So, what’s happening this week?

Discover the latest updates on BNB Chain, including the newly released roadmap, PancakeSwap's V3 announcement, and two DeFi protocols with skyrocketing TVL (Total Value Locked).

Let’s dive in!

TLDR

- BNB Chain has announced plans to improve performance, scalability, security, and decentralisation.

- Decentralised exchange PancakeSwap announced that it will roll out a new version of its application on the BNB Smart Chain next month.

- DeFi TVL has risen on the BNB Chain this year.

- Share this report with your family and friends.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

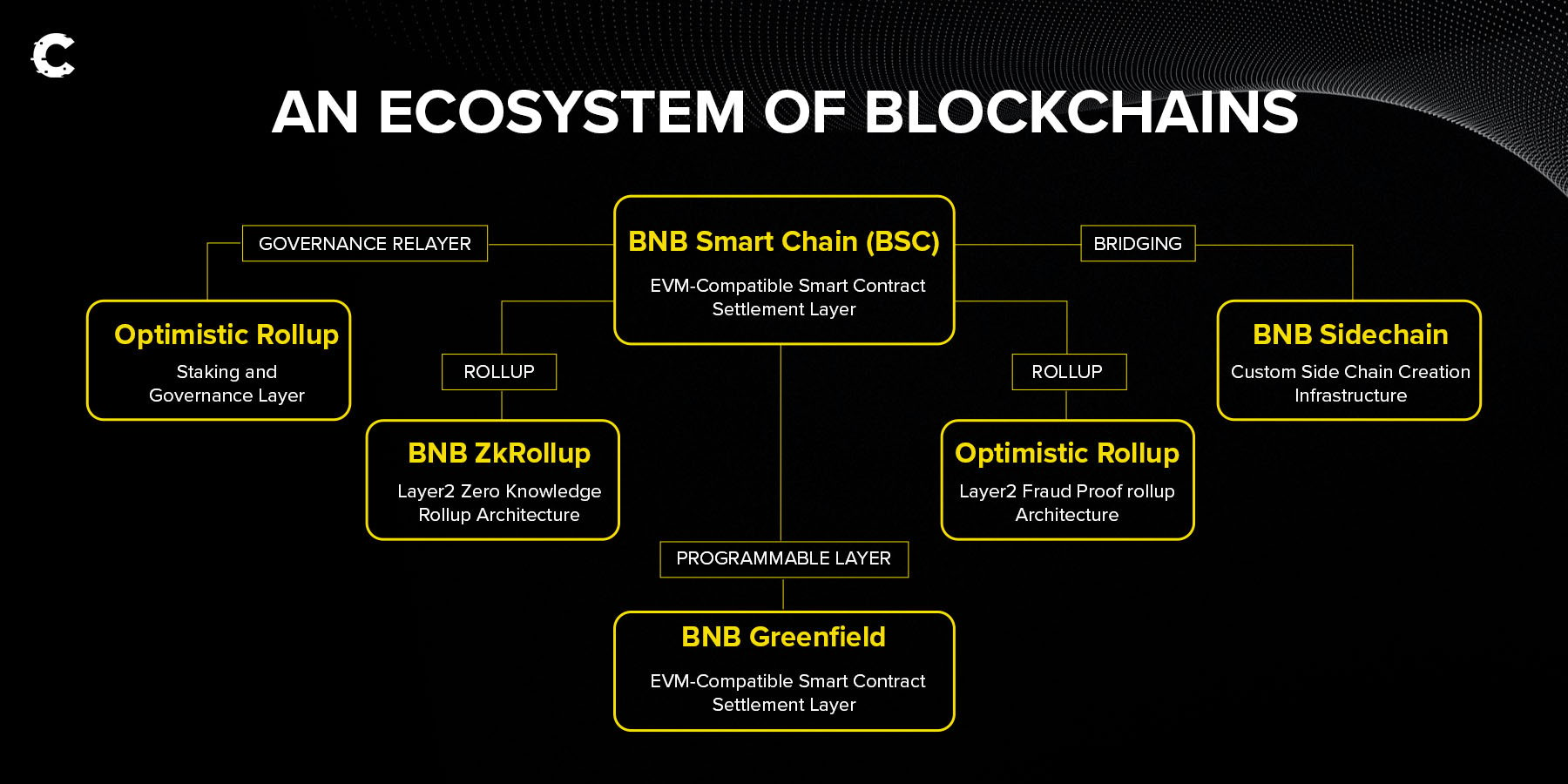

BNB Chain Unveils Ambitious Tech Roadmap for 2023

BNB Chain has announced extensive plans to improve performance, scalability, security, decentralisation, and infrastructure this year.

But there’s no need to sift through lengthy technical reports! We've got you covered with a quick overview:

Scalability

- Increase throughput from 2,200 transactions per second (TPS) to 5,000 TPS, allowing the chain to process more transactions at a faster rate.

- Introduce Optimistic rollups, making transactions cheaper and faster.

- Launch BNB Greenfield. This will host decentralised applications (dApps) and support the development of new blockchain-based businesses.

- Launch zkBNB. This Layer 2 infrastructure will be EVM (Ethereum Virtual Machine)-compatible.

Security

- Implement a hybrid consensus mechanism to improve security.

- Implement new data encryption and privacy features. This will open up new privacy applications, such as private transactions.

- Upgrade disaster recovery mechanisms and conduct regular security audits.

Infrastructure

- Upgrade the network's infrastructure to handle increased traffic and provide a seamless user experience for dApps.

- Improve the network's API service to provide additional endpoints for third-party developers to interact with. This means developers can build more complicated and useful apps on top of the blockchain.

- Develop a new cross-chain transfer protocol to facilitate interoperability between different blockchains.

Decentralisation

- Increase the number of validators (from 100 to 29). More validators will have on-chain governance to influence the direction of the network and its rules, improving decentralisation.

PancakeSwap V3 is Coming to BNB Chain

Decentralised exchange PancakeSwap announced on Saturday that it will roll out a new version of its application on BNB Smart Chain next month. This will be accompanied by upgrades like more competitive trading fees and improved liquidity provisioning.PancakeSwap also outlined a rewards campaign that will give users an airdrop of the exchange’s $CAKE token if they contribute liquidity.

Is Uniswap Coming to BNB Chain?

As PancakeSwap prepares to launch V3, a new competitor has emerged as Uniswap has voted to deploy on the BNB Chain using the cross-chain bridge Wormhole.A total of 500 addresses voted, with 84.8 million votes cast. 65.89% supported the proposition, 33.57% opposed it, and 0.53% abstained.

The move is happening now because Uniswap V3's business source licence (BSL) is set to expire in the coming months. This would allow other protocols to use its code.

When PancakeSwap V3 is released, it may face harsh competition from Uniswap for some of its market share…

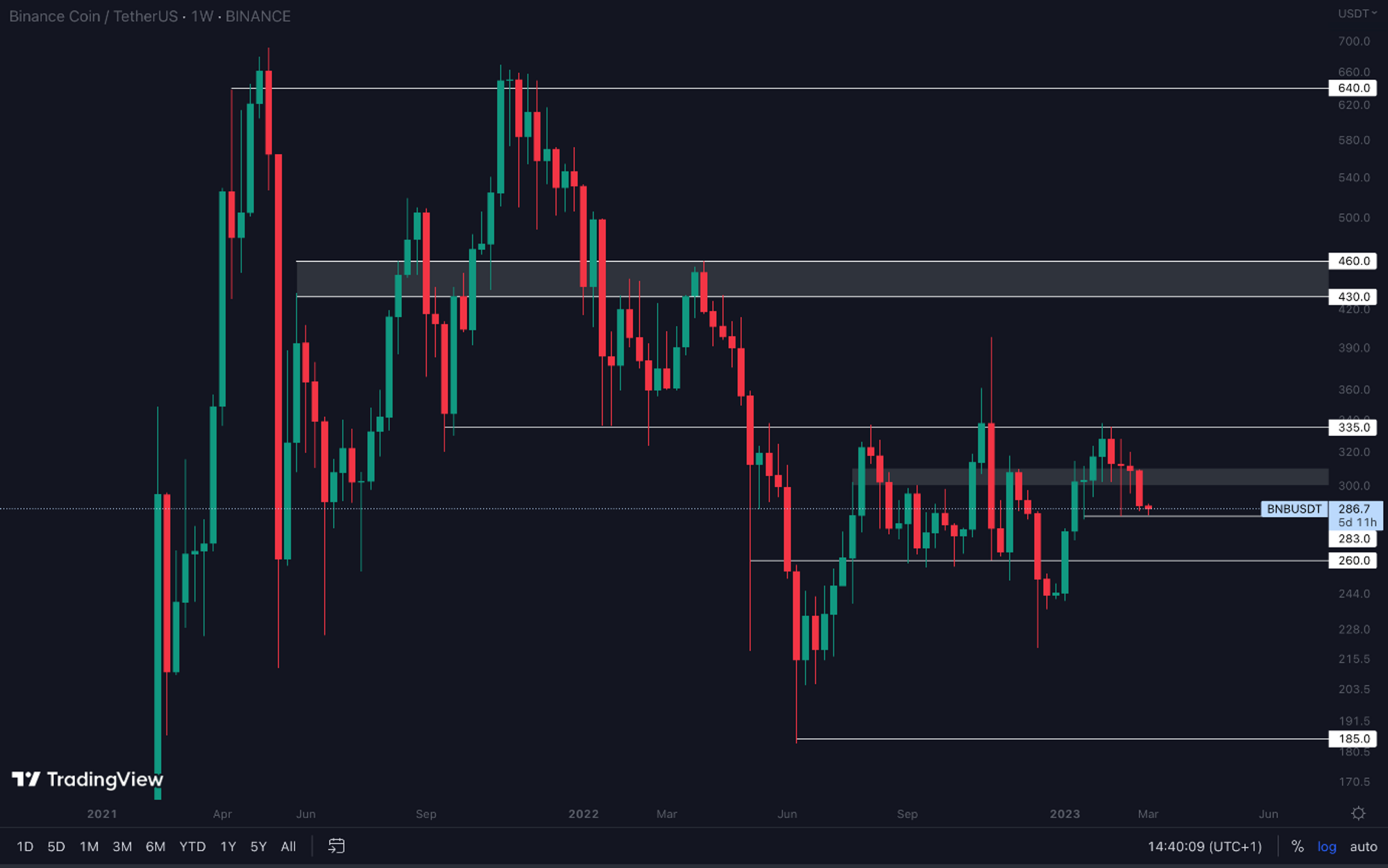

$BNB’s Price Action

BNB is currently testing $283 as support, but this level is relatively weak compared to others due to its limited number of tests. From a larger perspective, we’re focused on tracking BNB for a breakout from the $260-$335 range (where it’s been trading for more than 7 months).

If BNB closes a weekly candle above $335, we may see it test $430 in the coming weeks. Conversely, BNB closing below $260 would confirm a move to $185.

If you're considering investing in BNB, it's important to pay attention to its current support level and the $260-$335 range it has been trading in for over 7 months. Our take? Stacking some BNB right now is a good decision as long as Bitcoin remains bullish on the higher time frames. Altcoins aren’t prepared to perform well on their own, so Bitcoin’s price action is the main factor in their trajectories.

We keep a close eye on BNB's and BTC’s price actions in our weekly TA reports, so stay tuned.

BNB’s Ecosystem

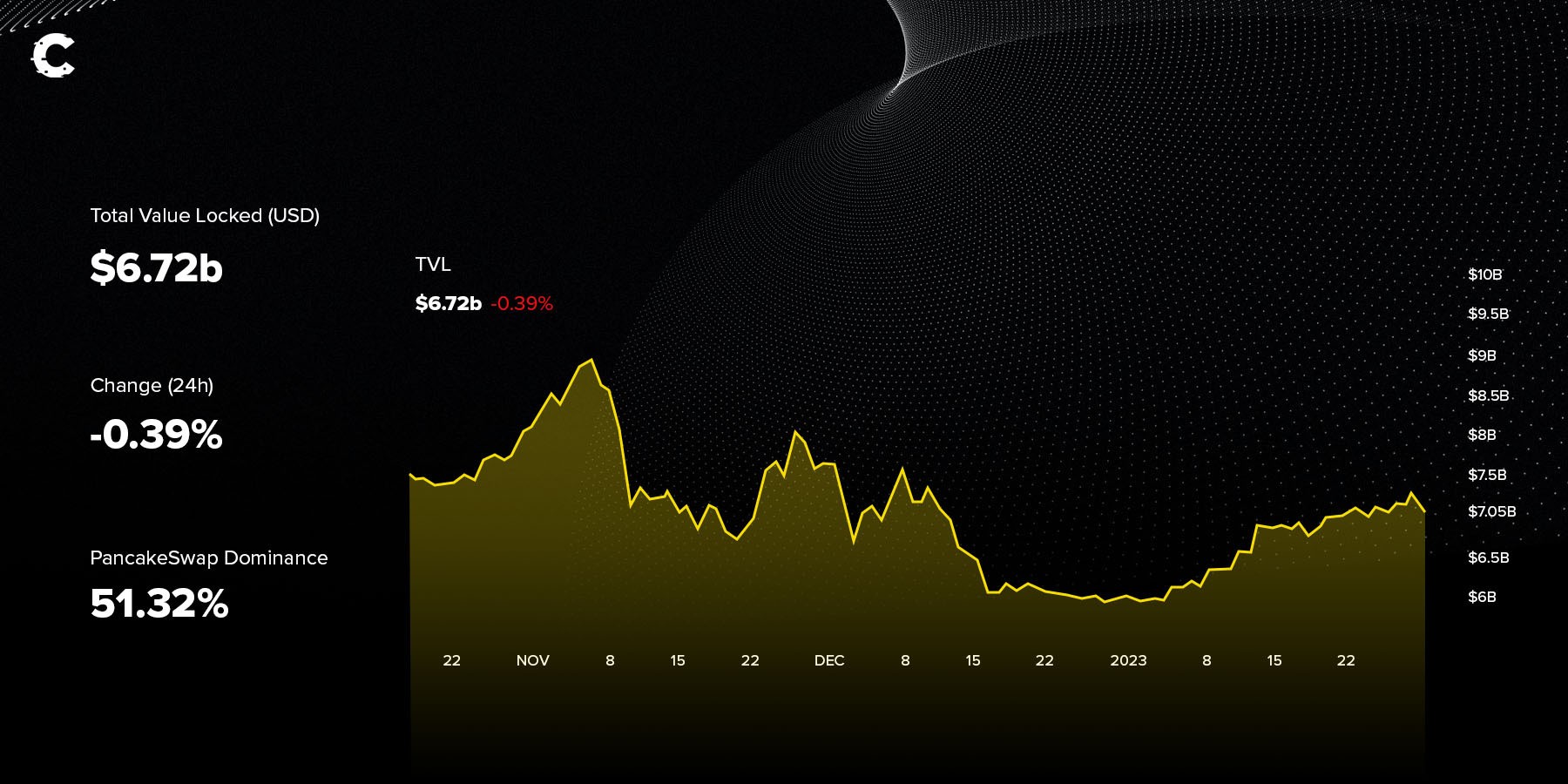

BNB Chain's DeFi TVL hit a low of $5.96B on January 2 but has since recovered, rising 12.75% to $6.72B on March 7.

Largest TVL growth:

- Thena Finance: the top Solidly exchange fork (designed to encourage high-volume instead of high-liquidity pools) has quickly become the 5th biggest protocol on Binance Smart Chain despite launching just two months ago. It raised $171M in TVL in just 3 months, contributing greatly to the overall TVL growth on BNB Chain.

- Level Finance: the leading perp DEX on BNB Chain. Despite still being relatively tiny, it witnessed the greatest percentage rise, from $1.2M in TVL at the start of the year to $21.99M in TVL on March 7 (1732.5% increase).

Other News

- Trader Joe is now live on BNB Chain.

- BNB Chain launches new ecosystem bounty board.

- BNB Chain hackathon winner accuses Binance of stealing AI-powered NFTs idea.

- Proposal for deployment of ‘Euler’ lending protocol to BNB Chain gets approved.

Cryptonary’s Take | Conclusion

There’s a lot of activity on BNB Chain right now, with the roadmap being the major focus. The roadmap is ambitious but it has undoubtedly piqued the interest of many. We’re particularly excited by the launch of zkBNB, which should be an interesting Layer 2 to explore this year.The DeFi ecosystem has developed significantly as protocols like Thena Finance have gained momentum. The battle between PancakeSwap and Uniswap to become the dominant DEX for BNB Chain will also be exciting to watch.

Despite the excitement surrounding BNB Chain and its growing DeFi ecosystem, BNB's price action has been lacklustre for the past 7 months. It's currently testing support at $283 and has a breakout potential above $335. We believe BNB will reach higher targets in Q2 because the rest of the market is due to perform well. Take a look at our predictions for Q2 here.

As always, thank you for reading.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms