So, what’s happening this week?

Binance shifted $1B from $BUSD to $BTC, $ETH, and $BNB. Uniswap launched its V3 on BNB Chain, and Level Finance’s TVL (total value locked) continued to grow.

What does all this mean for $BNB and the Binance ecosystem?

Let’s dive in!

TLDR

- Binance is abandoning $BUSD in favor of $1B in $BTC, $ETH, and $BNB.

- Uniswap V3 is now live on the BNB Chain, but it’s questionable whether it will be able to compete with PancakeSwap.

- Level Finance continues to rise in TVL, but a competitor emerged this month.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Binance converts $BUSD into $BTC, $BNB, and $ETH… why?

On March 13, Binance CEO Changpeng Zhao (aka CZ) announced that Binance would convert the remaining $1B of $BUSD from its Industry Recovery Initiative, which was created as a fund to help the crypto industry financially during bankruptcies and insolvencies from last year, into $BTC, $BNB, and $ETH. This move was made in response to recent issues surrounding banks and stablecoins. Circle experienced problems with $USDC, and $BUSD has been facing regulatory pressure. As a result, Paxos, a stablecoin issuer, decided to stop minting $BUSD because the SEC classified the stablecoin as a security.Overall, the market reacted quite positively, with $BTC increasing 10% on the day of the announcement!

It’s likely that Binance will allocate a significant portion of the $1B to $BNB, given its relationship with BNB Chain.

This had a positive effect on $BNB's price.

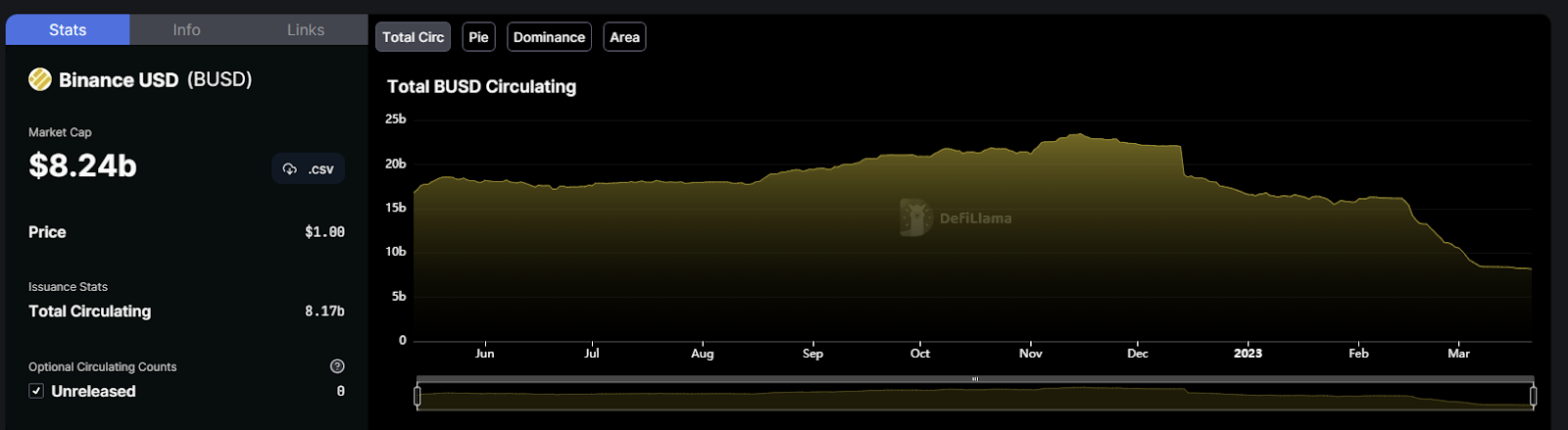

The decline of $BUSD’s market cap

CZ tried to present this move as one caused by the general uncertainty surrounding stablecoins and banks. However, the main reason is that $BUSD has been on shaky ground since February, when authorities forced stablecoin issuer Paxos to stop minting it.As a result, the market capitalization of $BUSD has steadily fallen from $16B to $8B. This decline is attributed to both Paxos' decision to stop minting new $BUSD tokens and users gradually shifting away from the stablecoin.

Which stablecoin will replace $BUSD on the BNB Chain?

As $BUSD is being phased out and no new stablecoins can be minted, it is expected to gradually fall out of the top five stablecoins on BNB Chain. The question is whether users will switch to traditional stablecoins such as $USDT and $USDC, or if a BNB-native stablecoin will emerge to take its place.Currently, Tether ($USDT) appears to be the strongest candidate to take $BUSD’s market share, with $3.21B already in circulation on BNB Chain.

However, we’re keeping an eye out for any new, decentralised stablecoins that may launch on BNB Chain. There appears to be an opportunity for a BNB-native stablecoin to launch and take some market share, similar to how $DAI grew on Ethereum as it was accepted by the Ethereum community.

Uniswap V3 launches on BNB Chain

Uniswap has announced the official launch of Uniswap V3 on the BNB Chain. This launch puts Uniswap in direct competition with Binance's DEX, PancakeSwap.Since its launch on March 15th, Uniswap V3 has only attracted $10.32 million in total value locked (TVL) on the BNB Chain. According to DefiLlama, Uniswap's trading volume has remained around $7 million per day since its launch. This is significantly less than PancakeSwap, which has a TVL of $2.33 billion and volumes ranging between $100 and $300 million. It remains to be seen whether Uniswap will be able to dethrone PancakeSwap, given PancakeSwap's entrenched position on the BNB Chain.

PancakeSwap V3 is also set to be released in April. It appears to be an upgrade designed to compete with Uniswap’s V3. However, it’s still early days and it will take some time for the exchanges to battle for liquidity on BNB Chain.

$BNB’s price action

BNB reached resistance ($335) last week and is now trading just under this level. Until we see a weekly closure above $335, the possibility that BNB could retrace back to support at $300 has a high chance of happening.

We'd want to see $335 reclaimed to confirm further upside, otherwise, a move to $300 (gray box) is on the cards.

BNB’s ecosystem

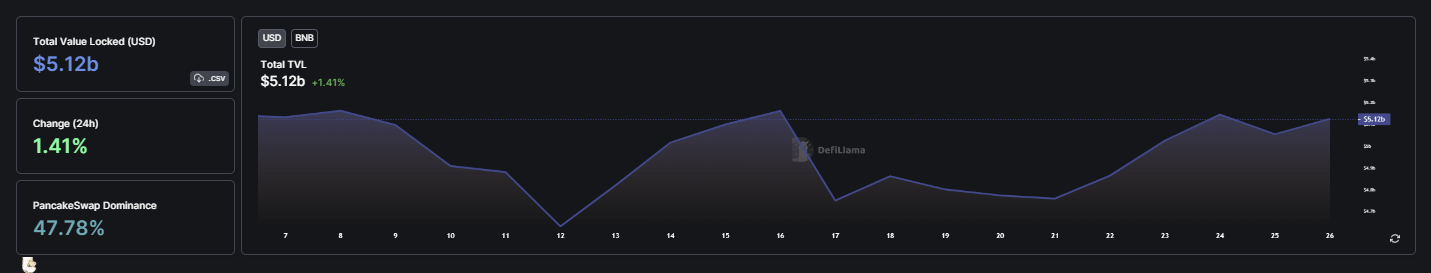

The total value locked (TVL) on the BNB Chain remained relatively stable. It experienced a downturn, reaching a low of $4.75 billion, before recovering to a TVL of $5.12 billion. This represents a small change from its previous amount of $5.13 billion on March 7th.

Largest TVL growth:

- Level Finance, the leading perp DEX on BNB Chain, saw an increase of 30% since March 7. Its TVL also increased from $19.7M to $25.8M, making it the most popular place to trade perps on the BNB Chain.

- Planet’s TVL climbed by 19%, from $15.7M to $18.73M, due to its release of perpetual markets in collaboration with ApolloX. This will compete with Level Finance as a new perp DEX for users to trade on.

Other News

- Oasis Origin won first prize in BNB Chain and CyberConnect Connected 2023 Web3 Social Hackathon.

- Community questions opaque finances at BNB Chain protocol Venus.

- THENA x FLOKI Alliance to Strengthen Liquidity on BNB Chain

- BNB Chain's Zero2Hero Hackathon Secures Strong Support

Cryptonary’s take

Binance appears to be abandoning $BUSD entirely, having shifted its $1B recovery fund into $BTC, $ETH, and $BNB. While this has had a favorable influence on $BNB’s price, it’s unclear what will replace $BUSD when the stablecoin is gradually phased out on the BNB Chain.When it comes to DeFi on the BNB Chain, Level Finance appears to be the obvious victor for the time being. But, Planet has also announced the creation of a rival perp DEX, so it will be interesting to see who can gain the upper hand here.

If BNB fails to reclaim $335, it could potentially drop to $300. Since we are currently in the middle of this range, the risk-to-reward ratio isn't that great.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms