Cryptonary’s DeFi Digest | March 2nd

Are you ready to get your quick and easy fill of DeFi? This report is part of Cryptonary's suite of blockchain and coin digests, a set of regularly-published reports covering the projects and developments you need to know about, when you need to know them. Our digests are fast but substantial reads, and you'll be better informed and prepared by consuming them.

Cryptonary’s DeFi Digest is the only decentralised finance guide you’ll ever need.

DeFi is shaking up traditional finance, and there are endless opportunities for the taking - if you know where to look.

Every other week, we’ll break down the latest trends in the DeFi space in simple terms and highlight the hottest opportunities just for you.

This week, we dive into Level Finance’s recent 200X rise. We break down the heated battle for the top spot in the NFT DeFi space. And, we look at the launch of MakerDAO’s exciting new protocol to compete with Aave.

Let’s dive in, Cryptonary crew!

TLDR

- Protocols continue to develop, shipping new upgrades and expanding to new chains.

- Tokenomics are improving (PERP, dYdX), making the industry more competitive.

- Protocols migrating to Arbitrum are experiencing a “pump” effect.

- Uniswap is working against the clock to expand to BNB Chain before its license expires in April (and anyone can copy/paste the code themselves).

- New decentralised stablecoins are on the horizon, one of which is tied to living costs rather than the US Dollar.

- The DeFi insurance sector is currently processing FTX/BlockFi claims.

The Quick Summary

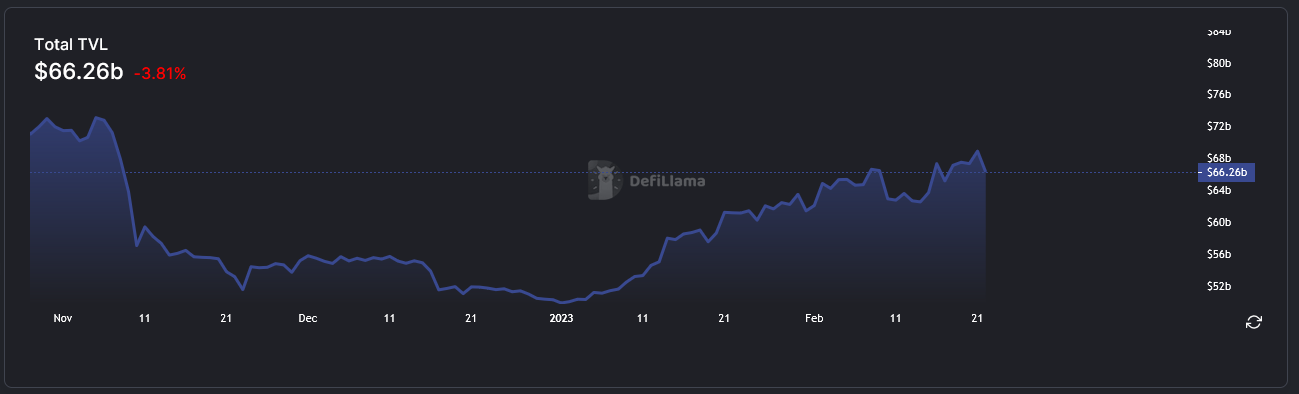

Since the start of the year, DeFi (blue) has been outperforming BTC (orange) - and for a good reason.

Total value locked (TVL: a measure of all assets staked/bonded/deposited) in DeFi is up $10B since the start of 2023.

What caused this impressive growth?

The most noteworthy development was the increased popularity of decentralised exchanges (DEXs), with over $200M in TVL added. Given the recent issues with centralised exchanges like FTX, many users opted for DEXs.

Other areas of DeFi, such as insurance protocols, asset management, and prediction markets, are also at the forefront.

The derivative sector has seen skyrocketing token prices, with many assets up over 100% since the new year. In this article, we even discuss one that is up a whooping 200X this year!

Lending Markets and Fixed Income

The first DeFi sector we’ll explore is Lending Markets and fixed income. Lending platforms allow users to borrow and lend cryptocurrencies, while fixed-income products offer a predictable rate of return.MakerDAO Launches Spark Protocol to Compete with Aave

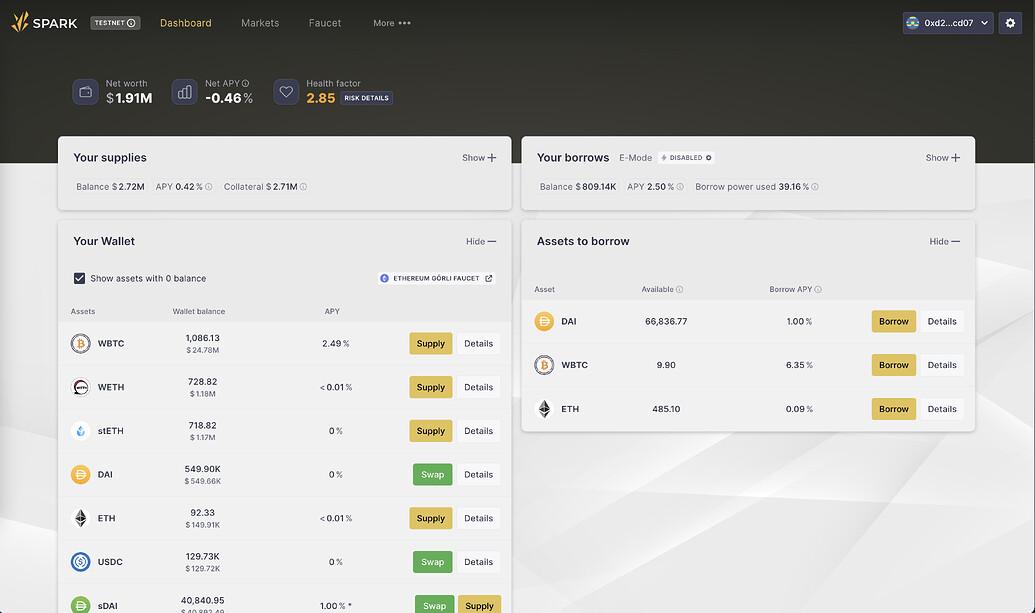

MakerDAO, one of the most prominent players in decentralised finance (DeFi), is launching a new lending platform to compete with Ethereum's Aave.

MakerDAO has been focusing on integrating its DAI stablecoin into popular DeFi protocols like Aave and Compound. However, Aave and Compound didn't integrate MakerDAO's Dai Savings Rate (DSR), offering as expected.

In response, MakerDAO has decided to fork Aave v3 and launch a new lending platform called Spark Lend, which uses Aave's code. Spark Protocol will pay 10% of its profits to AaveDAO for using the code.

MakerDAO is also collaborating with Element Finance and Sense Protocol to launch a fixed-rate product and a liquid staking derivative called sEtherDAI.

MakerDAO's latest moves come as competitors like Aave are preparing to launch their own stablecoins like $GHO, and crvUSD, both of which compete with DAI's on-chain liquidity.

By forking Aave and launching its own lending platform, MakerDAO intends to go it alone and not rely on competitors to integrate DAI.

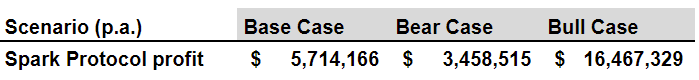

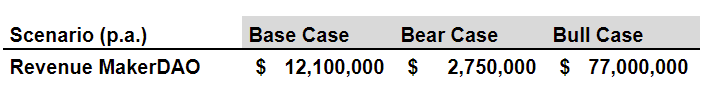

How much revenue could Spark Protocol generate?

Estimates of how much revenue Spark Protocol may generate after deployment have been provided in the governance proposal on the MakerDAO forum.

Based on assumptions, Spark Protocol may earn yearly protocol profits (after financing expenditures), as shown below, while also delivering substantial returns for MakerDAO as the protocol's only source of DAI.

MakerDAO price action

Despite the announcement of the Spark Protocol, MakerDAO has only marginally outperformed ETH since the beginning of 2023, with 47% performance vs 41% for ETH.

Radiant V2

Radiant Capital, a protocol aimed at creating the first omnichain money market (allowing users to lend and borrow assets from various blockchain ecosystems), has announced V2.

Advantages of Radiant V2:

- Users can deposit and borrow assets across multiple blockchains, starting with BNB Chain.

- Improved tokenomics, including lower emissions and a new fee distribution system.

- Liquidity providers (LPs) receive emissions, making it easier to provide liquidity to the platform.

- Improved locking gives users the ability to relock assets that have expired.

Radiant stated that V2 would experience a little delay but would launch as soon as the last audits and stress tests were finished, the protocol has not provided a definitive date.

Data Analysis

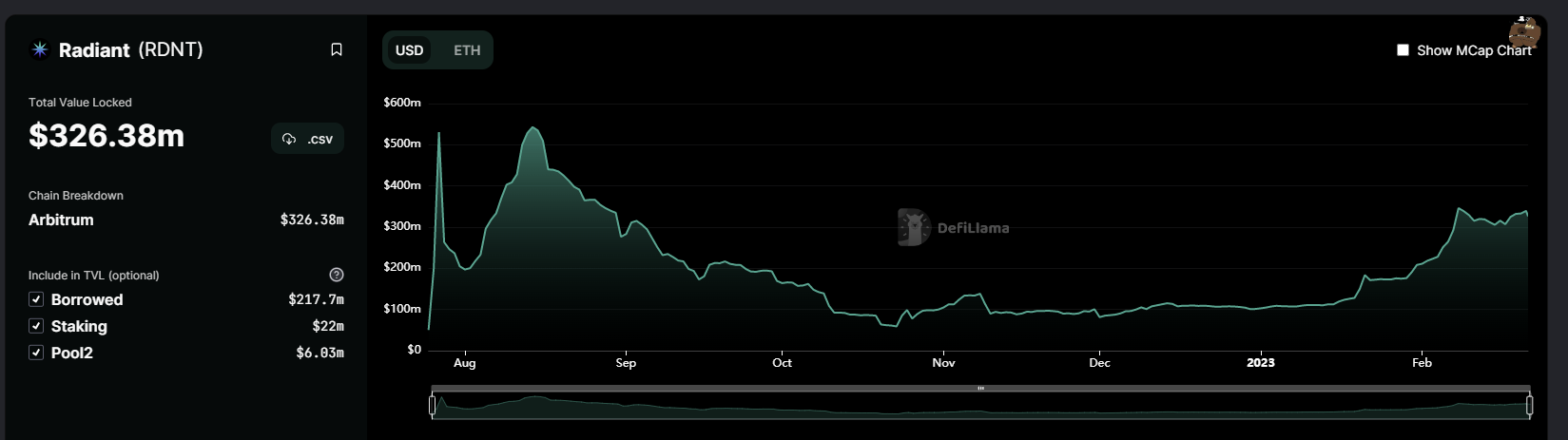

The protocol's TVL, which dropped to a low of roughly $60M in October 2022, has been steadily increasing and is currently at $326M.

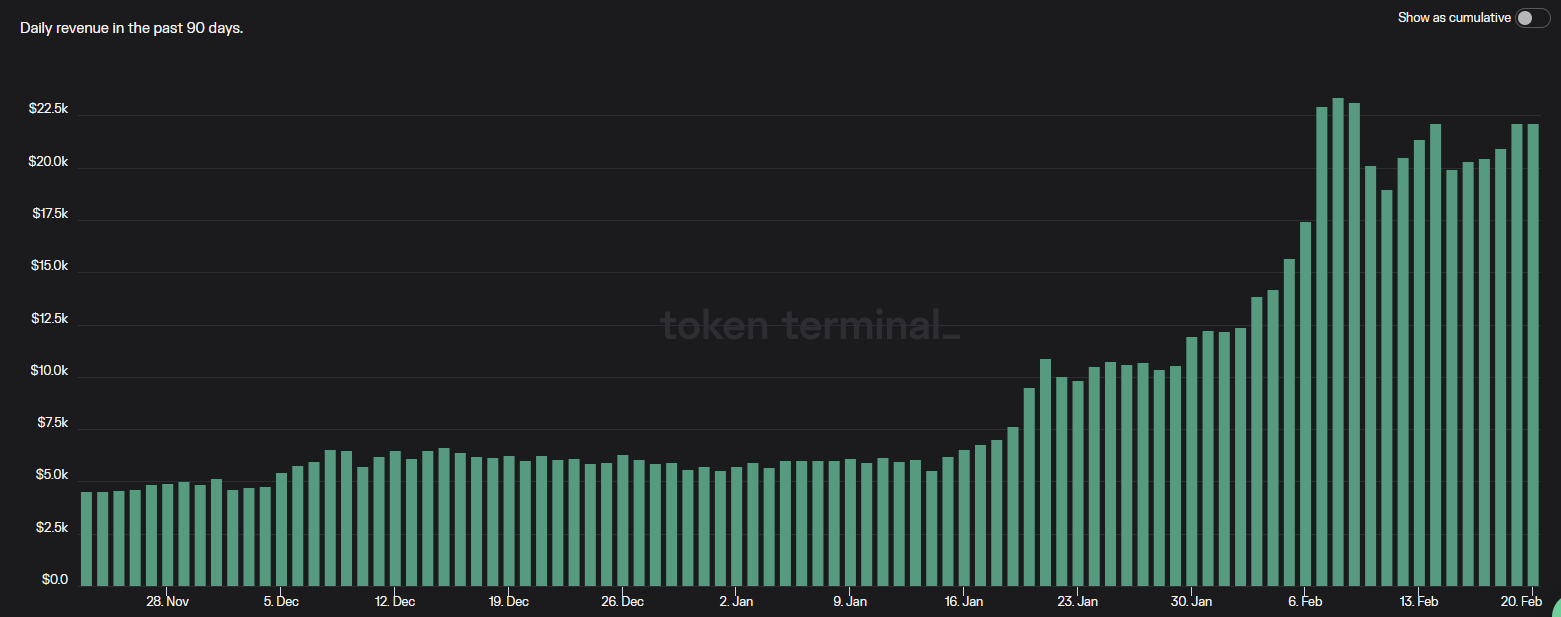

The daily protocol revenue has also grown, from $6K to $22K in the last 90 days.

Morpho Labs shares its plan now Aave V3 is live

Morpho, an on-chain peer-to-peer layer built on top of lending pools, has announced several changes in response to the latest Aave v3 upgrade.

Advantages of Morpho-Aave V3

- Seamless token approvals, reducing gas costs making DeFi interactions easier and safer.

- "Split Supply" mechanism for greater flexibility and improved rates for pure suppliers who don't borrow against their supplied positions while still allowing borrowing against some of their supply if they wish to do so.

- Morpho deployable on Aave V3 E-mode for maximized capital efficiency.

- "Manager" feature for users to approve actions on behalf of a given wallet, including supply, repay, withdraw, and borrow. Users can also withdraw and borrow directly to a different address.

Fixed Income

Yields often change in DeFi, but fixed income allows you to earn a predetermined yield regardless of supply and demand.Fixed income is essential for CeFi businesses, and it’s no different in DeFi. It’s very hard to plan ahead financially if loan conditions are constantly changing.

So what’s been happening?

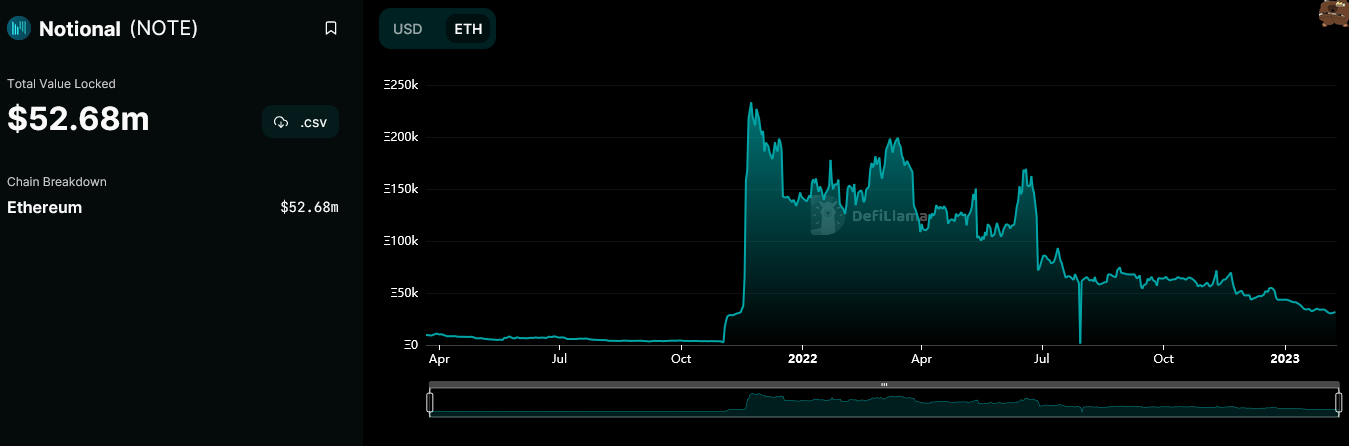

Notional Finance (NOTE): Leverage is Good

Notional Finance (NOTE) is an Ethereum-based lending market.

The launch of leveraged vaults has been a success - who doesn’t love more yield? Leveraged vaults allow borrowers to take out undercollateralised loans. They can use these funds in whitelisted smart contracts to generate increased yield.

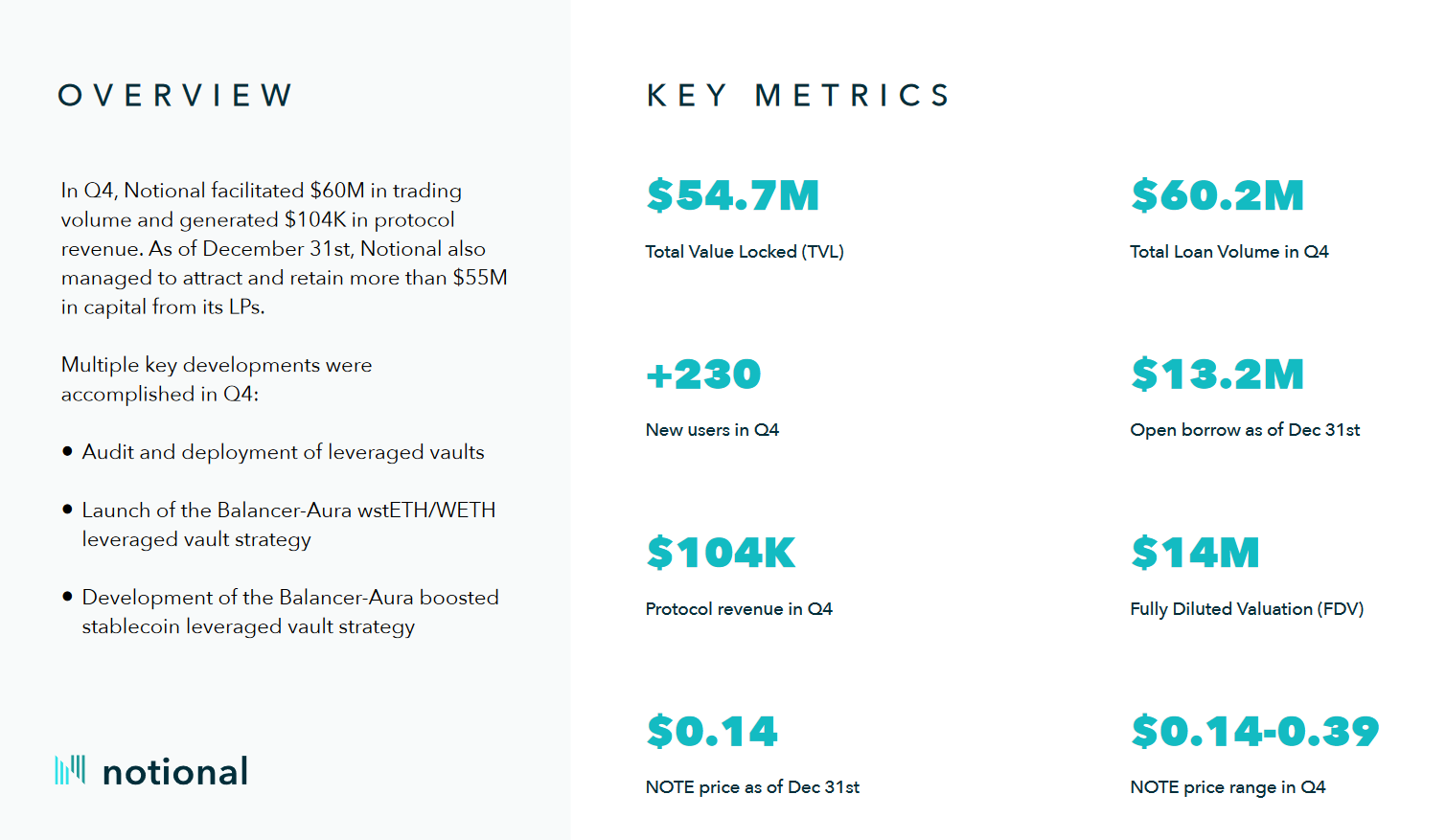

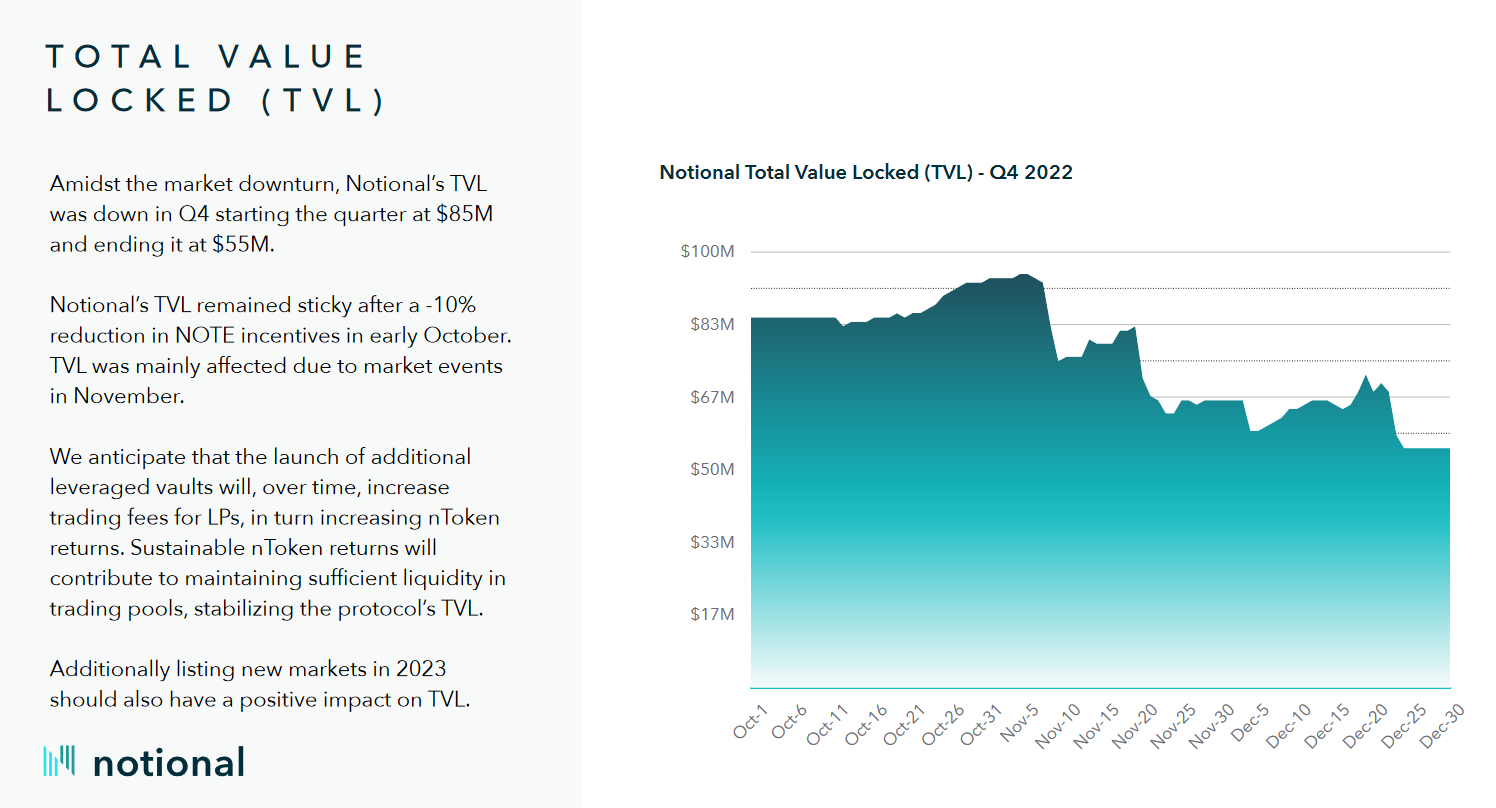

Notional released its Q4 2022 report; here are the highlights:

It’s striving to support new assets and expand leveraged vaults will be the key driver of growth in 2023.

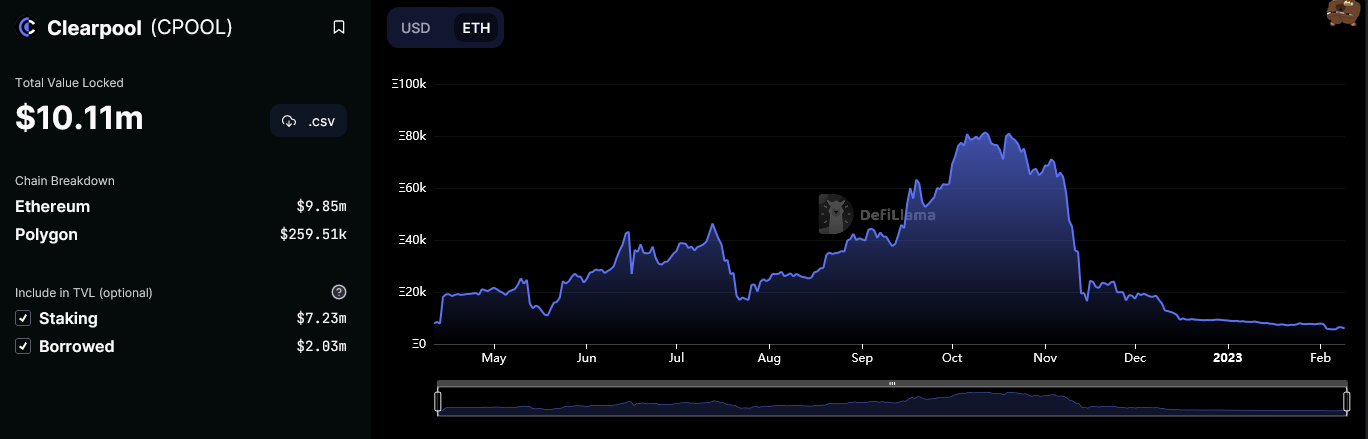

Clearpool (CPOOL): High-Class Patrons

Clearpool is another decentralised credit market. It recently announced the launch of Clearpool Prime, which aims to provide unsecured loans to KYC’d institutional borrowers.

Borrowers can attract capital to fill their loans, while lenders provide it through smart contracts. This should reduce the systemic risk factors inherent in CeFi lending.

The protocol also announced an industry first - exchange Traded Pools (ETPs). ETPs wrap up a basket of lending pools, allowing lenders to distribute across multiple pools in a single transaction. This is expected in Q4 2023.

Clearpool’s TVL has been trending down massively from the highs. However, with a target market of institutional borrowers, we expect this to pick up once Prime launches. Clearpool also offers one of the most competitive yields - 8% on ETH.

CPOOL has been picking up momentum, rallying 22% on the announcement of Clearpool Prime.

Protocols like Clearpool increase capital efficiency in the DeFi space as loans are not collateralised. Plugging the gap created by the collapse of centralised lenders is essential for large-scale DeFi operations. Credit markets like Clearpool fulfill that niche.

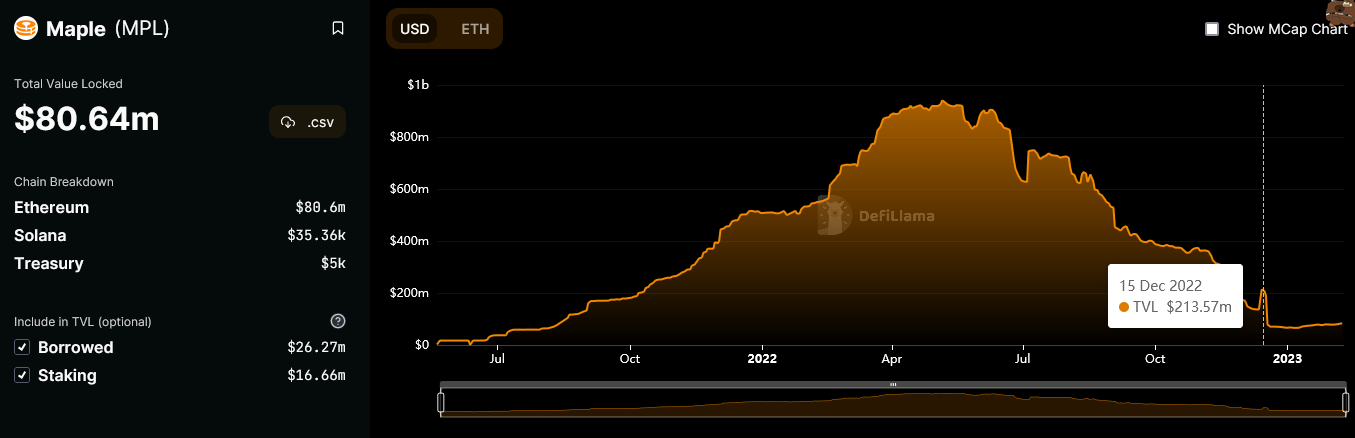

Maple Finance (MPL): Uncertain Times

Maple also offers undercollateralised loans to institutional borrowers. They’re active on Ethereum, but also Solana.

They suffered hugely after the collapse of FTX/Alameda, showcasing the risks of undercollateralised lending ($54 million in bad debt.)

TVL dropped massively as confidence was lost. But this was just the cherry on top of a long downward trend.

However, they tread on. Here’s their roadmap for the first half of 2023:

- Help ecosystems grow by targeting infrastructure - node operators, validators, and miners. These participants have stable incomes and strong balance sheets. Ideal candidates for lending.

- Expanding into real-world lending opportunities by offering low-rate alternative lending opportunities to CeFi businesses. And, taking advantage of external opportunities like US Treasuries and insurance refinancing.

Cryptonary is Watching…

- We are looking forward to the full launch of Spark Protocol and will keep an eye on its progress.

- We will be watching for the release of Radiant V2.

- Morpho Labs is an intriguing protocol, and we intend to test its Aave v3 integration.

- The $GHO launch will be Aave's next big event.

- New markets/assets being added to Notional’s offering.

- For an increase in protocol TVL, transactions, and fee generation.

- The launch of Clearpool Prime and its effects on protocol TVL/transaction count.

- CPOOL token price - continuation/confirmation that a bottom has formed.

- Any events or news that could prelude a rally.

- For a positive resolution to the FTX bad debt.

- The moves Maple makes both within and outside of crypto – products, partnerships, and investments.

Also in the News

- Euler Finance approved the plan to launch on the BNB chain

- The Aave community has voted to add cbETH, a liquid staking derivative token issued by Coinbase, to Aave V3 market on Ethereum.

- Silo Finance has released its 2023 strategy and roadmap.

- Hakka Finance is continuing its Play2Earn campaign. Users can complete simple tasks to earn rewards.

- Yield Protocol launched rETH support. Users can now take out a loan using rETH as collateral, and/or lend rETH.

NFT DeFi

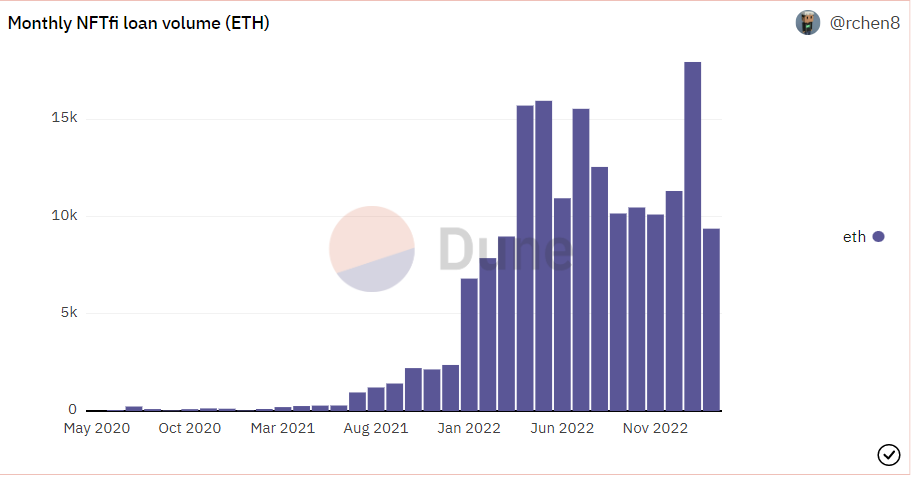

NFTfi & BendDAO: Battle for the Top Spot

The NFT lending ecosystem grew significantly in the first month of 2023. NFTfi, the lending protocol, reached an ATH in volume…

The USD loan volume hit $26.3M in January, the biggest since May 2022. In Febuary, the protocol has already achieved $15M in volume.

Despite NFTfi setting new records in January, BendDAO tops the list with more than $25M in USD loan volume already completed in February.

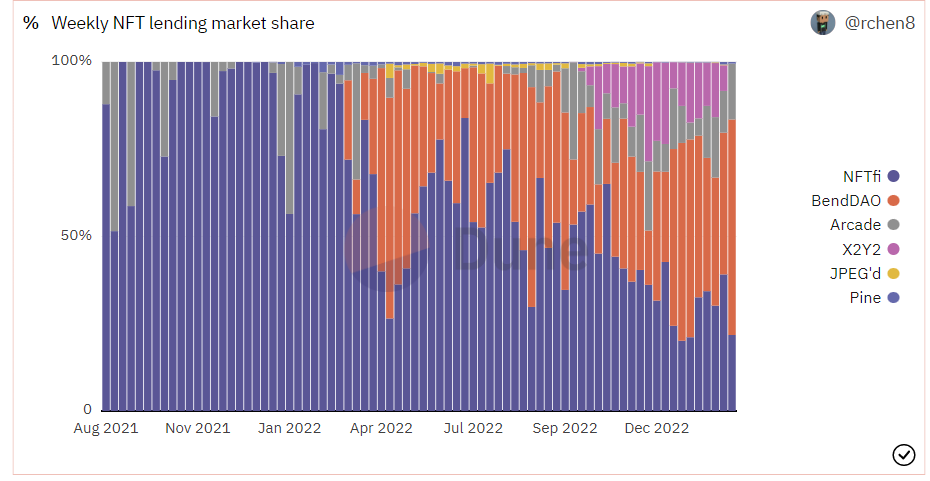

BendDAO has emerged as the largest NFT lending protocol, with a 60% weekly market share, followed by NFTfi, which has a 25% market share.

Sudoswap: Airdrop Done

Sudoswap, an NFT marketplace, distributed and airdropped SUDO tokens on January 30.

Early liquidity providers on Sudoswap and holders of 0xmon NFTs, a collection created by Sudoswap's team, were eligible for the airdrop. Holders of XMON, a utility token, can lock up their tokens on Sudoswap for one month to obtain SUDO tokens.

Sudo tokens were initially non-transferable, but have been made tradeable since February 18.

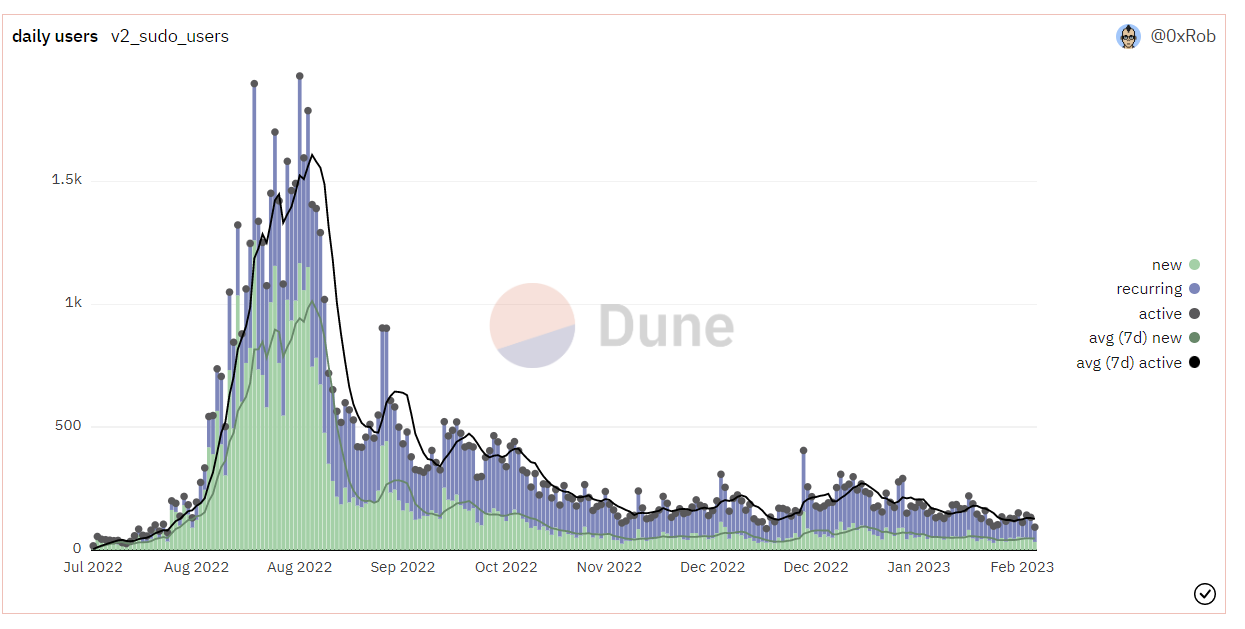

Despite the airdrop announcement, the number of daily active users on Sudoswap has remained low.

Sudoswap's trading volume in the last 30 days was barely $2.5M. In comparison, NFT marketplace Blur, saw a trading volume of almost $880M!

Caviar is officially open to the public

NFT Automated Market Maker (AMM) Caviar has announced the launch of its beta, enabling users to test out the product.

NFTs can be traded without a counterparty using Caviar. In contrast to similar protocols, it supports fractionalization and non-floor NFT trading.

The protocol will directly compete with Sudoswap when it goes live on the mainnet.

Cryptonary is Watching…

- The growth of protocols such as BendDAO and NFTfi.

- Sudoswap, to see whether it gains traction, but for the time being, it appears that most users are focused on Blur.

- We plan to test CaviarAMM's public beta to determine whether it has any promise.

Also in the News

- NFTPerp's private beta trading volume surpassed $70M in ETH

- CaviarAMM, an NFT marketplace, launched its private beta.

- Fungify raises $6M to build new NFT lending primitive

- Pine Protocol makes code audit available

Insurance

Decentralised insurance covers smart contract users from Exploits, hacks, and other events outside of their control. Although the market is small now, the potential is huge.Nexus Mutual (NXM): The Rug Safety Net

- Market Cap: $300M

- Total Value Locked: $225M

- Active Cover: $185M

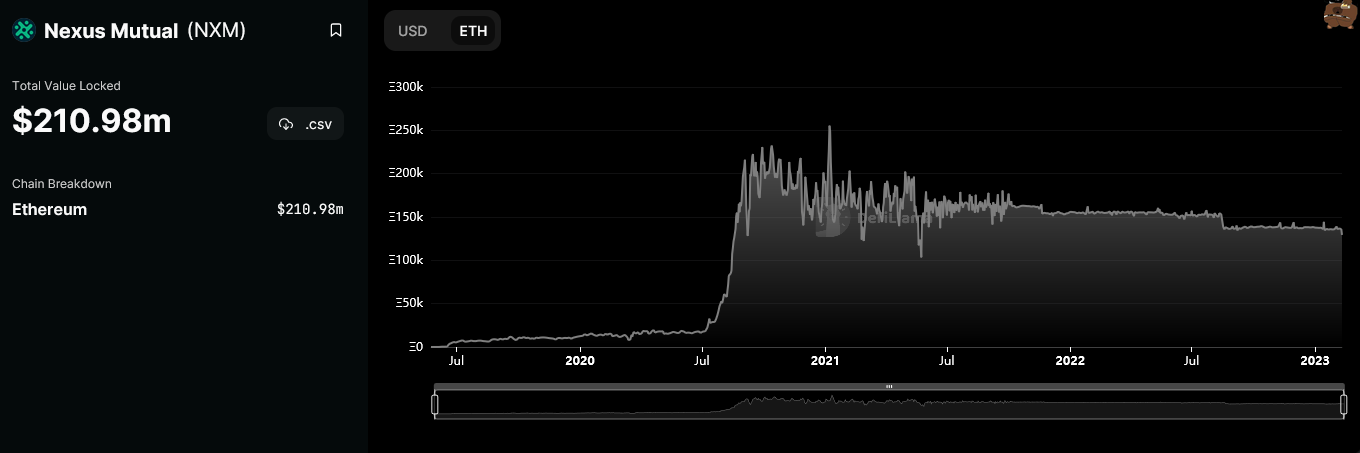

TVL has been steady over the last year. This is consistent with Nexus insurance being used mainly to cover ETH staking. stETH (Lido’s staking derivative) and WETH make up the majority of deposits.

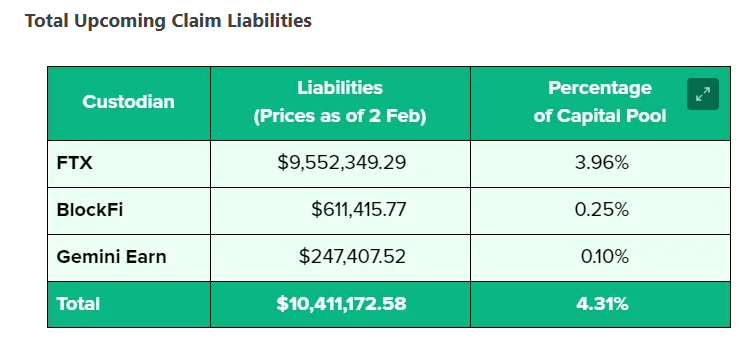

Nexus recently started the implementation of their V2 upgrades. The changes will improve coverage pricing, staking, and claims. Partial claims are already enabled, and we’ve seen this in action. Nexus recently paid a claim related to FTX losses. And, they are beginning to process BlockFi claims:

The dates for claims to begin are as follows:

- FTX International: 6th February 2023.

- BlockFi: 9th February 2023.

- FTX US: 9th February 2023.

- Gemini Earn: 14th February 2023.

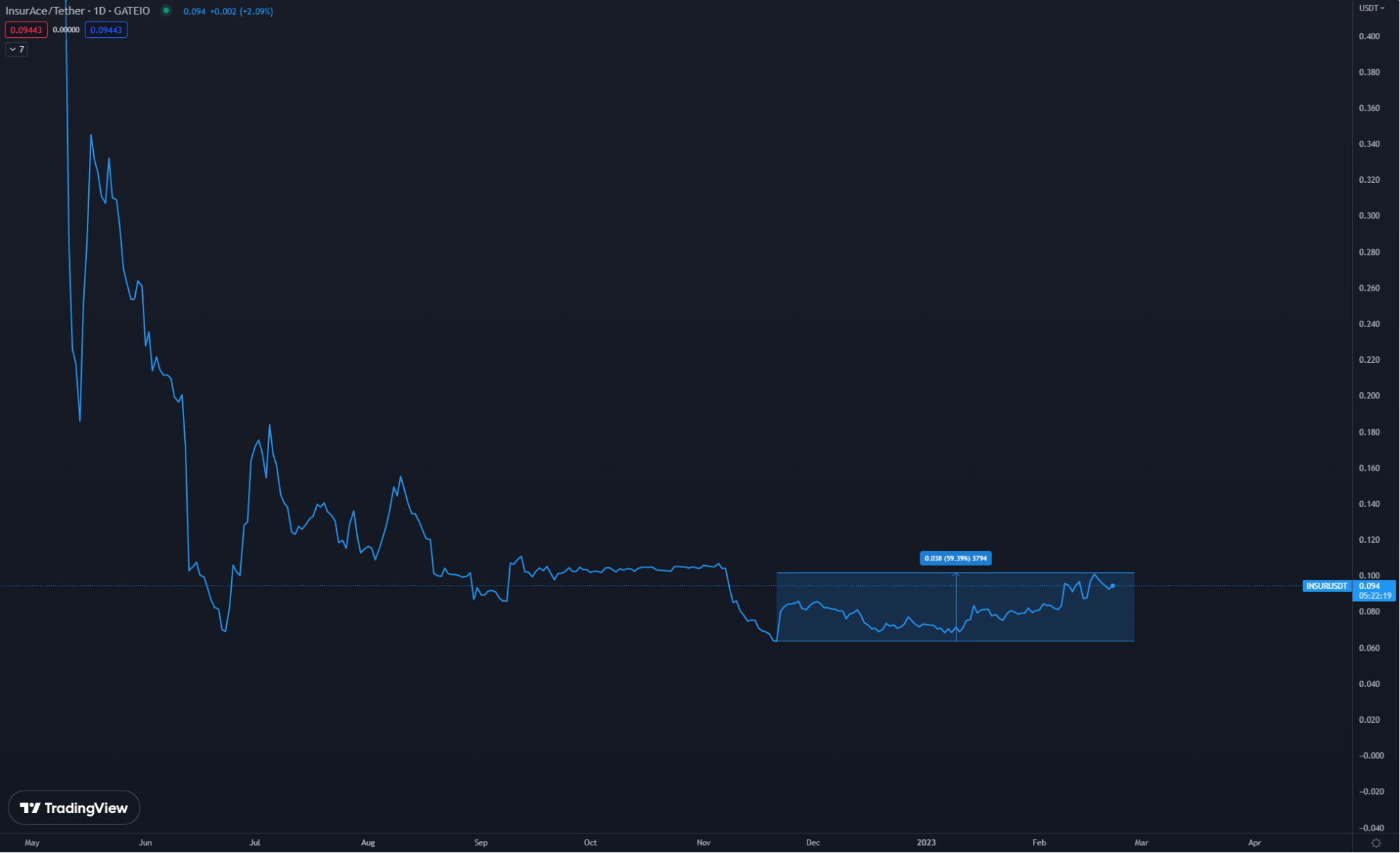

InsurAce: Insuring the Insurer? (INSUR)

- Market Cap: $5.4M.

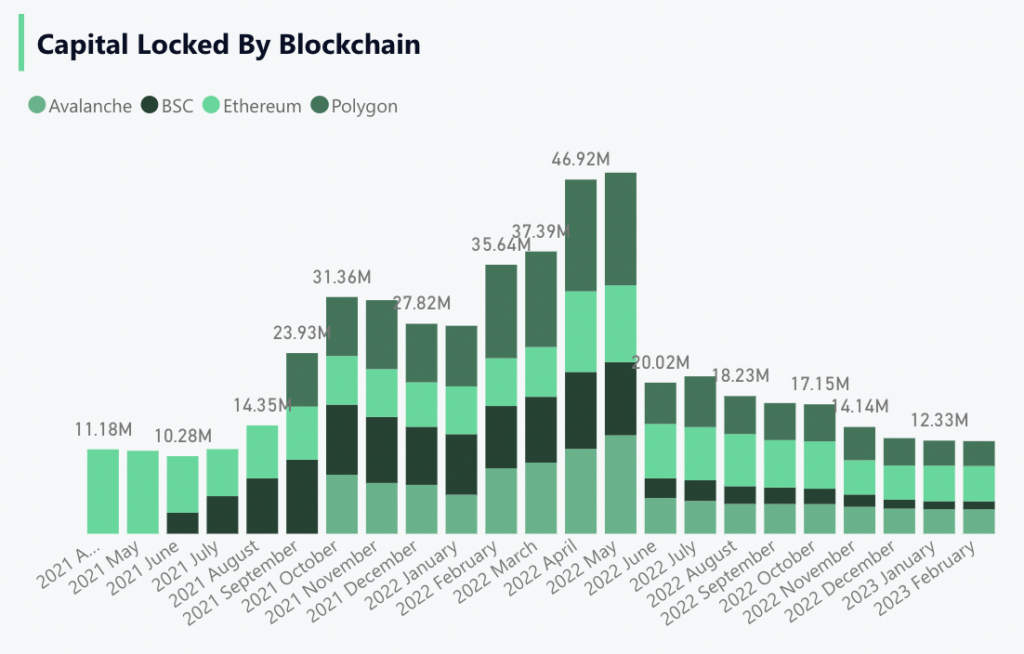

- Total Value Locked: $12.1M.

- Active Cover: $9.2M.

Claim information can be found here.

InsurAce is working on V2. Changes include:

- Liquidity sharing (and policies) across chain. This will increase capital efficiency and streamline user experience. The user’s preferred chain will be a portal to the InsurAce product.

- Investment arm. Deposited capital is stagnant at the moment. InsurAce will look to generate yield on idle assets.

- Cover Marketplace. Like Bright Union, InsurAce will create a marketplace for customised insurance policies.

- Cover Offerings. The protocol will begin covering NFTs, bridges, and other niche markets.

In line with the drop in DeFi activity, InsurAce has suffered from a flight of capital. This is reflected in its token’s lacklustre performance.

This reiterates the point that there isn’t interest in the sector. Tokenomics upgrades and buy backs are in discussion as part of the V2 upgrades. However, we don’t expect any major changes in the first half of this year.

InsurAce is looking to establish in Bermuda. This will allow them to cover larger clients/customers. Institutional funds and high-net-worth individuals have been seeking $20M+ in DeFi coverage. InsurAce has been unable to cater to these customers.

This will allow them to work with reinsurers (essentially insurers for insurance providers). It’s a move towards integrating with regulatory frameworks.

Cryptonary is Watching…

- For a smooth claims process and a decent number of payouts.

- For more news on the InsurAce’s move to Bermuda. Also, partnerships and the onboarding of institutional policyholders.

- For more details on INSUR tokenomics upgrades.

- For a large portion of FTX/BlockFi/Gemini claims to be paid by Nexus.

- Nexus wNXM token buy back proposals.

- The effect of Nexus V2 updates on TVL, transactions, and token performance.

Also in the News

Derivatives, Futures and Options

This sector is split into two elements: Futures & Options.DeFi Futures

dYdX: V4 & Delayed Unlocks, Bug Causes Losses, and Emissions Cut!

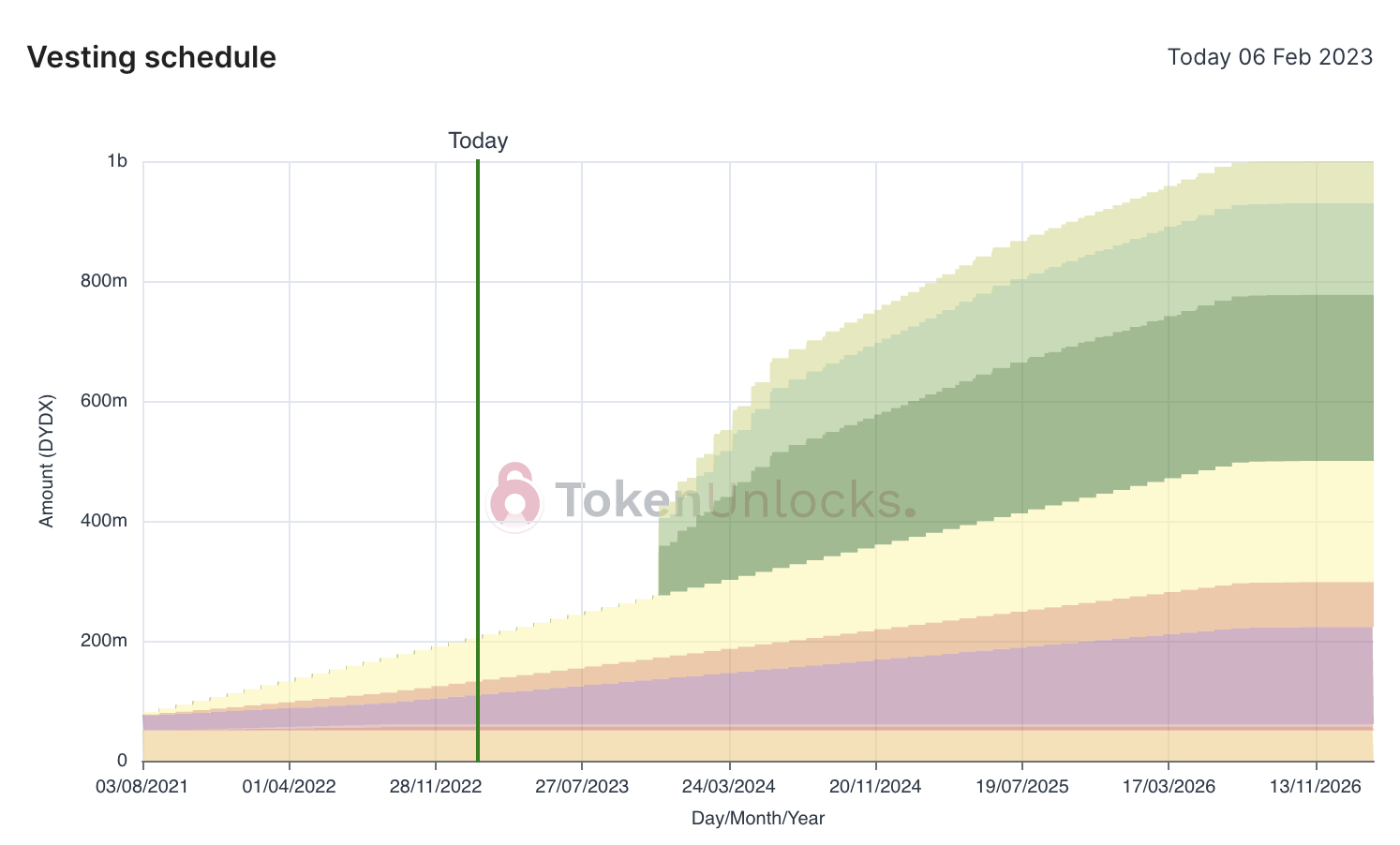

The DYDX circulating supply was scheduled to double overnight in early February. This would have created a supply shock, possibly leading to a dump! Thankfully, this has been delayed to December.

The reason for the delay is unknown, but it’s likely that dYdX had planned to release some big news around V4. However, due to delays, that wasn’t possible, delaying unlocks was the smart decision.

There is some news on V4, though, with milestone 2 out of 4 complete. The private testnet is expected at the end of July, with mainnet at the end of September.

dYdX Buggin’ Out…

On 10th February, dYdX had a bug which resulted in users losing funds. Market orders were executed at higher prices after a lag, and orders that were closed lagged, and opened opposite orders, resulting in huge losses.

The dYdX team has yet to address the issue, and their community moderators have been responding in a frankly unacceptable manner, as you can see below:

The team are now ignoring the messages, and showing no signs of addressing the issue. Awful customer service, and a massive red flag from the perp powerhouse. Hopefully this is addressed soon!

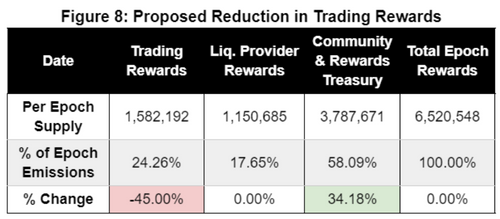

Trading Rewards Slashed

On 19th Feb, a governance proposal to cut $DYDX trading rewards by 45% passed. See the updated numbers below.

There is discussion around whether this is good or bad, with some traders stating they weren’t consulted. Some threatened to move large amounts of trading volume to different venues as a result.

All in all, we believe this is a good move, with $DYDX emissions high, a cut benefits token value. Price action hasn’t moved after the passing of the proposal, showing there is no strong opinion from holders either way.

Perpetual Protocol: Lazy River Launched

$PERP stakers now receive 15% of all fees generated on the platform, provided the fund has sufficient liquidity.

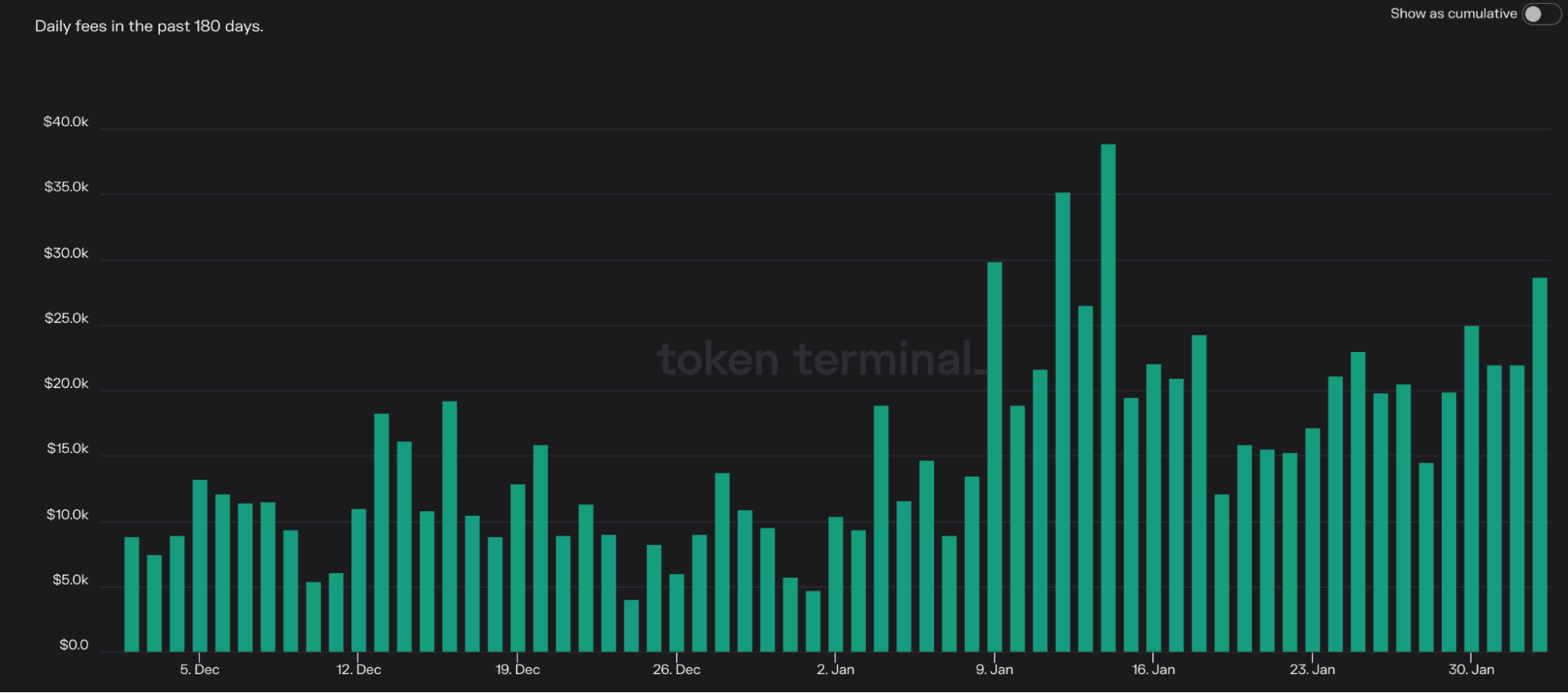

There has been a 100% increase in fees (and trading volume) since the announcement…

Market conditions certainly help, but no doubt the announcement is a large part of the pump we’ve seen in trading volume, and $PERP price.

Gains Network: Now on Arbitrum

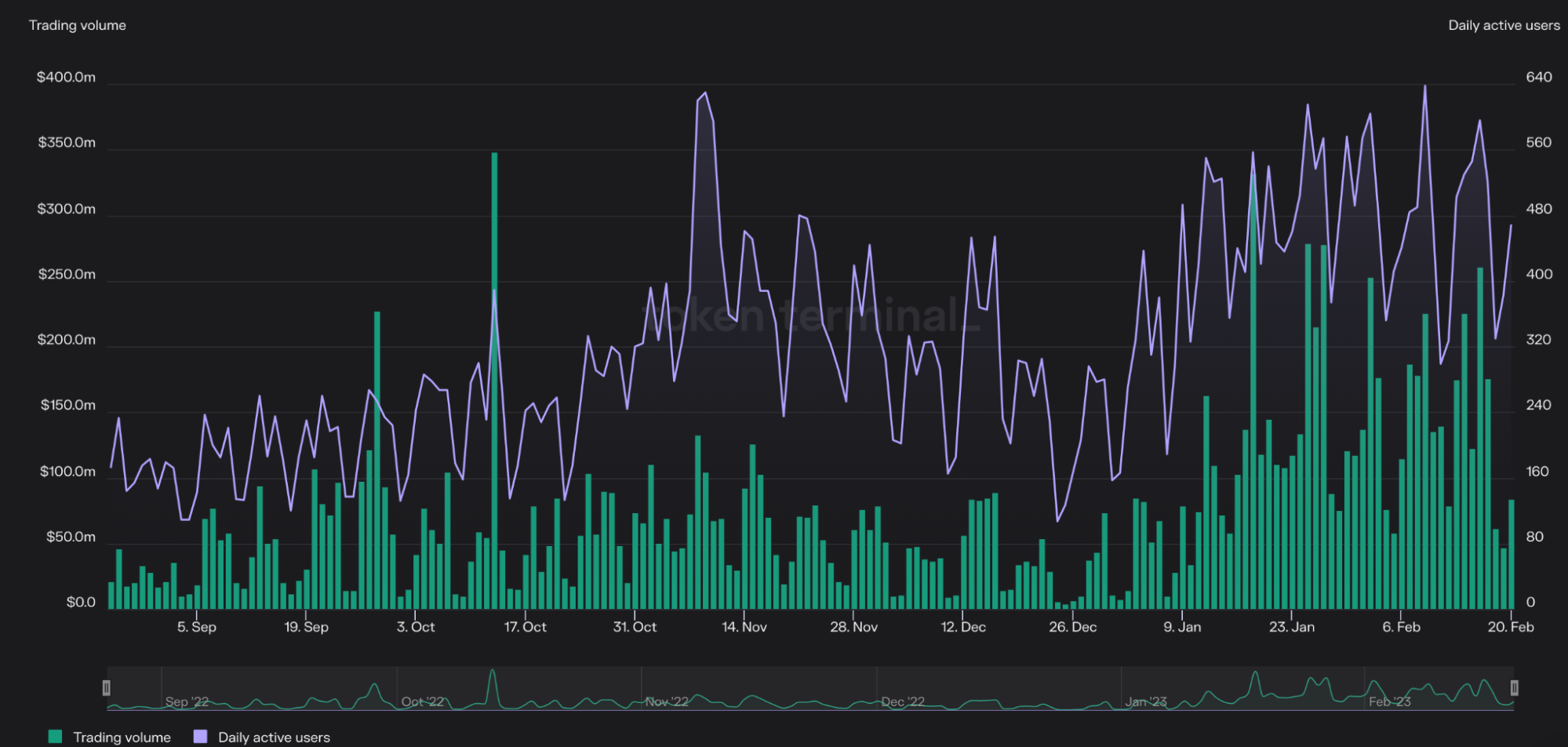

Gains Network moved to Arbitrum on December 31st, and has seen a steady increase in volumes and daily active users since.

It’s seen a huge increase in its token price and public profile. This is interlinked, as when price pumps, so does social engagement.

Level Finance Launches, Token Up 200X!

In one of the fastest growth spurts we’ve seen, Level Finance achieved over $1.9bn total trading volume in just under 2 months.Level is a DeFi perpetual futures exchange based on the BNB Chain.

Having launched on December 26th, Level boasts almost $200m in the last 24 hours alone!

The token certainly didn’t miss the move, up over 200X from Jan 7th lows to Feb 20th highs.

DeFi Options

Lyra: Now on Arbitrum, Front-End Expansion & DAO Taking Shape

Lyra Enhancement Action Proposal (LEAP) 38, known as the Newport Upgrade, went live on 1st February.

Lyra is now live on Arbitrum and Optimism, using GMX perpetual futures to delta-hedge (reduce the risk of losing money as prices change) their liquidity pools.

This resulted in a large spike in liquidity on the platform, with the Arbitrum vault boasting $15.65M TVL on 21st February.

With total volume of over $24M, open interest of $7.1M, and $32K in fees generated in the first month, the launch has been a success.

As you see below, $LYRA rose nicely with the news of the move to Arbitrum, and has been moving up since.

Front-End Expansion

Another important proposal, LEAP (43), has been approved. It will result in the Lyra options exchange being hosted by Kwenta, a perpetual futures exchange also in the Synthetix ecosystem. This will be done initially through a trial period of 6 months, and a grant of 400,000 $LYRA has been allocated.

In draft is LEAP-45, a proposal for Coinstore to fork and self-host Lyra.

Love It When a DAO Comes Together

LEAP 51 proposes moving Lyra governance from V1 (an off-chain council model) to V2 (fully autonomous on-chain model).

Currently still in draft, the proposal would mean that Lyra becomes a fully fledged DAO.

Siren Protocol is also Moving to Arbitrum

Rumours swirling of deployment onto Arbitrum have caused the token to pump an impressive 8X since the start of the year. It has increased to a market cap of $5m at the time of writing.

Whilst there has been no official announcement from the team, they retweeted this tweet, which all but confirms the move.

The user experience on Siren is very basic, despite the protocol launching in March 2021. This raises a red flag, but the hype Arbitrum deployment brings is a powerful tool, hence the huge returns.

Cryptonary is Watching…

- dYdX V4 progress. If this front-runs the unlocks in December as expected, it could be very bullish for price action. Some questions are arising around the bug issue and trading fee cut, so we are keeping an eye on how they develop.

- If Perpetual Protocol succeeds in recapturing market share, with revenue sharing, $PERP would be extremely undervalued.

- Arbitrum’s development: with protocols (Lyra and Gains Network) moving from Optimism, and the Arbitrum token yet to launch (which provides massive onboarding and hype potential), the ecosystem is set to explode in the coming year.

- The competition between DeFi options protocols is heating up. Interest is there, innovation is happening, and protocols are beginning to really differentiate themselves. This is the precursor to the pump we’ve known is coming. Also in the News

- Dopex: launched on Polygon, and has open-sourced their front-end.

- Kwenta: Perps V2 launched in December.

- MUX Protocol: Airdropped tokens to GMX users in an attempt to bring them into the platform.

- SynFutures: Released early access to their NFTFutures platform, which is set to be a perpetual exchange for NFTs.

- Ribbon: Cuts $RBN emissions.

- ZKX: Incentivised testnet launching March 14th.

Decentralised Exchanges

The biggest winners, based on the data at the start of the digest. Now, let’s find out why…Uniswap: Launching on BNB Chain

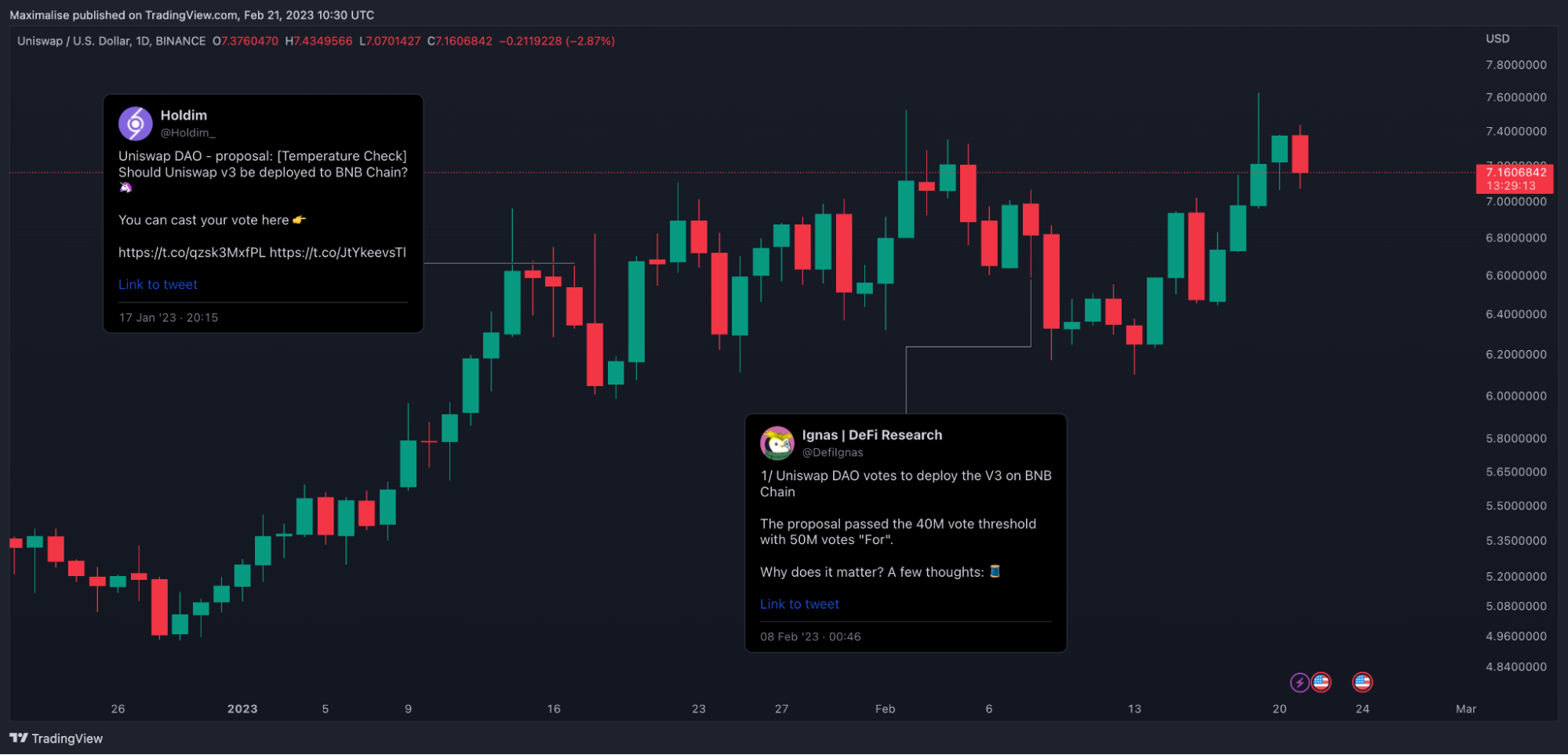

In a recent temperate check in the Uniswap governance forum, 80% of the community voted to deploy on BNB Chain.

Since then, the governance proposal passed, with 66% of votes in favour.

Speed is of the essence with the license expiring soon, but that doesn’t mean corners can be cut. It’s good to see Uniswap looking into alternatives, rather than simply going with Wormhole (as was voted for in a temperature check).

This could be huge for the protocol. Pancakeswap holds dominance over the BNB Chain swaps market, but has a considerably worse user experience than Uniswap.

Pancakeswap boasts $2.36B TVL and, assuming Uniswap can take 50% of this, that adds 35% to Uniswap’s current TVL across all chains. Logically, this would mean the token is worth 35% more, at least!

This move is about more than just expansion. With the Uniswap Business License (which stops any potential copycats by preventing use of the code-base for a period of time) due to expire on 01/04/23, it’s also important to get a foothold in the BNB Chain market before a competitor uses Uniswap open-source code and snatches it away.

Currently, the price hasn’t reacted to this. Whilst the proposal has passed, there is still some way to go before any real action is taken.

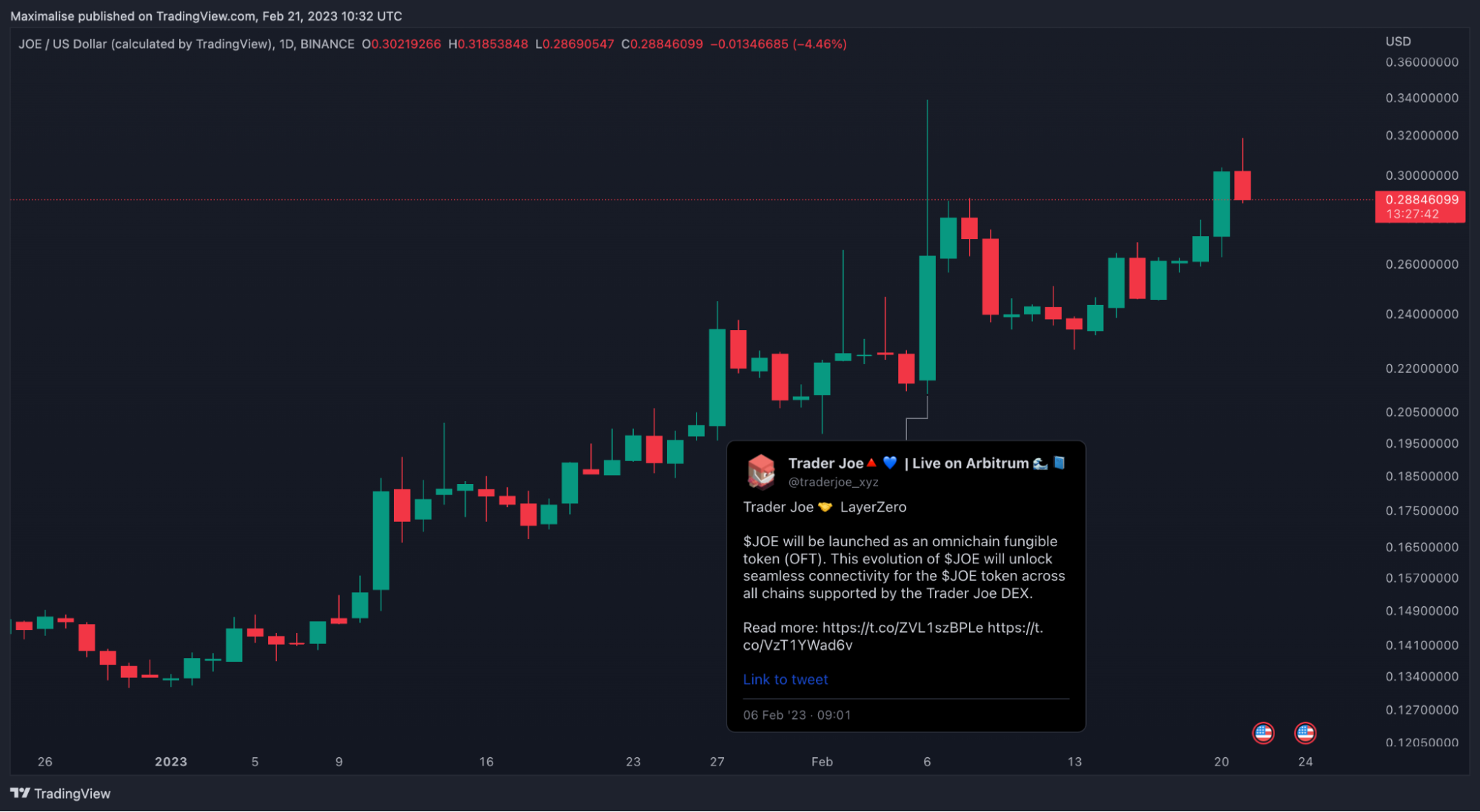

$JOE Goes Multi-Chain

Trader Joe has announced an integration with LayerZero, launching $JOE as an omnichain fungible token (OFT) that can be used across chains.

The move allows holders to bridge $JOE freely between Avalanche, Arbitrum and BNB. Using LayerZero removes many of the risks of bridging, as rather than wrapping and burning tokens, LayerZero uses a cross-chain messaging system.

sJOE holders (staked JOE) are entitled to a share of the platform's revenue. With the upgrade, holders will be entitled to a share of the protocols’ revenues across all chains, rather than just the chain they hold the tokens on.

This had a clear effect on $JOE, pumping the token over 50% instantly before retracing partly. It now sits above 50% higher than the announcement date.

Cryptonary is Watching…

- The exchange battle is heating up. Uniswap is a goliath in the market but to take share away, competitors need to innovate.

- Trader Joe is trying to do this with the launch of $JOE as an OFT, something we haven’t seen from a major protocol before.

- Level Finance has posted some wild statistics, keep a close eye on whether this continues.

- This battle is going to be a key narrative for 2023.

Also in the News

- Osmosis stableswaps are live. With this launch, Osmosis hopes to become the Cosmos equivalent of Curve, the top stablecoin swap venue on Ethereum.

- Dove Protocol, a cross-chain DEX that hopes to pool liquidity across chains, by leveraging cross-chain messaging, is out of stealth mode.

Asset Management

Friktion: The End.

Friktion is shutting down!

Friktion has been put into withdraw-only mode. No deposits are available, and any assets on the platform have stopped earning yield.

We’re expecting full details on why they’re shutting down soon.

Ribbon’s $SOL airdrop to ex-Friktion users:

Ribbon is airdropping all fees earned from their Solana vault in the last year to previous users of Friktion. This totals 550 $SOL.

To qualify, you have to deposit into the $SOL vault for at least 1 month.

The airdrop will be small, due to the relatively small pot and the number of Friktion users. Find out more here.

Cryptonary’s Take

It’s a sad day when a good protocol shuts down. We’ve been following Friktion for a while.

Our best guess is that they have been forced to shut due to the lack of liquidity in Solana DeFi following FTX’s collapse. As a yield-generating protocol using complex derivative strategies, liquidity is essential.

If you used the platform, we recommend withdrawing all assets. In regards to the Ribbon airdrop, it is certainly worth doing if you had assets in the SOL-covered call Volt on Friktion (as you’d essentially just be migrating this to Ribbon for some free SOL).

If your assets were in other strategies, you’d have to convert them into SOL and put them in Ribbons covered call vault. If that’s the case, we recommend staying away. For the modest pot, it’s not worth taking on the risks.

Factor DAO: Public Sale Live

Factor DAOs token, $FCTR, is launching on Arbitrum through Camelot DEX.

The public sale opened on 20th February at 6pm, UTC, and was open for 4 days.

Factor is an asset management protocol that allows managers to build financial products; tokenise baskets of assets, aggregate yield, and create derivative strategies.

$FCTR is the platform’s utility token. 50% of fees will be shared with $FCTR stakers, who will also get governance rights.

10% of the supply is going up for sale (100,000,000 tokens).

The price will start at $0.10 per token (representing a $10m FDV), but once $1M has been pledged, that price will increase.

At the time of writing (21st Feb, 10am UTC), the price is at $0.44 per token, with $4.4m pledged.

Will Cryptonary Take Part?

Public sales are always a risk when the price isn’t set beforehand. Many speculators buy in, hoping to make a quick profit, resulting in huge selling pressure after the launch.

This is especially true when the public sale doesn’t offer a price cap or the ability to withdraw pledged funds, as is the case with $FCTR.

Prices will likely be lower in the days following the sale, as price discovery takes place.

We will not be taking part.

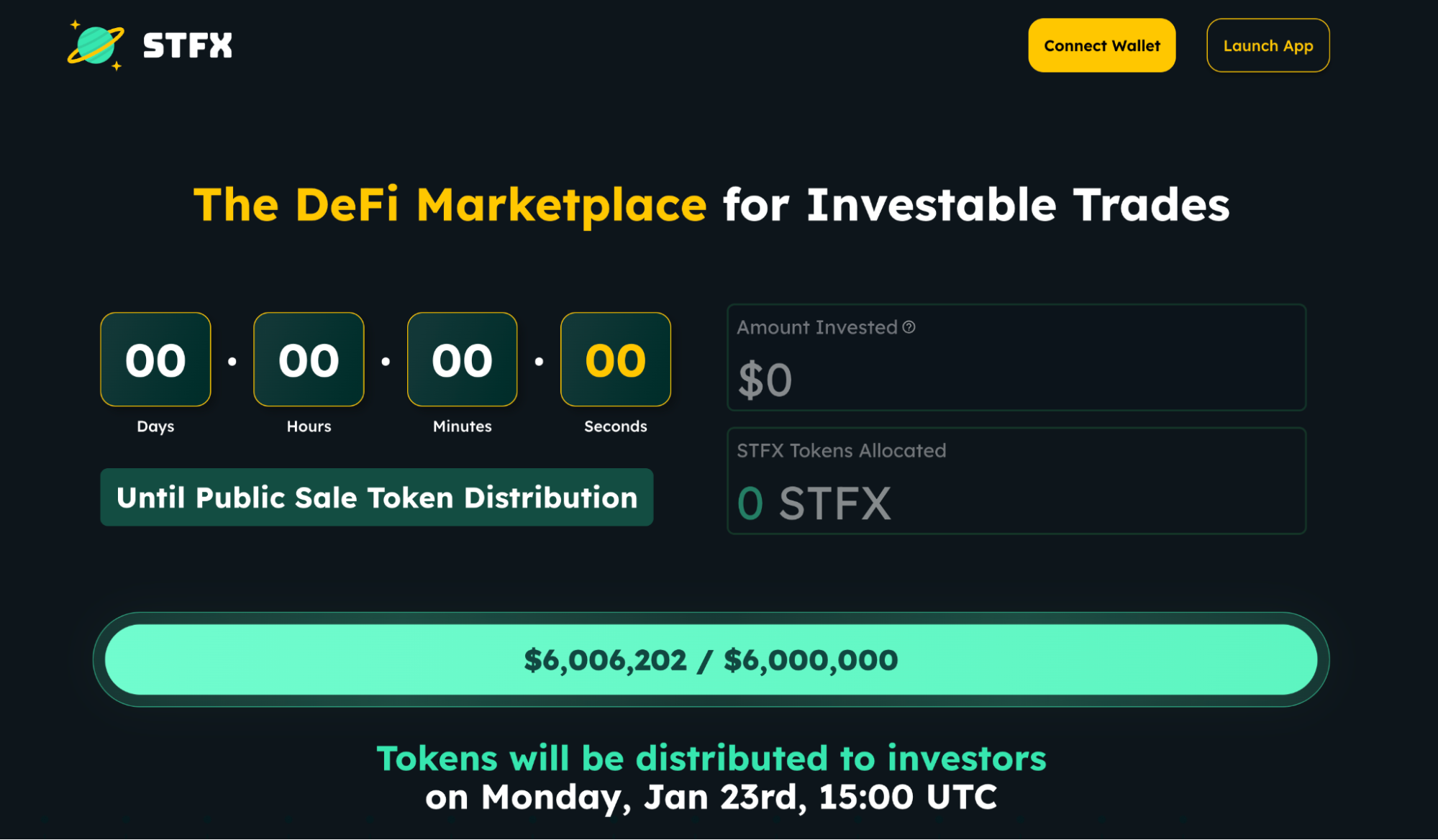

STFX: Token Launched

The $STFX token launched, after a successful public raise of $6M by 1,154 unique investors (average of $5,200 invested per person).

$STFX was issued at a price of $0.04 per token, implying a fully diluted value of $40M.

STFX is a DeFi platform that allows users to either deposit into, or create Single Trade Funds (STFs). These are trades, such as an Ethereum long or short, which have set perimeters, such as duration and target.

Managers on the platform can get a reputation for being profitable, and earn from it, as they get 15% of the profits their vaults generate. Currently, there is a $2,500 cap on vaults. Once this is removed, managers could earn huge amounts.

5% of the profits goes to the as fees, of which 80% goes to $STFX stakers, and 20% to the DAO treasury.

Since inception on October 14th, the platform has generated a total of $29,860 in profit. Representing $1,194 that is to be distributed to token holders.

Cryptonary is Watching…

- Asset management is in its early development stages. The majority of the protocols you see today will fail for one reason or another. But those that don’t could be massive! Over the coming years, this space could explode.

- Unfortunately, as the space is so early, even the good protocols can suffer from unforeseen circumstances, as we saw with Friktion. Our next steps are to keep our eyes peeled. Find promising protocols, wait for good risk/reward, and invest!

Also in the News

- PsyOptions launched PsyLend, a platform that allows users to deposit structure product vault tokens, and borrow other assets against them. Currently in gated mainnet, only accessible by Early Access Pass holders.

- Rysk, a decentralised market maker for options trading, has successfully raised $1.4m pre-seed funding. The round was led by Lemniscap, and is to finance Rysk’s go-to-market strategy.

Prediction Markets

Overtime Markets launches on Arbitrum

Decentralized sports trading platform Overtime has announced expansion into the Arbitrum universe, following a vote by Thales governance.

The protocol also launched a new Arbitrum Galxe Campaign that will give traders a chance to double their first $10 buy-in, and Overtime will integrate two new soccer leagues with its Arbitrum deployment, enabling users to take positions on UEFA Europa Leagues and the J1 football league.

Azuro Protocol teases V2

While there has not been much news about prediction markets recently, Azuro Protocol, a decentralized betting protocol, has hinted that it will go live on Arbitrum.

The protocol, which provides prediction markets for bettors to speculate on football matches and other major sporting events, has hinted towards releasing its V2 betting markets as well which is expected to improve both the user experience and the liquidity for users

Cryptonary is Watching…

- The launch of OverTime Markets to see if it attracts people's interest.

- The launch of Azuro on Arbitrum, as well as any updates on its rumored V2 release.

Stablecoins

Last but not least, DeFi’s heroic figure: stablecoins.Aave Deploys Native Stablecoin GHO on Ethereum Testnet

Aave Companies, the developer behind the Aave DeFi project, has launched the protocol’s native stablecoin called GHO on Goerli, an Ethereum testnet network.

Users wishing to test out GHO on Goerli can now access the stablecoin’s codebase on GitHub, according to the announcement. Today’s deployment on Goerli is part of the planned rollout of the stablecoin on the Ethereum mainnet.

Aave DAO, the community that oversees the Aave protocol, will vote to approve GHO’s official mainnet launch. This will happen at a later date.

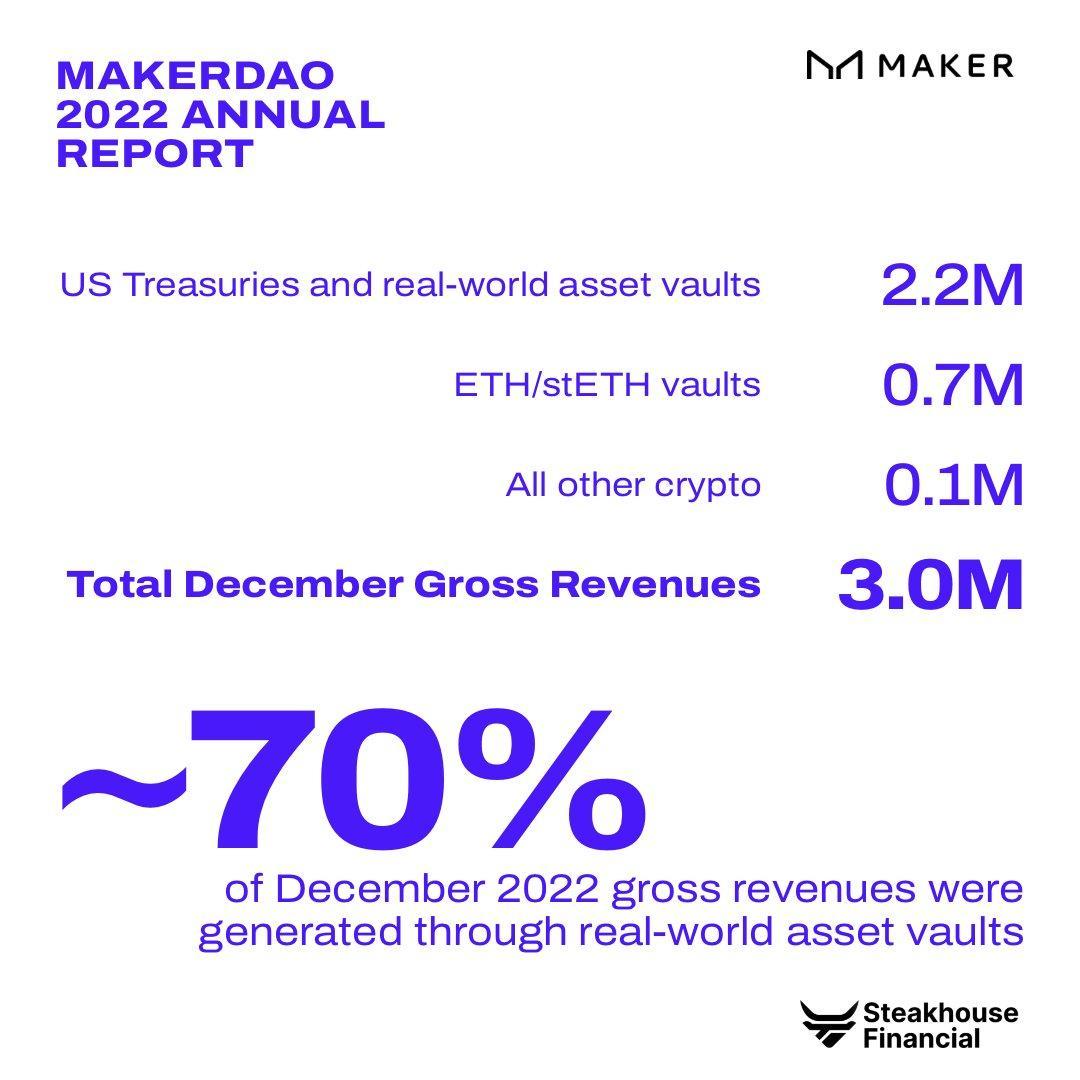

MakerDAO: Printing Revenue Using Real World-Assets (RWA)

According to a MakerDAO yearly report, US treasuries and other real-world assets represented less than 10% of issued $DAI but more than 70% of the protocol's overall revenue in December.

While real-world assets were a wise investment for MakerDAO, earnings and revenue fell by around 42% in 2022 compared to the previous year owing to a drop in lending market use.

Nuon Finance: New Stablecoin on Arbitrum

Arbitrum now has a new stablecoin competitor. The Nuon Protocol has announced the launch of the NUON flat coin: a cryptocurrency tied to a cost of living index.The concept is that, unlike other stablecoins, NUON would protect investors against inflation by offering a stable crypto asset that is not connected to a depreciating fiat currency such as the US dollar. Instead, the value of a Nuon flatcoin is determined by independently verified daily inflation.

Read their whitepaper for more details.

Cryptonary is Watching…

- We are looking forward to the launch of the $GHO mainnet and trying out the stablecoin ourselves.

- Real World Assets have shown to be a significant benefit for MakerDAO, and we will look into the impact Real World Assets can have on DeFi in general more, since MakerDAO has demonstrated how it can be a major source of revenue.

- Since Nuon Finance will be a new stablecoin, our major focus will be on its performance and whether it will be able to remain secure and stable over a longer period of time.

Also in the News

- On Angle Protocol's governance forum, a proposal to develop an Angle Gold stablecoin was presented.

- Curve created the governance proposal that needs to pass to launch $CRVUSD.

- Vitalik Buterin has written a governance post on the governance forum of the decentralized stablecoin $RAI with advice on how to make it more appealing to users.

- Optimism now supports Binance-Peg USD, often known as $BUSD.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms