So what’s happening this week?

The Federal Reserve is quietly firing up the printers again, sending investors scrambling for safe havens. But don't expect a smooth rocket ride to the moon – we're hitting resistance on our way up and a pullback is on the cards.

TLDR

- FED's balance sheet raises questions about money printing

- JPMorgan says $2 trillion might be needed to save the banking system

- Investors are looking for safe havens like gold and Bitcoin due to inflation concerns, both assets rallying hard!

- Resistance and selling pressure incoming, expecting a pullback from $30,000 to $25,500

- Share this report with your family and friends!

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

Bitcoin & gold rally together

SVB recently faced trouble, and the Federal Reserve had to help with a bailout. Because of this, investors are looking for safe havens to protect their capital.

When more money is printed, as is the case during a bailout, people worry about inflation, since the money in their pocket becomes less valuable. Gold has been a popular hedge agiants inflation, but now Bitcoin is an option too.

The Fed claims it’s not printing more money, but its balance sheet tells a different story. ICYMI:

The FED has been trying to reduce their balance sheet size since the start of 2022.

They were able to reduce it by $625B over 45+ weeks.Now, in a single week it has increased by $300B. Printer back on? pic.twitter.com/30OS5qoPrC

— Cryptonary (@cryptonary) March 18, 2023

JPMorgan stated the FED might have to print $2 trillion to keep the banking system safe. With things so uncertain, Bitcoin could be a good choice for investors who want to protect their money.

Bitcoin: The financial saviour

Story time!Once upon a time in the world of finance, the US Banking System teetered on the edge of collapse. Bitcoin, the hero of our story, was born on January 3, 2009, with a singular purpose: to rescue the financial system from itself.

On that fateful day, as the UK Chancellor announced the need for a second bank bailout, Bitcoin's Genesis block emerged, carrying the same statement as a beacon of hope. The banking system had faltered since 2008, but with the help of the mighty "Infinite Fed Money Printer," the day of reckoning was delayed. However, the more they printed, the less valuable those US Dollars became. And you know what else those devalued dollars could buy less of? Bitcoin.

The Fed may possess the power to conjure money out of thin air, but even it cannot defy the immutable law of supply and demand. As the supply of dollars swells, their value inevitably dwindles.

Whispers of an impending $2 trillion print by the Fed to salvage the banking system echo through the world of finance these days. To comprehend the sheer scale of this move, consider that in 2020, a $3 trillion injection ignited a spectacular crypto rally.

In that same year, billionaire fund manager Paul Tudor Jones publicly proclaimed Bitcoin as a hedge against inflation. Fast forward to 2023, and another financial titan has joined the chorus. Larry Fink, the chairman and CEO of BlackRock, a behemoth managing over $10 trillion in assets, declared: "At a time when the entire banking system seems to be melting down, Bitcoin has somehow emerged as a potential safe haven for investors."

As the tale of Bitcoin unfolds, its mission to protect and preserve financial stability has never been more evident. And as the hero of our story continues its quest, retail crypto investors from far and wide may find solace and opportunity in its unwavering purpose.

$BTC price

After playing the waiting game, Bitcoin finally is hair length's away from our $30,000 target. It took some serious foresight to believe in and bet on this outcome in January, but now everyone's on board.

Just a heads up: as the price inches closer to resistance, short-term buying might not be the best move unless you're in it for the long haul.

We're feeling confident that $BTC will rally even higher, hitting $35,000 and $45,000. But before we go all-in, we need to see the price confidently break past $30,000.

Given the capital flow situation we've got going on right now (explained below), that might be a bit tricky. Keep your eyes peeled!

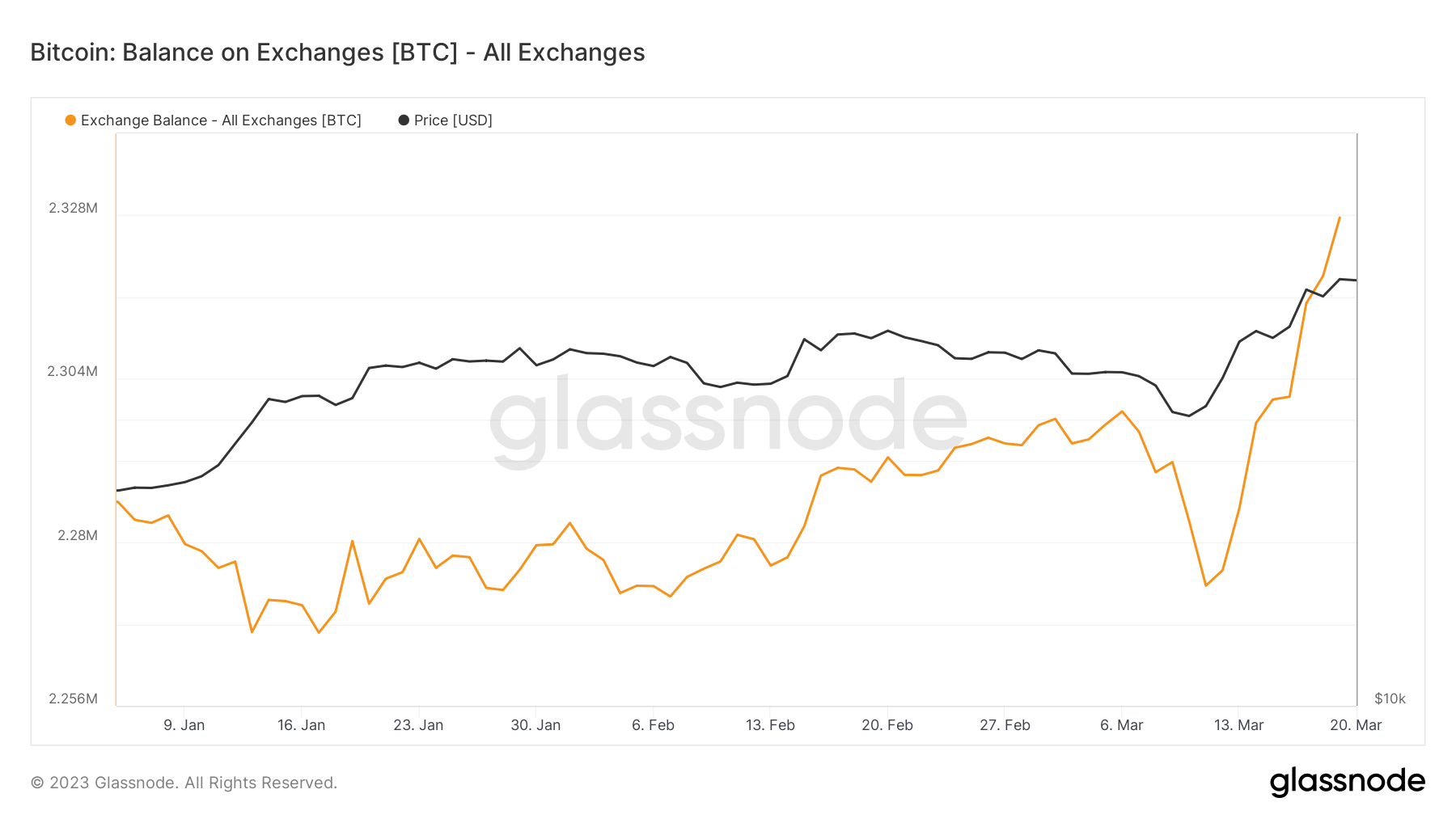

Balance on exchanges

Since March 11, a whopping 54,000 $BTC (worth over $1.5 billion) has been sent to exchanges. That's a pretty big deal.

Usually, when a Bitcoin investor or miner moves their stash to an exchange, it's to sell. So, as we approach that $30,000 milestone, we might see some serious selling pressure, making it tough to break through. The pullback will likely take price back to $25,500.

What could make the $30,000 resistance level crumble? A shift in the overall macro conditions might just do the trick.

In short: Brace for a pullback from $30,000.

But don't stress – just because there's some selling pressure, it doesn't mean buyers are backing down.

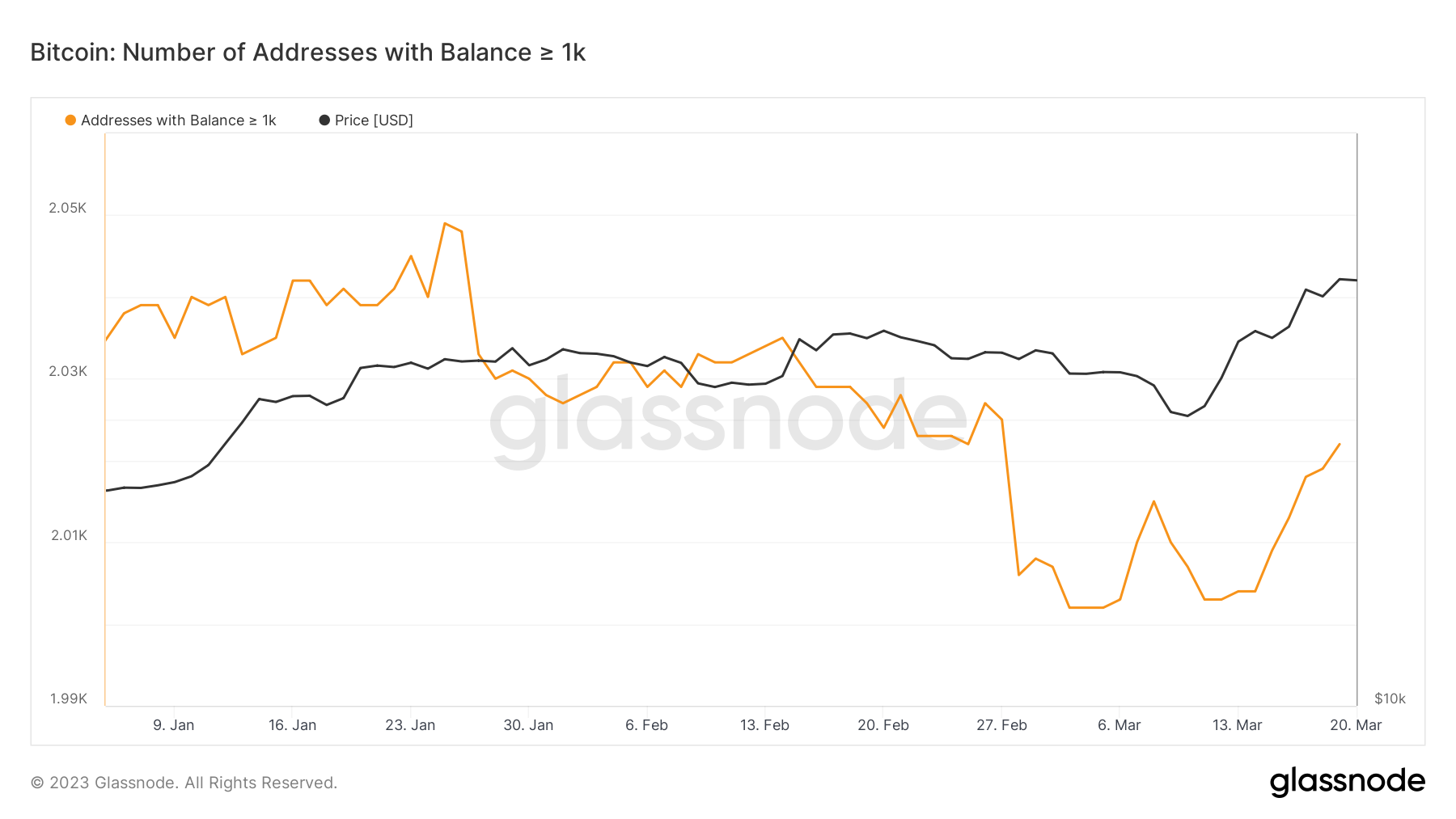

The smart money

The >1,000 BTC whale club has opened its doors to 18 new members in the past week to the existing 2,005. While this is not a massive change, it still shows there's some buying pressure out there.

As the Fed spills the beans on its next moves and the US banking drama continues, more investors will be on the lookout for a safe haven (unless something miraculous happens). And guess who's a top contender? That's right, $BTC! So, we're definitely expecting to see more new whales joining the ranks of the "One Comma $BTC" club (that's 1,000 BTC+).

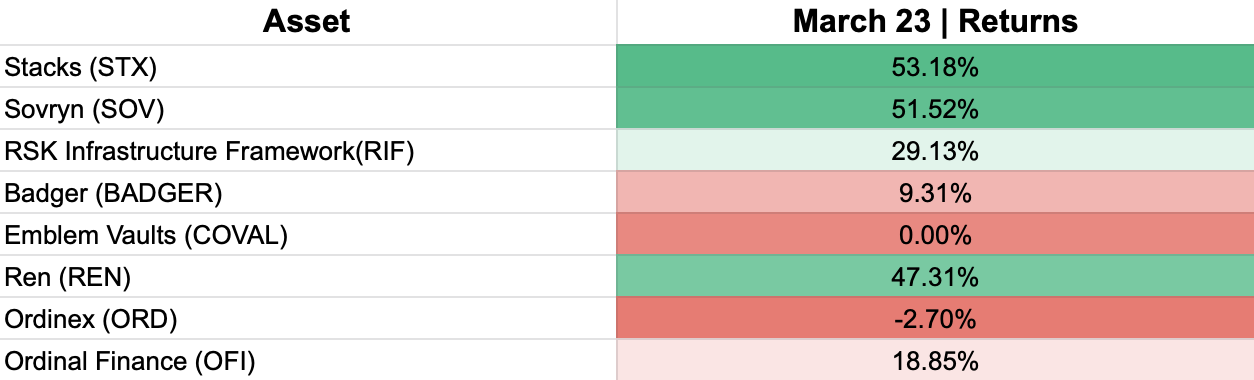

BTC-Fi update

Bitcoin-Fi (Bitcoin DeFi) assets had a great week with three of them pulling a +50% performance!

While DeFi on Bitcoin is controversial in itself, it is bringing attention - which is all we need for $BTC to see further adoption.

Stacks, a Bitcoin Layer-2, is preparing for a new upgrade which we are fully covering in our upcoming DeFi Digest! Stay tuned!

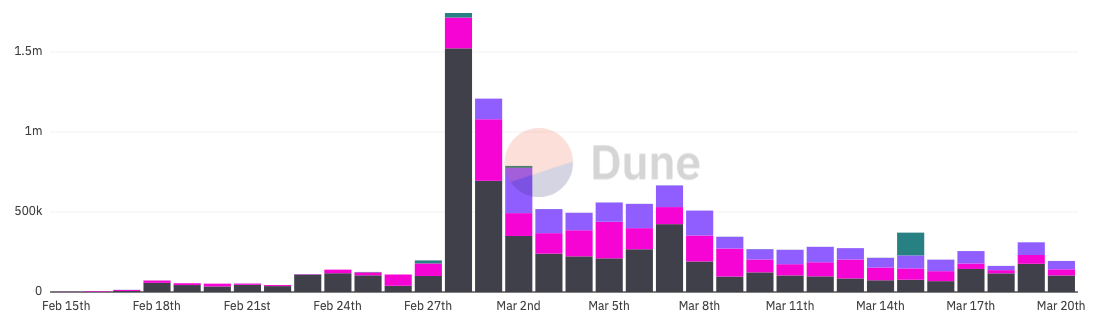

Bitcoin Ordinals (NFTs)

[caption id="attachment_265464" align="aligncenter" width="1096"] Volume by Ordinals Marketplace (USD)[/caption]

Volume by Ordinals Marketplace (USD)[/caption]

The Bitcoin NFT scene has chilled a bit since its early-March buzz, but it's far from game over. Multiple projects such as DeGods and Solana Monkey Business are expanding by launching an Ordinals collection.

However, watch out for shady projects that have popped up to cash in on the hype. Their developers are likely just after a quick buck and might ghost once they've got it. So, stay alert!

While Ordinals are interesting and attractive, NFTs and Bitcoin don't exactly go hand-in-hand. Still, a few collections might rise to legendary status, however – you have to do your homework before placing those bets. Good news, though: our NFT Digest is launching next week to keep you in the loop!

Cryptonary’s Take

In these unpredictable financial times, $BTC is stepping up as a potential safeguard of value, alongside classic hedges like gold.We're now just a hair's breadth away from our $30,000 target, but expect some resistance as a few investors cash in their chips. Don't sweat it, though – any pullback will likely be short-lived, taking us back to around $25,500 first before rallying to $35,000 and $45,000.

Now, if the financial system keeps crumbling and the Fed hits the brakes on rate hikes, Bitcoin could switch back to "Up Only" mode, smashing through new all-time highs. It's a big "IF," but definitely not off the table.

As always, thank you for reading 🙏

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms