So, what’s happening this week?

Regulators are fighting with one another on the “ETH is a security” debate, ETH’s supply continues to deflate, and Arbitrum announces its token!

TLDR

- NYAG has called $ETH a security. The SEC is yet to comment.

- ETH’s supply continues to constrict, which is bullish over the long-term.

- Arbitrum’s token $ARB is dropping on March 23rd. We predict a price of $1+.

- We remain convinced that $2,200 comes next for $ETH.

- Share this report with your family and friends!

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

“$ETH is a security”

US regulators have come out with guns blazing against the crypto industry, trying to remedy their public image after FTX’s collapse and the Silicon Valley Bank (SVB) meltdown. Let's not forget that the SEC was working very closely with Sam Bankman-Fried only months prior to the exchange’s collapse. So much so that congressmen have launched a probe) into the regulator’s handling of the FTX collapse.Most recently, NYAG (New York Attorney General) Letitia James called $ETH a security in her office’s lawsuit against the cryptocurrency exchange KuCoin. They argued that “Buterin and the Ethereum Foundation retain significant influence over Ethereum.” They would have been better suited reading our recent piece on “Would Ethereum die without Vitalik?” where we delved into why Web3 founders’ influence drops as a project matures and becomes decentralized (read our report here).

What’s ironic is that this has become a battle between (theoretically) peer regulators rather than a tussle between crypto developers and regulators. Why?

The CFTC (US Commodity Futures Trading Commission) allowed an American options exchange, CME, to launch $ETH futures in early 2021. By definition, the CFTC cannot make such a move unless they determine that $ETH is a commodity. CFTC head Rostin Behnam said that “We have regulated $ETH derivatives. It's not a coincidence that those futures were listed on CFTC markets. We did the analysis, the listing exchange did the legal analysis, and the analysis led to the conclusion that $ETH is a commodity, and I've been pretty consistent with that in the past.”

This ongoing war is mainly about improving regulators’ public image after the chain of collapses in crypto and now in the banking system. The SEC had the chance to deem $ETH a security years ago, but they’ve purposely not given a definitive answer to reserve power over the industry as and when needed.

This matter is very unlikely to have a significant effect on $ETH, and the SEC is even more unlikely to launch a lawsuit. This is because they simply cannot afford a loss on a case like this, as it would set precedent to be used by every project in the future. If and when the SEC makes such a move, it will be in a situation where it can score a sure win against a very small project. You can read more about this subject here.

ETHonomics

Since EIP1559’s introduction in August 2021, a small number of the $ETH paid in fees gets burned with every transaction. So when a lot of transactions come through, much $ETH gets burned. If enough $ETH is burned, deflation kicks in as the supply starts shrinking.This is exactly what’s happened 👇

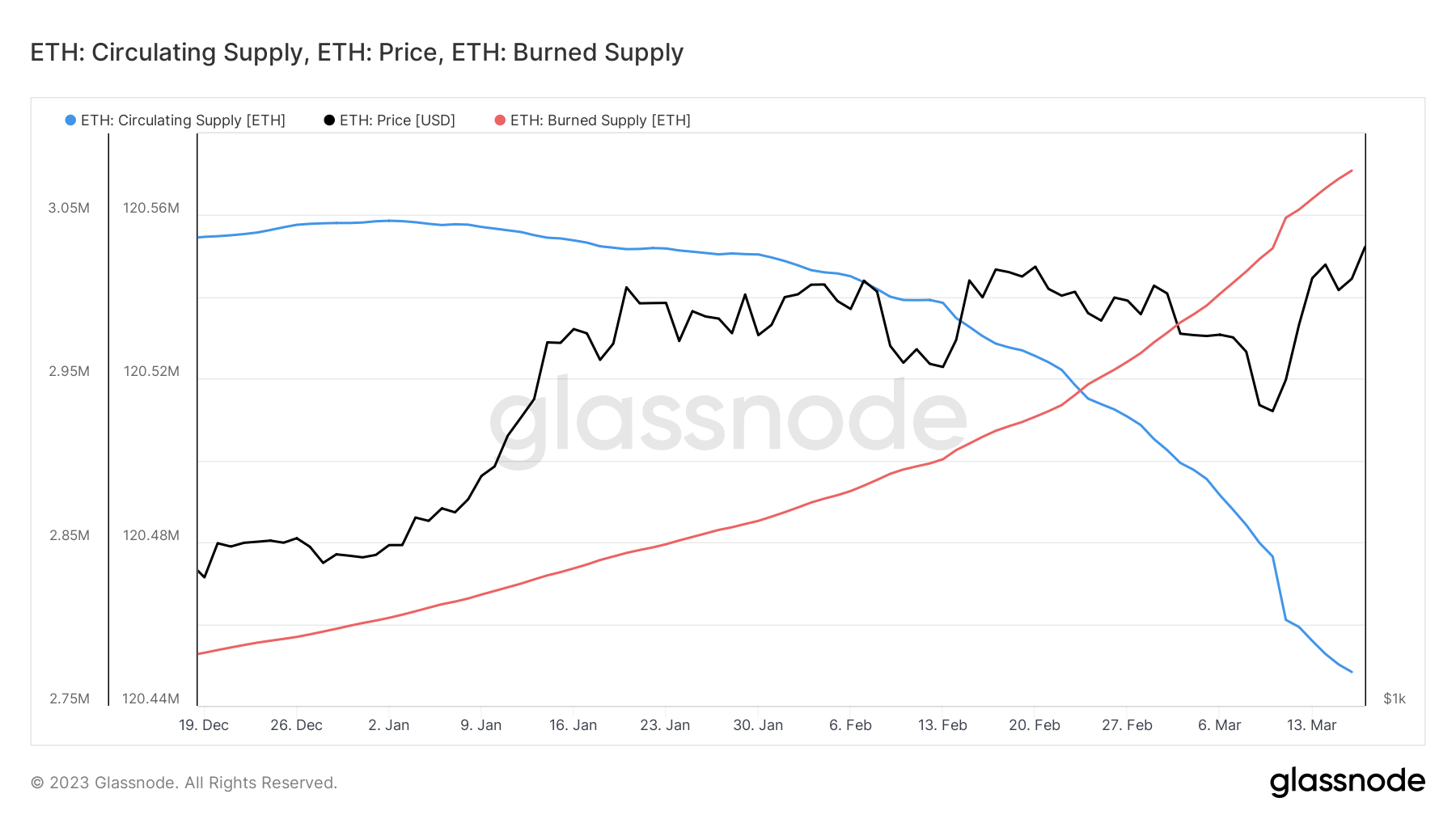

$ETH Circulating Supply (blue) & $ETH Burned Supply (red) | ETH Price (black)

The supply shrank from 120,505,220 to 120,448,277 (-56,943 ETH) in the first half of March alone.

The deflation of $ETH will not cause any sudden price movements, but it does make the asset that much scarcer. If you pair that with increased demand over the years (our anticipation), then you get a much higher token price than you would with an inflationary coin or token.

The state of $ETH

Price chart

$ETH’s price fell by a magnitude of -20% recently, taking the price all the way down to $1,400. We remained bullish despite the crash, and it has paid off.

We believe it is mandatory for you to devise a plan, one you will stick to. The market will take your emotions on a rollercoaster ride. Unless you have a plan that allows you to act objectively, you’ll often sell the bottom and buy the top.

We’ve been firm on $1,400 being the level that must hold, and for as long as it does, our target is $2,200.

Futures’ market health

The funding rate (middle chart) and the open interest (bottom chart) both tell us that the market is not overweight on longs. This is important because you need sidelined people buying later on to boost prices higher.

We had a very clear indicator that a short-squeeze (a situation that occurs when short positions are liquidated en masse) would happen, however, and that was the funding rate going unusually negative.

The funding rate goes negative when shorts are overweight. This can lead to a short squeeze (a situation that occurs when short positions are liquidated en masse). When a short is liquidated, it is forced to long an equal number of contracts to neutralize/close its position.

TLDR: The futures’ market looks healthy and won’t stand as an obstacle against more upside on $ETH.

The smart money

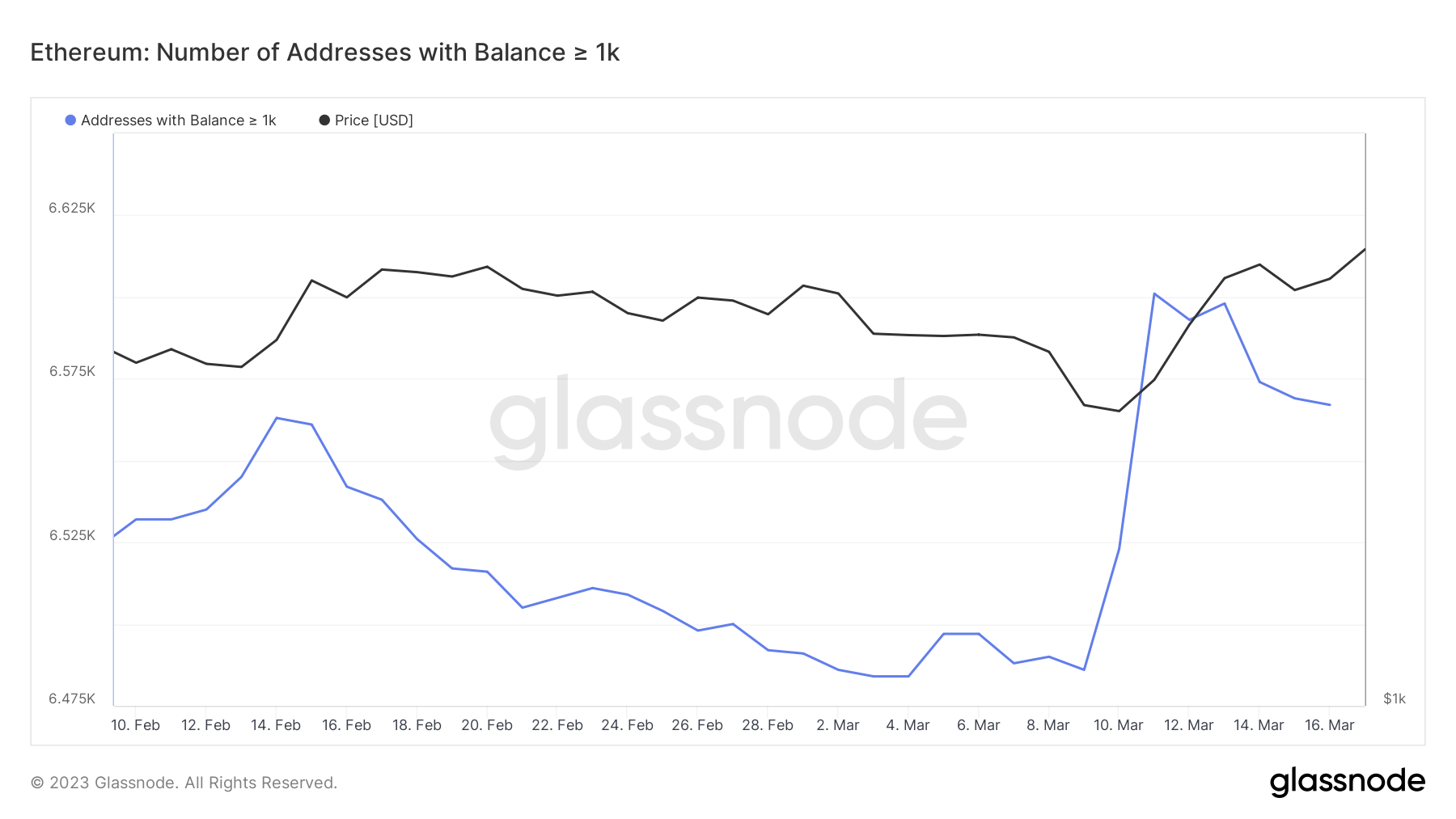

The "mid-tier $ETH whales" holding over 1,000 ETH have welcomed 81 new members to their group in the past week. While this only represents a 1.2% increase, it is still important to monitor the activities of these whales.

The larger whales, holding over 10,000 ETH, have remained unchanged, indicating that they are currently in "observation mode".

However, what is interesting and meaningful to us is that some whales will be standing in the way of the price at $1,878.75. While the resistance isn't large enough to prevent upside, it can cause stagnation.

The chart displays the current sell orders by one or more whales. It's important to keep up with this metric because the orders can be canceled (allowing for upside) or aggravated (causing a top).

Ethereum ecosystem

Decentralized Finance (DeFi)

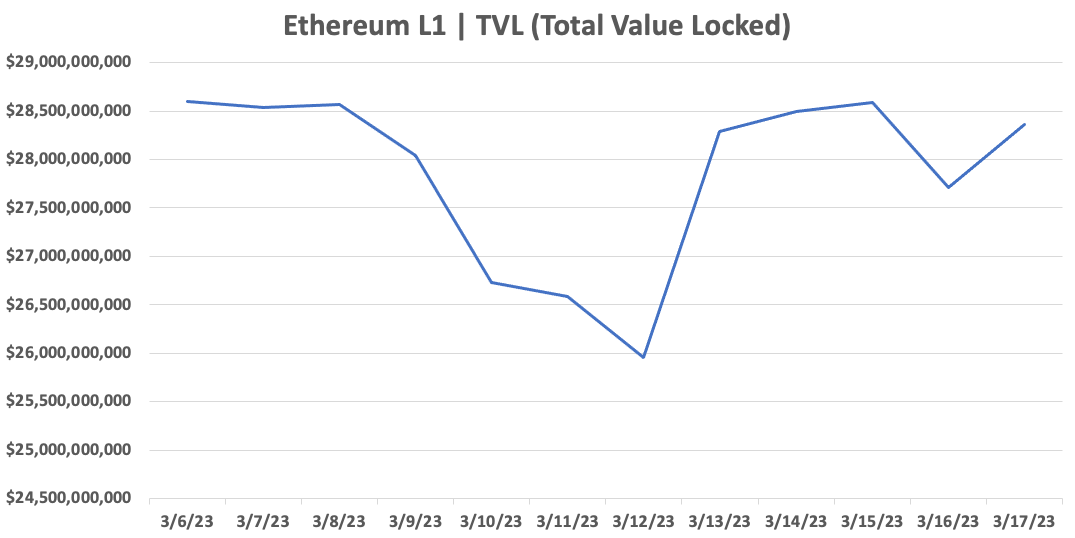

The DeFi TVL (total value locked) on Ethereum has recovered since March 12th but remains at a loss of -$230,000,000 since March 6th. Despite that loss, multiple protocols have been gaining immense traction:

- MakerDAO ($MKR): + $832,000,000 (+11.9%)

- Aave ($AAVE): + $400,000,000 (+92.1%)

- NFTfi (no token yet): + $21,000,000 (+248%)

Why? Because of $USDC’s de-peg.

Unless you’ve been living under a rock, you know the US’ 16th largest bank (SVB) has collapsed. Circle, the issuer behind USDC, held 8.5% of their USD reserves there, to which they no longer have access. This, of course, is not another $UST/$LUNA situation because there was still 91.5% backing, and the remainder has been covered by the US Federal Reserve. Nevertheless, people lost money holding $USDC.

Given that $DAI is a decentralized stablecoin, the narrative of a centralized stablecoin failing certainly gave it a boost.

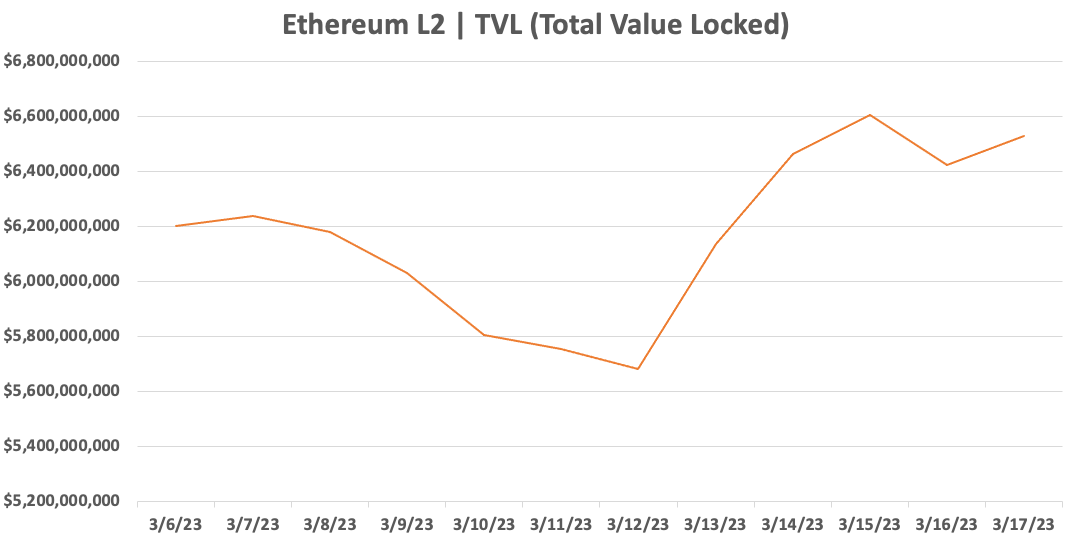

Layer-2s

Ethereum Layer 2s are continuing to outperform the main L1 with a 5.3% ($328,000,000) increase in TVL.

But the increase in TVL is not the biggest news. The biggest news is that Arbitrum has announced their $ARB token. If you missed it, check out our Twitter thread:

🚀 Exciting news for #crypto enthusiasts!

Arbitrum, the leading Ethereum Layer-2 network, has finally announced the release of its much-anticipated token: $ARB.Here's what you need to know about the launch:

— Cryptonary (@cryptonary) March 16, 2023

Let's use this section to estimate the price of $ARB upon its release on March 23rd. To do so, we must compare its overall growth and numbers to Optimism's, as it already has a token trading on the market.

- Arbitrum has 85% more TVL than Optimism.

- Arbitrum has 192% more users than Optimism.

- If you've been keeping up with our digests, you know that Arbitrum has consistently outperformed Optimism on multiple metrics.

- Optimism's token, $OP, trades at a valuation of $11,000,000,000.

- ARB's tokenomics have come in under a better model than OP's (more on that in a later report).

The average airdropped size was 1,800 $ARB, meaning that more free money was given out than the US Government gave to its people in COVID-relief.

And to be clear, this is our most conservative estimate. Our real estimate is quite a bit higher 😉

Ethereum NFTs

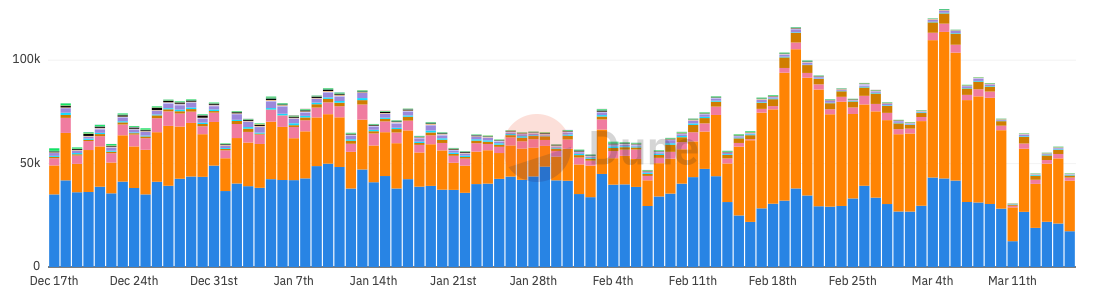

Daily NFT Trades | Source: Dune.com (hildobby)

From the previous digest: “We speculate that this spike in volume is not sustainable given that it is attached to a specific catalyst rather than overall organic demand.”

This has now revealed itself to be true, as we saw the number of trades fall drastically from 125,000 to 45,000 (-62.5%) since the March 4th peak.

We continue to keep an eye out for NFT developments and exciting news. This fairly uneventful week, however, featured little to be excited about when it came to NFTs.

Cryptonary’s Take

Macro and regulations have caused a lot of market uncertainty. Despite that, we remained bullish on ETH targeting $2,200 because we had a clear plan (we recommend that you build yours too).The biggest news is Arbitrum’s token $ARB incoming to our hands in less than a week. Our very conservative prediction for its price upon launch is $1+, our real one is multiples higher. We have a research report dropping about $ARB right before the launch, stay tuned!

And as always, thank you for reading 🙏

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms