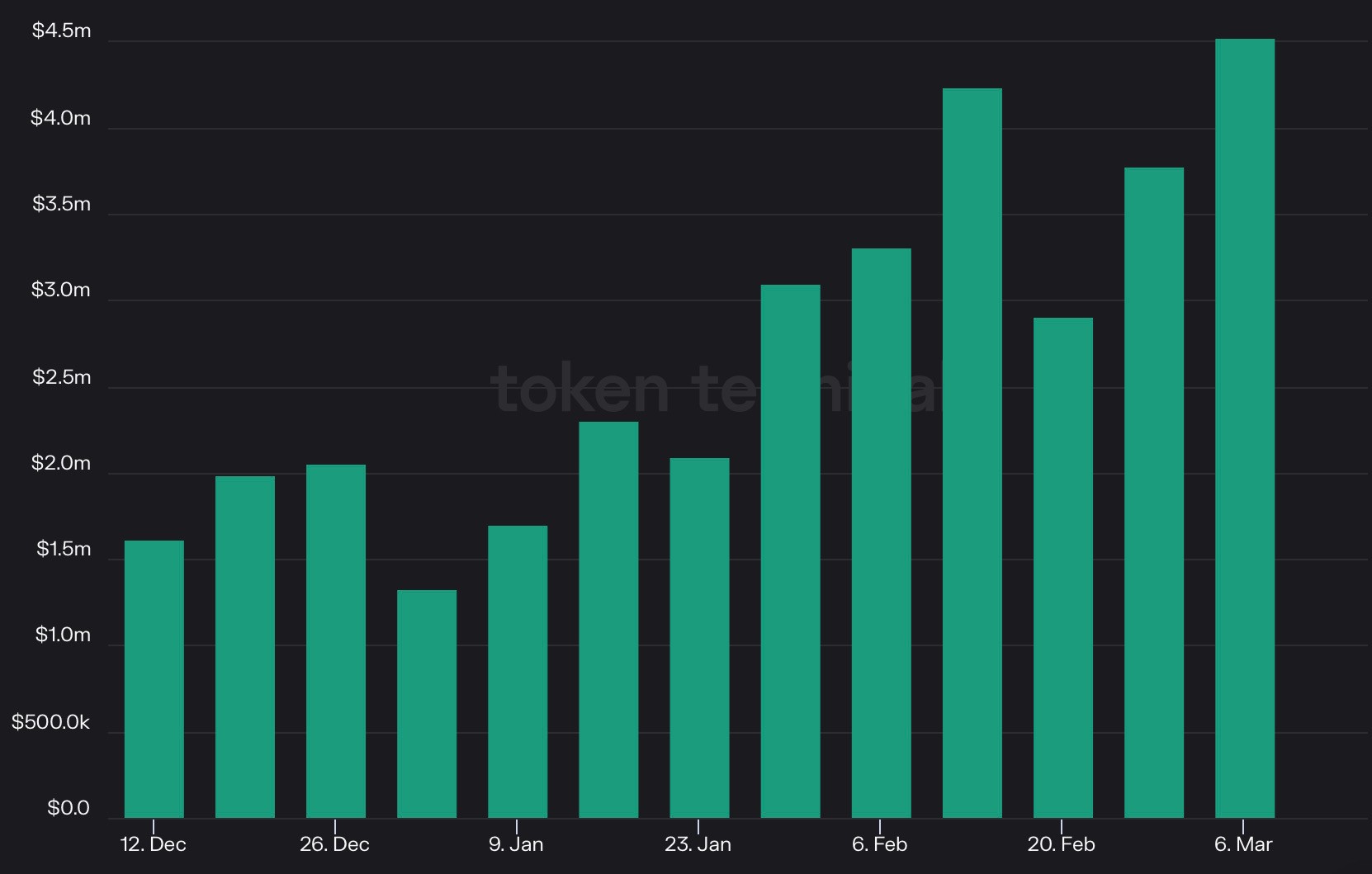

The arrival of Ordinals has led to an increase in fees generated on the Bitcoin bnetwork, with $4.5M generated in the past week alone.

Bitcoin-Fi | Down only?

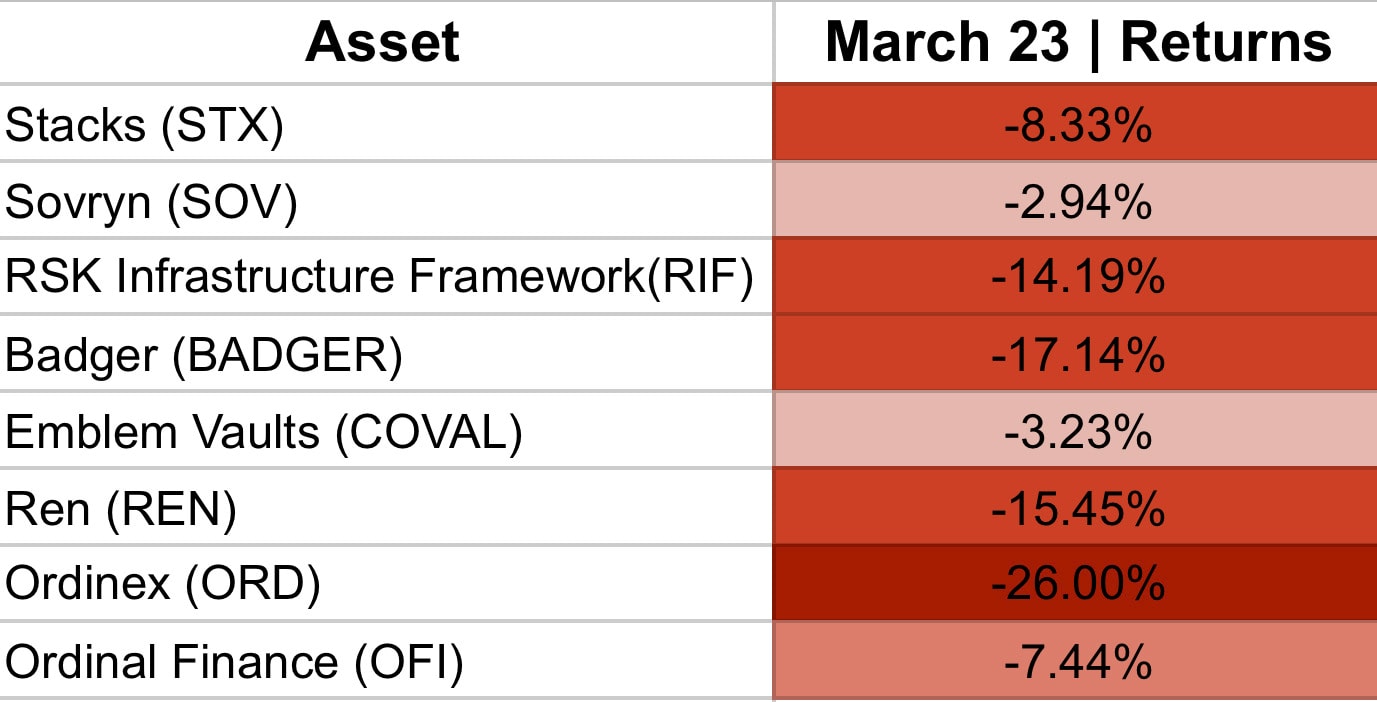

Bitcoin DeFi (Bitcoin-Fi) tokens experienced a significant rally throughout February, with several tokens increasing in value by over 200%.However, these tokens have had a poor start this month. Below are their performances since the beginning of March👇

All of these assets are down, with most dropping by more than 10% in less than two weeks. Out of the eight listed, COVAL stood out as the only with decent fundamentals. In last week's digest, we said, "If you're betting that Ordinals gain traction, then COVAL is probably a good play for you." And COVAL has outperformed most of them.

Never ignore the fundamentals.

The State of BTC

Price chart

“Did you change your mind Cryptonary? Did you think $30,000 was no longer possible after the fall in price?”

We like to remain flexible, rigidity only leads to losses as you cannot control the market. In this case however, nothing has changed since $20,000 wasn’t broken. We maintained our view throughout that $30,000 comes next.

The smart money

Whales are sidelined, awaiting to see how the next few weeks develop. They’re most probably monitoring the US banking system, seeing if the government bails out stragglers or allows more to fall.We can see this behaviour amongst the >10,000 BTC holders (massive whales) as they’ve not increased nor decreased in number. They are sitting on the sidelines.

And now the good news!

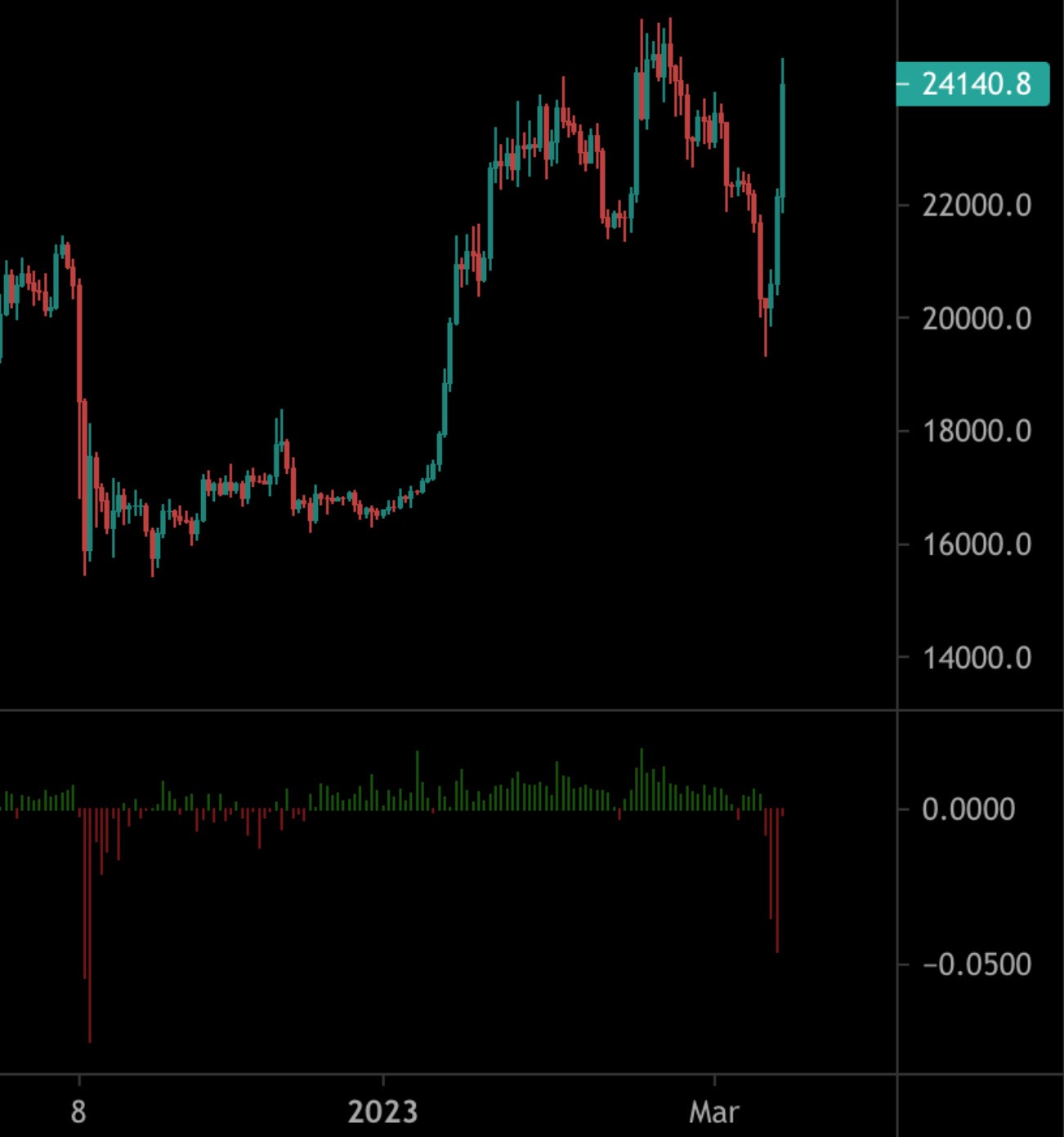

Amidst the chaos, there are two developments give us confidence in the rally.First, the funding rate has plunged deep into negative territory and stayed there despite the recent pump in prices. If we consider the previous example from November, a bottom was set during that time.

We will spare you the technical details as to why a funding rate this negative is a bullish element. All you need to know is that it never sustains at such low levels and is rebalanced by new longs opening. This can push the market even higher towards $25,000+ through further short squeezing.

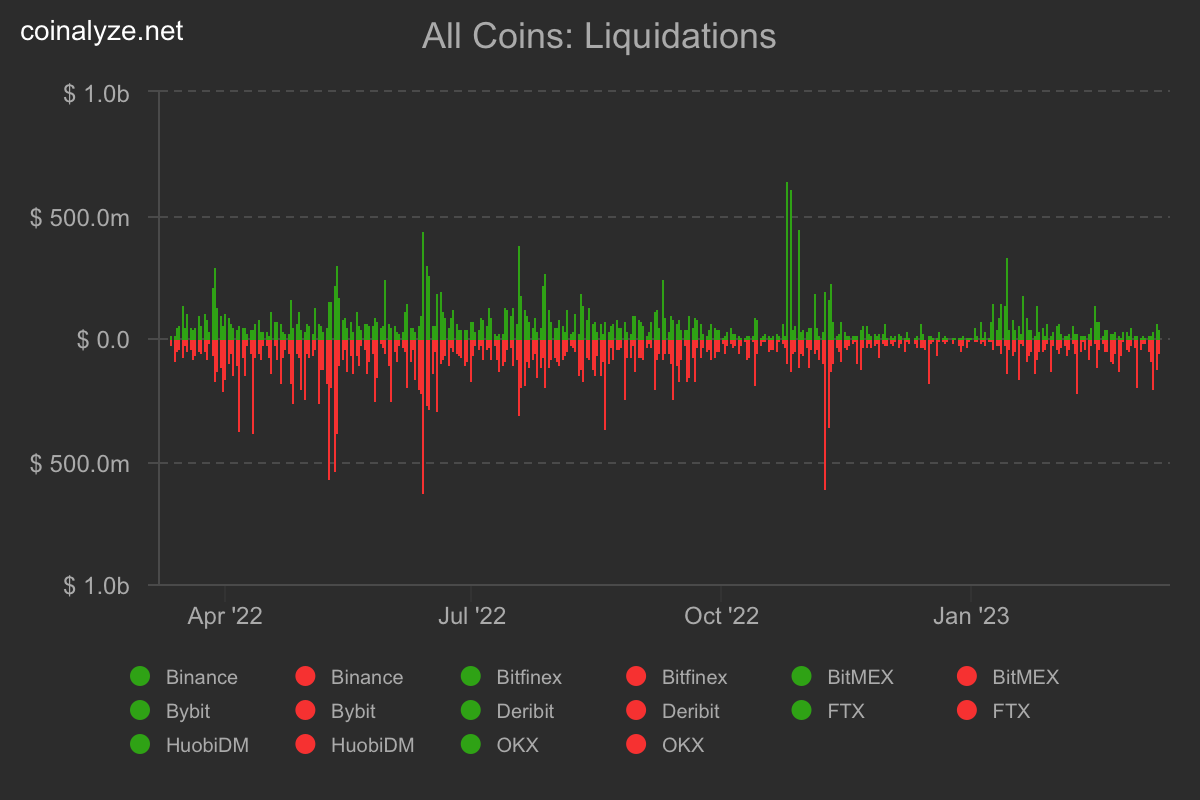

Secondly, we have not seen any extreme numbers on liquidations. Despite recent volatility, there hasn't been anything over $500M in a single day throughout 2023. This tells us that there isn't excessive leverage in the system, which is a sign of maturity.

Cryptonary’s Take | Conclusion

The market is currently in the throes of uncertainty, and indecision is at an all-time high. Investors, especially whales, are staying on the sidelines and observing the market despite the recent rally from $20,000.The Federal Reserve seems ready to print and save the banking system but the question becomes, will they wait until things get much worse and a domino effect happens? Or will they intervene here? We’ll be launching a report on our thought process this week.

In the meantime, it's essential to have a clear execution plan in these conditions. Ours is very simple, if the key level of $20,000 is breached, our previously held view of "this is going to $30,000" would be put on hold until further notice. However, the break has not occurred; so our target remains in place for now.

As always, thank you for reading 🙏🏼

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms