So, what’s going on this week?

Bitcoin DeFi is on the rise with multiple assets pulling +200% in February alone, Yuga Labs are launching their own NFT on Bitcoin and Gensler affirmed BTC not being a security.

TLDR

- SEC’s Gensler: “Everything other than Bitcoin is a security.”

- Bitcoin Ordinals growth is stagnant but may soon catch fire again thanks to Yuga Labs.

- BTC DeFi is becoming (very oddly) a major story with three related tokens going up +200% in February.

- Our BTC price target remains unchanged at $30,000

- Share this report with your family and friends.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

“Everything is a Security Except for Bitcoin”

Gary Gensler, the SEC’s Chairman, has told New York Magazine: “Everything other than Bitcoin, you can find a website, you can find a group of entrepreneurs, they might set up their legal entities in a tax haven offshore, they might have a foundation, they might lawyer it up to try to arbitrage and make it hard jurisdictionally or so forth. They might drop their tokens overseas at first and contend or pretend that it’s going to take six months before they come back to the U.S. But at the core, these tokens are securities because there’s a group in the middle and the public is anticipating profits based on that group.”

This is good news for Bitcoin, but it may have severe consequences for the crypto space. Gensler makes a valid point that many (but not all) crypto assets are securities.

However, the key is to change how securities are regulated. If the SEC chooses to be rigid and restrict innovation by regulating this technology in a century-old framework, the loser will be the US, as innovation will moveelsewhere.

Bitcoin Ordinals | Update

[caption id="attachment_263026" align="aligncenter" width="1112"] New Bitcoin NFTs (orange bars represent images, red are text).[/caption]

New Bitcoin NFTs (orange bars represent images, red are text).[/caption]

In the previous digest, we discussed the rise of of the NFT platform on Bitcoin called Ordinals. If you haven’t read it yet, we highly recommend you do so (click here) before continuing with this section.

As shown above, new NFTs are still being minted on Bitcoin, but at a stable rate without much hype.You can check out Ordinals on these two NFT marketplaces:

- Ordinals.Market

- Gamma.io

You might notice that neither is built directly on the Bitcoin network. One uses Stacks, a layer on top of it, and the other simply uses Ethereum for trading NFTs. This fact alone should give you an idea of how fundamentally unsound Bitcoin Ordinals are. However, the hype is there and it’s about to go up some more. Why? Because of Yuga Labs.

Yuga Labs is the company responsible for the popular "Bored Apes Yacht Club" NFT, which achieved massive success on Ethereum. Now, their team plans to launch a 300-piece NFT collection on Bitcoin called TwelveFold.Introducing TwelveFold. A limited edition collection of 300 generative pieces, inscribed on satoshis on the Bitcoin blockchain.https://t.co/aFWEIhzqcI pic.twitter.com/PjWABKKBr4

— Yuga Labs (@yugalabs) February 27, 2023

The auction will start next week with the date announced 24 hours prior. If you want to take part, keep your eyes peeled on Yuga Labs’ Twitter account (turn on notifications) and read the TwelveFold FAQ here.

In our opinion, Bitcoin Ordinals lack the technology but there will be a few collections that become timeless. If the latter happens then TwelveFold may be one of them, but a collection like Bitcoin Punks not so much. After all, you can’t just copy an existing collection from another chain and call it yours.

Bitcoin DeFi | WTF?

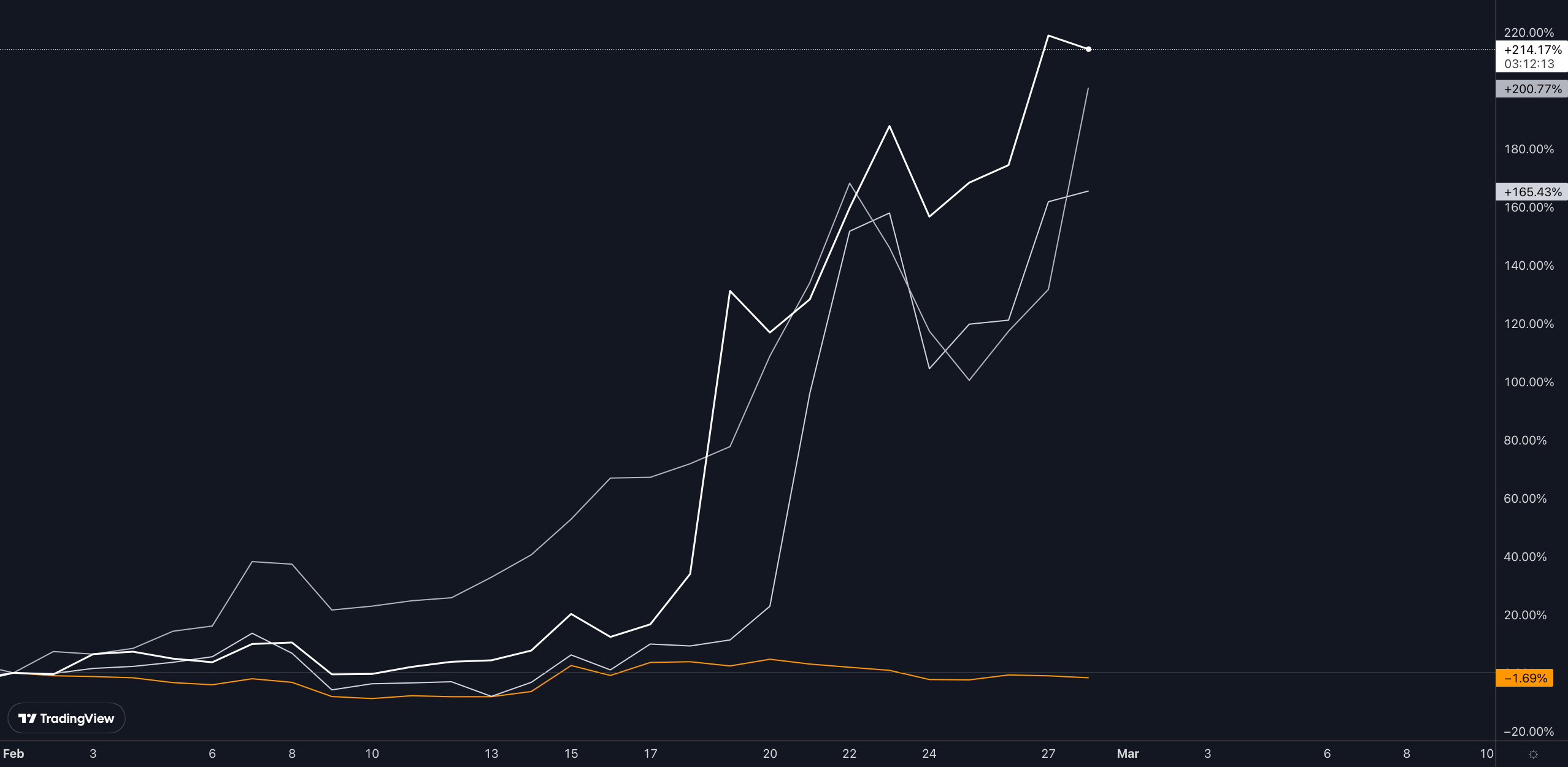

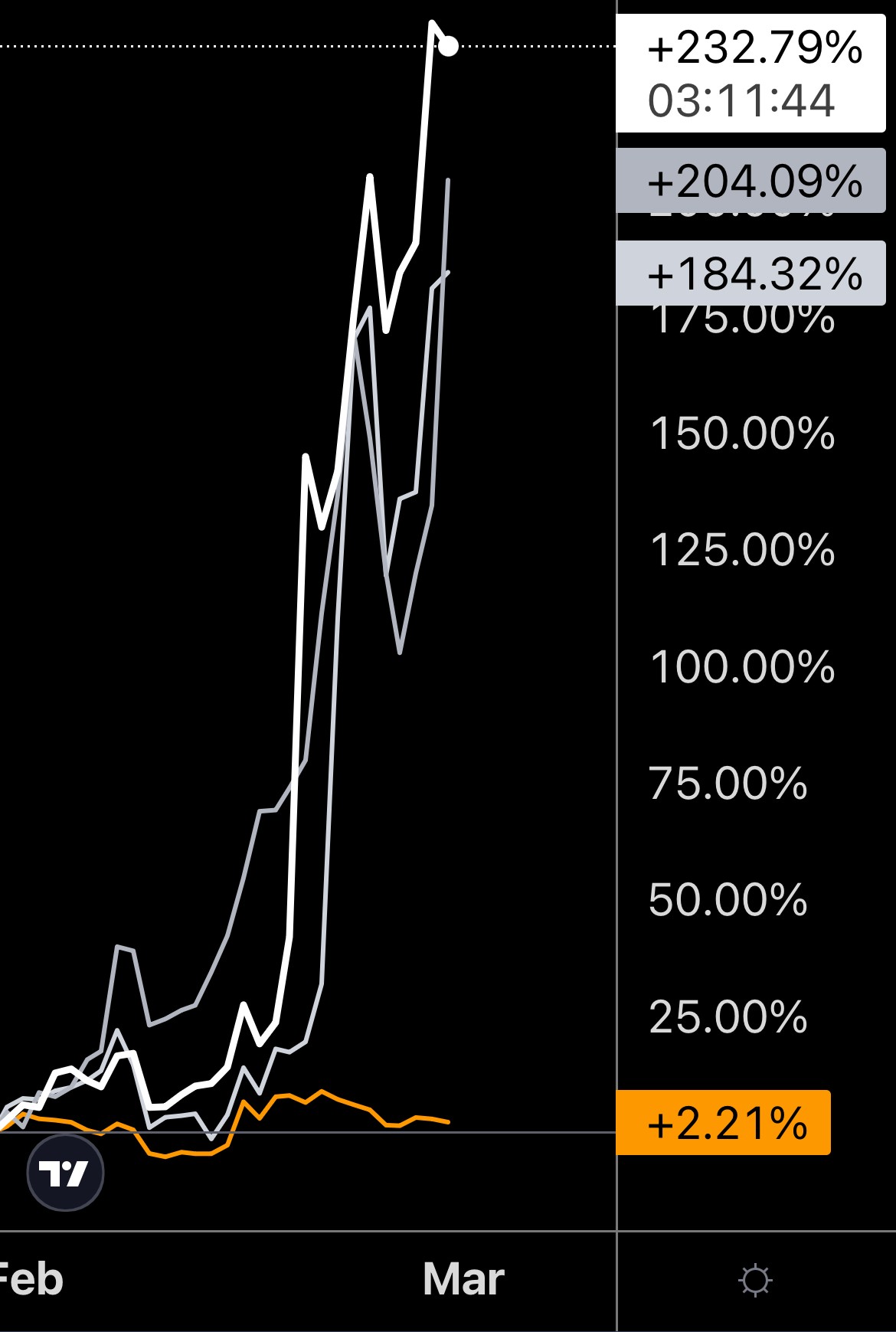

Two words that were never meant to meet in a single sentence, let alone sit side by side but it is what it is. We can either be critics or opportunists; and critics don’t make money.Take a look at the returns from three Bitcoin-Fi projects (shades of white) compared to BTC’s (orange) 👇

As you can see, the monster returns all occurred in February alone. Which projects are responsible for this?

- Stacks (STX | $1.2B MCap): The Stacks Network adds smart contract capability to Bitcoin.

- Sovryn (SOV | $17M MCap): DefI Solution on Bitcoin allowing trading, lending and more.

- RSK Infrastucture Framework (RIF | $148M MCap): Open source tools to build DeFi apps on Bitcoin.

- $BADGER ($70M MCap): Badger is not DeFi on Bitcoin but rather a project making efforts to grow Bitcoin in the existing DeFi landscape (Ethereum in particular). This project stands out not because of its fundamentals but rather its pumpamentals. Last week, Badger announced a competitor to Wrapped Bitcoin (wBTC) called eBTC. The timing of the release and the use of LSDs (Liquid Staking Derivatives) as part of the mechanism for eBTC tells us all we need to know. Badger’s founder is trying to pump Badger by using different narratives with hype, and attaching them to this project.

- $COVAL ($31M MCap): You heard it from Cryptonary first: we told you people are trading Bitcoin Ordinals on Ethereum. So the way this is done is through Emblem Vault, the project behind the COVAL token. Even Litecoin NFTs are using Emblem Vault to offer trading on Ethereum. If you’re betting that Ordinals gain traction, then COVAL is probably a good play for you. This is the only project on this list that stands out with decent fundamentals.

- $REN ($110M MCap): Ren has been building a competitor to the centralized wBTC. Unlike Badger, the developers of this project didn't just announce its existence for the hype. Unfortunately, Ren was acquired by Alameda, which filed for bankruptcy. The developers are looking to make a comeback by launching Ren 2.0 soon, but the road may be bumpy. There are also rumors that Binance is looking to acquire them. All this means Ren is a very risky play in the short term.

- $ORD ($5M MCap): Ordinex is planning to build an exchange for Bitcoin Ordinals. Maybe they’ll deliver, maybe they won’t; no one knows as they’ve only delivered words so far. This is a degen(erate) play.

- $OFI ($900k MCap): Ordinals Finance opens the door to Ordinals lending. Does it smell shady? Oh yes, but we want to keep you up to date on what’s been happening.

Bitcoin Price | $30,000 Target

Our target of $30,000 still stands, and the risk-to-reward ratio remains very low after BTC rose from resistance to support at $20,000.

There have been no changes since the previous digest regarding price (or whale movements) so we won’t bore you with unnecessary words just for the sake of them. To stay up-to-date, join our Free Discord to access daily BTC analysis.

Cryptonary’s Take | Conclusion

While some Ordinal collections may become OGs, we remain very doubtful on the sustainability of Ordinals and BTC-Fi. Nonetheless, this is the current hype and glowing narrative of crypto and betting against hype is wrong.This hype will drive further attention to Bitcoin and that’s all we need for our current target of $30,000 to be reached.

As always, thank you for reading 🙏Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms